Want to read it later?

Send the lesson to your inbox

Lesson 8 transcript

Every investment has a cost, even if you don’t realise you’re paying it. When you invest in an ETF or a managed fund, fees go to fund providers. They’re a set cost, as an annual percentage and deducted automatically. We explain more below.

On face value, seemingly small differences in management fees may not appear to matter all that much, but they can have a significant effect on returns over time, compounding along with your investment returns.

One of the factors driving the increasing popularity of ETFs is their generally lower cost compared to many traditional actively managed funds. Because most ETFs are passive investments, they tend not to charge the higher active management fees charged by traditional managed funds.

Painting the picture in numbers

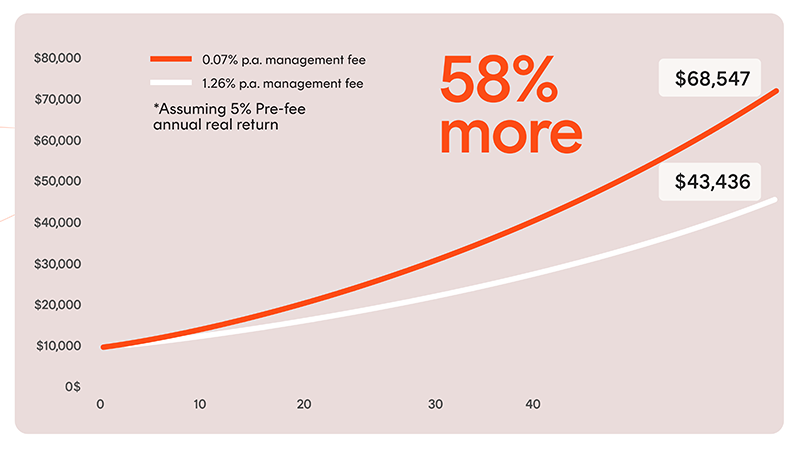

This chart compares the investment return of a low-fee passive ETF ( A200 Australia 200 ETF ) with an actively managed fund with a similar investment strategy (Australian shares), assuming:

- pre-fee returns of 5% p.a. for both funds

- a starting balance of $10,000

- A200’s current management fee of 0.04% p.a.

- an average active management fee of 1.26% p.a.

Over 40 years, the lower-fee ETF investment would grow to be worth $69,335, compared to the higher-fee managed fund investment value of $43,436.

The low-fee option would be worth around $25,900, or 59%, more than the high-fee option after 40 years.

Illustrative only. Assumed performance is not indicative of actual performance. Actual performance of A200 and the Australian sharemarket may differ.

How do ETF management costs work?

ETF investors don’t separately pay management fees to the ETF manager (e.g. from their bank account). Instead, the fees and costs are reflected and accrued in the Net Asset Value (NAV) of the ETF.

Fees in action

For example, the A200 Australia 200 ETF charges annual management costs of 0.04%*.

If you invested $10,000 in A200 over one year, assuming the underlying value of the fund’s holdings did not change, your investment would incur total management fees of $4.

Each day, approximately 1 cents in fees would be accrued ($4/365 days), and then deducted on a monthly basis, so after one year your investment would be worth around $9,996.