David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Week in review

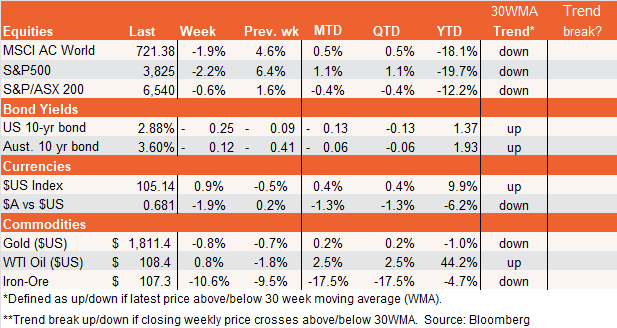

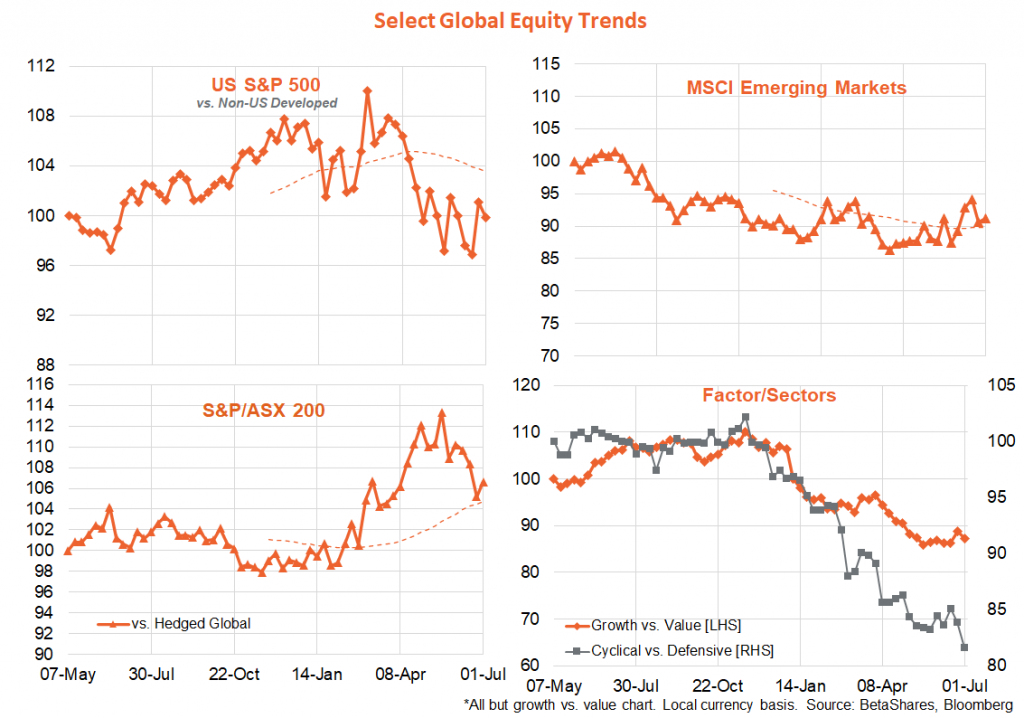

Global stocks weakened last week as the previous week’s hope of a soft landing morphed into fears of a hard landing, especially given a plunge in US consumer expectations and a weak ISM manufacturing report. Note, moreover, Wall Street weakened despite a slightly lower than expected rise in core consumer prices, likely because the same report revealed weaker than expected consumer spending which now makes a Q2 negative GDP outcome (and hence two quarters of negative economic growth) more likely.

It turns out bad news is bad news after all, especially if it is sufficiently bad. My call two weeks ago of an impending US recession remains firmly in place.

While US 10-year bond yields dropped for the second week in a row to 2.9% (a double top?), and Fed futures are now toying with the idea of rate cuts next year, near-term rate hike expectations remain strong – with a 90% probability still attached to a 0.75% Fed rate hike later this month. In other words, despite emerging weak activity data, the Fed is not yet prepared to pivot – as inflation remains stubbornly high and labour markets very tight. This is also why the $US remains strong.

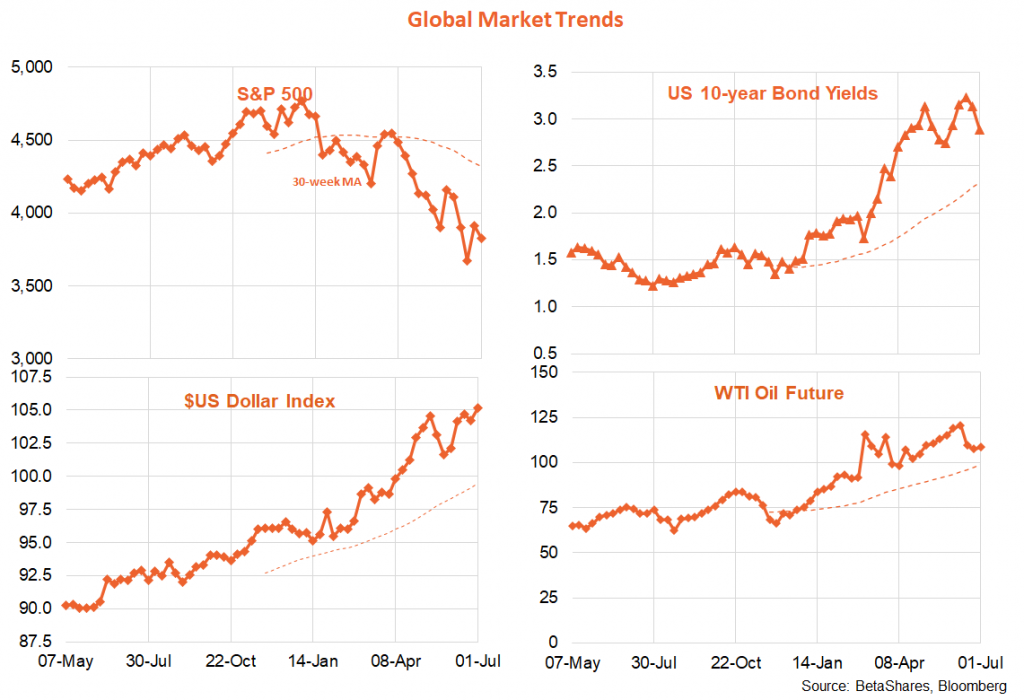

In terms of equity themes, growth again underperformed value despite declining bond yields, which now likely reflects fears that technology and consumer discretionary stocks are at greater risk of earnings weakness as economic growth slows. Globally, the energy and utility sectors held up last week, while materials, tech and consumer discretionary stocks were hit relatively hard. That’s also evident in the weakness in cyclical stocks versus defensive stocks last week. Energy remains supported by still high oil prices, through the latter appears at risk as central banks bear down on economic growth.

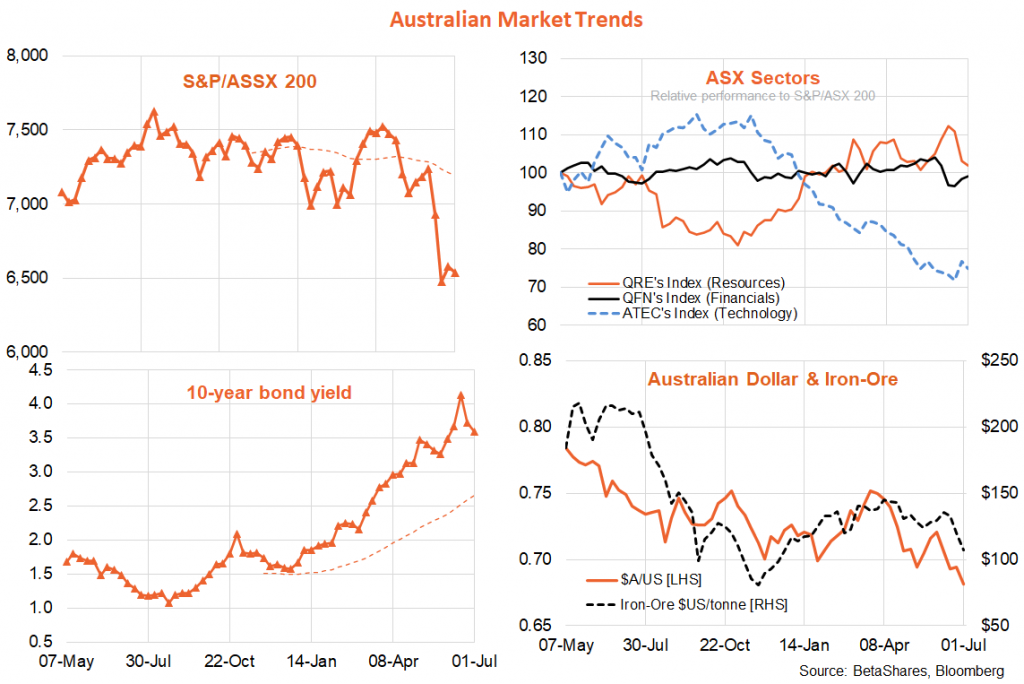

There were mixed economic data in Australia last week, with still solid retail spending in May yet the second successive decline in national house prices. There’s little here to suggest the RBA won’t move in line with market expectations and deliver another 0.5% rate hike at this week’s policy meeting.

In short, central banks today are all about aggressive upfront rate hikes – even at the risk of recession – to contain inflation expectations for as long as it takes to get actual inflation down to more tolerable levels. This is based on the view that there’s really no long-term trade-off between growth and inflation – if inflation is allowed to become entrenched at stubbornly high levels for the sake of short-term growth, this will only hurt long-term growth later.

In terms of Australian market moves, notable recent developments are the emerging weakness in mining stocks and the $A as markets start to focus on weaker global growth. Indeed, the $A appears to have broken below its recent range and I suspect will now weaken further – potentially as low as US60c in coming months.

Week ahead

Key focus points globally this week will be minutes to the Fed policy meeting on Wednesday, non-manufacturing (services) PMI survey on Thursday, and payrolls on Friday.

Markets will try to glean how much more aggressive the Fed intends to be from the minutes, though in reality beyond another likely 0.75% hike this month it will really depend on the data. The services PMI will be important to the extent it confirms the marked deceleration in growth evident from last week’s manufacturing survey – a weak result would be bullish for bonds but potentially still bearish for stocks.

The payrolls report is likely to show slower but still solid employment growth, with low unemployment and firm wages growth – it’s likely still premature to expected much weakness here as employment is usually the last shoe to drop when the US heads into recession.

In Australia, in a data-light week, Tuesday’s RBA Board meeting looms large. Despite the recent drop in consumer sentiment, overall economic activity and inflation pressure still appear sufficiently robust to suggest the Bank will follow through with market expectations for a 0.5% increase. That said, the RBA has recently shown a capacity to surprise and Tuesday could be no exception. If the RBA only hikes by 0.25%, expect the $A to drop like a stone.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.