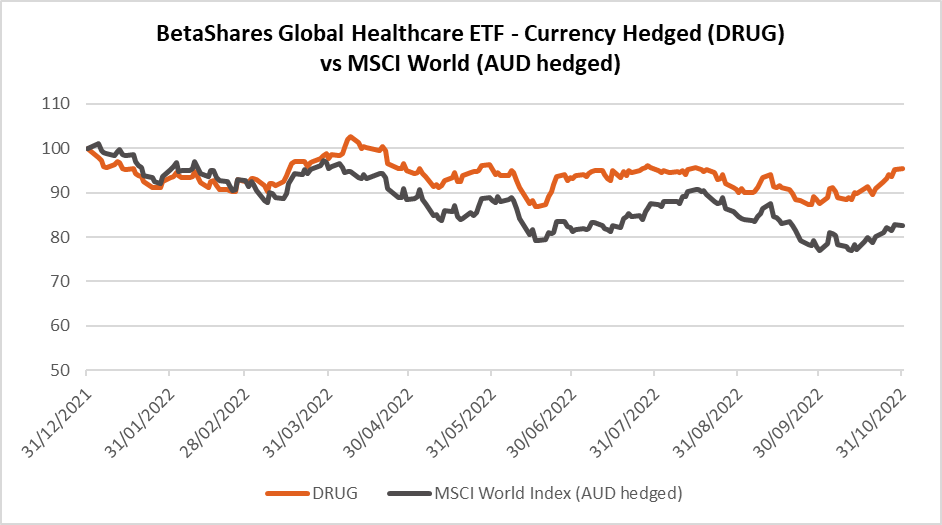

2022 has been a volatile year, with both stocks and bonds selling off over much of the year. But even when it seems like everything is falling, there can be pockets of the market that hold up relatively well. Global healthcare has been one such sector this year1.

Source: Bloomberg, Betashares. As at 31 October 2022. Re-based to 100 starting from 31 December 2021. Past performance is not an indicator of future performance.

As interest rates rise and global economic growth slows, many investors have turned to the healthcare sector, attracted by its perceived “defensive” characteristics. So-called defensive sectors are parts of the economy that tend to be quite resilient during economic downturns.

If this trend continues, healthcare could become increasingly important to investors’ portfolios in coming years. The DRUG Global Healthcare ETF – Currency Hedged has returned -4.9%, declining less than the MSCI World Index (AUD), which has returned -14.5% over the year to 31 October 2022. Other sectors that are normally considered defensive, including bonds, utilities and property trusts, have fallen harder, hit by rising interest rates.

Medicine for your portfolio

Over coming years, several demographic factors are poised to support increased spending on healthcare goods and services. These include ageing populations in developed countries, rising living standards in developing nations, population growth and ongoing medical advancements.

The incidence of chronic diseases such as cancer and Alzheimer are also predicted to rise as populations age2, driving up consumption of medicines and healthcare treatment. In addition, governments are often doing the spending as they fund public healthcare systems. Governments often spend in a counter-cyclical manner (i.e. increase spending when the economy struggles), which adds to the “defensiveness” of healthcare spending.

Reflecting the resilience of healthcare expenditure, spending increased on average by around 6% in 2021 in 17 OECD countries,3 easily outstripping economic growth in those nations. In 2020, average health expenditure grew 5%, driven by the exceptionally high growth in government spending in response to the COVID-19 pandemic.

According to the OECD, the pandemic revealed a lack of resilience of health systems in many countries, and additional financing is required to provide countries’ healthcare systems with greater agility to respond to future crises. There is a need to fortify the foundations of health systems and bolster the number of health workers on the frontline to protect the population’s health.

Over the short-term, the recent US midterm elections may also be a tailwind for healthcare. With Republicans winning a majority in the House of Representatives in the US, President Joe Biden may struggle to implement policies aimed at lowering drug prices.

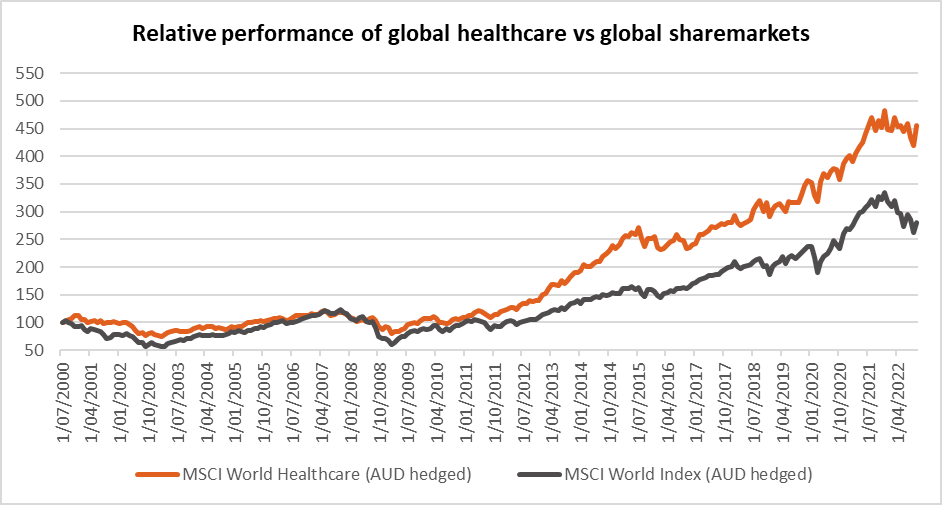

Over the long-term, the global healthcare sector has shown strong relative performance versus a broad index of global shares, as can be seen in the chart below.

Source: Bloomberg, Betashares. As at 31 October 2022. Re-based to 100 starting from 31 July 2000. Global shares represented by MSCI World Index (AUD-hedged), global healthcare represented by MSCI World Healthcare Index (AUD-hedged) (this index has been used to demonstrate the longer term performance of stocks in the healthcare sector – it is not the index tracked by the DRUG ETF). Past performance is not an indicator of future performance.

Healthcare arguably offers ‘the best of both worlds,’ that is the potential for relatively robust growth that is not highly influenced by rising interest rates or the economic cycle.

Gaining exposure to global healthcare

The DRUG Global Healthcare ETF – Currency Hedged offers investors a simple and cost-effective way to gain exposure to some of the world’s leading healthcare companies in a single ASX trade, including Pfizer, Johnson & Johnson and Roche.

The ETF is currency hedged, so any appreciation in the Australian dollar won’t bite into your returns -on the flip side, of course, you won’t benefit from a depreciation in the Australian dollar. Left unhedged, a rise in the Australian dollar erodes returns when assets are converted into the local currency. If, for example, the Australian dollar rises by 10%, the value of your offshore investments in AUD terms typically falls by 10%, all else equal. If, however, the Australian dollar falls by 10% against the US dollar, then the value of your US dollar-denominated investments would rise by 10%.

Currency hedging isn’t just for investors who think the Australian dollar will rise. Even investors who don’t have a view on the direction of currency may want to consider currency hedging their global equity investors as it alows them to gain exposure to a market or sector while reducing the effect of currency fluctuations.

There are risks associated with an investment in DRUG, including market risk, international investment risk, healthcare sector risk and concentration risk. DRUG may be subject to higher volatility than the broader market given its sector concentration. An investment in DRUG should only be considered as a component of a broader portfolio. For more information on the risks and other features of DRUG, please see the Product Disclosure Statement available at www.betashares.com.au. A Target Market Determination is also available at www.betashares.com.au/target-market-determinations.

References:

1. Represented by the Nasdaq Global ex-Australia Healthcare Hedged AUD Index, which BetaShares Global Healthcare ETF – Currency Hedged (ASX: DRUG) aims to track.

3. OECD Health Statistics 2022. See https://www.oecd.org/els/health-systems/health-expenditure.html

This article mentions the following funds

Written by

Betashares ETFs