Bitcoin trading was range-bound over the past week, trading between US$27,500 and US$30,000. Ethereum traded similarly, albeit with higher volatility.

As at 9 May 2023, bitcoin was trading at US$28,880. Ethereum outperformed bitcoin over the week, down -0.95% vs bitcoin’s -1.87% loss. Bitcoin’s market capitalisation sat at US$558 billion, with the total crypto market cap increasing to US$1.187 trillion. Bitcoin’s market dominance increased to 47%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $28,880 | $29,820 | $27,680 | -1.87% |

| ETH (in US$) | $1,910 | $2,017 | $1,809 | -0.95% |

Source: CoinMarketCap. As at 8 May 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Back in the spotlight

FTX is back in the spotlight as it attempts to repay creditors and customers US$11 billion that disappeared from its balance sheet prior to bankruptcy. Since November 2022, FTX surprisingly has managed to recover more than US$7 billion from asset sales and claw-back provisions.

More recently, court documents filed on May 3 reveal FTX is attempting to claw back funds in the form of repaid loans, withdrawn liquidity, and collateral from fellow bankrupt platform Genesis. The total sum at stake amounts exceeds US$3.88 billion across all entities affiliated with Genesis.

The rationale behind a claw-back provision is straightforward. A creditor who received full payment before an entity declares bankruptcy should not be at an advantage to a creditor who receives payment after (and who may only receive part of their entitlement).

But here’s what’s interesting about this story. Not only is FTX, understandably, attempting to claw-back loan repayments and collateral pledged, but it is also attempting to claw back US$1.8 billion in exchange withdrawals. Put simply – FTX wants Genesis’ money back.

Nonetheless, FTX is closing in fast on the US$11 billion figure, an achievement that many originally thought unlikely.1

Nigeria’s digital transition continues

Nigeria, one of the first countries to implement a central bank digital currency, looks to continue their shift towards a digital economy with the recent approval of their National Blockchain Policy. The push towards blockchain has also been prompted by Nigeria’s efforts to move away from its heavy economic reliance on the oil and gas sector, which accounts for 75% of its exports, and instead allow the economy to transition into one driven by digital technologies.

Regarding the policy, the Nigerian Federal Ministry of Communications & Digital Economy recently tweeted: “The vision of the Policy is to create a Blockchain-powered economy that supports secure transactions, data sharing, and value exchange between people, businesses, and Government, thereby enhancing innovation, trust, growth, and prosperity for all.”

Further, Nigeria’s SEC plans to support tokenisation, with the primary focus being real-world assets such as equities, bonds, and real estate.

According to Binance’s Africa Director, Nadeem Anjarwalla, the approval of the policy indicates that Nigeria is positioning itself significantly ahead of the curve. “We believe that growth in blockchain technology is set to become a key differentiator for economies and a key measure of international competitiveness in the next decade for attracting foreign direct investment, cultivating innovation, and creating jobs. As such, this is a welcome development and a significant milestone for the blockchain industry in Nigeria.”2

CRYP company spotlight

Nuclear-powered Bitcoin mining

America’s first nuclear-powered Bitcoin mine has announced remarkable results for the month of April 2023. This pioneering facility, which harnesses the power of nuclear energy to mine the world’s leading cryptocurrency, has surpassed all expectations and cemented its position as a trailblazer in the field.

The mining centre, Nautilus, which is owned and operated by TeraWulf, utilised over 91% of zero-carbon energy to power approximately 9,200 miners. The Nautilus centre self-mined 239 BTC in April and 771 BTC year to date in 2023, running on a gross margin near 70%.

TeraWulf owns and operates vertically integrated, environmentally clean Bitcoin mining facilities in the United States. TeraWulf generates domestically produced Bitcoin powered by nuclear, hydro, and solar energy with a goal of utilising 100% zero-carbon energy.3

On-chain metrics

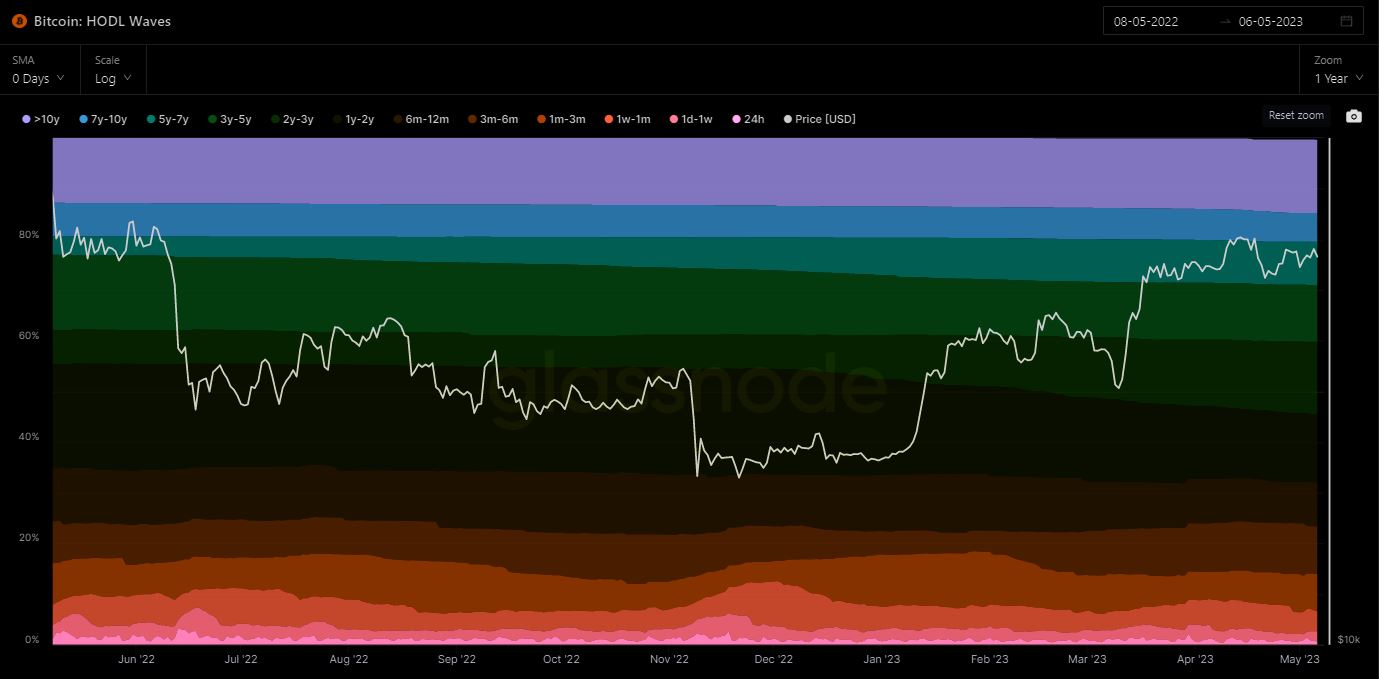

Bitcoin (BTC): HODL Waves

This metric shows a bundle of all active supply age bands. Each coloured band shows the percentage of Bitcoin in existence that was last moved within the time period denoted in the legend.

According to data from Glassnode, as at 8 May, more than 25% of all bitcoin has been held for five years or more. Longer term trends suggest people are holding bitcoin for longer.

Bitcoin (BTC): Addresses with balance >10 bitcoin

This metric shows the number of unique addresses holding at least 10 bitcoin.

Based on data from Glassnode, as at 8 May there were approximately 155,000 unique addresses with at least 10 bitcoins. This figure has increased notably since bitcoin’s price looked to have bottomed around November 2022.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Many readers will be familiar with the most recent trend in speculative cryptocurrencies. Launched in April 2023, PEPE is a cryptocurrency that features Pepe the Frog, a viral internet meme of the 2010s, as its mascot. Pepe coin, like many other cryptocurrencies, is built on blockchain technology and can be bought and sold on cryptocurrency exchanges.

Ironically, the core value proposition of PEPE is that there isn’t one. The official website for the cryptocurrency features a disclaimer that describes investment in the token in the following manner: “$PEPE is a meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. The coin is completely useless and for entertainment purposes only.”

PEPE has just crossed a market capitalisation of US$1 billion.4

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://www.reuters.com/legal/ftx-gets-approval-ledgerx-sale-asserts-39-bln-genesis-claim-2023-05-04/

2. https://au.finance.yahoo.com/news/nigeria-approves-national-policy-create-080257022.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAAJMAY1WViAuzR-hUTi3Uc7AjP0fhJtvvffsEloEPRYCZ_OG-x_kxFd0CiJkQEXd6_53Bq2XwgKL5eUvo8B3J7xq1aFCwY2o1MAqnPtM3g48CuwlEf4ZZsuLBmfv6OCFLyxPlP4dAYCnmrOMn7h_ThApnFfa0EYiBa9NbjAb2nPP3.https://www.businesswire.com/news/home/20230504005472/en/4.https://cointelegraph.com/news/pepe-memecoin-hits-1-billion-market-cap-fueled-by-binance-listing

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Benjamin Cahill