David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

3 minutes reading time

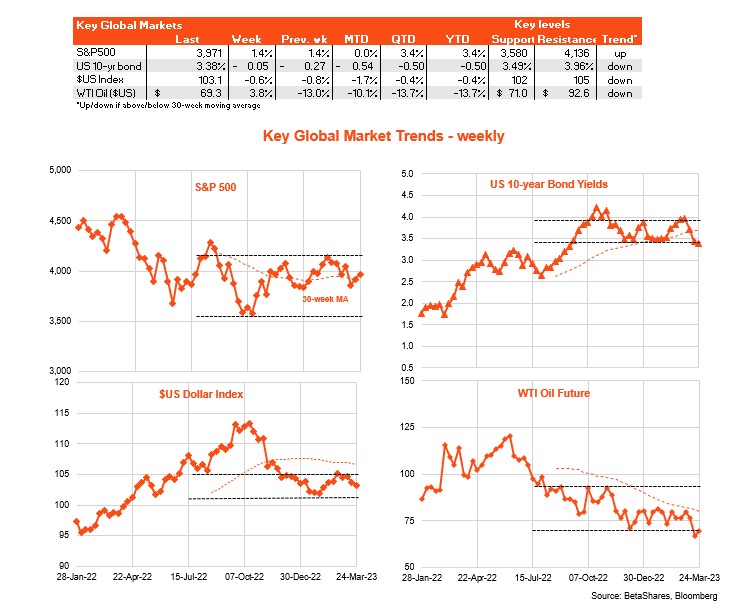

Global markets

Last week an eerie calm descended on global markets. Equities squeezed out a second week of small gains while bond yields and the US dollar eased.

Although all central banks that faced policy meetings went ahead and raised interest rates – from the United States and United Kingdom to Norway and even Switzerland – markets more broadly were generally relieved that there were no further major financial blowups.

So far so good!

The key highlight last week was the US Federal Reserve’s decision to raise rates by 0.25% – as was generally expected – though not raise its expected peak Fed funds rate despite warnings to this effect a few weeks ago before the recent surge in financial market volatility. According to the Fed’s own median forecasts, therefore, we’re likely to see only one further Fed rate hike at the May meeting (to a 5 to 5.25% range) before an extended pause sets in.

The biggest negative last week was US Treasury Secretary’s Yellen’s refusal to offer a blanket guarantee for all non-insured bank deposits – though she could hardly promise otherwise given there is no official policy to this effect. It seems officials will assess each case as it comes, depending on the degree of systemic risks posed.

Of course, just when we though the worst was over, Friday saw concerns over the viability of Deutsche Bank arise – if only because of its history of misadventure only rivalled in Europe by Credit Suisse. It remains to be seen whether DB really is in trouble or (more likely) this is just a case of fear begetting more fear.

Apart from watching for further potential financial blowups, the key global market focus this week will be the US private consumption deflator for February. Based on the already released CPI results for the month, this is likely to show still firm service sector price inflation – which should keep the Fed on track to raise rates again in May.

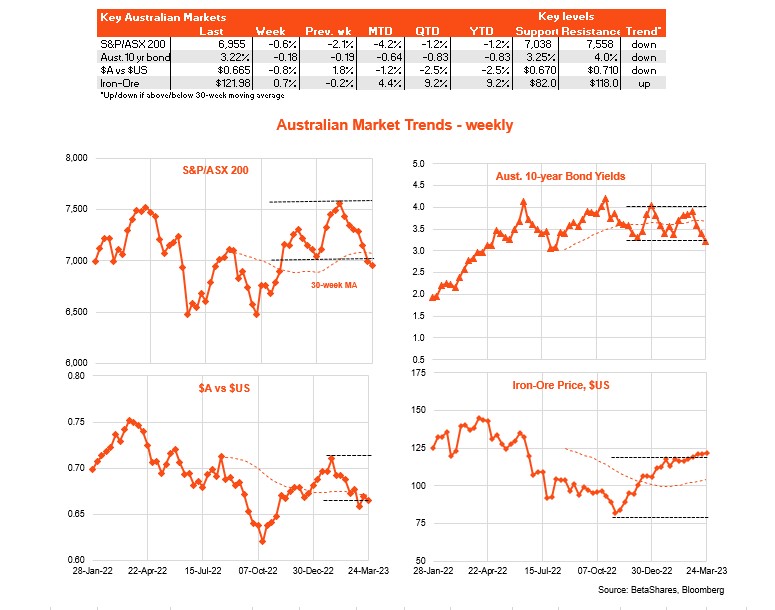

Australian market

There was little local economic data last week, with the main highlight being minutes to the recent RBA policy meeting, which suggested the RBA is open to pausing interest rates at the April meeting. Of course, the March meeting pre-dated the blockbuster February labour market report – with a 60k surge back in employment – as well as recent global financial market volatility.

All this suggests that it’s still an open question whether the RBA pauses next month or not. Global financial instability should not be a barrier – as this has not stopped other central banks raising rates in recent weeks.

Rather, the RBA decision may well turn on the strength in retail spending in tomorrow’s February sales report and the degree of price pressure in Wednesday’s monthly CPI report. My inclination is that both reports will be sufficiently firm that the RBA will remain on track to raise interest rates next week – though signal in the post-meeting statement that it will then likely pause for at least a few months.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.