David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

- Global

Global markets*

My last Bassanese Bites blog of last year was on Monday 18 December.

At the time, I expressed hope that the ‘soft landing’ scenario for both the Australian and global economy appeared increasingly possible for 2024 – indeed, Fed chair Powell was close to popping champagne bottles as we headed into Christmas.

Fast forward to late January 2024 and the good news is that economic data over the holiday period remained broadly consistent with this best-case scenario for financial markets. My only concern is that is remains almost too good to be true!

Indeed, only on Friday the US core consumption deflator (the Fed’s preferred measure of underlying inflation) rose by a benign 0.2% in December – in line with now increasingly optimistic market expectations. Annual core inflation dropped to 2.9%, and if we used rents on new housing leases – rather than the (lagging) average rent on all housing leases in the calculation – annual core inflation would already be close to the Fed’s 2% target level.

Mission accomplished?

That said, one mini-drama that has played out over recent weeks is a brief pull back in equities and bounce higher in bond yields as markets re-thought just how quickly the Fed could cut interest rates. The debate now is not if, but when and how deeply rates will be cut this year.

For what it’s worth, my base case is that the Fed won’t cut until mid year and only by 0.75% in 2024 – due to strength in the economy. This compares to current market expectations of a 40% chance of a March rate cut and 1.25% worth of rates cuts in total this year. I still think bond yields can fall by year-end and equities rise under my less aggressive rate cut scenario – only the path may be a little bumpier. Of course, I could be wrong and the Fed could easily cut by more.

In the week ahead, we have a likely firm – but not too troubling – US Q3 Employment Cost Index mid-week along with the Fed meeting. While the Fed will keep rates firmly on hold, of interest will be the extent to which it hints at future rate cuts. As we saw with Powell late last year, while I’m inclined to think the Fed will try to downplay near-term rate cuts – it may struggle to hide its glee at the current Goldilocks economic situation.

OPEC also meets this week and will likely keep current production limits in place to help support oil prices in the face of rising non-OPEC (especially US) supply. There’s a risk that OPEC may at some stage this year give up on trying to restrain supply – and (as in 2014-16) flood markets in a bid to bankrupt once again those annoying US shale oil producers. If so, that would not be great for the energy sector – though good news for inflation, bonds markets and equities in general.

Last but not least this week is US January payrolls on Friday, with a firm 177k employment gain expected – enough to keep the unemployment rate steady at 3.7%. If achieved, it would be another Goldilocks report – neither too hot nor too cold.

Australian markets

Australia’s economic data over the holiday period has been mixed – again neither too hot nor too cold, though assessment of trends has been complicated by the bringing forward of consumer spending and employment from December into November, given the growing popularity of black Friday sales.

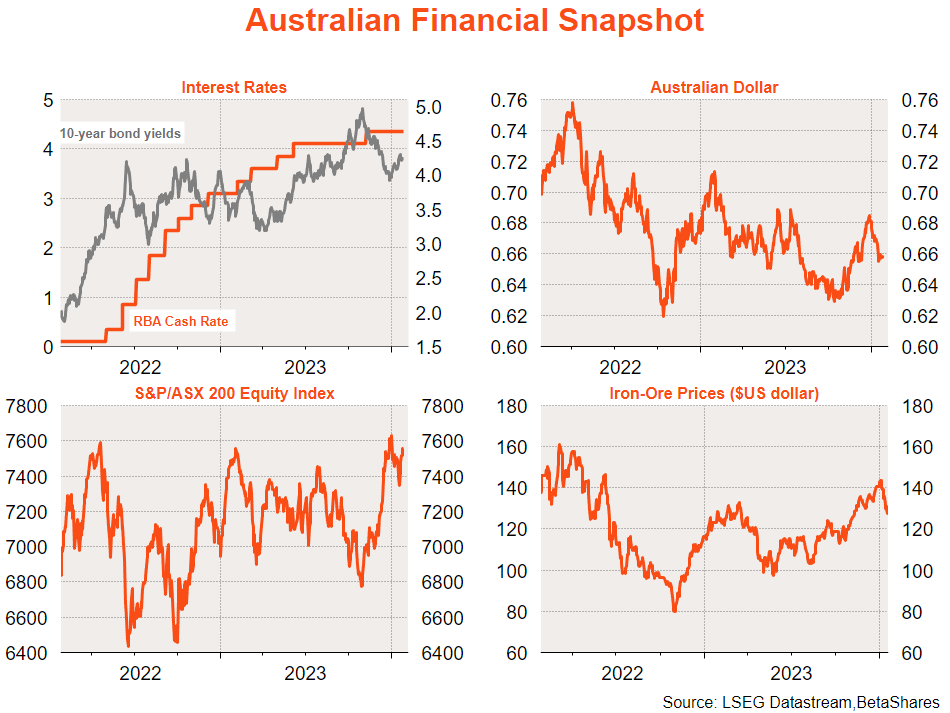

Either way, markets have decided there’s very little chance (3%) of a February RBA rate hike. This should be confirmed by this Wednesday’s Q4 quarterly CPI report, with annual trimmed mean inflation expected to ease further to 4.3% – or a little below the RBA’s November forecast of 4.5%.

It’s good to be back! Have a great week!

*Due to travel commitments, my usual chartset is not available this week – but will be back next week.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

2 comments on this

Very concise and relevant summary, thanks. Have followed you since the AFR days and enjoy your commentary .. and… your surname suggests you are a wog! That’s a double thumbs up from me.

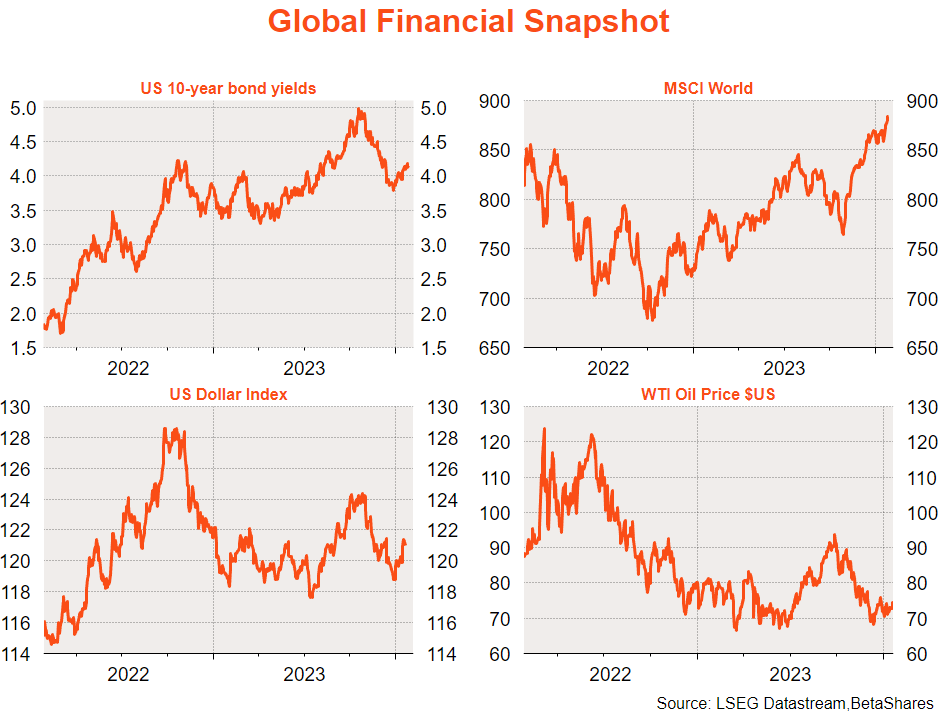

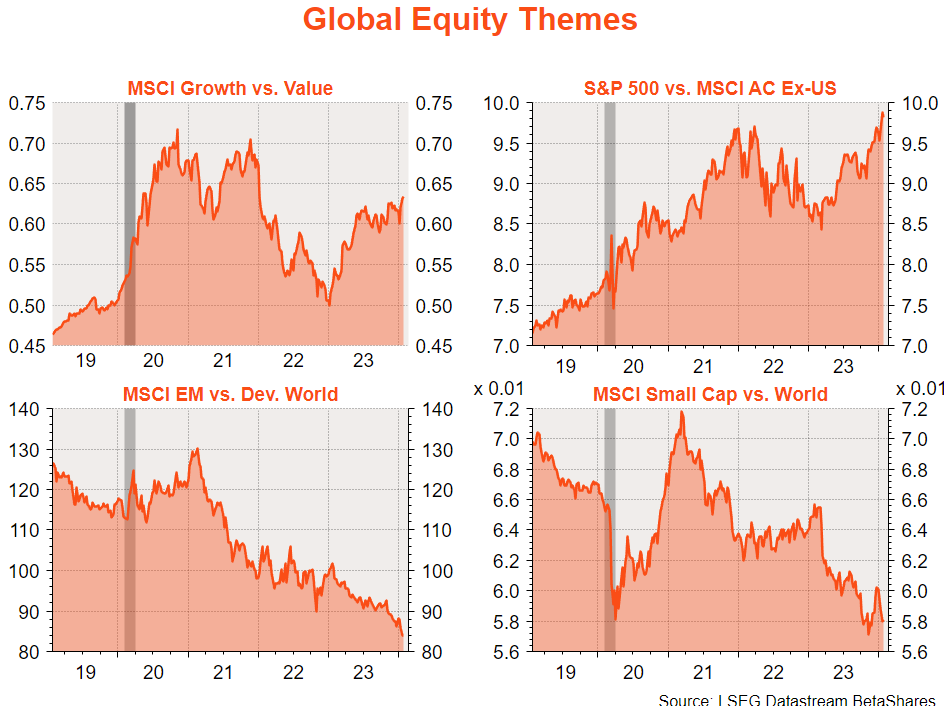

Plenty to consider from the chart sets you’ve provided here David. I read them with interest.