This year’s sky-rocketing Bitcoin price and the fact that, as at the time of writing, Bitcoin’s market cap is over A$130 billion, has brought cryptocurrencies into the public’s consciousness. With Bitcoin’s ultra-high levels of volatility since its inception in 2009 it has truly been a rollercoaster ride! Indeed, there’s not a day that goes by without coming across a clickbait article with headlines such as “Father sells family home in $2.2m digital gamble”; “If You Bought $5 of Bitcoin 7 years ago …”; or “The 2010 Bitcoin Pizza Purchase That’s Worth $20 Million Today”. So what is this really all about? And is there any chance of a Bitcoin ETF in the future?

First, let’s start with some of the key terminology used: underpinning the rise in Bitcoin is the technology behind it – blockchain. A quick search will tell you that blockchain is a decentralised and distributed digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network. Mining is the process where transactions are verified and added to the public ledger. In summary, blockchain promises to revolutionise the way we transact and perform actions by storing a record of them in an immutable secure shared system which aims to prevent disputes of what took place, ultimately lessening the need for middlemen and arbitrators (aka banks!).

And it’s not just Bitcoin itself any more – numerous other cryptocurrencies have sprung up recently, some through initial coin offerings (ICO), a process similar to a stock’s IPO, which have attracted large inflows of capital with the current ICO record for “Filecoin” topping A$325 million. And like anything that starts to go mainstream, celebrities have jumped on board endorsing various ICOs including Paris Hilton, Floyd Mayweather and Ghostface Killah. This year, retired basketball player Dennis Rodman was photographed wearing shirts emblazoned “Potcoin” on his visits to North Korea. Who would have thought?

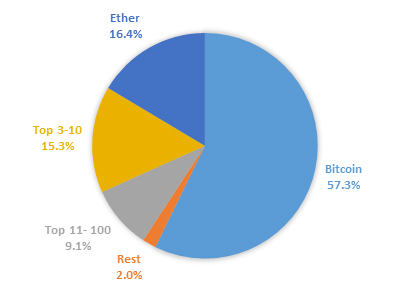

The A$232 billion cryptocurrency market capitalisation by Coin share as at 30th October 2017 (Source: coinmarketcap.com).

There are over 1,000 coins now available across multiple exchanges. With so much proliferation going on, ‘pump and dump’ schemes are common and as with any financial system there are scams and shady characters to be aware of. People have tried to take advantage of the lack of regulation and anonymous nature of crypto-coins to set up black markets, such as the Silk Road; move proceeds of crime; steal or avoid taxes. But it’s not all being used for nefarious activities – there are increasingly legitimate emerging technologies such as Etheruem, a blockchain development platform and Ripple, an interbank payment system – all of which have come about due to the increased popularity of these coins. Other applications in development tackle social network and gaming participation reward schemes, supply chain logistics, internet of things (IoT), storing digital identities and electronic voting.

The primary use of cryptocurrencies, however, is a store of value and medium of exchange and this has created controversy, causing polarised views within the finance industry. Naysayers have likened the growth in cryptocurrency to the 17th century Dutch tulip mania and the Beanie Babies bubble of the 1990s. It has also been compared to the rise and fall and rise again of the Dot-com era.

The mentality of many in the “coin” community is varied. Some participants are crypto-anarchists disillusioned with the global banking system who see Bitcoin as the new digital gold. There are those who believe wholeheartedly in the technology of blockchain and smart contracts, and also many who simply want to invest or trade and make money. Online forums and messaging services such as Reddit, Bitcointalk and Telegram are full of crypto-enthusiasts using playful terminology such as “hodl to the moon” or “Lamboland” – a term where investors keep hodling (hold purposely misspelt – a play on stupidity) their coins through volatility until they reach the moon or a fictional land where everyone has profited and is driving around in Lamborghinis.

So where is this all heading?

The truth is that the future of cryptocurrencies is still unknown, as many watch with baited breath as to how, when and if the bubble will burst. At the very least, the phenomenon is worthy of investigation and research. I believe as investors we should improve our understanding of the technology behind Bitcoin in the increasing likelihood or at least as a result of the possibility that cryptocurrencies become an accepted investment asset class in the future.

How far are we from a Bitcoin ETF?

Bitcoin ETFs have been a hot topic since the Winklevoss twins (or “Winklevii” to use the term popularised by the movie about Facebook’s early years, “The Social Network”) filed with the SEC to register a fund in 2013. This fund’s registration has since been rejected earlier this year. Regulatory authorities have been justifiably cautious and ETF product manufacturers have been examining ways to give investors exposure to the Bitcoin price movement. Needless to say, particularly in the US, there is an arms race and the flood gates will open when the first Crypto-ETF lists on a stock exchange.

Are there any other ways to capitalise on the growth of this space? Major tech companies like Microsoft, Google, Baidu, Amazon, Paypal and Cisco amongst others have also been investing in blockchain technology and research. Other companies such as Intel, Nvidia and Micron have seen increases in profits from the sale of their hardware used in blockchain mining. You can get exposure to these companies via the NDQ Nasdaq 100 ETF , which trades on the ASX via the ticker “NDQ”.

Over the coming months, I’ll try to post again about this fascinating world as the quest to Lamboland continues!

Written by

Nicholas Fritchley