Richard Montgomery

Senior Content Manager - Richard Montgomery brings over 25 years of financial expertise to Betashares, where he steers investor communication. Prior to joining Betashares, Richard worked as a communications consultant for various financial institutions, including the Australian Securities Exchange (ASX).

The end of the financial year is fast approaching, and investors are turning their minds to the sometimes tedious, but always important, taxation aspects of their investments.

With that in mind, we thought we’d try to answer some of the most frequently asked tax-related questions the Betashares team gets from investors about their investments in our Funds.

It’s important to note Betashares is not a tax adviser and this information should not be construed as tax advice. You should obtain professional, independent tax advice specific to your personal circumstances before making any investment decision or completing your tax return.

1. How do I get an annual tax statement for my Betashares investments?

Every year in July and August, tax statements are made available to investors in all Betashares funds that have paid a distribution in respect of the previous financial year.

Tax statements are made available via Link Market Services’ Investor Centre and not sent by post unless specifically requested. You can submit a request to receive your tax statement by post via Link Market Services’ Investor Centre or by calling 1300 202 738 or emailing [email protected].

It’s important to make sure you have registered your details with Link to receive your Tax Statement promptly.

2. Does it make a difference to my tax if I take my distributions in cash or participate in a distribution reinvestment plan (DRP)?

Your ETF’s distribution will be subject to income tax, regardless of whether you take it in cash, or participate in a DRP.

If you participate in a DRP, it’s important to keep records of each distribution. If and when you come to sell your units, you will need to calculate your capital gain/loss for each individual parcel of units you have bought, including those you received as part of a DRP. You need to know the date and allocation price for each distribution that was reinvested and any cost base adjustments attached to the ETF’s distribution. Learn more about DRP.

3. Why do some Australian-domiciled fund distributions contain foreign source income, and others do not?

Foreign source income is income that has been derived in a country other than Australia.

If a company earns foreign source income and passes that on to an Australian investor, it identifies the income as ‘foreign source income’. If the income has been taxed overseas, you may also receive a credit for the tax paid. Depending on your individual circumstances, you may be able to claim an offset for tax paid overseas.

If an ETF’s portfolio includes companies that earn foreign source income, then your distributions from that ETF may include a foreign source income component, and possibly a foreign income tax offset in respect of tax paid overseas. Details of the components of your distribution will be contained in the annual tax statement you receive.

4. What is my ‘attributable taxable income’?

Betashares has elected for all of our funds to be governed by the Attribution Managed Investment Trust (AMIT) rules.1

The key features of the AMIT regime include:

- AMITs use an ‘attribution’ method to allocate taxable income amounts and their characters to investors.

- The taxable income attributed to you may be different to the cash amount you actually receive.

- If the cash amount is different to the attribution amount, you make an adjustment to the cost base of your investment that reflects this difference.

5. Why might my attributable income be different from the cash I actually receive?

The AMIT rules give Betashares the flexibility to make a cash distribution that is different from the attribution amount.

An attribution amount may reflect not just income produced by the underlying investments of the fund, but also components that can change significantly from year to year, such as capital gains made by the fund, or profits from activities such as currency hedging.

In some years, simply passing these amounts through to investors in full in cash may result in distributions that are significantly higher or lower than the fund typically pays or than what may be expected from the fund’s investment exposure.

In order to more appropriately reflect the expected distribution yield of the relevant fund, taking into account the fund’s investment objective, Betashares may decide to pay a cash distribution that is different to the attribution taxable amount.

6. What are AMIT cost base adjustments?

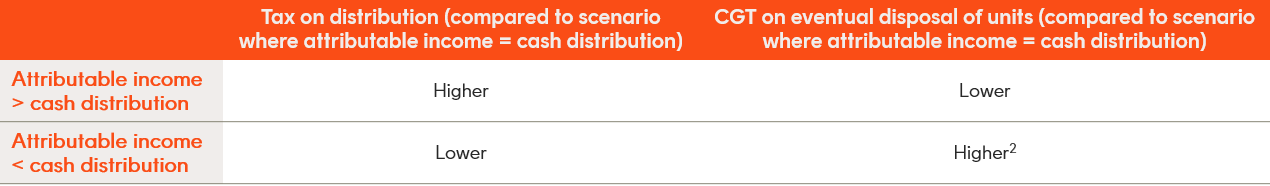

The adjustment you make to the cost base of your investment depends on whether the gross cash distribution you receive is higher or lower than your attributed taxable income for the year from the fund:

- If your cash distribution is more than your attributed taxable income, then you reduce your cost base by the excess.

- If your cash distribution is less than your attributed taxable income, then you increase your cost base by the shortfall.

The change to your cost base affects the capital gain or loss you will make when you come to dispose of your investment, and therefore the tax consequences of that disposal.

An increase in your cost base means that amounts that were counted as taxable income, but which you did not receive in cash, are not taxed again as capital gains on disposal.

A decrease in your cost base means that amounts you received in cash, but which were not counted as taxable income at the time you received those amounts, will increase the taxable gain (or decrease the loss) you make on disposal.

The table below summarises the tax implications, in comparison to a scenario where the attributable income is the same as the cash distribution.

7. Where do I obtain the details of the cost base adjustments?

Details of the annual cost base adjustments will be included in the Attribution Managed Investment Trust Member Annual (AMMA) Statement issued by Betashares to investors via our unit registry provider Link Market Services.

8. Worked example

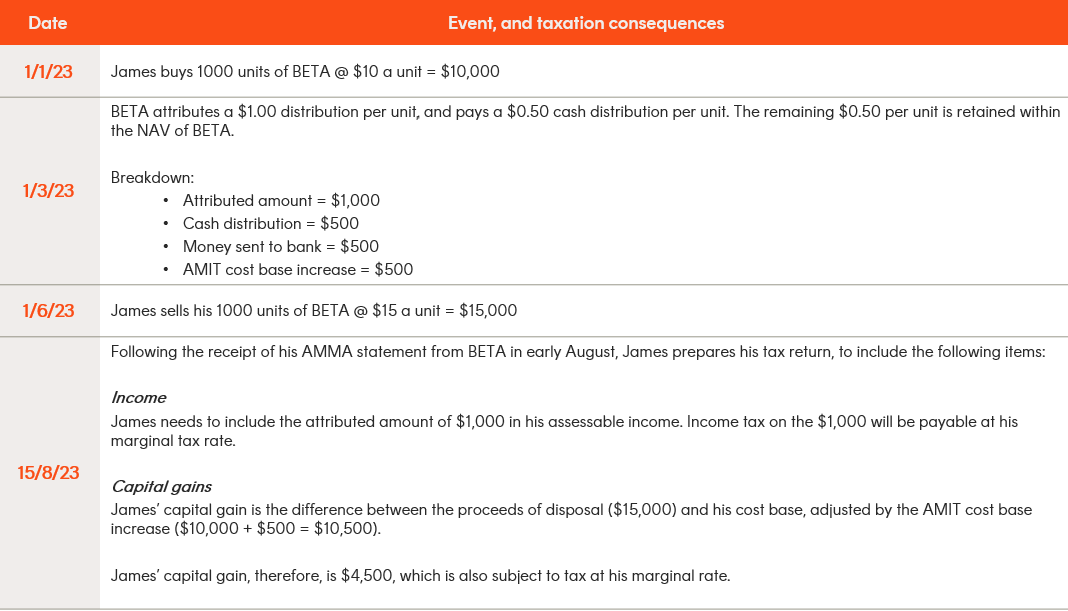

The table below sets out a hypothetical example where an investor’s attributable income from an ETF is greater than the cash distribution received. The example assumes the investor, James, has provided his tax file number (TFN) to Link Market Services.

This example is illustrative only. The unit purchase price, sale price and distribution amount have been used for ease of comprehension only and are not indicative of typical returns for any fund.

Betashares is not a tax adviser. This information should not be construed or relied on as tax advice and you should obtain professional, independent tax advice specific to your personal circumstances before making any investment decision.

The payment of distributions from Betashares Funds is not guaranteed. The amount of a distribution paid by a Fund may vary from period to period, and there may be periods when a Fund will not pay a distribution.

1. While Betashares has elected for all of our funds to be governed by the AMIT rules, it is possible that in a particular financial year a fund does not meet the eligibility criteria to be an AMIT. In that event, the AMIT rules would not apply and the fund’s distributions would be governed by the pre-existing, non-AMIT tax rules for managed funds.

2. If units are disposed of at a loss, there may be no CGT, in which case this will decrease the loss that may be offset against any other capital gain(s).

View some of our popular funds

Written by

Richard Montgomery

Senior Content Manager

Richard Montgomery brings over 25 years of financial expertise to Betashares, where he steers investor communication. Prior to joining Betashares, Richard worked as a communications consultant for various financial institutions, including the Australian Securities Exchange (ASX).

Read more from Richard.