If the idea of making money while sleeping sounds appealing, then passive investing may be a great approach to consider.

It’s commonly achieved by purchasing low-cost products, such as index funds and letting them compound returns over time.

Extolled by billionaire investor Warren Buffett, passive investing has increased in popularity globally, and Australia has caught on to the trend.

In fact, investors across all generations, including millennials, retirees, and self-managed superannuation funds, have poured over A$135 billion into exchange traded products trading on the Australian Securities Exchange (ASX), while that figure is A$14 trillion for ETFs globally.

Active vs passive: what’s the difference?

In order to understand why passive investing has become so popular, it’s important to compare and contrast the strategy to active investing.

Active vs passive investing performance: The Warren Buffett view

The debate between active and passive investing is an age-old conundrum: Should investors choose (the potential for) higher returns or lower fees?

Warren Buffett, the chairman and CEO of Berkshire Hathaway, has stated his belief that most investors are better off sticking to index funds as they don’t have the time or skills to manage their own portfolio, and the fact that higher fees don’t necessarily translate to superior returns.

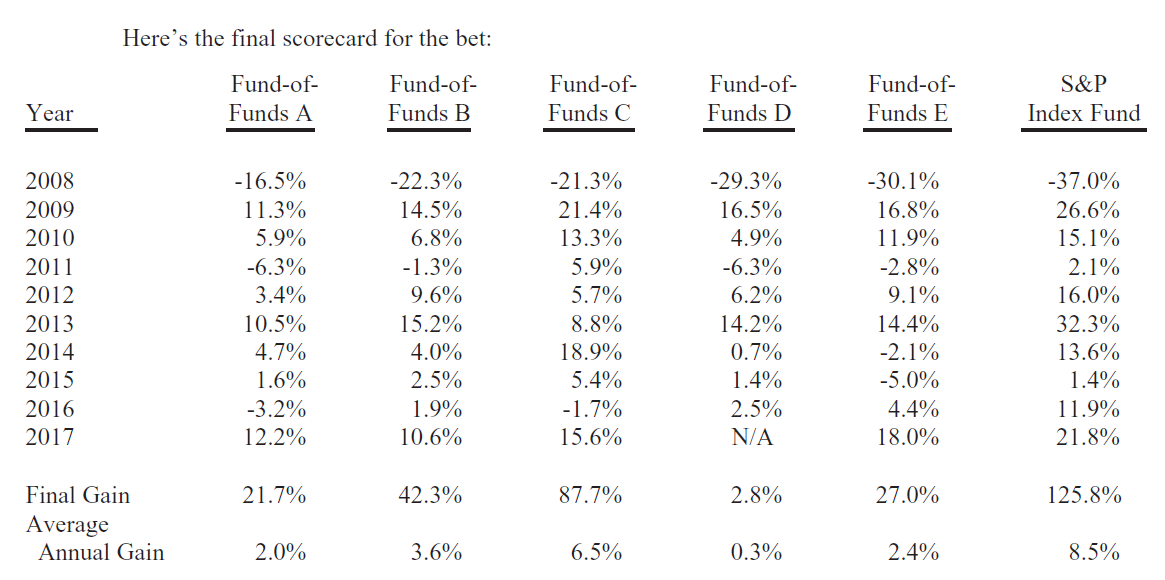

In fact, Buffett test-drove this theory by making a US$1 million bet in 2007 that a passively-managed S&P 500 index fund would outperform five high profile active funds run by highly-paid Wall Street professionals over the next decade.

“A virtually cost-free investment in an unmanaged S&P 500 index fund – would, over time, deliver better results than those achieved by most investment professionals, however well-regarded and incentivized those ‘helpers’ may be,” Buffett wrote in his 2017 Shareholder Letter where he shared the results of that bet.

Over the 10 years to 2017:

- The S&P 500 delivered 125.8% cumulative growth

- The worst of five active funds delivered a paltry 2.8%, while the best returned 87.7% over the same period.

Of course, it’s important to remember that past performance isn’t indicative of future performance.

Table: The Buffett Bet – S&P 500 versus five select active funds

Source: Berkshire Hathaway 2017 Shareholder Letter. Provided for illustrative examples only. Not a recommendation to investor or adopt any investment strategy. Past performance is not indicative of future performance.

Passive outperforms in Australia

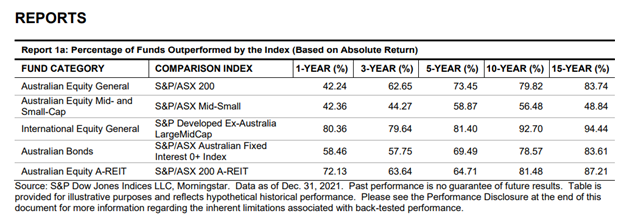

The data also supports Buffett’s views about passive investing in an Australian context.

Standard & Poor’s, the company famous for creating the namesake “S&P” indices, conducts regular studies on the performance of active and passive managers over time.

In its SPIVA Australia 2021 Scorecard, the company found over a 10-year period:

- About four out of five active funds in Australian equities, global equities, Australian Real Estate Investment Trusts and bonds underperformed the respective comparison indices

- Nearly all global equity funds underperformed the comparison index

- Only 44% of mid- and small-cap funds beat the comparison index

Table: Active funds vs the comparison index across core asset class categories

Source: SPIVA Australia 2021 Scorecard by Standard & Poor’s

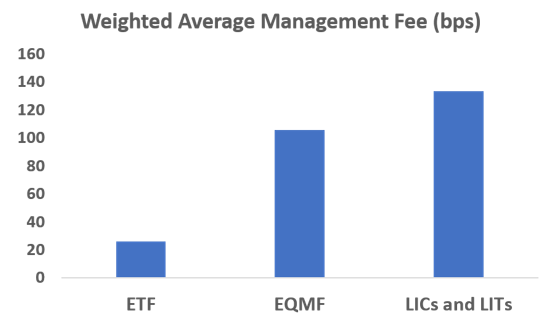

Consider the impact of fees

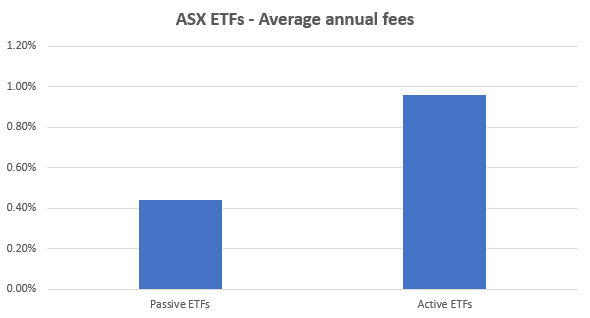

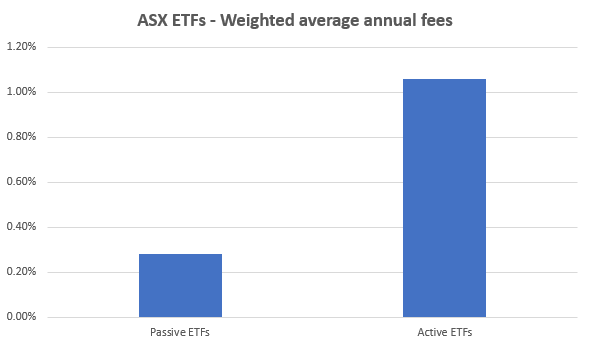

Despite data highlighting that majority of active funds have underperformed, investors have tended to pay more to hold them.

ASX data indicates average fees are:

- 1.33% p.a. for listed investment companies (LIC) and listed investment trusts (LIT), which are popular active investment structures listed on the ASX

- 1.06% p.a. for exchange-quoted managed funds (EQMF), which are essentially actively-managed funds quoted on the ASX

- 0.26% for passive ETFs

Table: Average management fees across passive and active products

Source: ASX Data, Betashares – 30 June 2022

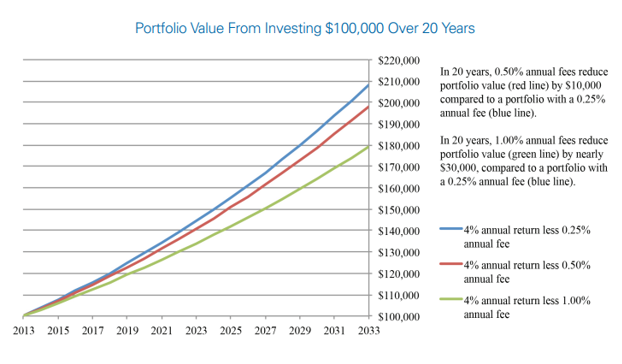

Ongoing fees matter because they can reduce the value of an investor’s portfolio and have a major impact on how much they earn, particularly in the case of any underperforming active funds.

The following chart shows the impact of various fee levels on an investment portfolio with a 4% annual return over 20 years.

Table: Portfolio Value From Investing $100,000 Over 20 Years

Source: Investor.gov. Hypothetical example provided for illustrative purposes only.

ASX ETFs – Average annual management fees

Passive ETFs: 0.44%

Active ETFs: 0.96%

ASX ETFs – Weighted average annual management fees

Passive ETFs: 0.28%

Active ETFs: 1.06%

Useful tip: Use the Australian Government’s managed funds fee calculator to help you understand the impact of fund fees as you compare different products for your portfolio.

Consider active where it makes sense

While costs are important considerations for all investors, the reality is investors should carefully consider their personal circumstances and which strategies are best aligned to them.

In an active versus passive context, one possible approach to consider is a core/satellite strategy where “core” index funds and ETFs form the bulk of a portfolio to keep costs low. Meanwhile, “satellite” active strategies are used selectively to enhance a portfolio’s overall returns, yield, or capital preservation qualities.

How to start passive investing with ETFs?

Building a portfolio with passive investments can be a great strategy for long-term wealth creation. Before getting started, it is critical for investors think about what they need from their portfolio before deciding where to invest.

Below are useful considerations if you’re thinking about using ETFs to begin your passive investing journey:

You may also wish to consider seeking the services of a financial adviser (as well as seeking independent tax advice) to help you plan your investing journey and structure a portfolio based on your goals.

Start your journey by comparing Betashares ETFs

Now that you have a better understanding of passive investing, take a peek at our broad selection of ETFs across major asset classes and sectors in the table below. When you’re ready to invest, you’ll need to create a brokerage account (if you don’t already have one). Prior to making a purchase, check out the nine things to know before investing in ETFs.

Fund categories

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant Product Disclosure Statement and the Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice. An investment in any Betashares Fund should only be considered as a component of a broader portfolio.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.