Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

International equities products drive the industry towards $200B

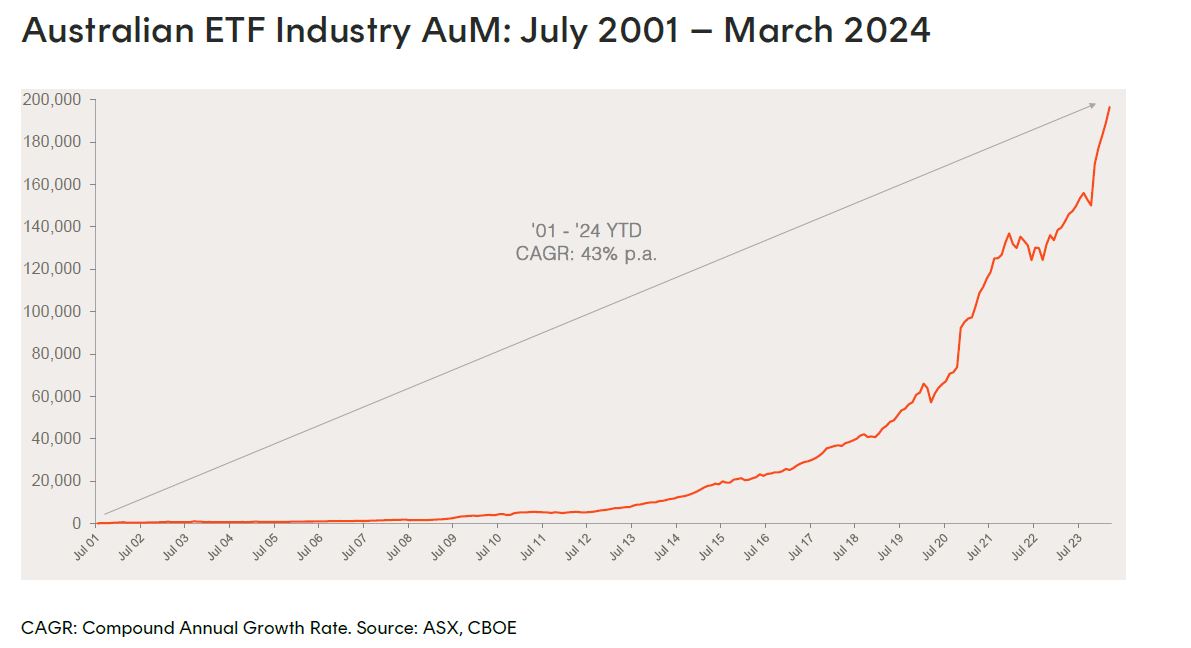

- The Australian ETF industry hit a new all-time high in assets under management in March, ending just shy of the $200B milestone, with industry growth driven by a combination of asset value appreciation and investor net inflows.

- March saw assets grow 3.9% month-on-month, for a total monthly market cap increase of $7.3B, with the industry reaching a new all-time high of $196.7B.

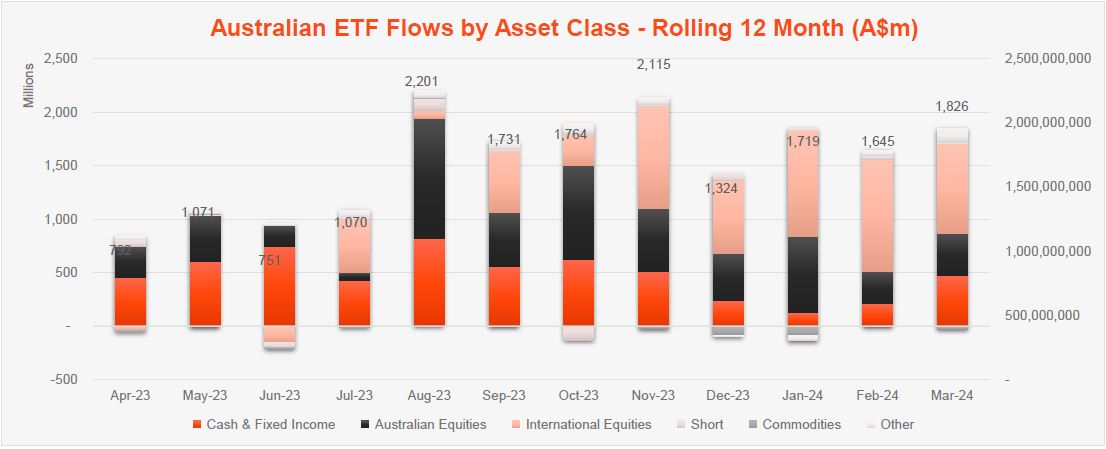

- Net inflows for the month were $1.8B, representing ~25% of the industry’s growth in March.

- Trading value declined marginally, dropping 9% month on month in March, with ASX trading value of ~$9B for the month.

- Over the last 12 months the industry has grown by 37.9%, or $54.1B.

Exchanged Traded Funds Market cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $196.7B – New all-time high

- ASX CHESS Market Cap: $168.1B1

- Market Cap increase for month: 3.9%, $7.3B

- Market cap growth for last 12 months: 37.9%, $54.1B

Net Flows

- Net flows for the month: $1.8B

New Products

- 359 Exchange Traded Products trading on the ASX & CBOE

- No new launches or fund closures this month

Trading value

- Trading value declined by 9% in March, with ASX trading value of ~$9B for the month

Performance

- The best performing ETFs this month were gold miners ETFs, including our MNRS Global Gold Miners ETF which returned ~19% for the month. Bitcoin and Crypto exposures also performed relatively well, albeit not at the rate experienced in February.

Top 5 category inflows (by $)

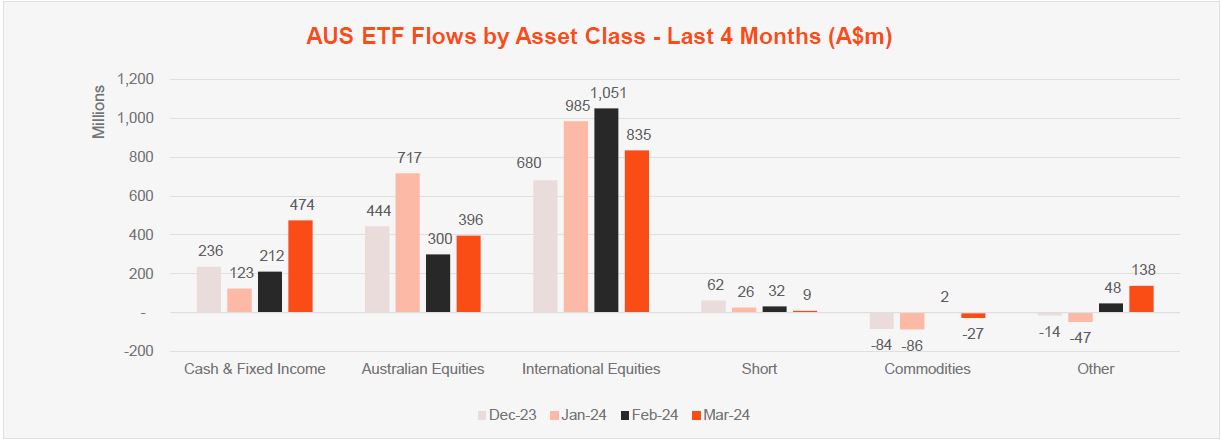

| Broad Category | Inflow Value |

| International Equities | $834,862,479 |

| Fixed Income | $453,435,632 |

| Australian Equities | $396,415,252 |

| Listed Property | $80,773,032 |

| Multi-Asset | $35,884,782 |

Top category outflows (by $)

| Broad Category | Inflow Value |

| Commodities | ($27,444,446) |

Top sub-category inflows (by $)

| Sub-category | Inflow Value |

| Australian Bonds | $338,182,681 |

| Australian Equities – Broad | $336,060,091 |

| International Equities – Developed World | $285,524,903 |

| International Equities – US | $274,997,820 |

| International Equities – Sector | $143,269,094 |

Top sub-category outflows (by $)

| Sub-category | Inflow Value |

| US Equities – Short | ($16,910,250) |

| Australian Equities – Geared | ($15,072,848) |

| Gold | ($10,163,396) |

| Oil | ($9,616,000) |

| Australian Equities – Sector | ($6,167,000) |

Top Performing Products – March 2024

| Ticker | Product Name | Performance |

| GDX | VanEck Gold Miners ETF | 19.4% |

| MNRS | Betashares Global Gold Miners ETF – Currency Hedged | 19.3% |

| WIRE | Global X Copper Miners ETF | 16.6% |

| EBTC | Global X 21Shares Bitcoin ETF | 13.2% |

| CRYP | Betashares Crypto Innovators ETF | 12.2% |

Footnotes:

1. Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it will exclude, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity.

Investor & founder with a Financial Services & Fintech focus. Co-founder of Betashares. Passionate about entrepreneurship and startups.

Read more from Ilan.

1 comment on this

Last 4 months, Australian Bonds, achieved the highest inflow. Could you please provide the top 5 Australian Bonds with the highest inflow?

Thank You

Nick