Insights

ETF distributions: frequently asked questions

ETF distributions: frequently asked questions

Is this the perfect storm for cybersecurity stocks?

Is this the perfect storm for cybersecurity stocks?

Cybersecurity companies stand to be a key beneficiary in today's world.

Where could income-starved investors park $11 billion?

Where could income-starved investors park $11 billion?

With interest rates falling, these bond ETFs could be an alternative for income-hungry investors.

Market Trends: June 2025

Market Trends: June 2025

Equities moved higher in June, helped by a quick containment of Middle East tensions.

US payrolls will be a focus this week.

The world's most important market is making noise

The world's most important market is making noise

When rumblings occur in the US Treasury market, everyone should pay attention - including you.

Where does the Israel-Iran crisis affect markets most?

Where does the Israel-Iran crisis affect markets most?

When markets are difficult and news flow is uncertain, where do investors focus their attention?

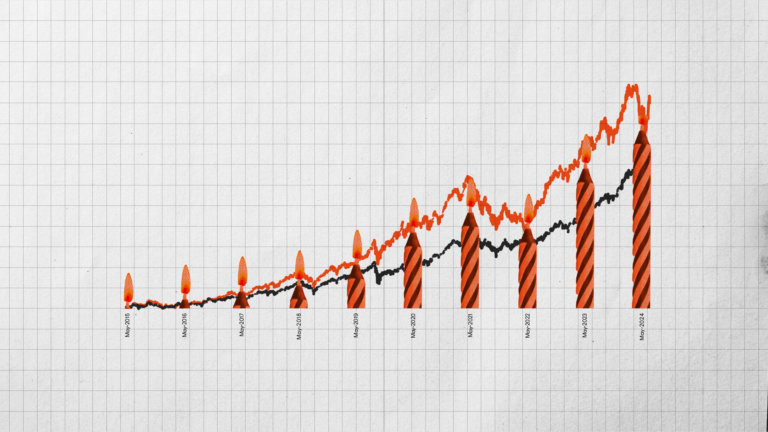

Charts of the month: May 2025 – Birthday Edition

Charts of the month: May 2025 – Birthday Edition

In this special edition of Charts of the month, we celebrate the birthdays of some...

Fallout out from the US strike on Iran will be a major focus this week.

No results were found. Please try a different search.

Stay up-to-date

Subscribe now to receive our latest insights and updates, including in-depth market analysis and regular thought pieces on investing, portfolio construction and ETF industry.