Bitcoin managed to penetrate US$20K during the week, but failed to hang on to those gains. It finished the week flat along with the broader crypto market.

At the time of writing, bitcoin is trading at around US$19,270. Ethereum slightly underperformed bitcoin, down -1.63% vs bitcoin’s 0.96%.

Bitcoin’s market cap is at US$369.3B, with the total crypto market sitting at US$934.9B. Bitcoin’s market dominance is up to 39.49%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $19,270 | $20,338 | $18,553 | 0.96% |

| ETH (in US$) | $1,311 | $1,396 | $1,267 | -1.63% |

Source: CoinMarketCap. As at 2 October 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

World’s largest banks exposed to crypto

A study authored and published by the Basel Committee on Banking Supervision (BCBS) found that the world’s largest financial institutions are exposed to approximately US$9 billion in crypto assets. The paper explains that crypto exposure is estimated to be about 0.014% of all the banks’ total risk exposures. The data represents a small group comprising 19 banks worldwide which submitted data for the research, predominantly from the Americas and Europe. 182 banks were considered for its Basel III monitoring exercise.

Secretariat Renzo Corrias, who wrote the paper, explains that the crypto assets held are mainly bitcoin, which was around 31% of exposures, and ethereum, which accounted for 22% of exposures. The banks’ exposures were in three categories – crypto holdings and lending, clearing and market-making services, and custody/wallet/insurance services.1

FTX wins Voyager assets

Following an auction that lasted over two weeks, FTX has won the bid to buy Voyager’s assets. The bid is valued at approximately US$1.4B, comprising real assets plus intangible assets. Voyager, a crypto exchange and investment platform, declared bankruptcy back in July. FTX offered to bail it out shortly thereafter, however was rejected by Voyager at the time. Unfortunately, there have been few options open to Voyager. If no objections are presented, the plan will go to court for approval by 19 October, and if the takeover is approved, FTX reportedly plans to get the exchange and platform back up and running as soon as possible.2

RBA issues white paper for CBDC

The RBA has continued its interest in an Australian CBDC (eAUD), recently announcing developments to its CBDC pilot project. In a whitepaper, the RBA outlined key objectives of the project, including to identify and understand innovative business models, and use cases, benefits, risks, and operational models for a CBDC in Australia.

The pilot project, which was launched in July and will be completed in mid-2023, will also allow financial authorities to better understand technological, legal, and regulatory aspects of the issuance of a CBDC.

Some of the use cases the RBA is assessing include multi-party or syndicated transactions, escrowed transactions and enabling conditional or programmable transactions. It is also testing CBDCs as a verifiable reserve asset to reduce counterparty risks, and the feasibility of running operations 24/7.

This is a limited-time project, during which the pilot CBDC may be utilised by approved participants on a private, permissioned ledger. At the end of the project, all pilot CBDC must be redeemed. The project implies no commitment from the RBA to issue a CBDC at the end of the project, or at any future time.3

On-chain metrics

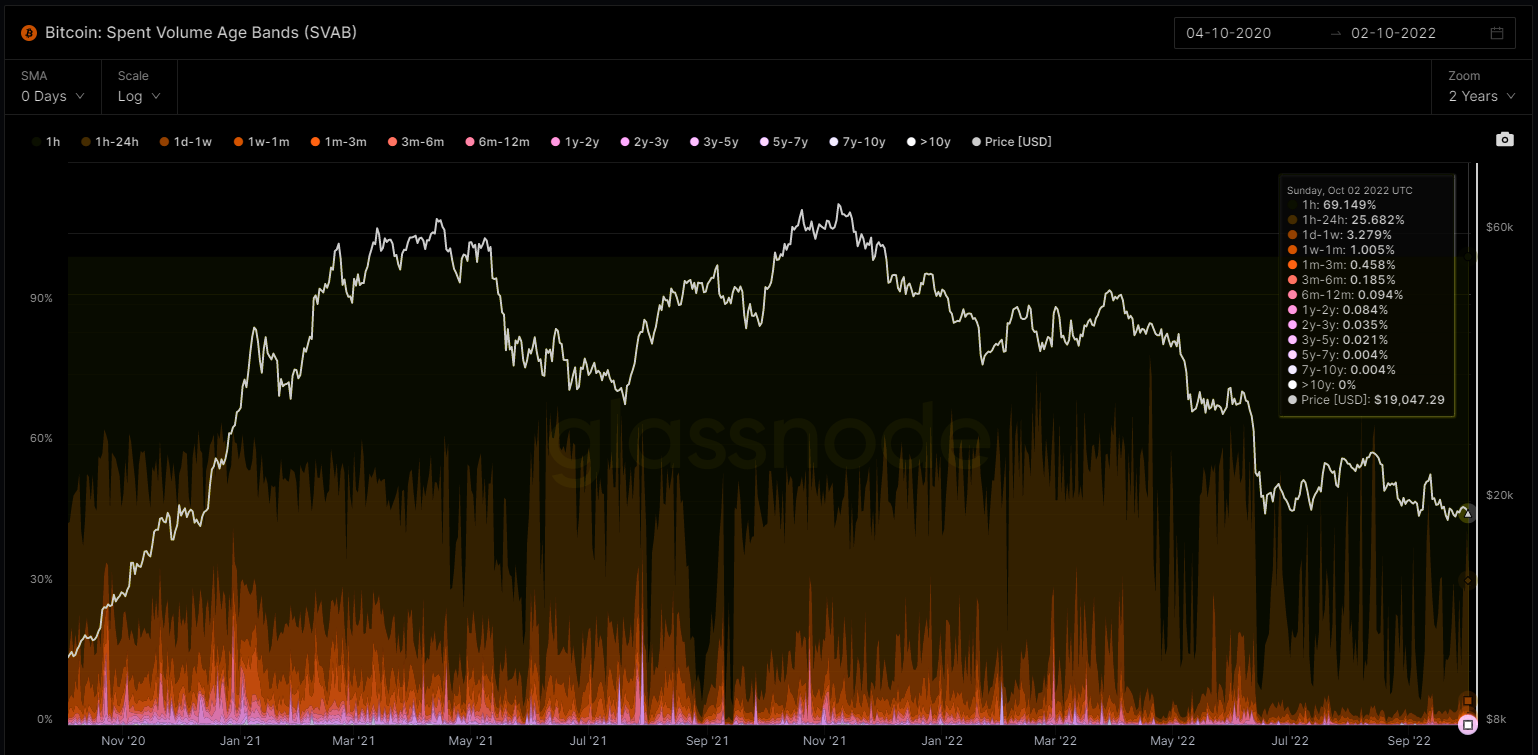

Bitcoin (BTC): Spent Volume Age Bands

The above metric provides a breakdown of on-chain transfer volumes into age bands to assess the extent to which spending is dominated by ‘old hands’ possibly losing conviction.

Looking at data from on-chain analytics company Glassnode, the spent volume is primarily from coins with an age of less than 24hrs, potentially indicating significant speculation.

Source: Glassnode. Past performance is not indicative of future performance.

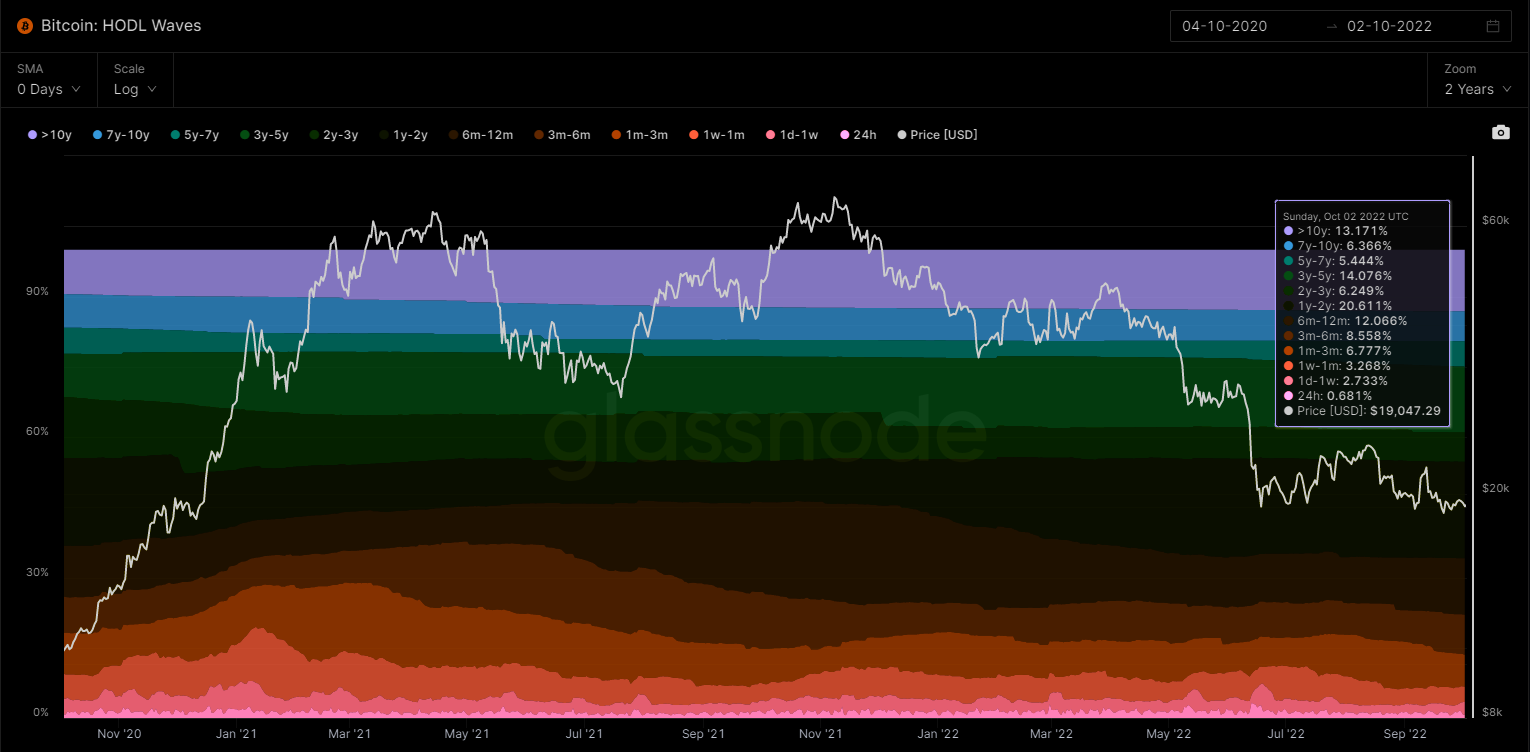

Bitcoin (BTC): HODL Waves

This metric looks at the bundle of all active supply age bands, aka HODL waves. Each coloured band shows the percentage of Bitcoin in existence that was last moved within the time period denoted in the legend.

According to Glassnode, at the time of writing, investors with older coins have continued to hold on to their coins. Almost 66% of coins have been held for one year or longer.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, USD Coin (USDC) is eyeing expansion after being delisted from the global exchange Binance. Currently available on eight blockchains, the plan is to expand to another five. The new blockchains will be Arbitrum, Cosmos, NEAR, Optimism, and Polkadot in 2023. Currently, the blockchains USD runs on are Ethereum, Solana, Avalanche, TRON, Algorand, Stellar, Flow and Hedera. Joao Reginatto, VP of Product at Circle Internet Financial, the firm behind USD Coin, said that the expansion will allow users to have “greater liquidity and interoperability within the crypto economy. Extending multi-chain support for USDC opens the door for institutions, exchanges, developers and more to innovate and have easier access to a trusted and stable digital dollar.”4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://news.bitcoin.com/basel-study-shows-worlds-largest-banks-are-exposed-to-9-billion-in-crypto-assets/

2. https://www.coindesk.com/business/2022/09/27/ftx-wins-bid-to-buy-voyager-digitals-assets/

3. https://www.investordaily.com.au/news/52128-rba-to-issue-eaud-as-part-of-cbdc-research-project?utm_source=Investor%20Daily&utm_campaign=27_09_22&utm_medium=email&utm_content=1&utm_emailID=c88e8847148577a83a44d821c096c7ed117162ef4ab77674dd824212359f73a1

4. https://cointelegraph.com/news/circle-product-vp-usdc-chain-expansion-part-of-multichain-vision

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.