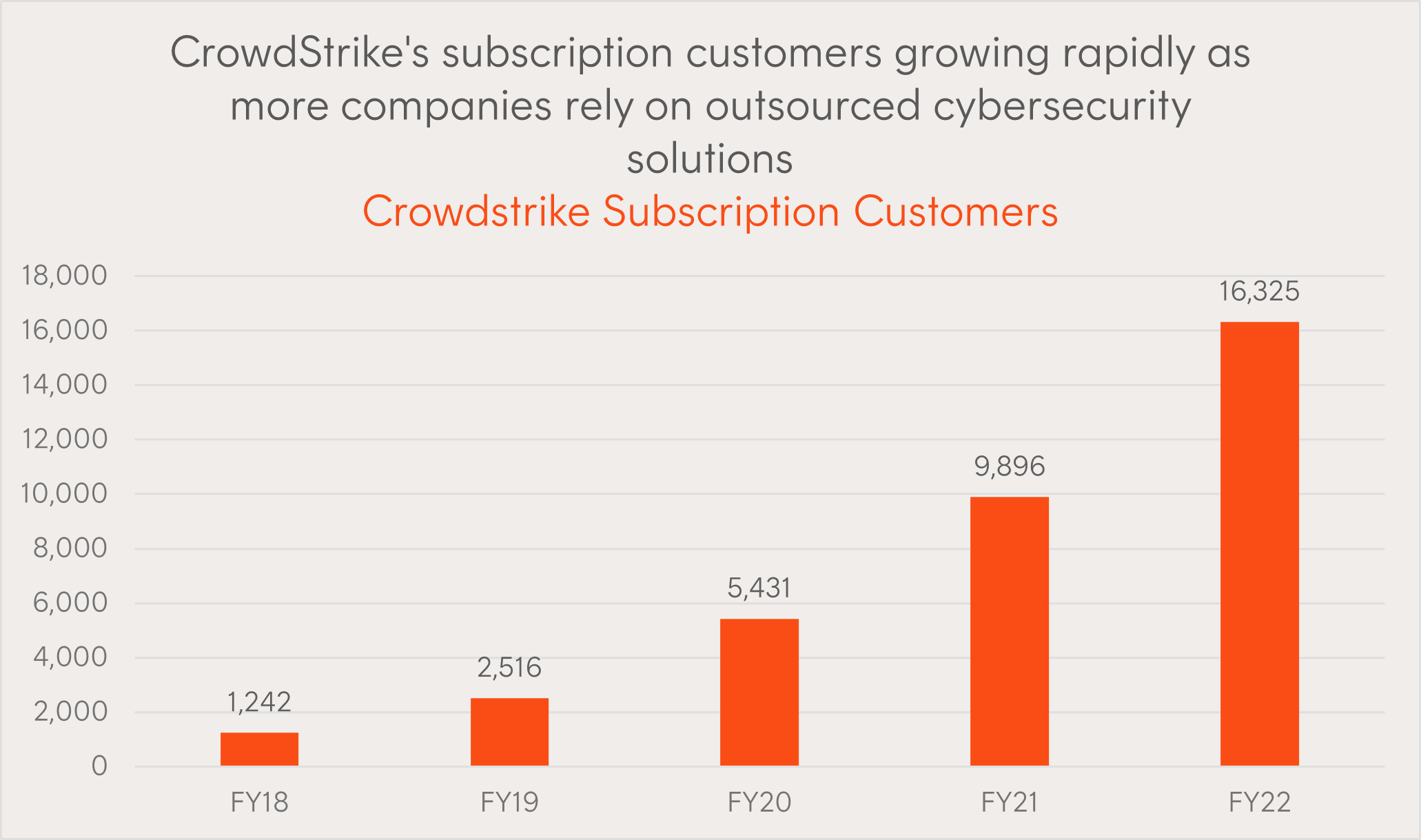

On the back of greater accessibility to artificial intelligence and due to a structural undersupply of private cybersecurity professionals, we are seeing a growing reliance on outsourced cybersecurity solutions driving growth in the companies underlying the cybersecurity industry.

Fighting back with AI

Leading cybersecurity software company Check Point demonstrated the potential of AI to be used in every stage of a cyberattack, from crafting convincing phishing emails to writing malware and embedding it in documents. Check Point believes the lowering barrier to creating cyber threats will lead to a greater number of and more sophisticated cyberattacks, that in turn will lead to a rise in corporate cybersecurity budgets.

According to Gartner, information security spending is expected to grow by 11.3% in 2023 to reach $187 billion, as companies invest in AI-augmented security tools to counter evolving cyberattack techniques.

Companies like CrowdStrike, a global cybersecurity leader, are already utilising AI to fight back. CrowdStrike introduced Charlotte AI in 2023, a generative AI cybersecurity analyst, available to businesses subscribed to their Falcon platform. Charlotte AI aims to democratise security and enable users, regardless of their skill level, to enhance their ability to detect, investigate, and respond to various security events, including advanced threat detection and remediation. By combining AI with human intelligence, CrowdStrike believes it can deliver unmatched security and business outcomes.

Source: CrowdStrike.

Cybersecurity companies set to benefit

The sophistication of cybersecurity software offered by specialist companies is creating a growing desire for businesses to outsource to these solutions. Implementing in-house AI-powered security systems can be expensive and requires specialised hardware, software, and skilled professionals to develop and maintain the systems.

Not only is this not feasible within a lot of companies’ budgets, there is also estimated to be a shortage of 3.4m cybersecurity professionals globally. 85% of organisations already outsource some or all cybersecurity operations to third party service providers with this reliance forecast to grow1.

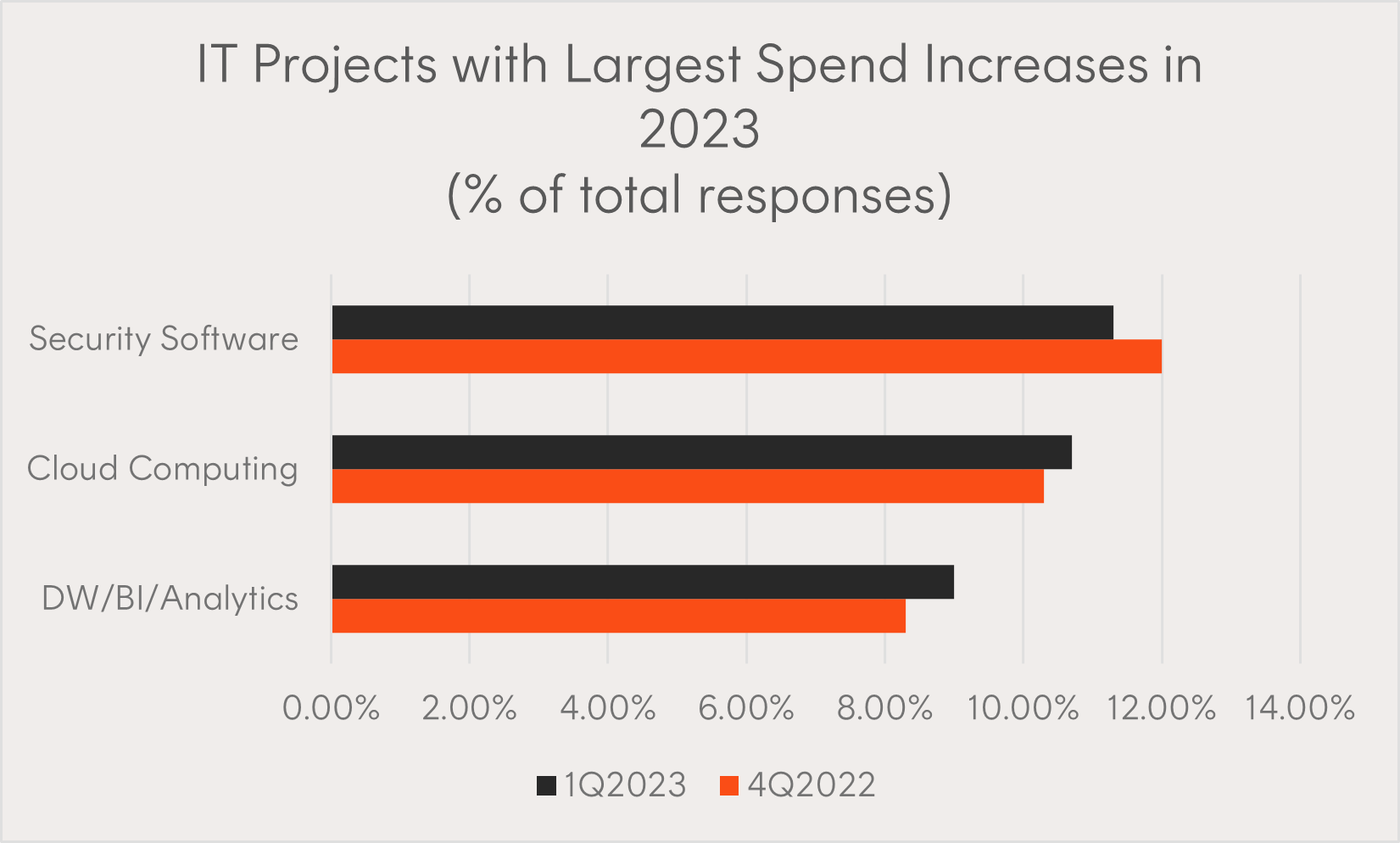

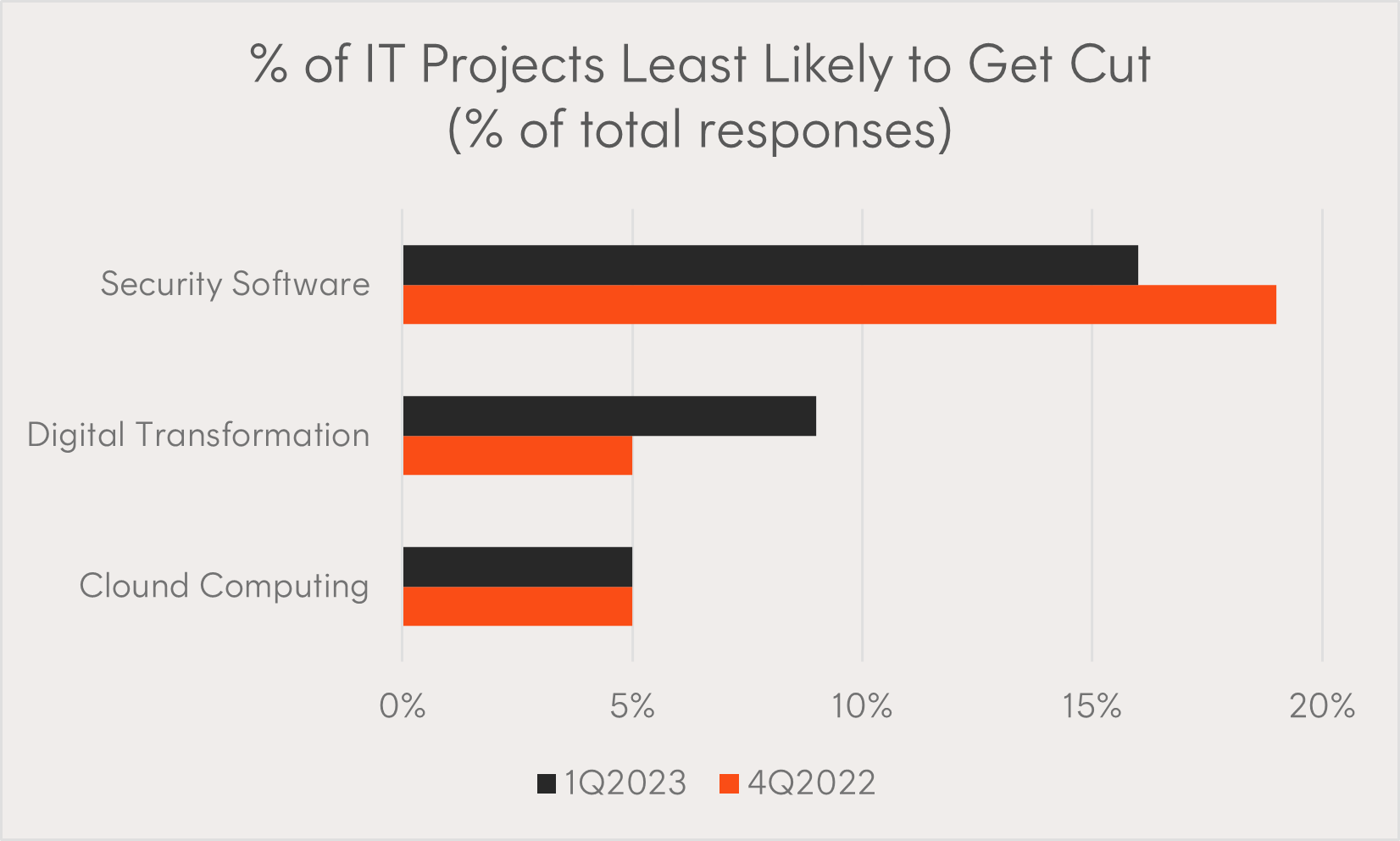

The confluence of these factors and growing threat of cyber attacks has security software at the top of global companies spending budgets. Security software ranked number one in Morgan Stanley’s Q1 2023 CIO survey for the projects that will see the largest spending increase in 2023 and for the IT projects least likely to get cut.

Source: Morgan Stanley 1Q2023 CIO Survey. Percentage of total responses.

Closer to home, as highlighted in this AFR article, Australian companies became increasingly vocal about their security spending following the high-profile breaches at Optus and Medibank. Brad Banducci, CEO of Woolworths, stated cybersecurity budgets had already doubled over the past three years, with $60m expected to be spent in the 2023 fiscal year alone.

Tighter financial conditions and the potential for economic deterioration in 2023 means more scrutiny will be placed on discretionary corporate spending by investors and companies alike. Despite this, the cybersecurity industry appears well placed and may display relatively defensive attributes by maintaining resilient revenues over the business cycle.

Implementation

HACK Global Cybersecurity ETF provides exposure to leading pure-play companies in the global cybersecurity industry – across hardware, software, threat intelligence, and services – including Check Point and CrowdStrike.

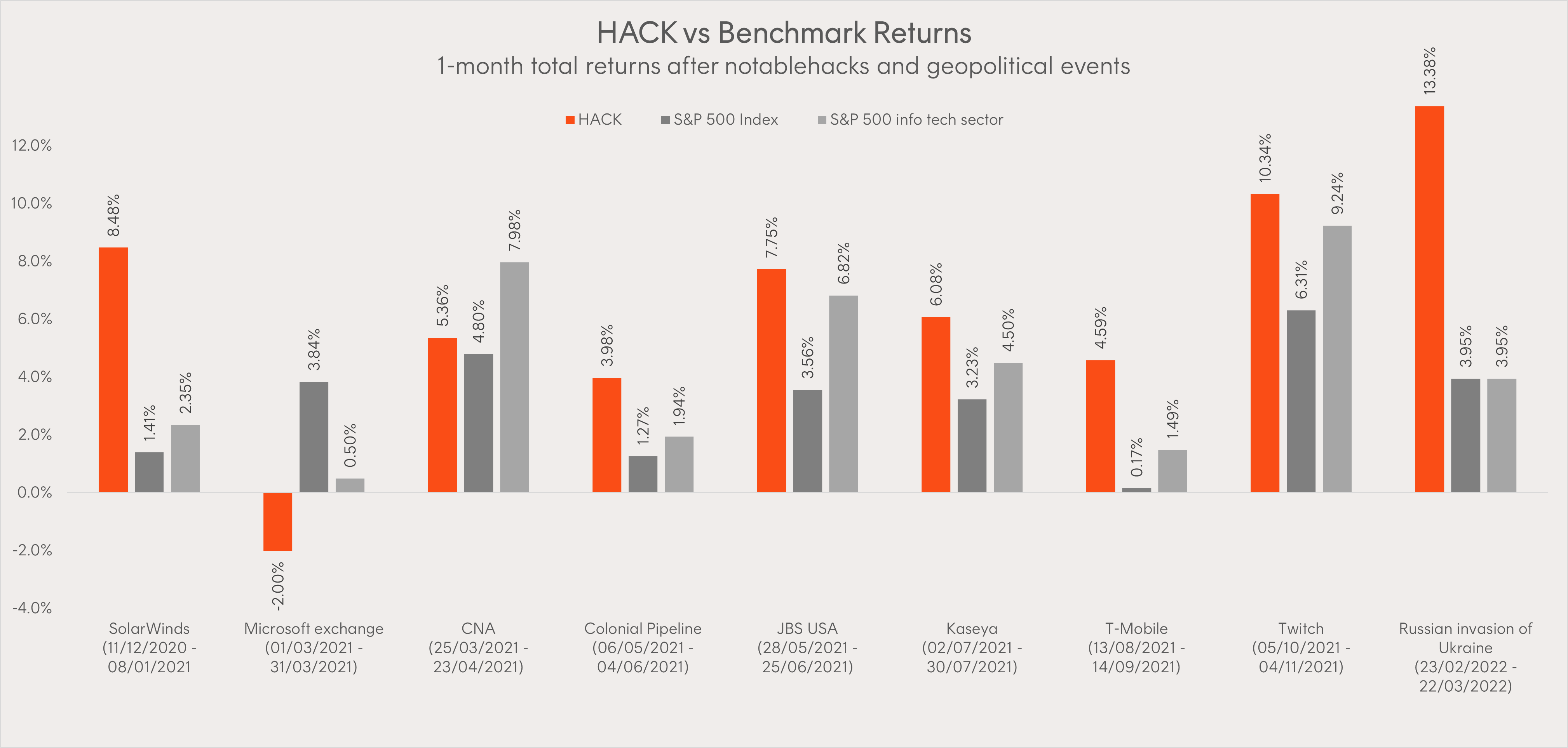

Due to the nature of its underlying holdings, HACK’s performance has historically responded positively to significant cyber incidents and geopolitical events potentially proving a good proxy for investors to growing cyber threats and the companies defending against them.

Source: Source: CIBR and Bloomberg. Notable hacks are based on the number of search results after the hack as well as Google trends data. Past performance is not an indication of future performance. Returns in AUD. See HACK’s webpage for further performance information.

HACK is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

For financial intermediary use only. Not for distribution to retail investors.

-

HACK

Global Cybersecurity ETF

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from Tom.