David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

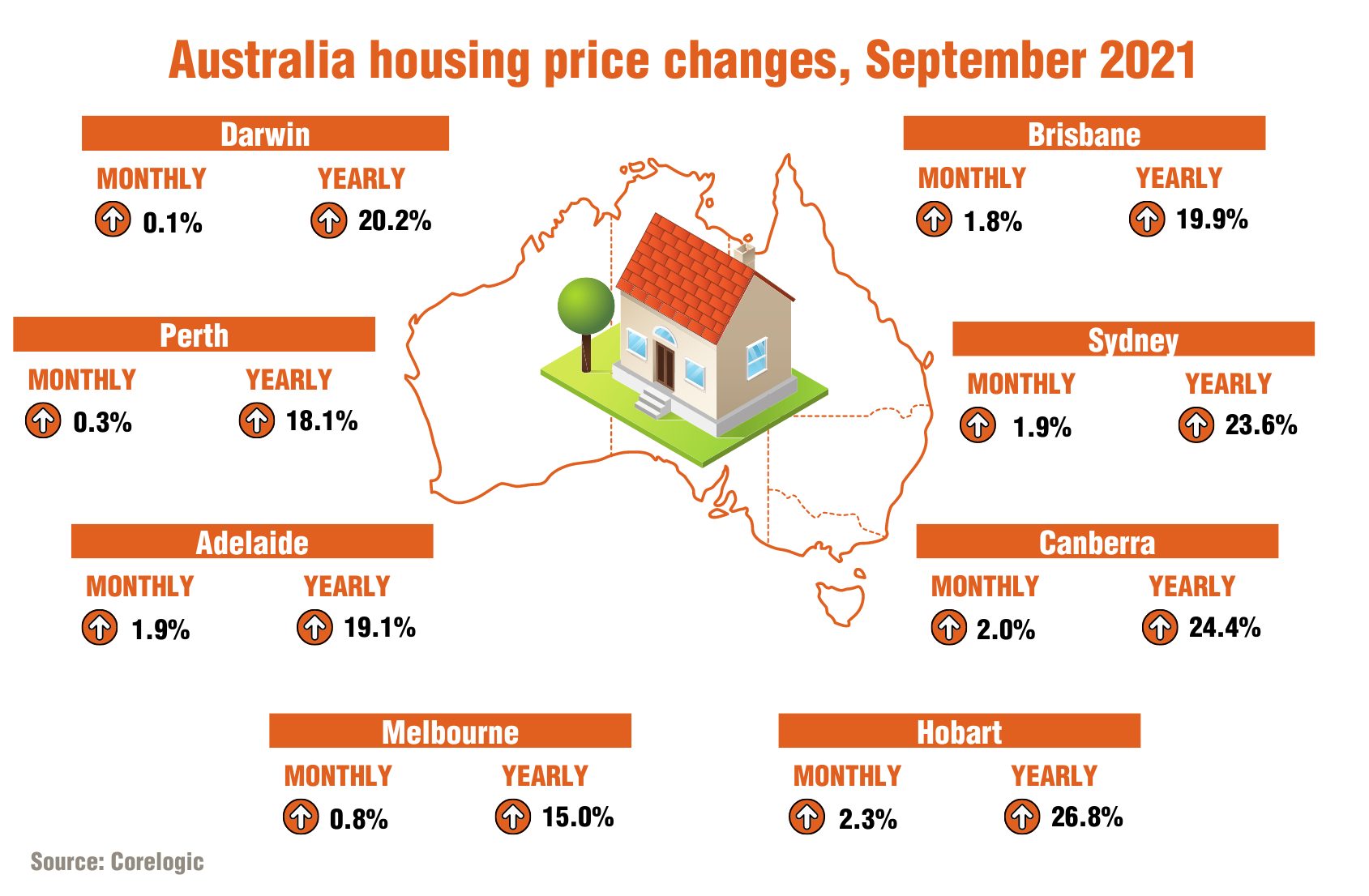

Property prices on the rise – again!

Those who were hoping that the 2020 COVID crisis might cause a “crash” in house prices to more affordable levels haven been left bitterly disappointed.

Across major capital cities in Australia, it now takes at least half a million dollars to buy an averaged priced property.

As at 1 October 2021, the average property price in Sydney is $1.3 million.1

Even a 10% home deposit requires at least $50,000 to $100,000 to get a foot on the property ladder.

What’s more, given still very low interest rates and the strong rebound in the economy following the initial COVID crisis, Betashares Chief Economist, David Bassanese, estimates prices nationally may rise another 10% to 20% over the coming year – further putting beyond reach the dreams of many younger Australians to own their own home or investment property.

Those that fear they’ve missed the property boat so far have two choices:

- Start saving furiously to build their deposit requirement

- Look for alternate ways to build wealth over time

Either way, having a savings or investment plan outside of the property sector – at least for a time – may make sense for many people.

As this report shows, for these investors some luck is on their side: thanks to innovations in the funds management industry, it has never been easier or more cost effective for Australian investors to start investing and to create their own highly diversified investment portfolio on the Australian share market.

Additionally, due to the beauty of investment compounding, even relatively small investments could build up significantly over time – especially if any income earned is automatically re-invested and regular extra investments are made as part of a systematic savings plan.

Learn more about the property vs shares debate here.

Assuming you have access to your own share trading account, here are 3 steps to easily and cost effectively build a highly diversified exposure to investments outside of the housing market.

Step 1: Discover ETF investments

While the ASX has traditionally been seen as a place to buy and sell individual company shares (such as Commonwealth Bank, BHP Billiton or Woolworths, which almost all of us are likely to already have exposure to through our superannuation funds already), investors these days don’t need to worry about which stocks to buy if they just want broad exposure to the sharemarket.

That’s because investors can buy exchange traded funds (ETFs) instead.

ETFs are essentially professionally run managed investment funds that can be bought and sold on the ASX, just like a company share. Put a simple way, ETFs pool money from their investors and use the proceeds to buy portfolio of individual company shares – limiting investor exposure to any one company and offering diversification across the relevant market or sector.

As with company shares, each ETF has a trading code, or ‘ticker’ – to view the ETF’s price, or buy/sell the ETF through your share trading account, you can easily search for the ETF using this code.

Most ETFs are passively managed “index” funds, which aim to track the performance of the market or an index.

The key advantage to this approach is the ETF provider is not actively buying and selling shares looking for outperformance, so does not need to use a team of highly paid investment gurus to pick stocks, with the cost saving passed onto investors in the form of relatively low investment management fees.

Another advantage of this approach is transparency. As passive ETFs only buy and sell securities based on the index being tracked, anyone can see at any time what stocks an ETF holds by going to the ETF provider’s website.

ETFs are also regulated investments. Indeed, ETFs must meet stringent regulatory requirements with investor protection in mind. This includes, for example, requirements that the ETF provider be appropriately licensed and that the ETF’s assets be held separately on trust, for the benefit of investors.

ETFs also have no minimum investment (subject to any broker requirements) – you can buy as little as one ETF unit on the ASX. That said, due to share trading or “brokerage” costs – which, as noted above, can be around $20 a trade – investors may prefer to buy ETF investments in somewhat larger chunks.

Step 2: Consider your risk appetite and asset allocation

There are now over 200 exchange traded products on the ASX – covering Australian and international equity markets, bonds, currencies and even commodities like gold and oil.

That means your investment portfolio can be as simple or multi-faceted as you want to make it – you can buy only one or two ETFs covering a specific investment market (like Australian equities), or a range of ETFs covering many markets.

What’s more, investors also face a risk-return trade-off: asset classes such as equities and listed property generally offer higher returns than cash or bonds over time, but the returns of the former tend to be much more volatile on a year-to-year basis.

Ideally, a well-diversified yet still relatively simple portfolio might contain a mix of ETFs providing broad index-like exposure to all of these asset classes, with some additional weight also given to growth assets like equities depending on your risk tolerance.

Investors who are relatively early in their investment careers may be willing to accept more volatile equity exposures – as long-run returns have tended to be higher, and they have time to recover from any market dips that may take place over the short to medium-term.

That said, all investors can have a different tolerance for investment volatility – irrespective of age. If in doubt, consult a financial planner to help decide the asset allocation that might suit you best.

Step 3: Choose and review an ETF portfolio & holdings

Subject to your own assessed level of acceptable risk and considering your financial objectives, outlined below are three example ETFs from the Betashares suite of funds that illustrate the types of exposures you can obtain.2

For starters, history suggests that equities tend to produce the strongest returns over time, albeit with more volatility, compared to other types of investment such as cash or bonds. For investors seeking long-term capital growth, therefore, it’s hard to go past a high allocation to shares.

Explore ASX: DHHF

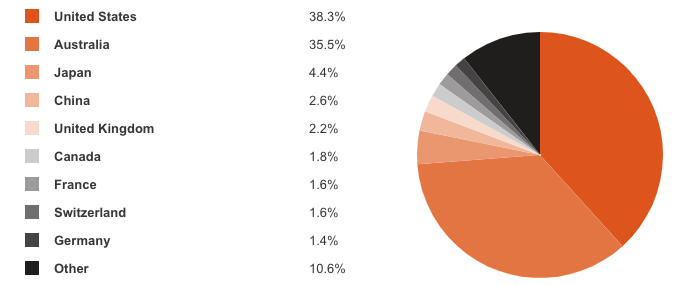

Arguably, one of the easiest ways to get broad exposure to shares is through the DHHF Diversified All Growth ETF . This fund invests 100% into equities and gives you exposure not just to the Australian share market but also to international shares – all in the one fund.

DHHF currently invests around one third of its funds into the broad Australian share market, with the remaining two thirds across global markets – such as the United States, Europe, Japan and China. All up, the fund invests in around 8,000 listed shares in over 60 global stock exchanges around the world.

Betashares Diversified All Country Growth ETF: County Allocation, 30 July 2021

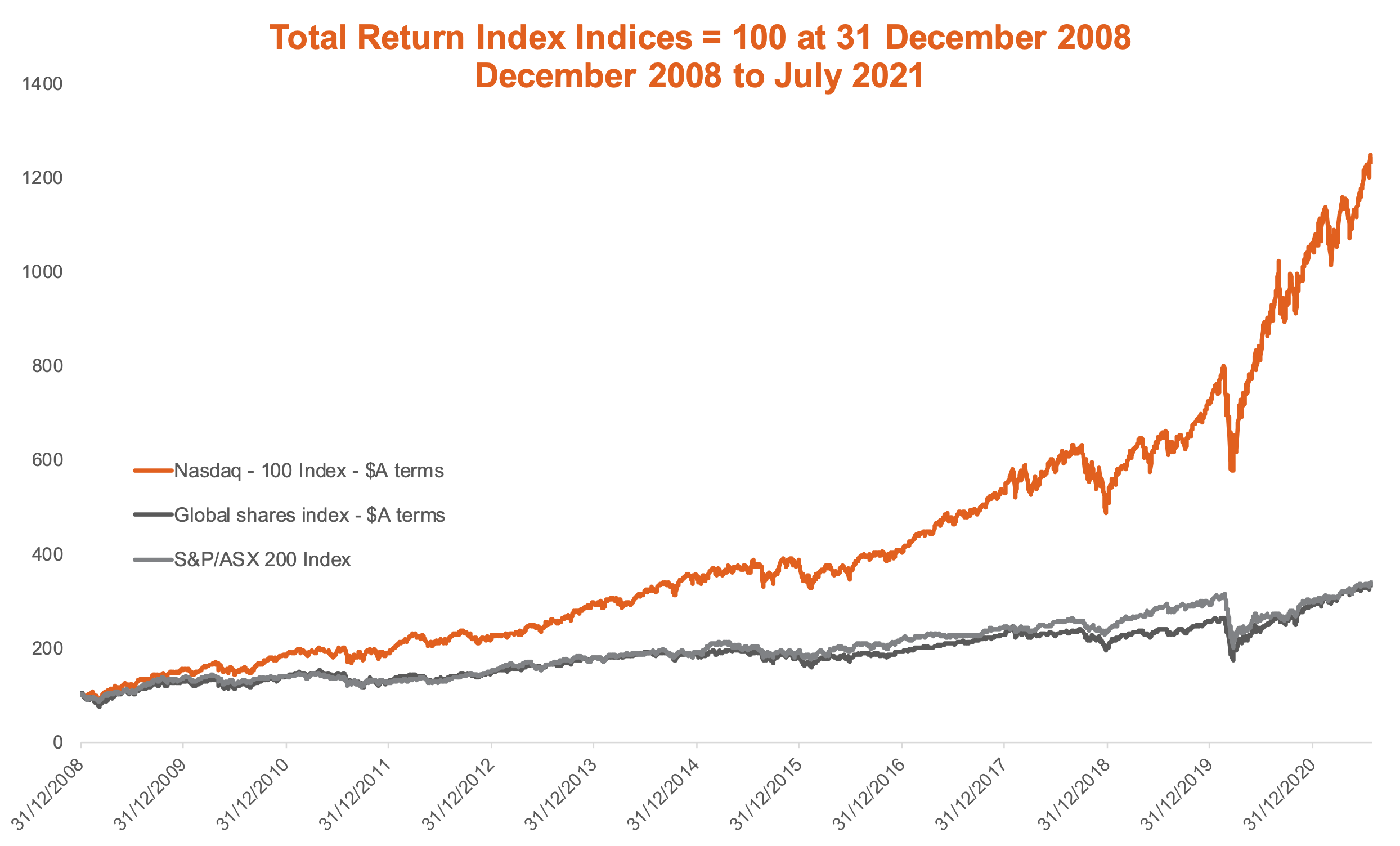

Explore ASX: NDQ

For those interested in exposure to companies with particularly attractive long-run growth potential, another option is the NDQ Nasdaq 100 ETF .

This fund provides exposure to the 100 largest non-financial companies listed on the US-based NASDAQ exchange, which historically has been home to some of the world’s most innovative companies. At present, the top companies on the NASDAQ exchange include such household names like Apple, Microsoft, Facebook, Amazon and Google.

The Nasdaq-100 index (that NDQ aims to track) has been a strong performer in global markets in recent years thanks to the strong underlying earnings growth of these increasingly dominant countries.

Source: Bloomberg. Past performance of the index is not indicative of future performance of the index or ETF. Graph shows performance of the index that NDQ aims to track (being the Nasdaq-100 Index) relative to the S&P/ASX 200 Index and the MSCI All-Country World Equity Index. It does not show the performance of NDQ and does not take into account NDQ’s management fees and costs of 0.48% p.a. or other fund costs. NDQ’s inception date is 26 May 2015. Investing involves risk. The Nasdaq-100 Index’s returns can be expected to be more volatile (i.e. vary up and down) than a broad Australian or global shares exposure. You cannot invest directly in an index. Nasdaq-100 is a registered trademark of Nasdaq, Inc (Nasdaq). NDQ is not issued, endorsed, sold or promoted by Nasdaq and Nasdaq makes no warranties and bears no liability with respect to NDQ. There are risks associated with an investment in NDQ, including market risk, country risk, currency risk and sector risk. For more information on risks and other features of NDQ, please see the Product Disclosure Statement, available at www.betashares.com.au. NDQ’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global or Australian shares exposure, given its concentrated sector exposure. NDQ should only be considered as a component of a diversified portfolio.

Explore ASX: ERTH

Another investment option that taps into an area with increasingly apparent mega-trend potential is the ERTH Climate Change Innovation ETF .

There’s no denying the world is racing to “decarbonise” economic activity, with a view to reducing net greenhouse gas emissions from around 30 billion tonnes of CO2 last year, to zero by 2050. In the area of clean energy alone, the International Energy Agency (IEA) recently estimated investment will need to more than triple by 2030 to over $US4 trillion.3

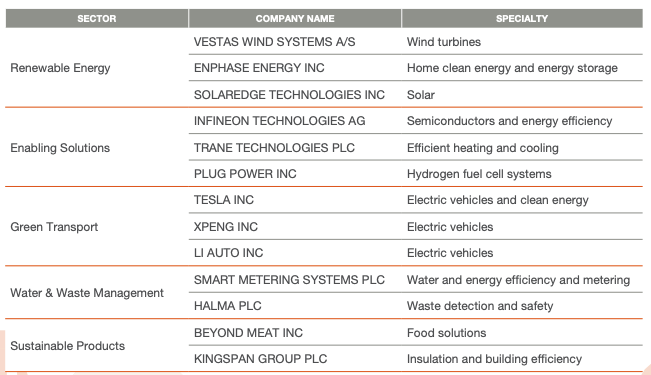

ERTH aims to provide exposure to this rapidly emerging trend, with exposure to a portfolio of up to 100 leading global companies that derive at least 50% of their revenues from activities that help to address climate change through the reduction or avoidance of CO2 emissions.

Importantly, as seen in the table below, these potential activities cover not just clean energy provision (an area which in itself is subject to significant change and uncertainty), but also leading companies tackling green transport, waste management, sustainable product development, and improved energy efficiency and storage.

Betashares has a broad range of other ETF options available to suit different tolerances, providing exposure to a wide range of – markets and asset classes.

Either way, as should be clear, Australia’s ETF market is now so easily accessible by everyday investors that no-one need feel constrained into thinking the only useful investment they can make is through the property market.

With only your carefully considered investment goals and a share trading account needed to get started, ETFs have opened up the full gamut of global investment opportunities to Australian investors.

Learn more…

1 Above data is based on Core-Logic Home Value indices – https://www.corelogic.com.au/news/september-2021-home-value-index

2 Net Zero by 2025: A Road Map for the Global Energy Sector, International Energy Agency, May 2021

3 Please note this is general information only and does not constitute personal financial advice. It does not take into account any person’s financial objectives, situation or needs

Important Information

An investment in any BetaShares Exchange Traded Fund (‘ETF’) is subject to investment risk including possible delays in repayment and loss of income and principal invested. Neither BetaShares Capital Ltd (“BetaShares”) nor BetaShares Holdings Pty Ltd guarantees the performance of any ETF or the repayment of capital or any particular rate of return. Past performance is not an indication of future performance.

This information is prepared by BetaShares Capital Ltd (ACN 139 566 868 AFS License 341181) (“BetaShares”), the product issuer. It is general information only and does not take into account your objectives, financial situation or needs so it may not be appropriate for you. Before making an investment decision you should consider the product disclosure statement (‘PDS’) and your circumstances and obtain financial advice.

The PDS is available at www.betashares.com.au or by calling 1300 487 577 (within Australia) or +61 2 9290 6888 (outside Australia). Only investors who are authorised as trading participants under the Australian Securities Exchange (ASX) Operating Rules may invest through the PDS. Other investors may buy units in the ETF on the ASX through a stockbroker, financial adviser or online broker. This document does not constitute an offer of, or an invitation to purchase or subscribe for securities.This information was prepared in good faith and to the extent permitted by law BetaShares accepts no liability for any errors or omissions or loss from reliance on any of it. BetaShares® and Back Your View® are registered trademarks of BetaShares Holdings Pty Ltd.

Any BetaShares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the provider of the index. No index provider makes any representation regarding the advisability of buying, selling or holding units in the BetaShares Funds or investing in securities generally. No index provider is involved in the operation or distribution of the BetaShares Funds and no index provider shall have any liability for the operation or distribution of these Funds or their failure to achieve their investment objectives.

An index provider has no obligation to take the needs of the BetaShares Fund or the unitholders of the Fund into consideration in determining, composing or calculating the relevant index. Any intellectual property rights in the index name and associated trademarks, index methodology, index values and constituent lists vest in the relevant index provider and/or its affiliates. BetaShares has obtained a licence from the relevant index provider to use such intellectual property rights in the creation and operation of the BetaShares Funds

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.