David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

Week in review

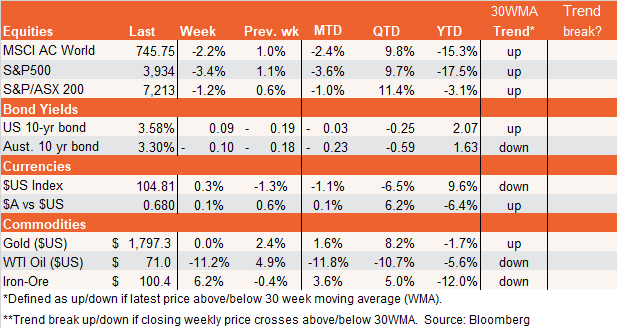

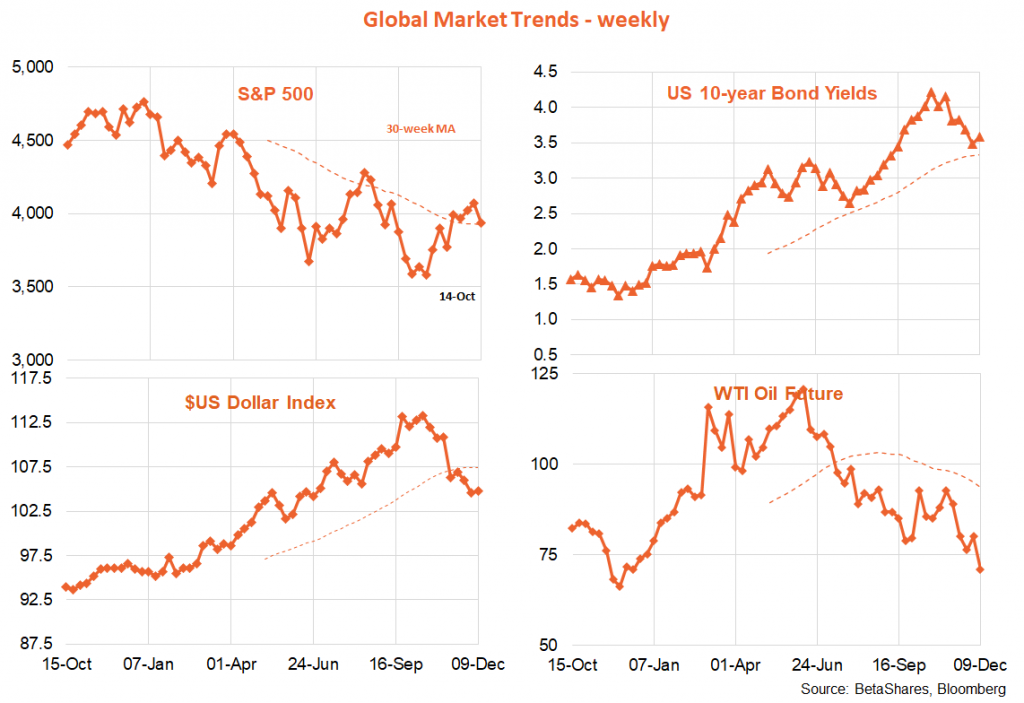

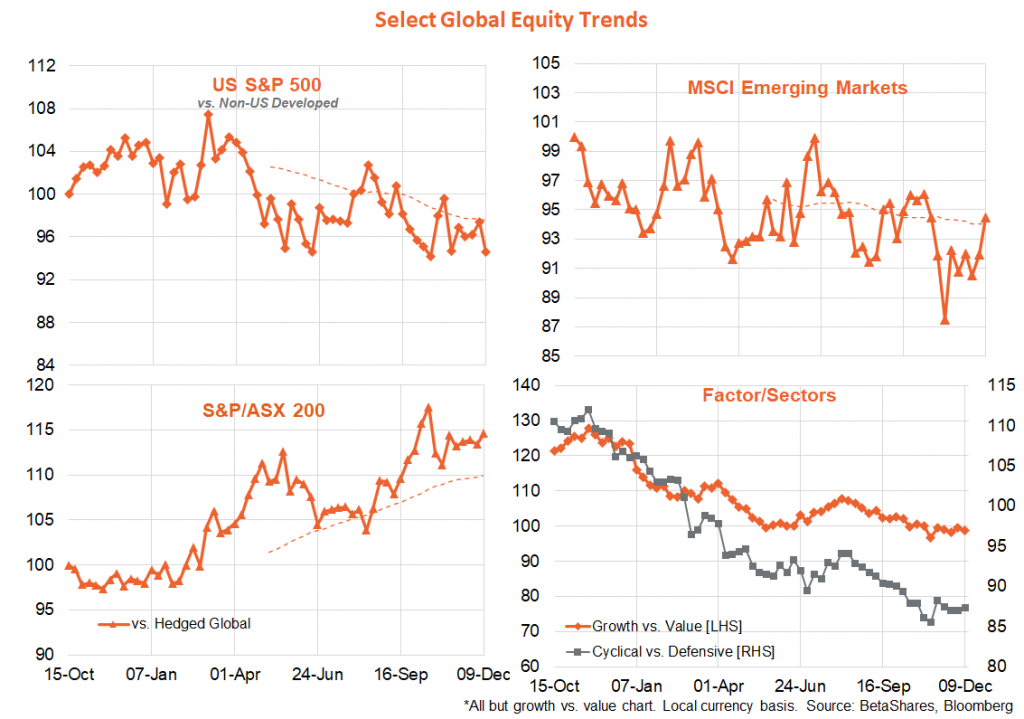

Global equities suffered a setback last week after a few weeks of hopeful gains. Technically, the US S&P 500 tried but failed to break through the downward sloping trend line from the high of earlier this year, along with the 200-day moving average. Fundamentally, the market rally of late came despite falling earnings and a rebound in price valuations to an uncomfortably high 18 times forward earnings.

There were two triggers for the market pullback last week: a stronger than expected US services sector report (back to the “good news is bad” story) and a higher than expected producer price index report. Neither of these is likely to dissuade the Fed from raising rates by 0.5% at this week’s policy meeting, and the market is increasingly nervous about just how far the Fed will need to ultimately raise rates to get the economy to slow.

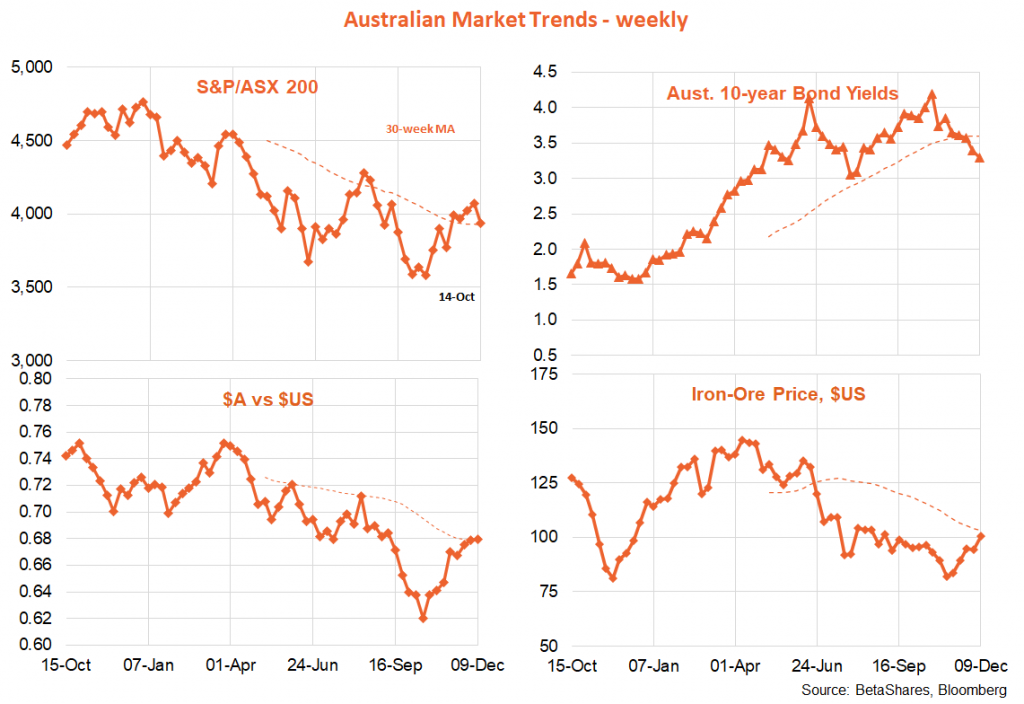

In other news, the Bank of Canada lifted rates a further 0.5% – taking its total lift in rates this year to a lazy 4.0%! Perhaps fearing weaker global demand ahead, oil prices dropped 10% last week to US$71 a barrel – down from a peak of US$120 earlier this year.

In Australia, the RBA duly went ahead and lifted rates 0.25% – despite some talk that it might surprise and keep rates steady. No such luck! What’s more, the RBA gave little hint that (at this stage at least) it is thinking about a pause in the new year. September quarter GDP, meanwhile, hinted at the slowdown in growth likely coming – with only a 0.6% gain in output, largely reflecting lingering strength in consumer spending. Most other parts of the economy were fairly subdued.

Week ahead

Two key US events will dominate market action this week: the consumer price index (CPI) report and the Fed meeting on Tuesday and Wednesday respectively (US time).

The monthly gain in the core CPI (which is what I focus on) is expected to hold steady at 0.3%, which would see the annual rate slow from 6.3% to 6.1%. Note the core CPI surprised on the downside last month, in part reflecting an unusually steep decline in medical care services. While we’ll likely see further declines in goods prices (such as used cars), medical care services could bounce back somewhat while service sector inflation more broadly – including rents – should also remain firm. Such is the market sensitivity to inflation, expect major market moves on even a modest upside or downside CPI miss – and I suspect asymmetric risk around the result in that the market might likely stage a relief rally if the result is no worse than market expectations. Indeed, the higher than expected producer price result last week likely already has the market bracing for a bad CPI outcome.

Also clearly important will be the Fed meeting, although the actual policy action – a stepped down rate rise of only 0.5% – should be no surprise. That said, the market is attaching a small 10% probability to yet another 0.75% rate hike, so there could similarly be a relief rally if the Fed only does what is expected. Of equal importance will be the Fed’s updated economic projections. Fed chair Powell has already hinted that the Fed’s ‘dot plot’ of expected future Fed funds rate levels will be revised higher – after all, the current end-2023 Fed funds rate median expectation among Fed members is 4.6% – implying only one further 0.25% rate hike after this week’s likely 0.5% hike. By contrast, the market currently expects another 0.5% hike in H1’23, with this being reversed in H2’23 – leaving the Fed funds rate at 4.3%.

As the Fed is not talking about rate cuts in 2023, its end-2023 dot plot expectation will therefore reflect the updated Fed consensus about the likely degree of further tightening next year. So the big question is this: will it lift its expected end-2023 Fed funds rate from 4.6% to only 4.9% (in line with market expectations of only 0.5% of further tightening next year), or to 5.2% or even 5.5%! I suspect it will lift the expected rate to 5.2% (implying 0.75% of further tightening next year), which could be a little uncomfortable for the market to digest.

Also critical from the Fed will be its expectations for inflation and unemployment. The Fed currently expects the unemployment rate to rise to 4.4% by the end of next year and core inflation to drop to 3.1%. My hunch is that it could keep its inflation expectations unchanged though potentially revise up the expected unemployment rate to 4.6% or more. All up the key takeaway from the meeting therefore would be the Fed thinking it needs to hike rates more and slow the economy more to keep on track with bringing inflation down.

In Australia, there’s a smattering of interesting data this week – including the Westpac and NAB surveys of consumer and business sentiment respectively. We already know consumer sentiment is weakening, so the interesting question this week is whether there’s been some flow though to still fairly resilient business confidence. Also out this week is the labour market report on Thursday, with a slowing in November employment growth to only 17k expected, though with the unemployment rate holding steady at 3.4%. RBA Governor Phil Lowe will have another chance to explain his thinking in a speech on Tuesday.

Have a great week

PS. Next week’s Bassanese Bites will be the last for the year. We’ll go out with a bang, reviewing the Fed policy meeting and US CPI outcome.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.