David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

- Global

Global markets – week in review

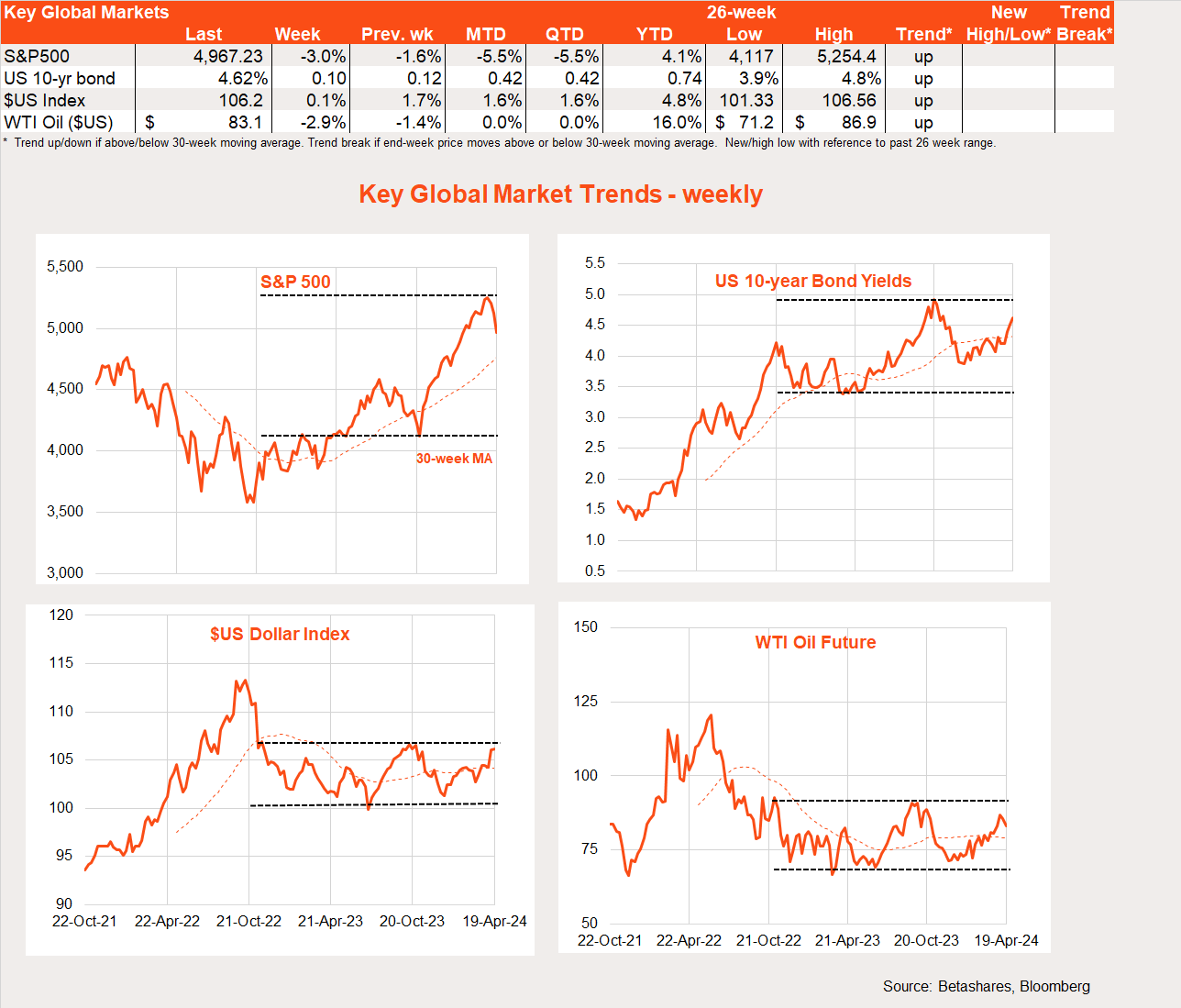

The global equity market correction continued last week, with a solid US retail sales report and a hawkish tilt by Fed chair Powell further unsettling bond and equity markets. One market reprieve was signs that Iran is seeking to avoid further escalating its stoush with Israel.

The US economic juggernaut rolls on, with March retail spending up 0.7% – much healthier than the 0.4% market expectation. As I warned last week: “Wall Street remains vulnerable to a deeper correction if the bad run on inflation continues and/or the Fed starts to sound more hawkish.”

Last week the Fed did indeed turn hawkish – which should not be too much of a surprise after three consecutive higher-than-expected CPI reports. Fed chair Powell noted recent data had not given him “greater confidence” that inflation is falling in a way that could justify rate cuts any time soon. This is likely a signal that he no longer thinks three rate cuts this year – as included in the latest dot plot forecasts – is appropriate. As is stands, the market is now expecting only one to two rate cuts later this year.

The week ahead

We’ll learn more on the US inflation front with the all-important consumption deflator on Friday. The market anticipates that both the headline and core measures rose 0.3% in March, which would see annual core inflation edge down from 2.8% to 2.6% but headline annual inflation edge higher from 2.5% to 2.6%. A higher number could see the market fully price out US rate cuts this year and potentially deepen the US equity market correction.

Also this week, four of the Magnificent 7 companies (Tesla, Meta, Alphabet and Microsoft) report Q1 earnings. Given jittery market sentiment and high tech valuations, any earnings disappointments are likely to be severely punished.

Global equity trends

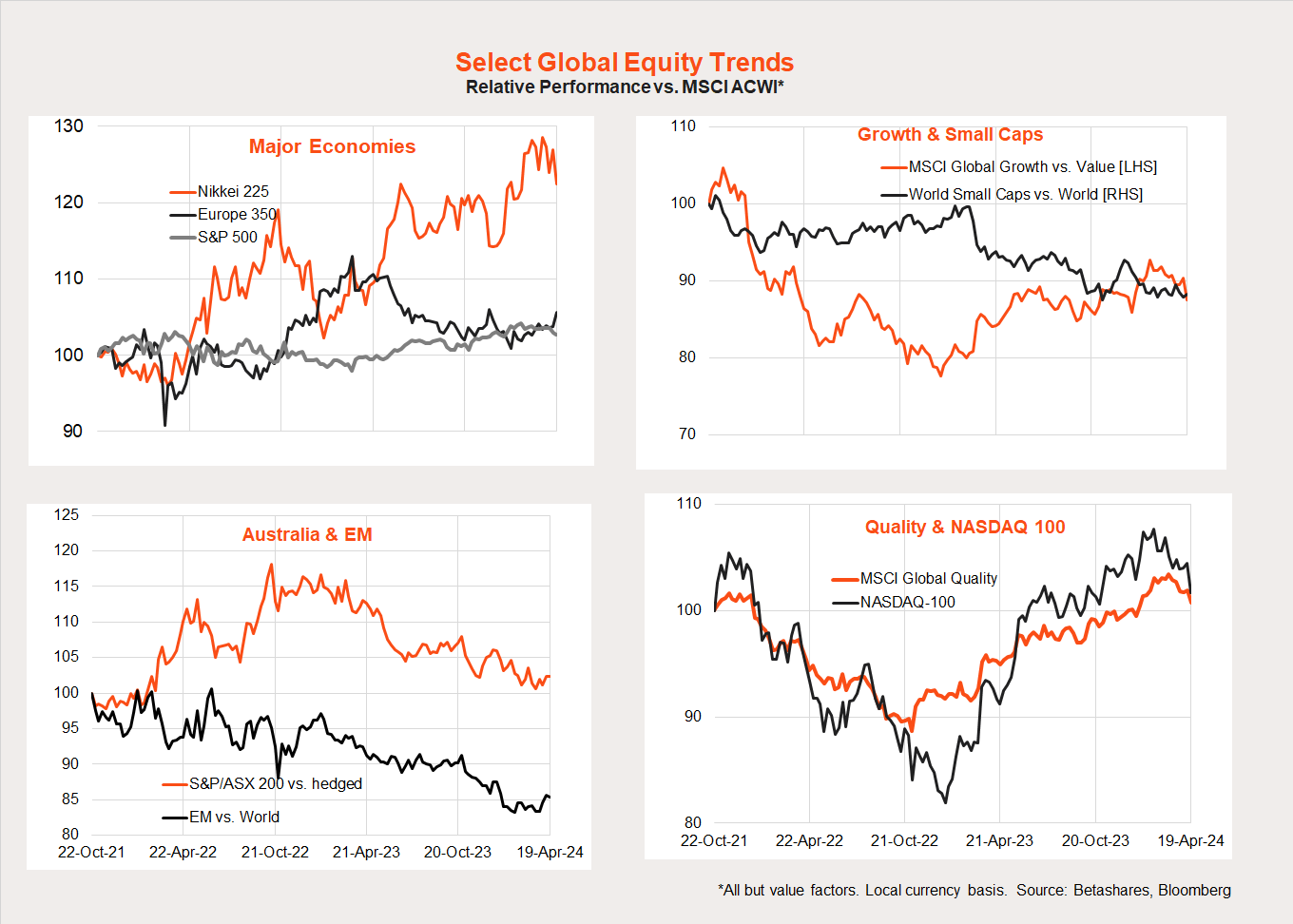

Looking at global equity trends, the rebound in bond yields is helping drag back the relative performance of growth over value, as evident in the pullback in Nasdaq-100 relative performance. Japan has also pulled back, with Europe faring better. The extended period of Australia and emerging markets underperformance has bottomed out over this period.

Australian markets

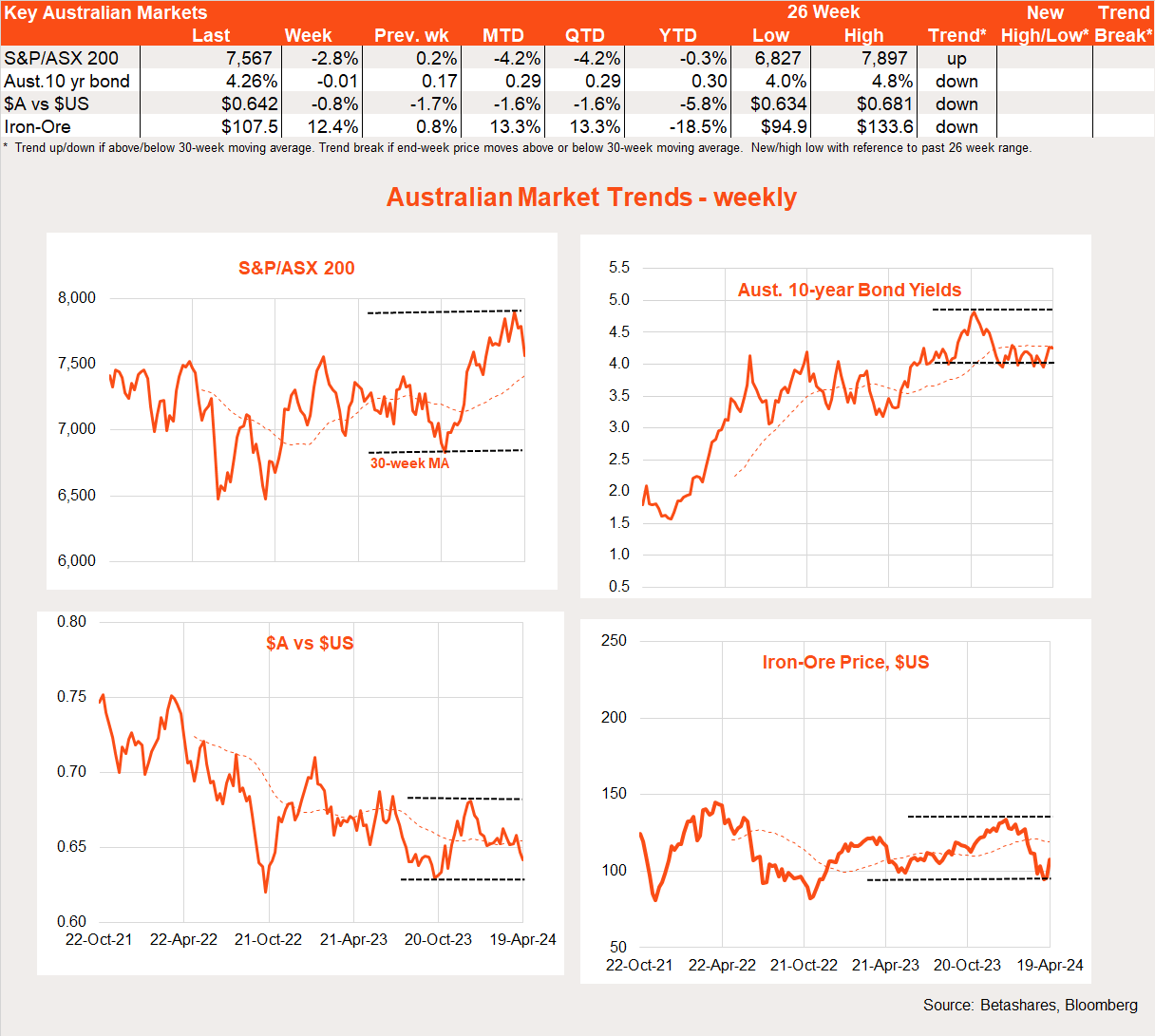

The S&P/ASX 200 caught up with the global pullback last week, with a loss of 2.8%. Iron-ore prices bounced back after recent heavy losses, perhaps partly reflecting a stronger-than-expected Chinese Q1 GDP report.

The main local highlight last week was another fairly solid labour market report, with an employment loss of only 7k in March after a supercharged 100k surge in February. The unemployment rate ticked up from 3.7% to a still low 3.8%.

The key local highlight this week will be Wednesday’s March quarter consumer price index report. Of particular note, the trimmed mean measure of underlying inflation is expected to rise by 0.9% which – although a touch higher than the 0.8% in Q4 – would still be consistent with an easing in annual trimmed mean inflation from 4.2% to 3.9%. That said, with annualised underlying inflation still expected at around 4%, such a result would not be a green light for the RBA to shift to a more convincing easing bias any time soon.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

1 comment on this

It just goes to show how the data and information from several weeks ago was flawed.

Interestingly, the majority of USA Investment News providers that I follow have been advising for a few months of the now corrections. Even this morning, Saxo Trader advised of further significant corrections. Many News Services in the USA are advising to sell off from many of the major tech stocks. The FED is about to announce that Inflation is out of control and interest rates will not be going down, but may in fact go up. the $US is struggling throughout the world and most major countries have been stock piling Gold and Silver for years. I am pleased with how Betashares ETF’s have performed for me with high returns, but strategically, at my right time, I sold outl and invested in GOLD which has been outstanding. Much more doom and gloom to come. Like our health authorities during covid times lied to us, the FED and RB have been not telling the whole truth. As Gomer Pyle once said, Shame, Shame, Shame.