Bitcoin made a new high in local currencies around the world, including AUD, after trading over US$63K for the first time in more than two years, ending the week higher along with the broader crypto market. Bitcoin was up 18.95%, while Ethereum jumped 11.78%. Bitcoin’s market capitalisation was up to US$1.2 trillion, with the total crypto market cap at US$2.3 trillion, and bitcoin’s market dominance sitting at 52.3%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $61,517 | $63,432 | $50.948 | 18.95% |

| ETH (in US$) | $3,386 | $3,514 | $3,036 | 11.78% |

Source: CoinMarketCap. As at 3 March 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

$10B in FUM

Out of 3,400 ETFs, roughly 150 have surpassed the US$10B in FUM milestone, and most of those ETFs were launched over 10 years ago. BlackRock’s IBIT bitcoin fund has managed to accomplish this feat in just seven weeks. The largest inflows for the fund were last Wednesday in the US, with $612.1 million in one day. The fund now holds over 162,000 bitcoin.

The closest competitors with spot bitcoin ETFs are Fidelity’s FBTC which has over 105,000 bitcoin ($6.3B) and Ark Invest 21 shares’ ARKB with over 34,000 bitcoin ($2.1B)1.

Global demand for bitcoin

CEO of Galaxy Digital, Mike Novogratz, opened up in a recent interview with Bloomberg, saying that bitcoin is currently going through its own price discovery, and that “this is the first time that anyone who wants to buy (bitcoin) has easy access to buy it.”2 He commented on the amount of wealth being held by baby boomers with registered investment advisers, with at least half of them having the capability to invest in bitcoin ETFs. He noted that there is “a new army of buyers” and also “an army of sales people”, and that he currently sees “tremendous global demand for bitcoin”.

Marathon beats analyst expectations

Another sector that is benefiting from higher bitcoin prices is bitcoin miners, and a standout company within that sector has been Marathon Digital. The company recently reported revenue increases of 452%, beating analysts’ predictions. Marathon’s production rate tripled from 2022, which was reflected in its results. The company reported a total EBITDA for 2023 of US$419.9 million vs a loss of $543.4 million in 2022. The company has also reduced its debt by 56%, and reported net revenues of $261.2 million.3

Marathon Digital is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. According to its website, the company is one of the largest bitcoin mining companies, as well as one of the largest holders of bitcoin among publicly traded companies in North America.

On-chain metrics

Bitcoin (BTC): Number of Addresses (7d Moving Average)

This metric reflects the total number of unique addresses that ever appeared in a transaction of the native coin in the network.

According to data from Glassnode, the number of addresses is at an all-time high with 1,265,155,176 addresses on the network as of 2 March 2024.

Source: Glassnode. Past performance is not indicative of future performance.

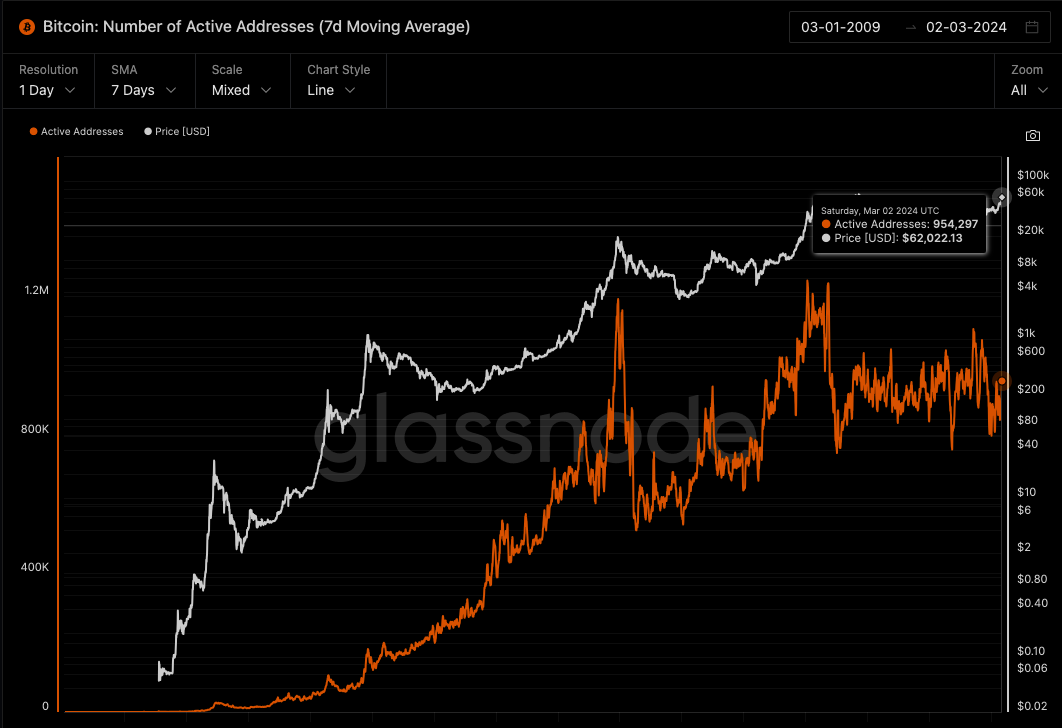

This metric shows the number of unique addresses that were active in the network either as a sender or receiver. Only addresses that were active in successful transactions are counted.

According to data from Glassnode, there are 954,297 active addresses as of 2 March 2024 – still lower than all-time highs.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Given the continued strong performance from bitcoin, altcoins are also being lifted. In altcoins, memecoins had a strong week, reflecting the positive investor sentiment, confidence and enthusiasm in the crypto market currently. Over the seven days to 3 March 2024, Dogecoin DOGE and and Shiba Inu SHIB were up 52% and 112%, and over 74% and 80% over the last year respectively.

Memecoins are a sector within cryptocurrency that is highly speculative, usually ‘non-serious’ and supported by certain enthusiastic online communities. The coins usually are centred around internet memes, pop-culture references, and viral online trends.4

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://cryptopotato.com/entering-top-150-etfs-blackrocks-ibit-bitcoin-fund-surpasses-10-billion-in-aum/

2. https://news.bitcoin.com/galaxy-digital-sees-tremendous-global-demand-for-bitcoin-ceo-says-theres-a-new-army-of-buyers/

3. https://ir.mara.com/news-events/press-releases/detail/1345/marathon-digital-holdings-reports-fourth-quarter-and-fiscal.

4. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.