Chamath De Silva

Betashares - Head of Fixed Income Chamath is responsible for the portfolio management function and fixed income product development at Betashares. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their international reserves section in Sydney and London, where he managed the RBA’s Japanese and European government bond portfolios. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne, is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

5 minutes reading time

Financial literacy is a complicated and often sensitive topic. In this post, I won’t cover the personal finance aspects of this area (i.e. saving, budgeting and debt management) and instead I’ll focus on the investment and retirement planning side.

Understanding the long-term effects of compounding returns, management fees on investment products, and inflation can help demystify this topic somewhat, and allows us to see the profound consequences our investment and asset allocation choices can have on our ultimate retirement outcomes.

Compounding returns over the long run

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Whether or not Albert Einstein said this doesn’t change the truth of the quote. However, for the purposes of this post, instead of focusing on compound interest, we should focus on the more general compound returns, of which interest may be just one component.

The key point is there is an exponential feature to returns – i.e. if it takes 7 years to double your initial money at a given rate of return, it will take 14 years to increase your initial wealth 4 times (2 doublings), 21 years to increase it 8 times (3 doublings), 28 years to increase it 16 times (4 doublings) and so on until we get extremely large multiples.

The main implication of all this is that even small changes to the rate of return can make a huge impact on ending wealth over a long investment period, such as 30 years. I illustrate this point in the below:

Table 1: Number of years to double an investment’s value at different rates of return, monthly compounding

Source: Betashares

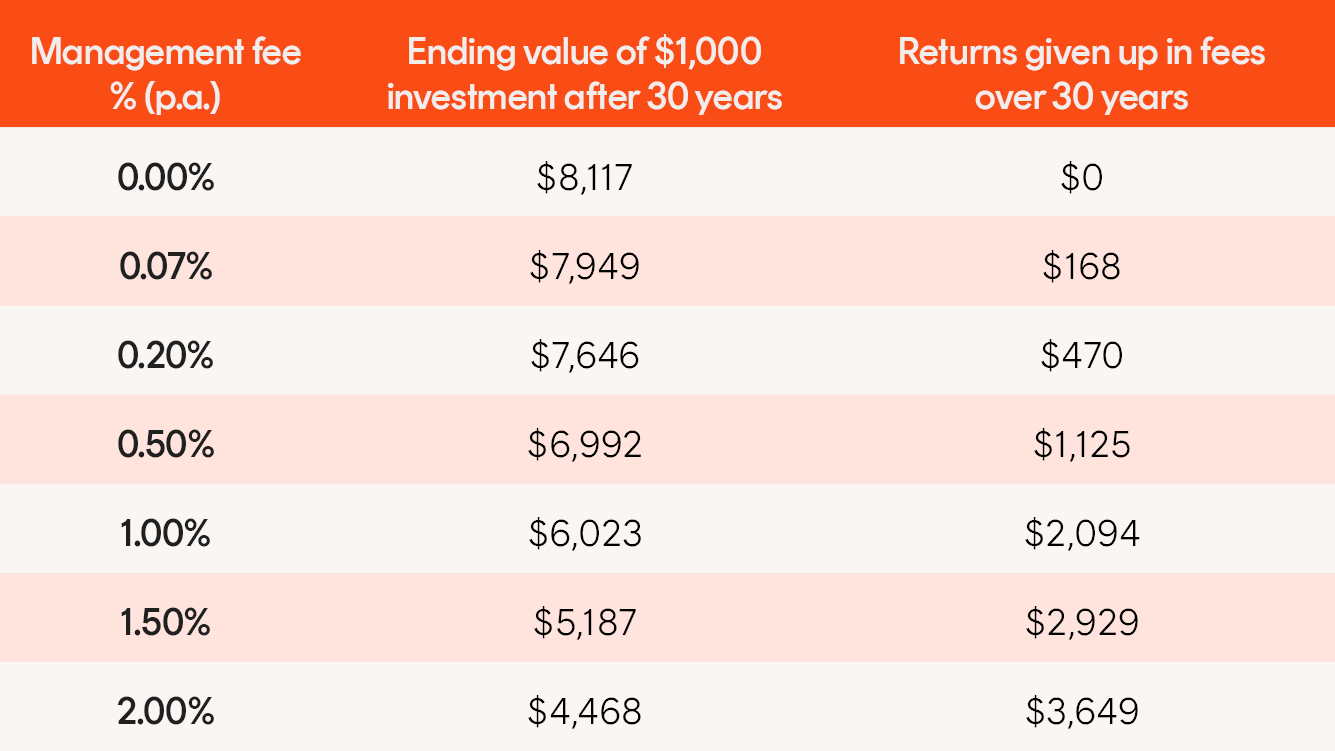

The effect of fees on compounded returns

Like returns themselves, fees also compound. What is not immediately apparent is that the effect of fees not only depends on the fees themselves, but also the pre-fee returns of the investment. Higher fees as a % of FUM create a higher fee drag over time, but a given fee at a higher annualised pre-fee return can also significantly detract from ending wealth.

For example, at 50 bps annual fee (or 0.5%), we typically pay away much more in fees over a 30-year horizon on an equity ETF exposure than we do on a bond or cash ETF exposure (given the expected higher rates of return equities should earn compared to bonds or cash).

The implication is also that fund managers receive far more revenue on high return products than low return products for a given management fee. It’s worth remembering that fees on their own are not everything and that risk-adjusted after-fee returns are more important.

However, for vanilla, broad-based market cap-weighted index exposures where pre-fee returns will not vary significantly between competing products, fees can be a crucial product differentiator. A few tables below are helpful to understand this further:

Table 2: Impact of different levels of management fees on a 7% pre-fee annual return, monthly compounding

Source: Betashares

Table 3: Impact of 0.50 per cent management fee on different pre-fee returns, monthly compounding

Source: Betashares

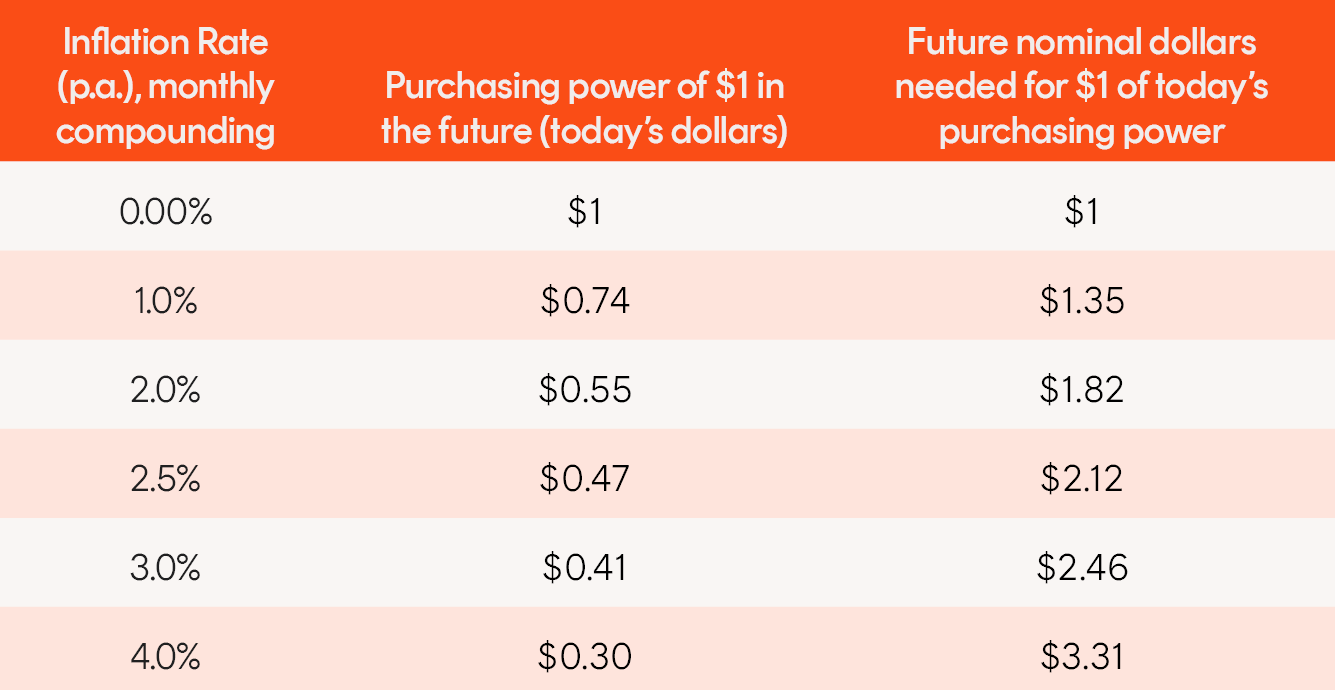

The effects of inflation and implications for purchasing power over long horizons

If we are investing to fund our retirements, we need to be aware that inflation erodes the purchasing power of nominal dollars over time. This means we require our investments to, at the very least, exceed inflation to maintain the real value of our capital.

Inflation is typically measured by changes in the consumer price index (CPI), which captures a typical basket of goods and services for Australian households. It is also worth noting that the RBA has an inflation-targeting objective and will typically adjust monetary policy to keep core inflation between 2 and 3 per cent per annum over time.

However, when looking to fund retirement it is important to remember that the basket of goods and services may not be reflective of your consumption needs at retirement and inflation rates of such a basket may be higher than the CPI.

Table 4: Erosion of purchasing power of $1 over 30 years at various inflation rates

Source: Betashares

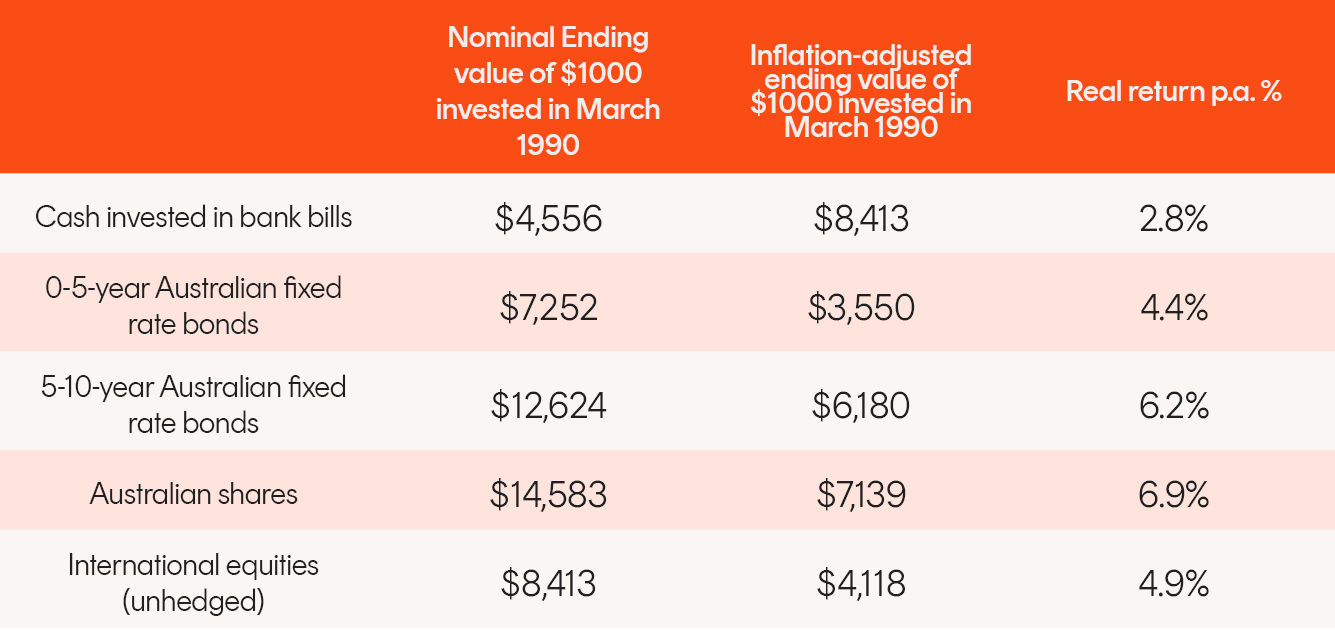

Table 5: Inflation-adjusted (real) returns of various asset classes, Mar-1990 to 31 August 2019*

Source: ABS; Bloomberg; Betashares

*Nominal values deflated by historical CPI (All Groups, 2.5% p.a.), Cash represented by the Bloomberg AusBond Bank Bill Index, short term bonds by the Bloomberg AusBond 0-5y Composite Index, long term bonds by the Bloomberg AusBond 5-10 year Composite Index, Australian shares by the All Ordinaries Accumulation Index, international equities by the MSCI World Net Total Return Index.

Putting it all together

Compounding affects many aspects of our investing lives, both in positive and negative directions.

Once we understand the power of compounding on returns and how inflation and fees compound in a negative direction, we are far more informed in constructing portfolios to support our retirements, maximise returns or to simply preserve capital.

Written by

Chamath De Silva

Head of Fixed Income

Chamath is the Head of Fixed Income at Betashares and is a voting member of the firm’s Investment Committee. He is responsible for managing the fixed income ETFs and leading the fixed income product development. In addition, he shares responsibility for the strategic and dynamic asset allocation decisions for the Betashares model portfolios. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their FX reserves management function in Sydney and London. There, he managed the RBA’s Japanese and European government bond portfolios across a range of market conditions. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne. He is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

Read more from Chamath.