David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

Week in review

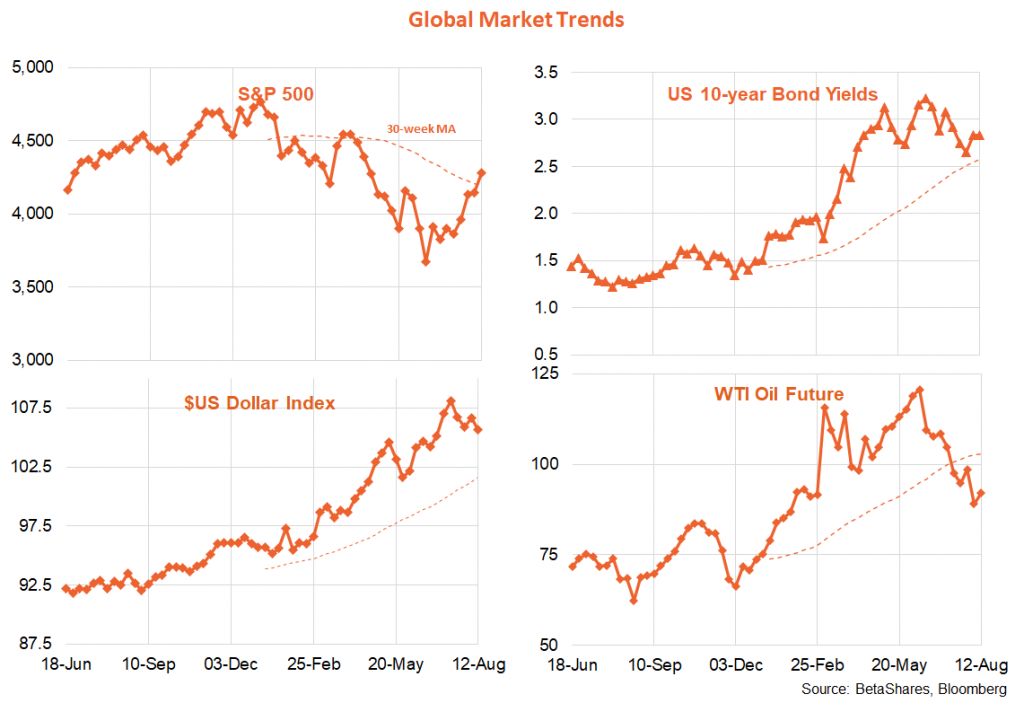

By far the global highlight last week was the softer than expected US July consumer price index report, with both headline and core inflation lower than market expectations. In turn this helped extend the rally in stocks and bonds that we’ve been enjoying since the peak in both bond yields and oil prices mid-June. Markets got a further boost later in the week with softer than expected producer prices, along with a rebound in consumer sentiment thanks to the decline in oil prices. As evident in the table above, global stocks and the S&P 500 closed the week above their respective 30 week moving average – suggesting a resumption of the uptrend. On this measure, US 10-year bond yields and the US dollar remain in uptrends, while oil prices have slipped into a downtrend in recent weeks.

All this begs the question: is this all just about oil prices? Could it be that just as the surge in oil prices in H1 hurt both bond and equity returns, can both now rally if oil prices continue to drop? The stagflationary challenge we faced (rising inflation and interest rates yet weakening consumer sentiment) could miraculously be replaced with a goldilocks scenario of falling inflation and interest rates yet improving consumer sentiment.

If it turns out that US inflation can fall quickly enough, the Fed can pivot and recession could at least be forestalled. That said, I’m still not sure this is the most likely outcome. For starters, we still have a very tight US labour market and rising wage costs. Secondly, much of the decline in oil prices appears to reflect expectations of weakening US growth (along with actual weak growth in lockdown-prone China). If US growth holds up much better than feared, the risk remains that oil prices could rebound – along with the fact that wage growth will likely remain quite firm. That’s why I still suspect the US economy will need a much weaker outlook than Wall Street currently anticipates (given still bullish earnings expectations) in order to achieve the type of sustained slowdown in inflation that the Fed is hoping for.

If I’m right, what will end this bear market rally? A rebound in oil prices would surely do it. Barring that, another scenario is stubbornly firm core inflation (and/or wage growth) over the next month or so, coupled with still hawkish Fed rhetoric even as some lead growth indicators (for example, in the housing market) continue to weaken.

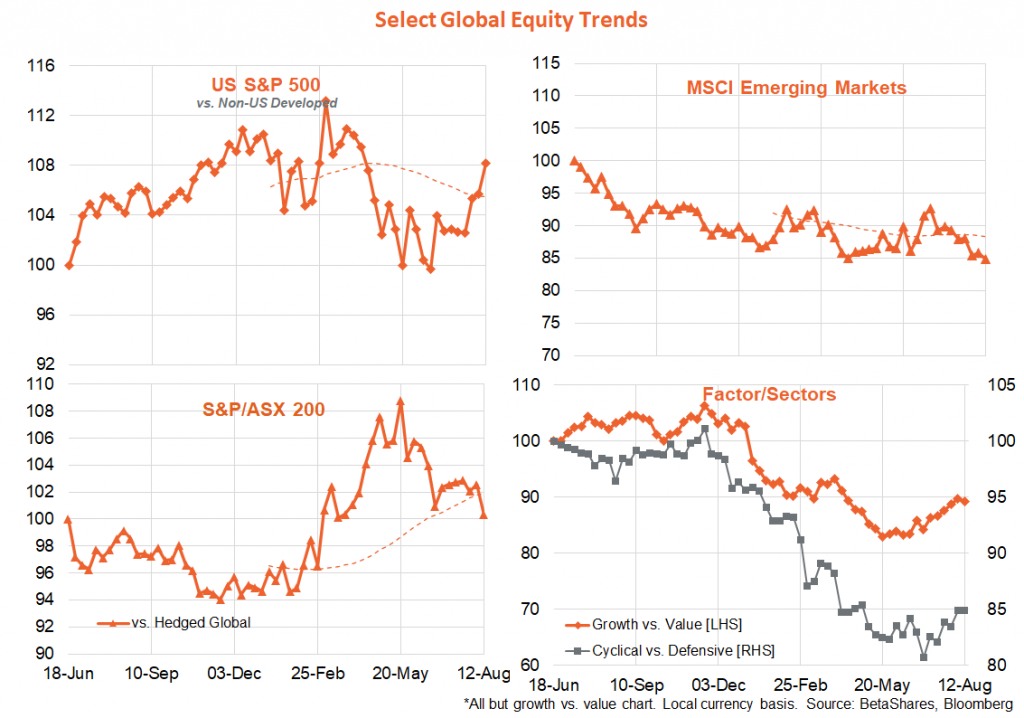

In the meantime, the rebound in risk sentiment has also seen a rebound in relative US equity performance, along with outperformance of growth over value and cyclical over defensive stocks. Australia and emerging markets are underperforming once again.

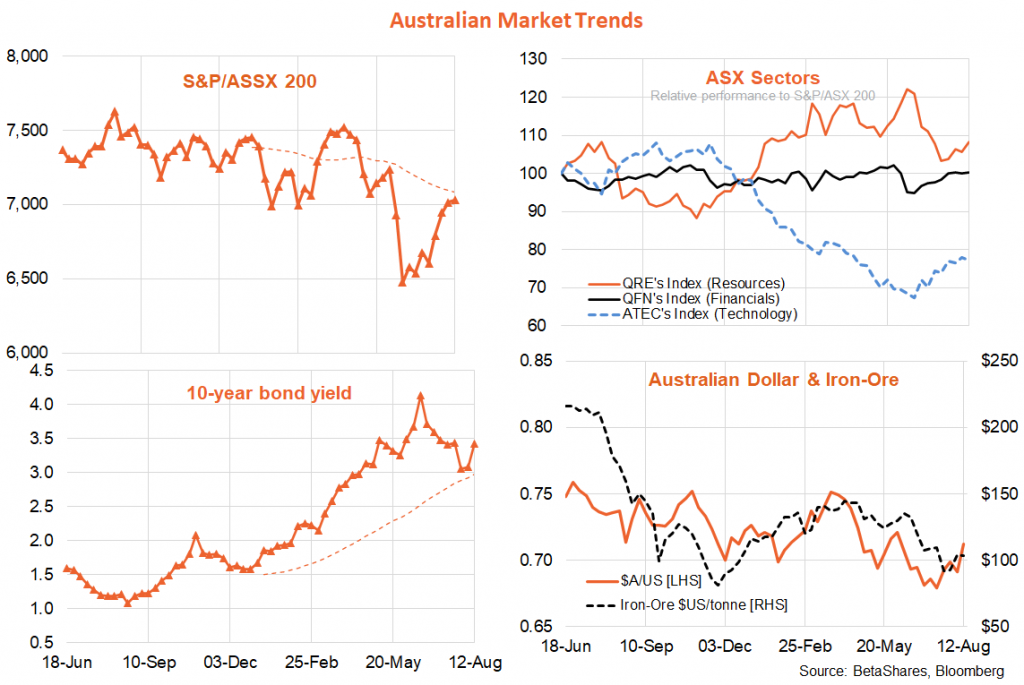

Closer to home, local business and consumer sentiment surveys continued to give conflicting signs on the economy. The NAB measure of business activity remains upbeat, although concerns around capacity constraints and cost pressures remain elevated. The Westpac/Melbourne Institute index of consumer sentiment continued to tumble, however, reflecting concerns with higher interest rates and inflation yet falling house prices. So far at least, subdued consumer confidence has yet to be reflected in subdued consumer spending, with the latter still buoyed by a booming jobs market and lingering post-COVID satiation of pent-up demand.

Week ahead

There’s nothing quite like last week’s critical US CPI news on the horizon this week, though US retail spending on Wednesday will be of interest along with a range of US housing indicators. Thanks to lower oil prices, nominal US retail spending should have been more subdued in July – nothing much to worry about there. Of more potential concern could be further evidence of housing market weakness via the housing starts and existing home sales reports. There’s also minutes to the July Fed meeting – though the market these days seems to be downplaying ongoing hawkish Fed signals as long as the inflation and oil prices trends remain encouraging.

In Australia we’ll get a very important update on wages, with the wage price index on Wednesday – especially given all the talk from the RBA and business about escalating wage costs. As it stands, the market expects a quarterly gain of 0.8%, which equates to a firm annualised rate of 3.2% but still subdued growth over the past year of only 2.7%. Despite the still low year-on-year rate, the firm annualised rate – or certainly anything higher – should be enough to support another 0.5% rate hike next month. Also likely supportive of a 0.5% hike will be Thursday’s labour force report, which is expected to reveal another solid employment gain in July of around 25k, with the unemployment rate holding steady at a generational low of 3.5%. More insight into RBA thinking may be gleaned from minutes to the August meeting tomorrow.

Either way, my base cases remains that the RBA will hike rates only a further 1% this year, taking the cash rate to 2.85% – which remains below the market’s expectation of a year-end cash rate of 3.3%. I expect one further 0.15% hike in Q1 2023.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.