Bitcoin and the broader crypto market inched higher over the last week, after an impressive rally following the announcement that Ripple received a favourable ruling in a court case with the SEC that started over two years ago.

As at 16 July, bitcoin was trading at US$30,279. Ethereum outperformed bitcoin over the week, up 3.2% vs bitcoin’s 0.03% gain. Bitcoin’s market capitalisation is at US$588 billion, with total crypto market cap rising to US$1.21 trillion. Bitcoin’s market dominance fell to 48.5%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $30,279 | $31,582 | $29,996 | 0.03% |

| ETH (in US$) | $1,926 | $2,026 | $1,848 | 3.2% |

Source: CoinMarketCap. As at 16 July 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

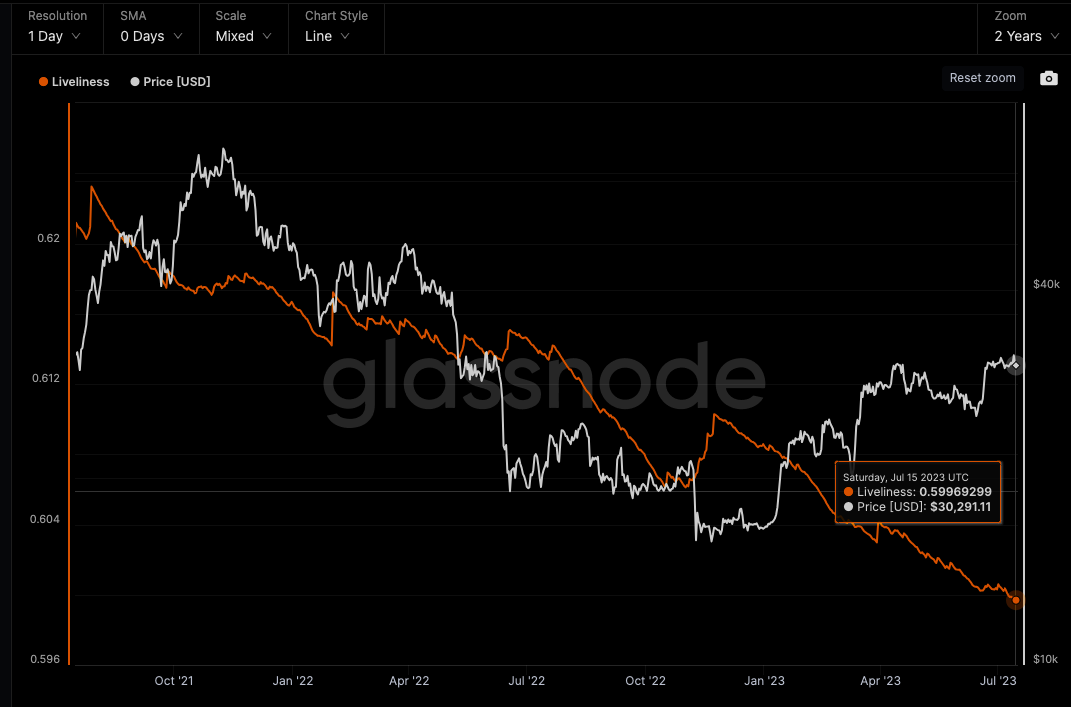

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

SEC formally accepts BlackRock’s spot bitcoin ETF application

An official review of the BlackRock spot bitcoin ETF will now commence as the SEC formally accepts the application. The application for the iShares Bitcoin Trust was filed nearly a month ago, fuelling a wave of spot bitcoin applications from other prominent asset managers, and helping push the bitcoin price higher. After years of rejecting spot bitcoin ETF applications, the acceptance of the BlackRock application and other filings may indicate that the SEC is open to actively exploring the idea of a spot bitcoin ETF. Now in the SEC’s official calendar, the BlackRock application will be published in the Federal Register and trigger a 21-day public comment period.1

Europe set to launch first spot bitcoin ETF

After a 12-month delay, Europe is set to launch its first spot bitcoin ETF. London-based Jacobi Asset Management is ready to launch its ETF product later this month after originally announcing that it would list in July 2022. At the time, the asset manager ultimately decided the “time was not right” following the crash of Terra Luna back in May and the collapse of FTX in November. Currently in Europe, all digital assets exchange-traded products are structured as exchange-traded notes, making this offering different.

The co-founder and Chief Operating Officer of Jacobi said: “There has been so much misinformation and misuse of the term ETF by (ETN) issuers, presumably to obfuscate the risks that are inherent in acquiring and investing in ETNs.” The ETF is designed differently from an ETN, in that ETFs in Europe can’t use derivatives or be leveraged.2

CRYP company spotlight

New CleanSpark bitcoin mining facility goes live (Nasdaq: CLSK)

Top 10 holding in the Betashares Crypto Innovators ETF (CRYP) (as at 14 July), Cleanspark, invested nearly US$55 million for construction, infrastructure and machines on a new site in the US state of Georgia. The purchase is part of its aggressive expansion plan. The second phase of operations is now up and running after the facility was bought in August 2022. Last month, CleanSpark purchased bitcoin mining facilities in Dalton, also in Georgia.3

According to the company’s website, “CleanSpark is a sustainable bitcoin mining company that believes bitcoin mining can be an important tool for solving modern energy challenges”. The theory is that because bitcoin miners can operate anywhere, they can turn stranded methane gas into electricity and use it to mine bitcoin, generating both a monetary and an environmental benefit.

On-chain metrics

Bitcoin (BTC): Liveliness

Liveliness is defined as the ratio of the sum of coin days destroyed and the sum of all coin days ever created.

When a coin is spent, the coin is considered ‘destroyed’, and the Coin Days Destroyed (CDD) metric is updated. For example, a coin that has been held for a year, and then sold, will result in 365 coin days being destroyed. As older coins are spent, more coin days are destroyed.

Liveliness increases as long term holders liquidate positions and decreases while they accumulate. This quantitative measure gives us insight into shifts in long-term holder behaviour.

According to data from Glassnode, as at 15 July, Liveliness has declined to around 0.599, a two-year low.

Source: Glassnode. Past performance is not indicative of future performance.

Mining difficulty refers to the degree of difficulty involved in discovering new bitcoin blocks through mining. Whenever there is an influx of miners or mining rigs, difficulty ramps up, and if there is a drop, mining difficulty reduces. This metric shows the current estimated number of hashes required to mine a block. (Note: Glassnode values are denoted in raw hashes).

Based on data from Glassnode, as at 15 July, mining difficulty was at an all-time high.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Over the week to 16 July, the largest mover within the Top 20 was Ripple Labs token (XRP), with a 52% gain. Ripple got a partial win in the SEC lawsuit as the US District Court of the Southern District of New York ruled that the sale of Ripple’s XRP tokens on exchanges and through algorithms did not constitute an investment contract. However, the court ruled that institutional sale of the tokens did violate federal securities laws.

Following the order, Ripple CEO, Brad Garlinghouse, tweeted: “We said in Dec 2020 that we were on the right side of the law, and will be on the right side of history. Thankful to everyone who helped us get to today’s decision – one that is for all crypto innovation in the US. More to come.”4

Ripple is a blockchain-based digital payment network and protocol with its own cryptocurrency called XRP.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.investing.com/news/cryptocurrency-news/sec-accepts-blackrocks-bitcoin-etf-application-signaling-regulatory-review-3126441

2. https://www.ft.com/content/1d1de06a-a904-4db3-9017-4c061bd6854d3. https://cointelegraph.com/news/cleanspark-s-bitcoin-mining-capacity-hits-8-eh-s-as-new-facility-goes-live4.https://cointelegraph.com/news/ripple-xrp-price-market-cap-jumps-sec-ruling

Past performance is not indicative of future performance.

Off the Chain is published every 2nd Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.