Ele de Vere

Ele de Vere is a Director at Betashares and responsible for the strategic direction and implementation of marketing, communications, and customer strategy initiatives. With a keen interest in markets and personal finance, Ele regularly contributes to articles, on podcast and speaks at events across Australia.

5 minutes reading time

How emotions can affect your investment decisions

Have you ever become emotional about money? Even the most rational investors sometimes experience feelings of anxiety or euphoria when their money is involved. Why? Because we are human.

Understanding emotions, and how we project different emotional biases, can help us better understand our decision-making processes, so we can act more rationally, hopefully leading to better investment outcomes.

Role of emotions in investing

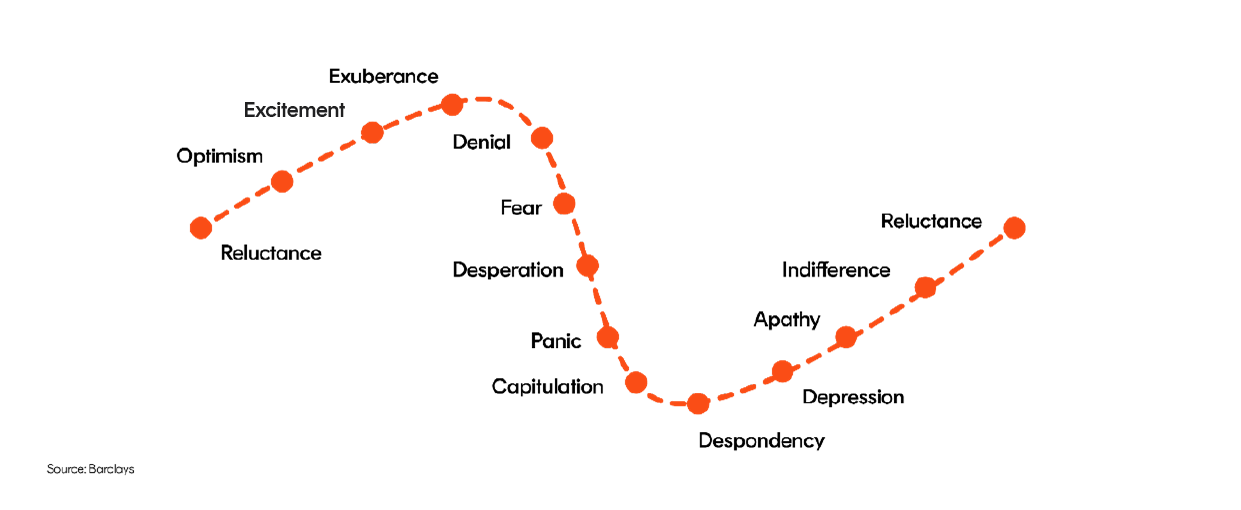

One way of better understanding how emotions affect investor behaviour is to look at the chart below – commonly known as the cycle of market emotions. It suggests that typically our emotions work against us when investing.

In a rising market, our optimism, and the excitement of rising values, can lead us to think that we will continue, or start, making gains easily. Fuelled by feelings of hope and greed, we may increase our level of risk just when prices have already risen significantly, investing more at precisely the time we should be cautious.

Conversely, when markets are falling, we may be presented with strong buying opportunities. However, anxiety, fear and panic can prevent us from investing, and in some cases are enough to drive us to exit the markets – at precisely the wrong point in time, when prices are at lows.

There are fascinating examples of this cycle, repeated over many decades, from the 2008 Global Financial Crisis all the way back to the Dutch tulip bulb market bubble in the 1630s, also known as ‘tulip mania’, one of the most famous market bubbles and crashes of all time.

By understanding this cycle of market emotions, we may be able to better take advantage of investment opportunities while potentially mitigating risks.

Behavioural biases to watch out for

As well as this simplified cycle of emotions, there are biases that can affect our decision-making processes in both strong and weak markets. It’s important to be conscious of how your emotions may be playing into behaviours when buying, selling, or reviewing your investments.

1. Anchoring bias

Faced with making a decision, we often use an ‘anchor’ or focal point as a reference to guide our choices. Psychologists have found that we tend to lean heavily on the first piece of information we learn (the ‘anchor’), regardless of how accurate that information is.

If you catch yourself relying on your anchor too much, step back and consider all the available information before making your decision.

2. Overconfidence bias

Confidence is generally to be valued as a human trait, but when it veers into overconfidence, the result can be the ‘overconfidence bias’, whereby we overestimate our abilities and underestimate our weaknesses.

Applying this to investing, overconfidence bias can lead people to overestimate their understanding of financial markets or specific investments and disregard hard data and expert advice.

For example, overconfidence bias can trick the brain into believing it’s possible to consistently beat the market by making risky bets. This bias can be countered in several ways, such as making room for other people’s perspectives.

3. Confirmation bias

Confirmation bias favours information that confirms our current beliefs or thinking. This is when we actively seek, favour, and remember information supporting our views, while discounting anything opposing.

Social media is an example of how confirmation biases are perpetuated, given that its algorithms learn what we like over time and serve us more and more of this same content. The result is that many people end up living in ‘echo chambers’, having their own views continually fed back to them.

In investing, confirmation bias may lead investors to focus only on information that reinforces their opinions about an investment. Selectively choosing which information to use can lead to a lack of diversification and investments that are not researched or that carry higher risk.

A recent example of the disastrous effects of confirmation bias is the infamous blood-testing startup Theranos, run by the now-convicted Elizabeth Holmes. Among prominent investors in the company was George Shultz, the former Secretary of State. Shultz was not only an investor, he was also a close friend of the Holmes family.

As a result, when Shultz’s grandson Tyler presented him with fact-based evidence that Theranos was a scam, Shultz refused to believe it. Tyler presented him with information that was contradictory to his pre-existing beliefs, yet ultimately turned out to be correct.

4. Regret-aversion bias

The emotional process behind the regret aversion bias is simple. Regret causes us emotional pain. In order to avoid this pain, we do nothing out of excessive fear that we may regret our actions. Or alternatively, we make a less-than-optimal decision, for example, buying into a ‘hot’ stock to avoid the potential regret of ‘missing out’.

In holding off a decision or making a decision that we think has a lower potential to lead to a regrettable outcome, we can alter our investment risk profile, making us more risk-averse or risk-seeking than appropriate, which can result in lower returns over time.

Don’t be driven by emotion

While almost everyone is susceptible to the influence of emotional factors, it is important to raise these influences from the unconscious to the conscious. Educate yourself on the biases that investors are commonly prone to and ask yourself whether your decisions are being influenced by them. By doing this, you give yourself the best chance of making rational investment decisions based on facts and logic rather than driven by emotions.

Written by

Ele de Vere

Marketing Director

Ele de Vere is responsible for the strategic direction and implementation of marketing, communications, and customer strategy initiatives. With a keen interest in markets and personal finance, Ele regularly contributes to articles, on podcast and speaks at events across Australia.

Read more from Ele.

1 comment on this

Well-written and informative article. If you’re interested in learning more, I suggest click here for supplementary resources.