Bitcoin and the broader crypto market increased slightly over the last week.

As at 13 August, bitcoin was trading at US$29,382, while Ethereum underperformed bitcoin over the week, up 0.83% vs bitcoin’s 1.10% gain. Bitcoin’s market capitalisation is at US$571.6 billion, with total crypto market cap sitting at US$1.17 trillion. Bitcoin’s market dominance is at 48.7%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $29,382 | $30,030 | $28,746 | 1.10% |

| ETH (in US$) | $1,848 | $1,869 | $1,806 | 0.82% |

Source: CoinMarketCap. As at 13 August 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

PayPal launches USD stablecoin

Payments giant PayPal (PYPL) announced last Monday it will be launching a US dollar-pegged stablecoin, PayPal USD (PYUSD). The token will be available to PayPal users in the US and then on Venmo, and can be exchanged for US dollars at any time. Users will be able to transfer PYUSD between PayPal and supported external digital wallets. The tokens may be used to pay for goods and services or convert any of PayPal’s supported cryptocurrencies to and from PYUSD. It’s the first time a major financial company in the US has announced plans to launch a stablecoin1.

SBF sent to jail

Ahead of his trial in October, FTX founder Sam Bankman Fried (SBF) has been sent to jail after a federal judge revoked his release on bond last Friday. It is alleged that he tried to tamper with witnesses. SBF has been accused of leaking former Alameda Research CEO Caroline Ellison’s diary to the New York Times. He faces charges of having stolen billions of dollars in FTX customer funds.

Judge Lewis Kaplan, of the US District Court for the Southern District of New York, said Bankman-Fried is willing “to risk crossing the line in an effort to get right up to [the line], wherever it is2.”

Coinbase launches own blockchain (Nasdaq: COIN)

Top 10 holding in the Betashares Crypto Innovators ETF (CRYP) (as at 13 July), Coinbase (COIN), becomes the first publicly-traded company to launch its own blockchain. Known as Base, it is Coinbase’s layer-2 (L2) network. An L2 network operates on top of an underlying blockchain protocol, in this case Ethereum, processing transactions off the mainnet. Some of the benefits are improved scalability and efficiency, increased transaction speed and reduced gas fees.

Coinbase announced the blockchain has gone live, giving the company a new revenue opportunity by generating fees and having applications built on top of the network3.

On-chain metrics

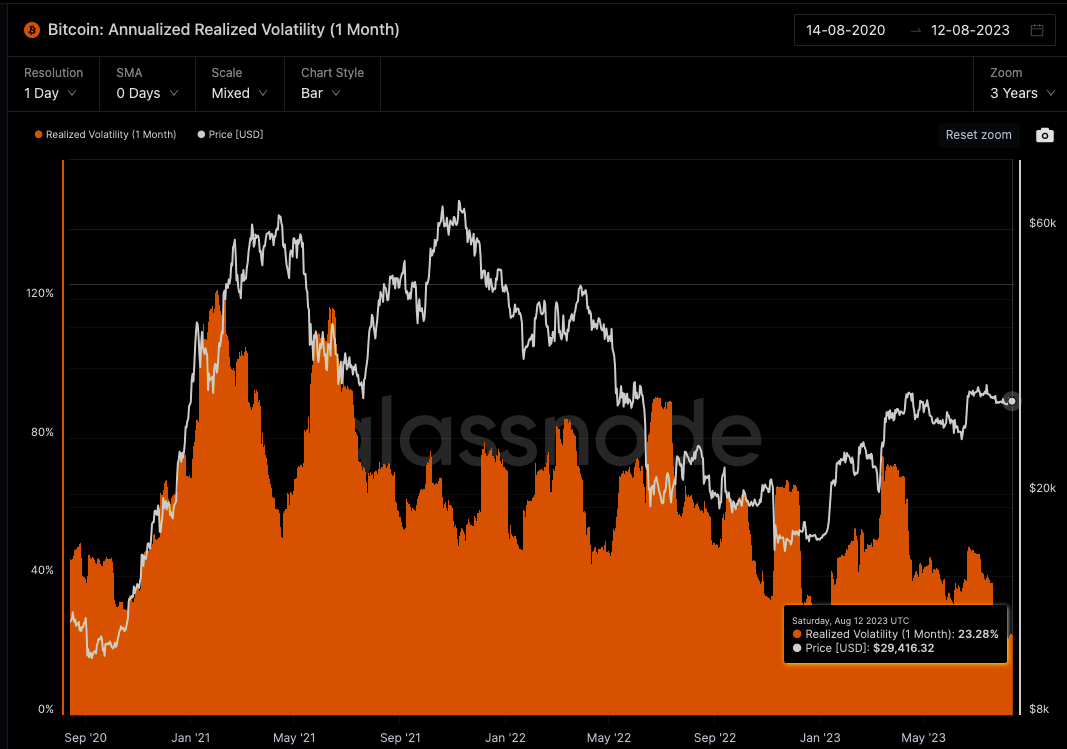

Bitcoin (BTC): Annualised Realised Volatility (1 Month)

Realised volatility is the standard deviation of returns from the mean return of a market. High values in realised volatility indicate a phase of high risk in that market. It is measured as log returns over a fixed time horizon or over a rolling window to obtain a time-dependent observable. Realised volatility measures what happened in the past. Realised volatility is based on daily returns multiplied by a factor of sqrt (365) to yield the annualised daily realised volatility over a rolling window of 1 month.

According to data from Glassnode as at 12 August, volatility is at 3-year lows.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the total number of successful transactions based on a 7-day moving average.

Based on data from Glassnode, the Bitcoin network has experienced its most active period historically, starting at the beginning of the year and up noticeably since April. The rise has been attributed to the Ordinal inscriptions on the Bitcoin blockchain.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Over the week to 13 August, one of the largest movers within the Top 20 was the memecoin Shiba Inu (SHIB), with a move higher of more than 9%. The price of SHIB pushed higher shortly after a couple of announcements earlier in the week.

First, the crypto payment gateway BitPay entered a partnership with Sardine to enable SHIB card payments in more than 180 countries, which allows holders to spend as much as US$3,000 worth of SHIB daily on various purchases. Then BitPay introduced a new service called Bill Pay. The service is available initially in 19 US states, provides access to more than 5,000 service providers, including car payments, mortgages and credit cards, and is embedded into BitPay’s self-custody wallet4.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio

References:

1.https://www.coindesk.com/business/2023/08/07/paypal-to-issue-dollar-pegged-crypto-stablecoin-bloomberg/

2. https://www.reuters.com/legal/ftxs-bankman-fried-seeking-avoid-jail-due-back-court-2023-08-11/

3. https://www.coindesk.com/tech/2023/08/09/coinbase-officially-launches-base-blockchain-milestone-for-a-public-company/

4. https://cryptopotato.com/shiba-inu-price-soars-10-daily-could-this-be-the-reason/

Past performance is not indicative of future performance.

Off the Chain is published every 2nd Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.