Bitcoin and the broader crypto market ended relatively flat over the last seven days.

As at 29 January 2023, bitcoin was trading at US$23,228. Ethereum underperformed bitcoin over the week, declining -2.08% vs bitcoin’s 1.37% gain. Bitcoin’s market capitalisation is hovering around US$447 billion, with the total crypto market above US$1.06 trillion. Bitcoin’s market dominance is sitting at 42.31%.

|

Price |

High |

Low |

Change from previous week |

| BTC (in US$) |

$23,228 |

$23,722 |

$22,387 |

1.37% |

| ETH (in US$) |

$1,595 |

$1,658 |

$1,530 |

-2.08% |

Source: CoinMarketCap. As at 29 January 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Amazon’s NFT initiative

Amazon is launching a NFT initiative, according to a report by Blockworks1, with April being targeted for a public announcement of the plans. Sources quoted in the report have indicated there is interest in entities that are “layer-1 blockchains, blockchain-based gaming, startups and developers and digital asset exchanges.”

Amazon’s potential entry into the space is “a big one” for crypto “for many different reasons”, one source said. “We knew it was possible, but now it seems like it’s really happening. That’s going to affect the existing players in the space — if they execute and do this right and are smart about it.”

52 NBA games in the metaverse

The National Basketball Association (NBA) and Meta have extended a partnership to broadcast 52 games in Horizon Worlds, Meta’s flagship metaverse app. Using virtual reality (VR) technology, the games will be broadcast on the co-viewing platform Xtadium, while using a compatible headset for an immersive sports experience. Five of the games will feature 180-degree monoscopic tech for a more immersive experience.

Meta’s Director of Media Content, Metaverse, Sarah Malkin stated: “VR’s superpower is making it possible to immerse yourself in shared experiences with friends and fans from around the world, and we’re thrilled to bring these killer features to the NBA Arena and live games.”2

Moody’s working on stablecoin scoring system

As reported by Bloomberg, credit rating firm Moody’s is working on a scoring system for stablecoins. Stablecoins, which are pegged to either a currency or commodity, are one of the most heavily traded sectors in the cryptocurrency ecosystem, and continue to be highly scrutinised due to the Terra collapse last year and the size of the largest stablecoins, Tether and USD Coin.

Up to 20 stablecoin projects will be included in the scoring system. While no credit score will be given, the system will be based on the quality of attestations and the reserves backing them, according to one person close to the plans.3

Bitcoin (BTC): Number of Addresses with Balance ≥ 0.1

This metric shows the number of unique addresses holding at least 0.1 BTC, valued at approximately US$2300 in today’s prices.

According to data from Glassnode, since the November lows, there has been a steep increase of just over 316,000 unique addresses that now hold more than 0.1 BTC.

Source: Glassnode. Past performance is not indicative of future performance.

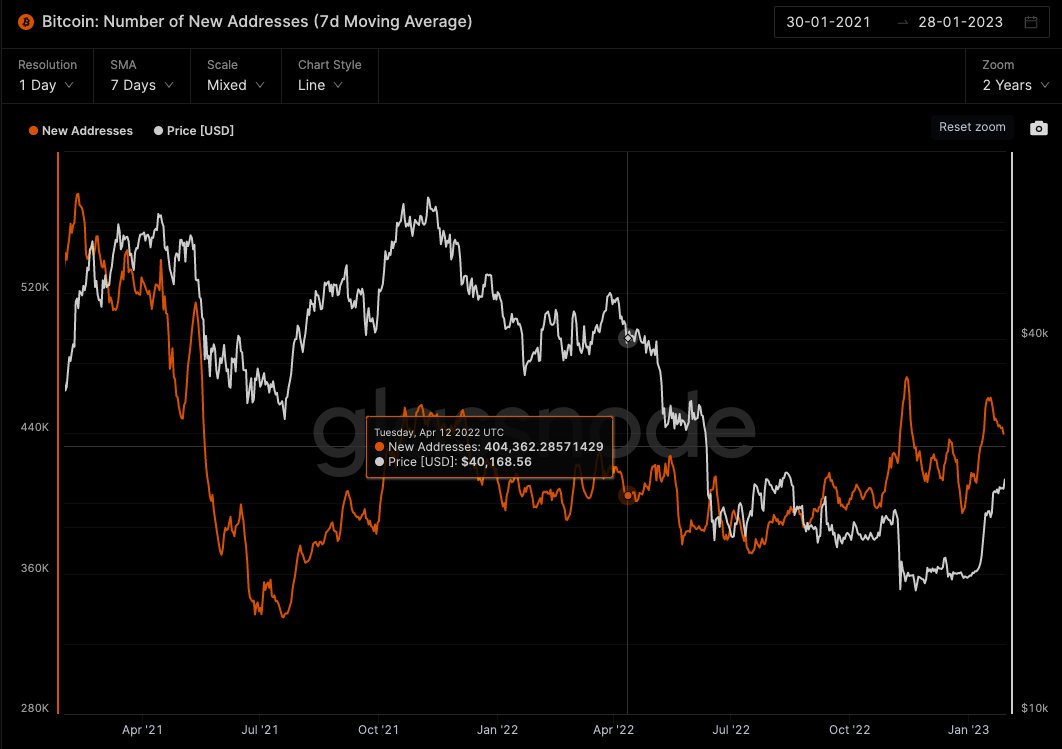

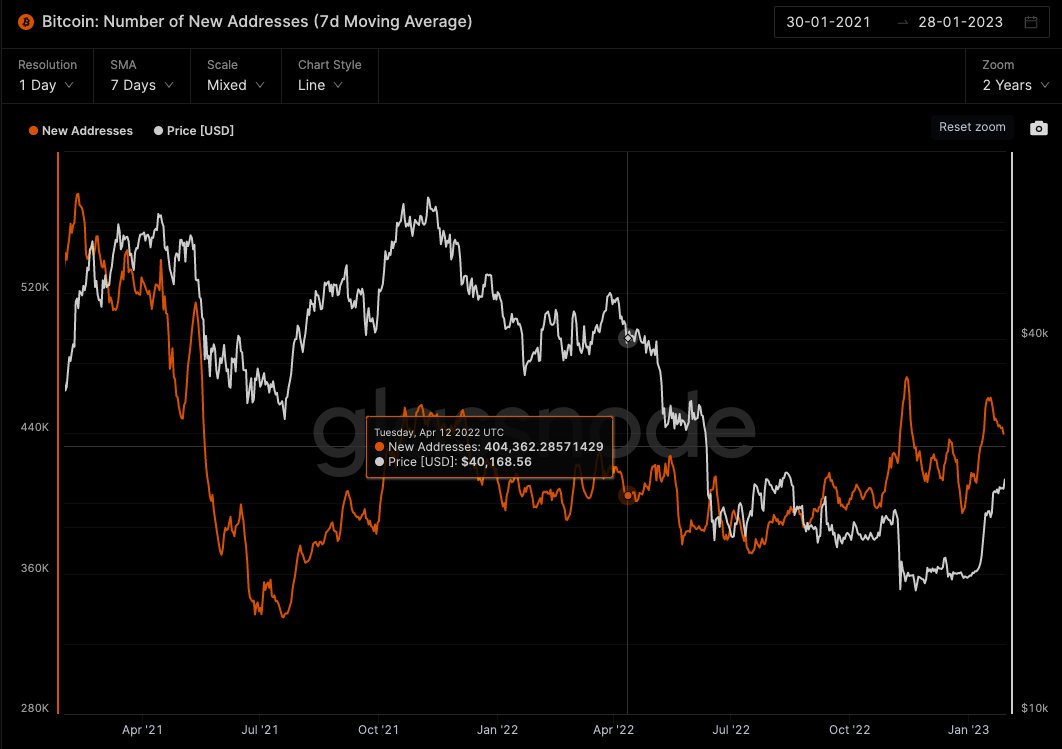

Bitcoin (BTC): Number of New Addresses (7-Day Moving Average)

This metric shows the number of unique addresses that appeared for the first time in a transaction for BTC.

According to data from Glassnode, there was an initial spike back in November with a follow-up of additional new addresses appearing as prices increased to US$21,000. However the trend seems to be reversing which could be an indication that investors believe prices are getting “frothy”.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, Aptos (APT) hit new record highs and was the top performing Top 30 coin over the week to 29 January 2023, up about 30%. Aptos is a layer-1 blockchain developed by Aptos labs.

According to its website, the blockchain uses the MOVE programming language, aims to increase scalability and reliability, and offers unique security and usability options. APTOS was created on 12 October 2022 and was based on the Diem blockchain initiative (from Meta) that had been abandoned and created by Diem developers.4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

|

1. https://blockworks.co/news/amazon-nft-marketplace-web3

2. https://news.bitcoin.com/nba-extends-partnership-with-meta-to-bring-basketball-games-to-the-metaverse/

3. https://www.bloomberg.com/news/articles/2023-01-26/credit-rater-moody-preps-crypto-stablecoins-scoring-system?sref=6EQWk76O

4. https://poloniex.com/blog/what-is-aptos-apt

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.