Bitcoin finished the week slightly higher, finally halting its run of consecutive losing weeks at a new record of nine. A number of altcoins also finished the week positive. At the time of writing, bitcoin is trading at US$29,744.

Ether also managed to squeeze out a positive return of 0.59% vs bitcoin’s 2.60% over the week.

Bitcoin’s market cap is at $566.8B, while the total crypto market has risen to $1.23T. Bitcoin’s market dominance increased to 46.14%

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $29,744 | $32,249 | $29,303 | 2.60% |

| ETH (in US$) | $1,793 | $2,005 | $1,751 | 0.59% |

Source: CoinMarketCap. As at 5 June 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

Bitcoin: Knowledge and perceptions

Block Inc. the parent company of two prominent Bitcoin businesses, Cash App and Spiral, published a report last week titled Bitcoin: Knowledge and Perceptions 2022. The survey, taken in early 2022, had 9500 participants in 14 countries across the Americas, EMEA, and APAC. Key themes from the report were:

- People see promise in Bitcoin for a more equitable economy

- Education is key: Knowledge feeds optimism and participation

- Bitcoin stands out among cryptocurrencies

The survey suggests that people with lower incomes recognise the utility of bitcoin while higher-income respondents tend to see it as an investment and as an opportunity to make money. The trend also holds up on a country-by-country basis. Countries with lower per capita GDP and higher shares of income from remittances have higher rates of people citing ‘purchasing goods and services and sending money’ as good reasons to buy bitcoin. People from these same countries also cite ‘protection against inflation’ as a reason to buy. The higher people rate their level of knowledge, the more optimistic they are about bitcoin’s future. People in Nigeria, India, Vietnam, and Argentina have the highest rates of optimism globally about bitcoin’s future. People around the world are considerably more aware of bitcoin than any other cryptocurrency, with 88% of adults surveyed having heard of bitcoin.1

The Monetary Authority of Singapore explores asset tokenisation and decentralised finance

Singapore’s central bank, the Monetary Authority of Singapore (MAS) is partnering with DBS Bank Ltd., JP Morgan and Marketnode to launch a project called Project Guardian, described as “a collaborative initiative with the financial industry that seeks to explore the economic potential and value-adding use cases of asset tokenisation” and decentralised finance (Defi). The MAS also said: “The pilot aims to carry out secured borrowing and lending on a public blockchain-based network through execution of smart contracts.” Han Kwee Juan, head of group planning and strategy at DBS, commented: “DBS is pleased to lead the charge to explore potential digital assets and use of defi concepts that will enhance efficiency and scalability in trading, clearing, and settlement; while managing risks to financial stability and integrity.”2

ANZ and NAB rule out crypto for retail

Executives at Australia and New Zealand Banking Group (ANZ) and National Australia Bank (NAB) have stated that these banks will not allow retail customers to trade cryptocurrency on their platforms. At the Australian Financial Review Banking Summit, ANZ group executive for Australian retail, Maile Carnegie, told the Summit they do not want to endorse speculation on crypto when “the vast majority of them [retail customers] don’t understand really basic financial well-being concepts.” Angela Mentis, chief digital officer of NAB, was asked if NAB would consider offering crypto trading. She responded: “not in the foreseeable future and not for retail”. Commonwealth Bank (CBA) recently put their second trial on crypto trading on hold in May but could still proceed. At the Summit, CEO Matt Comyn added that if it were to proceed with the offering, the bank would look to restrict trading to those “who understand the risky asset class.”3

On-chain metrics

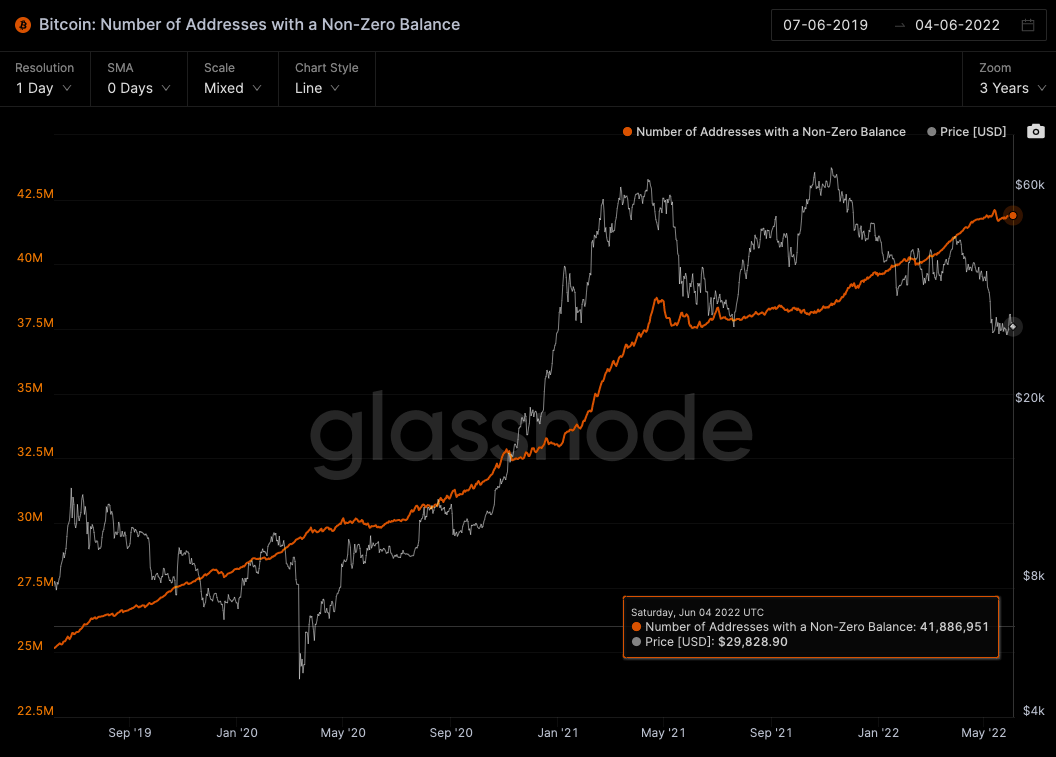

Bitcoin (BTC): Number of Addresses with a Non-Zero Balance

Number of Addresses with a Non-Zero Balance shows the number of unique addresses holding a positive (non-zero) amount of coins. This metric gives us a big picture view into whether the network is growing.

Looking at data from on-chain analytics company Glassnode, people are continuing to come into the network. Since October, there has been renewed wallet growth, with a slight dip in May on the pullback, but the trend has been higher once again. The growth curve is, however, less steep, signaling growth at a slower rate.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Lightning Network Capacity

Lightning Network Capacity shows the total amount of BTC locked in the Lightning Network. Lightning Network is a second-layer technology focused on transactions. Capacity refers to the total amount of Bitcoin locked in the network. Lightning Network payment nodes open payment channels with each other. As transactions are made across channels, the channel balance is reflected without the need to broadcast a transaction on-chain, effectively creating a second layer on top of the Bitcoin network.

According to data, Lightning Network Capacity touched an all-time high of 3,915.34 BTC recently. At the time of writing, its capacity was at 3,903.33 even though bitcoin prices have fallen significantly in the last 30 days.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Within the Top 20 altcoins, the standout performer was Cardano’s ADA with an uptick of over 20%. One reason for the recent jump could be NFT usage. Users have minted more than 5 million NFTs on the Cardano network which has increased the issuance of ADA. Another reason for the ADA rally is speculation about the impending Vasil hard fork, a software upgrade to the network, due on 29 June 2022. The hard fork should boost the scalability capabilities of Cardano’s network and its smart contracts, Plutus. Once completed, Cardano’s fork is expected to provide higher throughput to the network and an upgraded range of decentralised exchange (DEX), decentralised finance (DeFi) and smart contracts.4

According to its website: “Cardano is a proof-of-stake blockchain platform: the first to be founded on peer-reviewed research and developed through evidence-based methods. It combines pioneering technologies to provide unparalleled security and sustainability to decentralised applications, systems, and societies.”5

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://block.xyz/2022/btc-report.pdf

2. https://news.bitcoin.com/singapores-central-bank-dbs-jpmorgan-collaborate-to-explore-uses-of-digital-assets-defi/

3. https://www.afr.com/companies/financial-services/cba-casts-doubt-over-foray-in-crypto-trading-20220531-p5apx6

4. https://www.business2community.com/crypto-news/cardano-price-pumps-54-where-to-buy-ada-02499497

5. https://cardano.org/

Off the Chain will be published every Tuesday, and provide the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.