Thematic investing is a forward-looking investment approach that seeks to capitalise on megatrends and long-term structural changes.

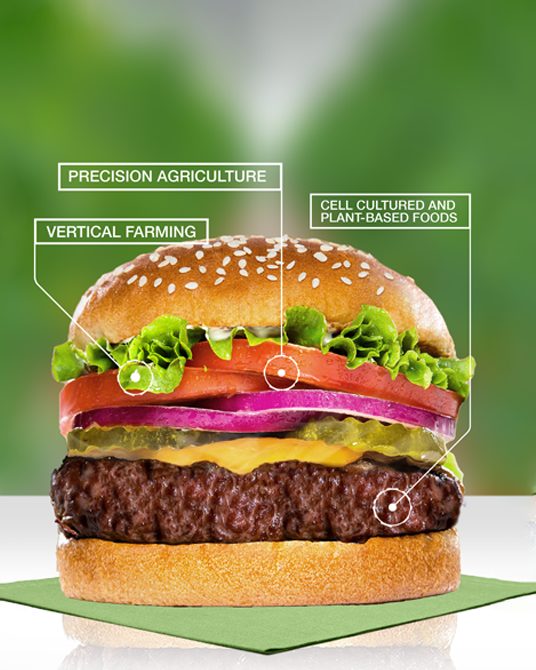

We believe there are three overarching megatrends that are shaping the future:

- Demographic change

- Technological innovation

- Climate change

These are broad forces that reach into almost every part of our lives, and as they evolve – and interact – they create themes that have a radical, observable impact on the world. Thematic investing aims to identify these thematic opportunities, and make investments that potentially will benefit if they are realised.

As most investors know, generating good share market returns requires identifying companies likely to produce healthy earnings and dividends over time. Thematic investing is primarily about accessing the potential for significant growth. Most thematic investors are looking for opportunities to generate returns higher than those they would get from investing in the broader market.

Thematic investing focuses on structural, not cyclical themes. Where cyclical themes play out over the short and medium-term, structural themes – for example, the move towards clean energy – play out over a much longer term, and tend to be one-off shifts that irreversibly change the world.

| Cyclical themes | Structural themes |

|

|

|

|

|

Frequently asked questions

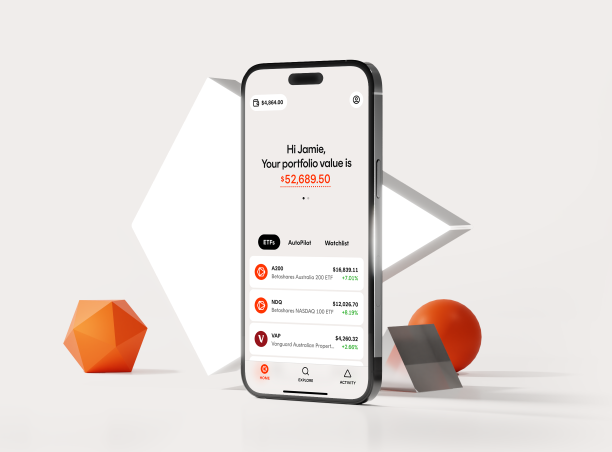

How to invest in thematic funds

It’s never been easier for investors to gain diversified, transparent and cost-effective exposure to these major investment themes shaping our world with ETFs.

These are some of the global thematic investment opportunities we’ve identified and the ETFs we’ve introduced to the market that offer exposure to these trends.