You may have seen the term ‘in-specie transfer’ and wondered what it means. Put simply, in-specie transfers allow investors to move assets between different investing platforms or brokers. Here, we break down exactly what they are and how they work.

What is an in-specie transfer? What does ‘in-specie’ mean?

An in-specie transfer involves the transfer or movement of assets (such as investments or property) without selling the assets or first converting the assets into cash. An example is an investor transferring their ETF holdings from one investment platform to another without selling them or converting them to cash.

Another example is when an asset is transferred out of an SMSF (e.g. following retirement) or into an SMSF (e.g. during accumulation phase).

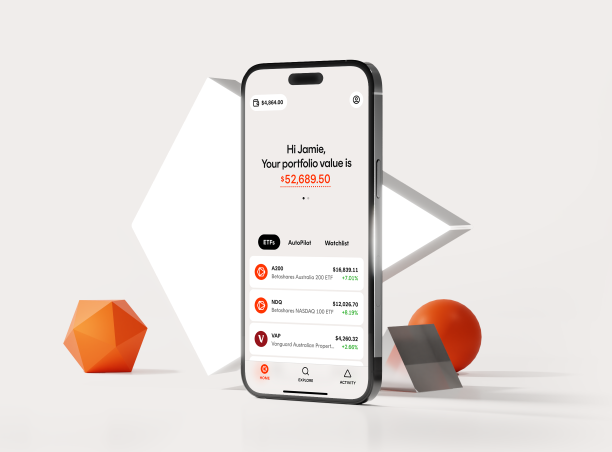

With Betashares Direct, you can transfer your ETF holdings from another account via an in-specie transfer.

How do in-specie transfers work on Betashares Direct?

Betashares Direct makes the in-specie transfer process very simple. It takes less than five minutes to complete and submit the transfer request if you have the required information at hand. There’s no paperwork required as the process is completed online.

Before you start, make sure you have:

- details of your other account/s that you’ll be transferring your holdings from

- details of the holdings to be transferred, including ASX code, the quantity you want to transfer and (if available) the cost price and purchase date of the relevant holdings

- the photo ID for each account holder.

Once you have the information ready, the in-specie transfer process consists of 5 easy steps:

- Log into Betashares Direct, click on Profile and then Transfer Holdings

- Enter the details of your account with the other provider

- Enter the details of the securities you want to transfer

- Upload photo ID e.g. driver’s licence or passport

- Review, digitally sign and submit.

Holdings will generally be transferred to your Betashares Direct account within 7 business days of submitting your transfer request.

Transfers may sometimes be delayed due to circumstances outside our control e.g. issues or delays with the account provider you are transferring your holdings from.

With other brokers or investment platforms, in-specie transfers typically involve far more time and paperwork.

The process can consist of printing and manually filling out an Off Market Transfer form which requires having to find details like the Participant Identification Number for your broker or account provider.

You may also need to email or post the form to your broker or account provider.

For additional information, please refer to our FAQs.

Why make an in-specie transfer?

By making an in-specie transfer of your ETF holdings to Betashares Direct, you can enjoy the benefits of consolidating your investments in one place, including making it easier to manage your portfolio and to keep track of portfolio performance.

With Betashares Direct, you can invest in any ETF traded on the ASX with zero brokerage, and cost-effectively invest in diversified pre-built portfolios, or build your own custom portfolios, for low monthly fees.

Betashares Direct also offers you powerful tools to automate your investing strategy, as well as streamlined, personalised performance and tax reporting to make your portfolio simple to administer and manage.

Refer to the Product Disclosure Statement, available at www.betashares.com.au/direct, for information on interest retained by Betashares on cash balances.

How much does it cost to make an in-specie transfer?

We do not charge a fee to transfer holdings into your Betashares Direct account from another account.

Your other account provider may charge fees – be sure to check before you submit the transfer request.

Betashares Direct charges a fee of $9.50 per security to transfer your investments out of your Betashares Direct account to another account in your name. Such a request will need to be initiated with the provider of your other account.

Is there capital gains tax (CGT) on an in-specie transfer?

As long as there is no change in beneficial ownership, the transfer of holdings from one investing platform account to another account should not trigger a CGT event. We recommend you obtain independent professional taxation advice to confirm the taxation implications of transferring your holdings.

Annabelle Dickson was previously a journalist at Financial Standard and prior to that at The Inside Investor and The Inside Adviser. She holds a Bachelor of Arts in Communication (Journalism) from The University of Technology Sydney.

Read more from Annabelle.