Bitcoin and the broader crypto market continued to hold steady and ended last week essentially flat.

At the time of writing, bitcoin is trading at US$16,559. Ethereum outperformed bitcoin for the week, down -0.03% vs bitcoin’s -0.81%.

Bitcoin’s market capitalisation is at US$318.2B, with the total crypto market sitting at US$841.9B. Bitcoin’s market dominance is down to 37.82%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $16,559 | $16,771 | $15,599 | -0.81% |

| ETH (in US$) | $1,218 | $1,224 | $1,081 | -0.03% |

Source: CoinMarketCap. As at 27 Nov. 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Proof of reserves

Following the FTX collapse, and billions of dollars in crypto moving off exchanges due to concerns around centralised exchanges, many crypto exchanges said they aimed to provide proof-of-reserves audits (PoR). PoR refers to an independent audit completed by a third party to verify the assets that are held in custody for users.

A number of exchanges have released wallet addresses to provide visibility on what they hold. Most recently, Coinbase CEO Brian Armstrong tweeted about the total amount of bitcoin being held: “If you see FUD out there – remember, our financials are public (we’re a public company). We hold ~2M BTC. ~$39.9B worth as of 9/30.”1

Last week Binance posted its PoR on the Binance website, to evidence its commitment to transparency. The launch of this feature will start initially with BTC, with other tokens and networks expected to follow in the next couple of weeks. The On-Chain Reserve currently sits at 582,485.9302 BTC while the Customer Net Balance is 575,742.4228 BTC, meaning a Reserve Ratio of 101%.2

First US state to restrict bitcoin mining

A bill in the state of New York has been passed to ensure that existing PoW mining companies are required to change their power sources to renewable energy, or face not being allowed to renew their permits for the next two years. No new mining entities are permitted during this moratorium period.

New York becomes the first US state to restrict PoW crypto mining. The state has a goal of reducing carbon emissions by 80%, and the new legislation aims to balance economic development and climate goals. New York Governor Kathy Hochul said: “I will ensure that New York continues to be the centre of financial innovation while also taking important steps to prioritise the protection of the environment.” The legislation has been signed by the New York Governor and approved by the New York State and Senate.3

Record inflows into crypto short-funds

According to CoinShares, there were “record” inflows into short-investment products following the collapse of FTX. For the week ending 18 November, 75% of total inflows by institutional crypto investors were into short-investment products, according to the Chief Strategy Officer of CoinShares, James Butterfill. A short product seeks to generate returns that are negatively correlated to the returns of the underlying investment (i.e. value increases as the price of the underlying investment goes down in price, and vice versa). Butterfill said that the view that prices will continue to fall is most likely “a direct result of the ongoing fallout from the FTX collapse.” Over the week, $14 million went into short Ether, the largest weekly inflow on record, and $18.4 million went into short bitcoin products, increasing AUM to $173 million.4

On-chain metrics

Bitcoin (BTC): MVRV Z-Score

This metric is used to give an indication whether bitcoin is over/undervalued relative to its ‘fair value’ (as defined by the metric). When market value is significantly higher than realised value, it historically has indicated a market top (red zone), while the opposite has indicated a market bottom (green zone). Technically, MVRV Z-Score is defined as the ratio of the difference between market cap and realised cap, and the standard deviation of all historical market cap data i.e. (market cap – realised cap)/std (market cap).

According to data from Glassnode, the MVRV Z-Score sits at levels not seen since 2019 bear market lows.

Source: Glassnode. Past performance is not indicative of future performance.

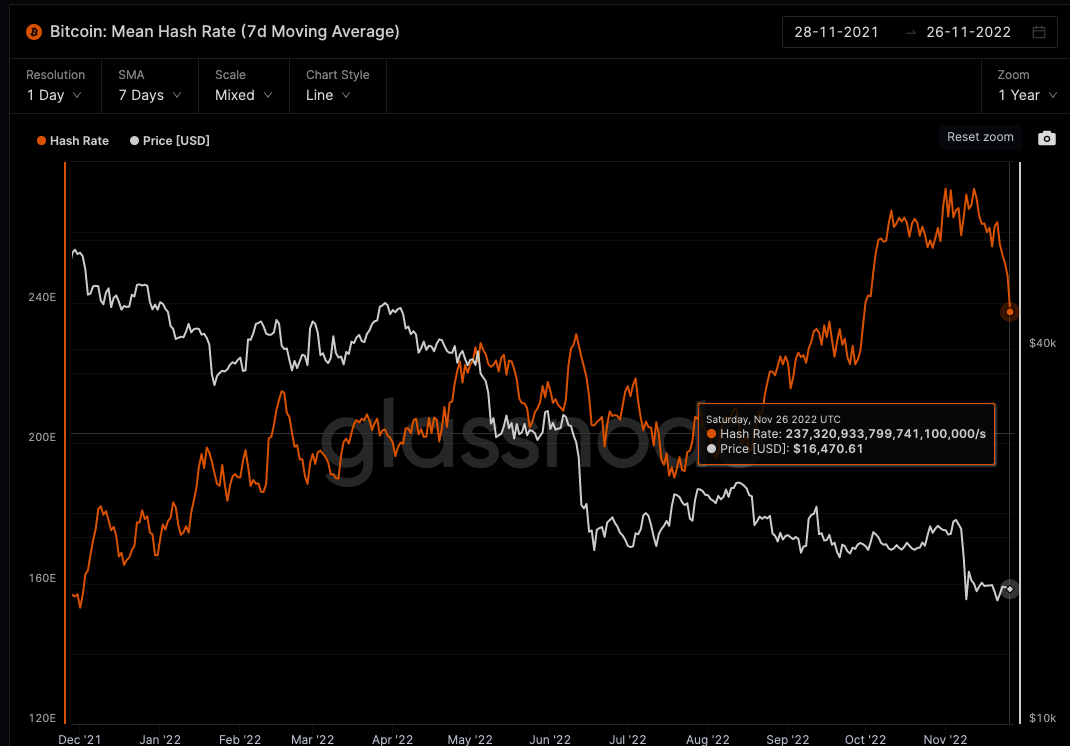

Bitcoin (BTC): Mean Hash Rate (7d Moving Average)

This metric shows the average estimated number of hashes per second produced by miners in the network.

According to the data on Glassnode, the hash rate of the Bitcoin network witnessed a steady decline over the past two weeks. The hash rate is a security metric that is designed to help protect the Bitcoin network from double-spending attacks. This decline is not surprising, considering factors such as the fall in the price of BTC, greater mining difficulty and rising energy prices.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Litecoin (LTC), which started trading in October 2011 and is the oldest peer-to-peer cryptocurrency after bitcoin, was up over 25% over 7 days and the top performing Top 20 coin over the last seven days. The coin is about to experience its third halving event which appears to be the catalyst for the most recent jump in price. The halving event is set to occur in eight months and will cut LTC’s pace of supply expansion by 50%. Rewards paid to LTC miners for confirming transactions on the blockchain will drop from 12.5 LTC to 6.25 LTC per block.5

Litecoin was designed to improve on some of bitcoin’s deficiencies such as slow transaction speeds, and be used for everyday transactions, while bitcoin has become more of a ‘store of value’.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://news.bitcoin.com/coinbase-ceo-says-company-holds-2-million-bitcoin-reminds-people-firms-financials-are-public/

2. https://www.binance.com/en/support/announcement/binance-releases-proof-of-reserves-system-0c7a786cbe8c4e108f3301385ab61e39

3. https://cryptopotato.com/new-york-becomes-first-us-state-to-restrict-bitcoin-mining/

4. https://www.reuters.com/technology/investors-flock-short-crypto-funds-products-negative-sentiment-deepens-2022-11-21/

5. https://cointelegraph.com/news/litecoin-hits-fresh-2022-high-versus-bitcoin-but-will-ltc-price-halve-before-the-halving

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.