David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

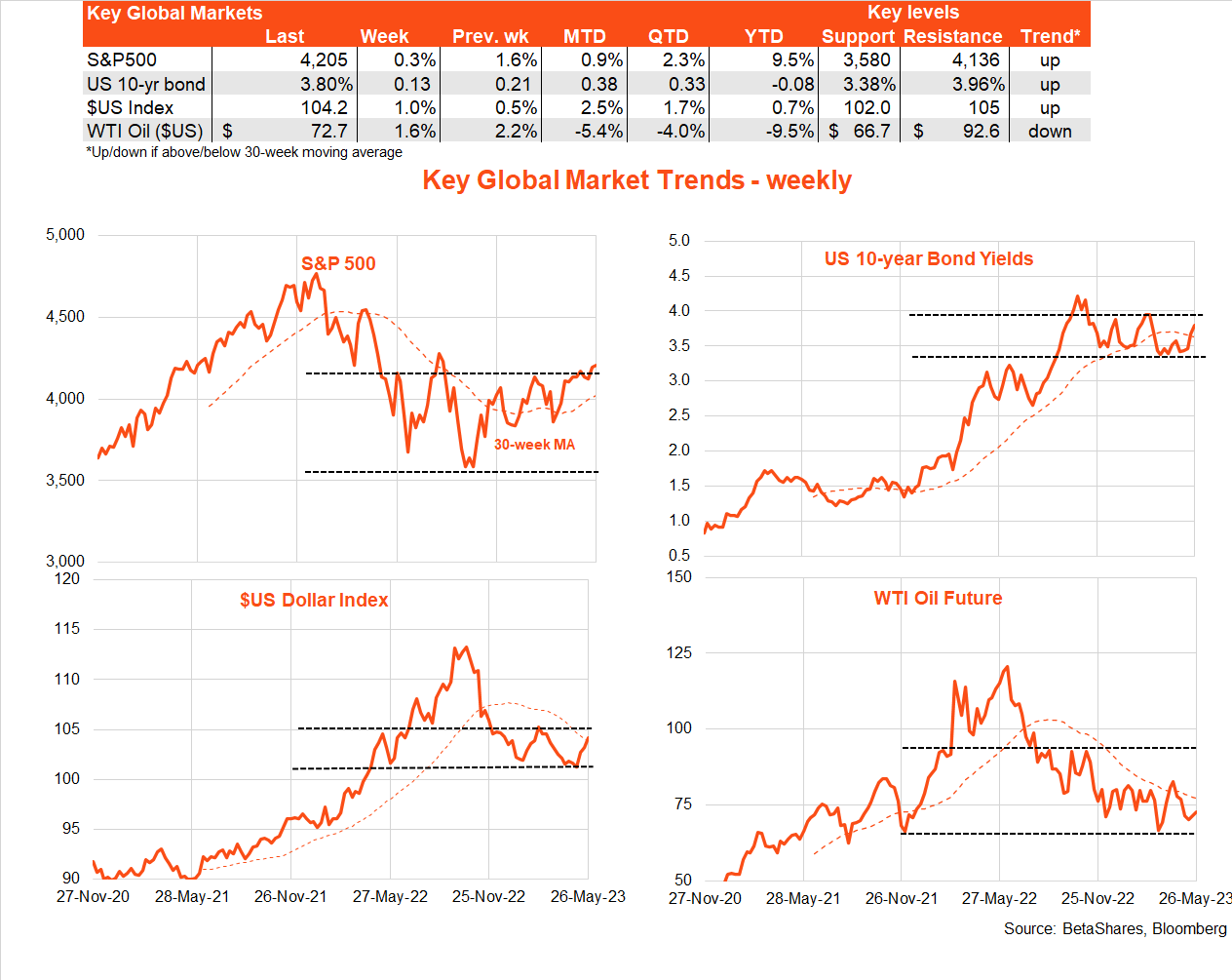

Global markets

Global markets were fixated on US debt ceiling negotiations last week along with the meanderings of various Fed officials. The week ended with a report suggesting US core inflation pressures remain uncomfortably high. US equities and bond yields ended the week modestly higher – with the S&P 500 valiantly trying to emulate the NADAQ-100 in breaking above recent resistance.

As most expected, US President Biden and House speaker McCarthy eventually came up with an 11th-hour deal over the weekend to avoid a US debt default. That said, there remains the risk of it not passing the Senate and/or House of Representatives. Indeed, those with long memories may recall the bank bailout during the GFC in 2008 was at first voted down by an irate Congress.

In other news, it’s fair to say Fed officials remain divided on the need for further US rate hikes, especially as early as next month. We should expect some clarity with more economic data, including this Friday’s May payrolls report which is expected to show still fairly robust employment growth, and possible strong wage growth to boot.

Last week we learned that weekly jobless claims – which had appeared to be rising and signalling a weakening labour market – were revised down notably. Bottom line: the US labour market still appears tight as a drum, albeit the level of job vacancies has eased from stratospheric heights. There has also been some easing in average and median US wage growth, albeit both remain uncomfortably high.

The most critical economic news last week was Friday’s slightly higher-than-expected April private consumption deflator – along with still solid consumer spending. In short, service sector inflation remains sticky, with core services excluding housing (a current Fed focus) rising 0.4% after a 0.3% gain in March. Equities might have been more spooked by this report were it not for hopes of a weekend debt deal.

The other notable development on Wall Street is the recent surge in artificial-intelligence-related stocks, most notably Nvidia – following the launch of AI services such as ChatGPT and Bard. This is adding to concentration risks in the US equity market at a time when valuations are already high and the Fed is still toying with further rate increases to slow growth and bring down inflation.

In the week ahead, markets will at first likely remain focused on whether the weekend debt deal gets through Congress. Assuming that’s the case – and after a likely relief rally – focus will return to an overly hot economy and the Fed. To that end, Friday’s US payrolls report looms large, with another solid employment gain of 180k and an average hourly wage gain of 0.4% expected.

As it stands, markets now attach a 66% chance to a US rate rise next month.

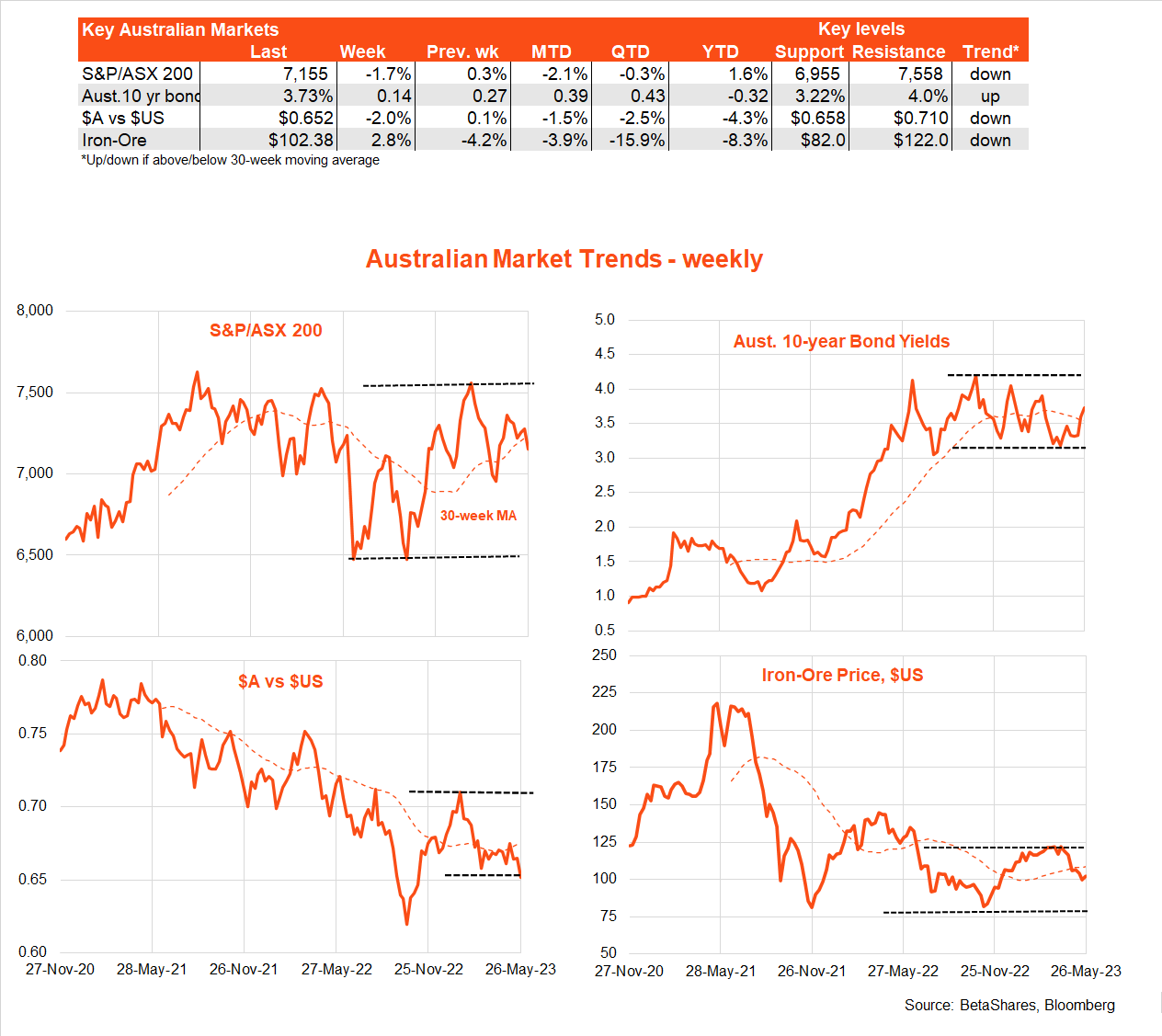

Australian markets

It was also a data-light week in Australia, with the highlight being the flat April nominal retail sales result on Friday. This suggests the slowdown in consumer spending evident since late last year has continued into the June quarter, and is one argument against the RBA feeling the need to raise rates again as early as next week.

Of some note, the Reserve Bank of New Zealand surprised last week with a smaller-than-feared 0.25% rate hike whilst also signalling at least a temporary pause. The $NZ – and the $A – fell accordingly, with the latter now clinging to the US65c level.

Markets think there’s only a negligible risk of an RBA rate hike next week. Of course, that could change – though it’s unlikely – with RBA Governor Lowe due to appear before the Senate Committee on Wednesday, along with the release of the monthly CPI report for April on the same day.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.