This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

The rise of interest rates over the past 18 months has caused uncertainty for investors and volatility in major asset class returns. Given these market conditions, cash ETFs have received strong inflows as they once again offer reasonable alternatives and lower risk than equities and fixed rate bonds.

How can investors gain flexible exposure to cash?

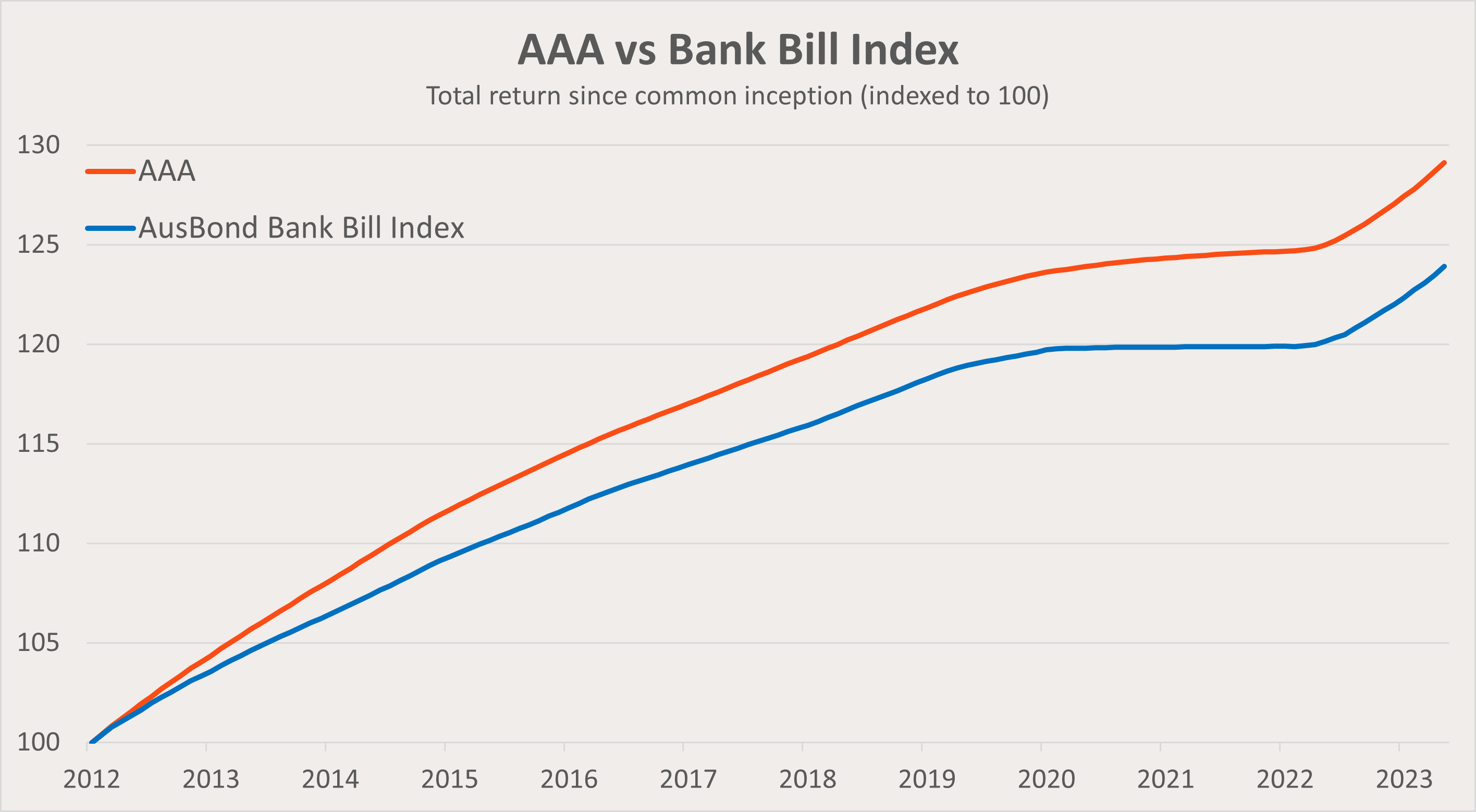

Betashares Australian High Interest Cash ETF (ASX: AAA) is an exchange traded fund that simply invests in cash deposit accounts held with selected banks in Australia. AAA has been operating for more than 10 years and has over $3 billion invested in the fund (as at 31 July 2023).

Over the past decade, AAA has been a popular alternative to term deposits by offering an attractive yield with the benefit of T+2 liquidity. AAA’s distributions are paid monthly, and it’s a true cash fund, unlike some other ‘cash’ exposures which utilise cash-like instruments. Since inception, AAA has consistently paid a higher net of fee rate than the RBA cash rate.

Source: Bloomberg, Betashares. As at 30 June 2023. Past performance is not an indicator of future performance. Common inception is 6 March 2012. Returns are net of fee total returns. You cannot invest directly in an index.

When allocating to cash, investors may wish to consider flexible exposures that have regular, attractive income. The key points of differentiation and features of AAA are:

- Security – the ETF’s assets are cash accounts (‘at call’ deposits, term deposits and notice accounts) with one or more selected banks regulated in Australia by APRA. The fund does not invest in bonds or money market securities.

- An attractive interest rate – as compared to alternative cash deposit products and/or custodial facilities.

- Ease of implementation – a monthly cash interest distribution, with a DRP option.

- Bought/sold like any other listed security with normal ASX T+2 settlement.

You can find more information including AAA’s interest rate updated daily on AAA fund page here.

AAA is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

-

AAA

Australian High Interest Cash ETF

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from .