David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

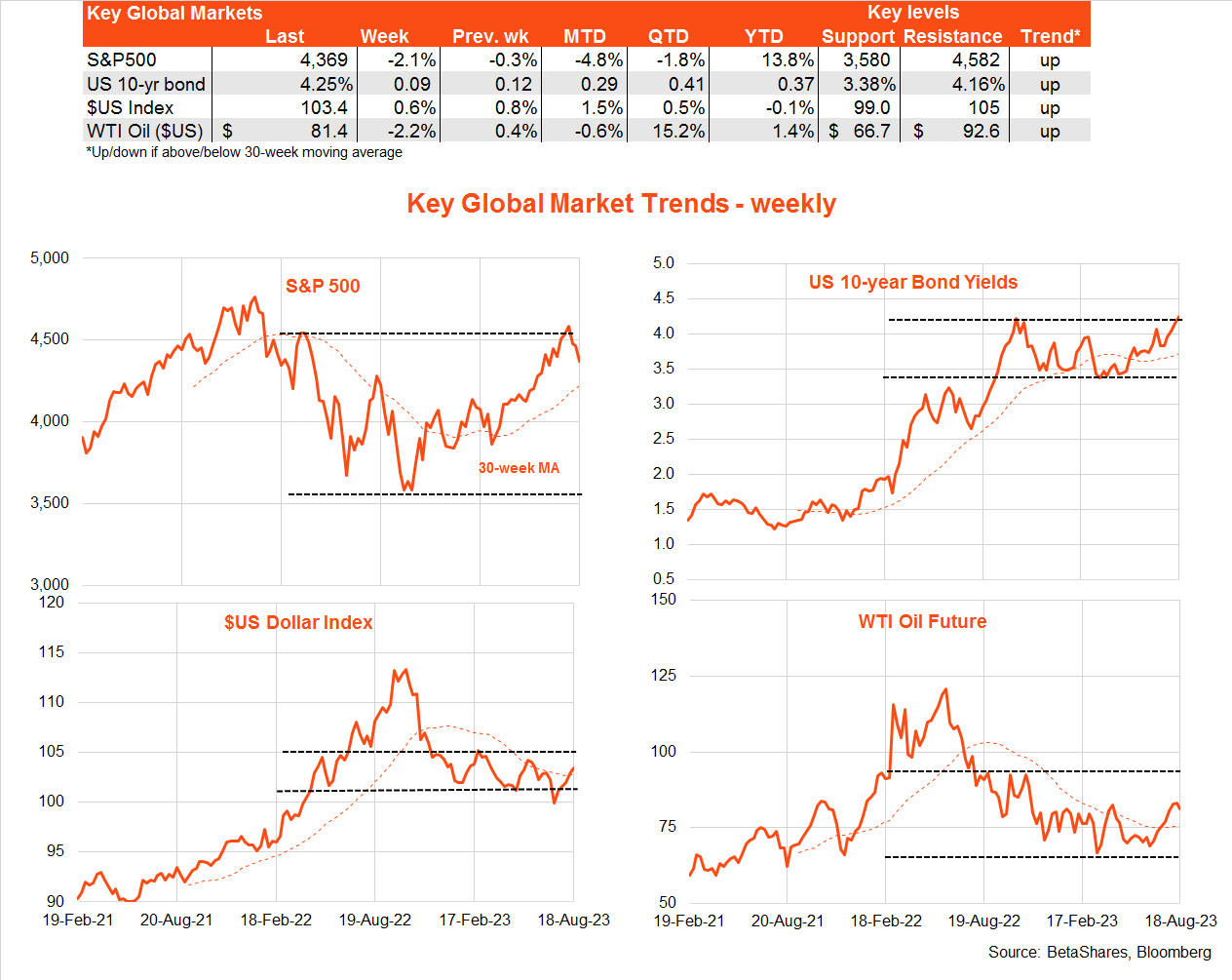

Global markets

US stocks weakened for the third week in a row under pressure from rising US bond yields and concerns over the Chinese economic outlook. Strong US retail sales in July along with the market’s hawkish interpretation of the minutes of the Fed July policy meeting saw US 10-year bond yields rise for the fifth week in row to 4.25%. US 10-year bond yields broke above the highs of 4.22% of mid-October last year.

Essentially, the US yield curve is undergoing a ‘bear steepening’ as, despite easing inflation, ongoing resilient economic growth is reducing the market’s confidence in rate cuts as early as H1’24. America’s large government debt issuance requirements – along with credit downgrades – are not helping.

Ironically, it’s the decline in inflation – which is boosting real household income – that is now helping support US economic growth. In turn, this paints a mixed picture for the Federal Reserve when deciding what to do with interest rates from here – should it worry about a rebound in growth caused by softening in inflation?

China also presents a mixed picture. While its low inflation rate bodes well for lower global inflation, its activity numbers – such as last week’s retail sales and industrial production – continue to disappoint. The piecemeal policy responses so far (small rate cuts) suggest the government is either comfortable with a more modest and less debt-dependent pace of economic growth, or it is still unsure what to do. Indeed, can and should policy makers try to reflate a massive bubble in home building even if economic growth depends on it?

Against this backdrop, there’s little in the way of major global economic data this week – with the key highlight being US Fed chair Powell’s Jackson Hole speech on Friday. I suspect the Fed is not yet overly concerned with the back up in bond yields – as it helps tighten financial conditions – so Powell is unlikely to offer the market much in the way of dovish support. While Powell may hint at the possibility that the Fed is done raising interest rates, he’s likely to retain a tightening bias and throw more cold water on the idea of rates cuts any time soon.

The other key global flashpoint remains China – will another major property developer get into financial difficulty and/or will policy makers provide more forceful macro stimulus?

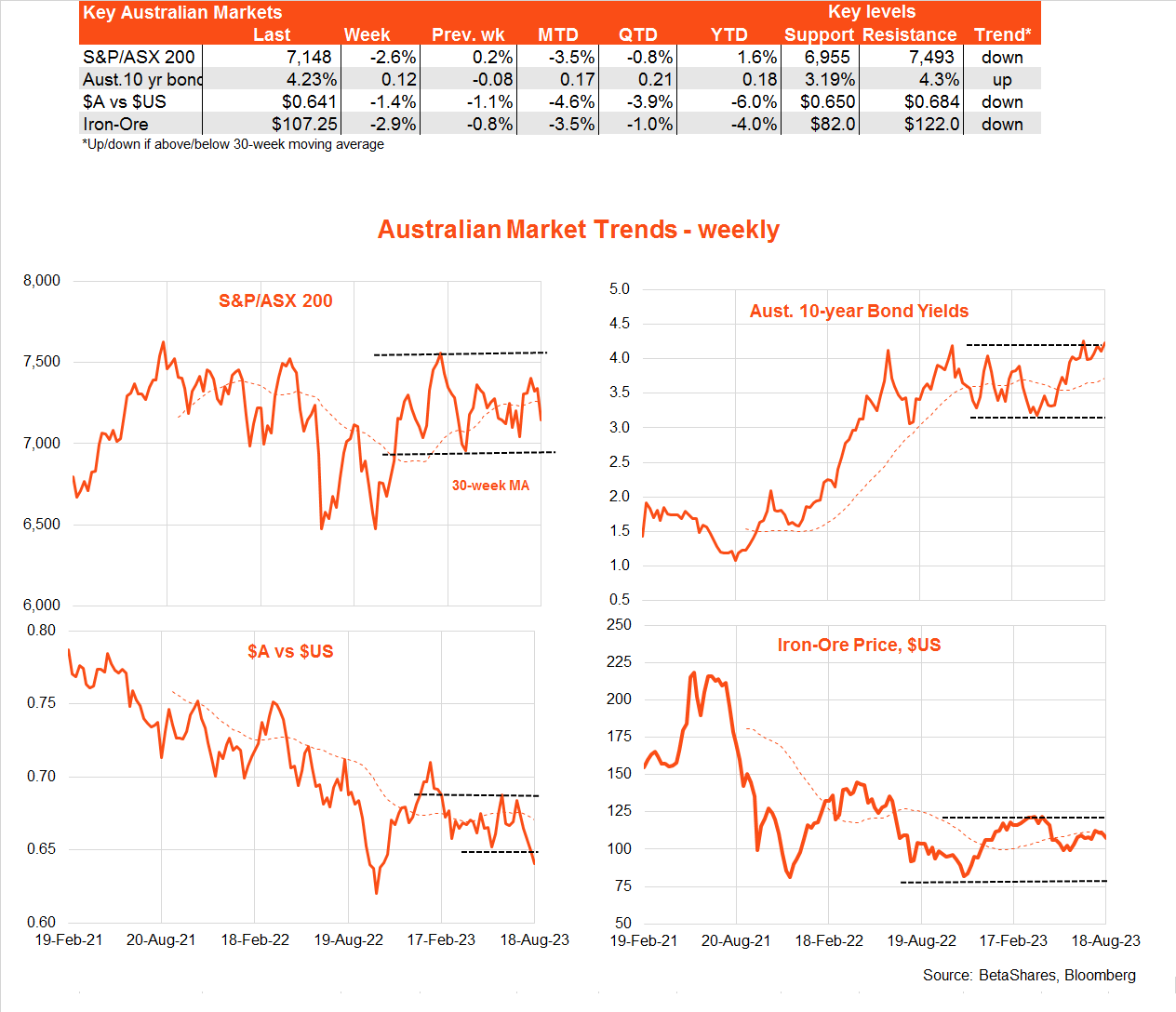

Australian market

The main market development locally of late as been the slump in the $A – down almost 5% in the month to date, ending last week just under US65c. While this in part reflects broad $US strength (due to relative US economic resilience) it also reflects contagion from global concerns over China. Perhaps of some surprise, despite all the current woe around China, iron-ore prices are still holding up reasonably well.

Also of interest, despite growing dovishness from the RBA, local long-term bond yields have been dragged higher in recent weeks by the rout in global bonds. On that basis, long-term Australian bonds appear to offer exceptional value.

Indeed, last week we received generally bond-supportive news with a softer than expected wage price index and a surprise drop in employment and jump in the unemployment rate from 3.5% to 3.7%. While seasonal adjustment quirks associated with school holidays may have distorted the July employment results, some softening appears on the cards eventually given declines in corporate hiring intentions.

There’s little in the way of major local data this week, with the focus therefore likely to remain on developments in China and the United States.

Have a great week!

| Top events of the past week | Comment |

| Strong US retail sales | US retail sales rose 0.7% in July compared to a market expectation of 0.4%. Softening inflation and firm wage growth is supporting real income growth. |

| Soft Chinese economic data | China’s monthly ‘data dump’ covering retail sales, industrial production and fixed-asset investment was generally weaker than expected in most areas. Despite this, China’s central bank cut certain interest rates by a modest 0.15%. |

| Weak Australian employment/soft wages | Employment fell in July, while the unemployment rate rose. Some caution is required in interpreting the results, however, due to potential seasonal adjustment quirks associated with school holidays. The June quarter wage price index was a touch softer than expected, suggesting annual growth in wage inflation may already have peaked at just under 4%. |

| Key events to watch this week | Comment |

| Powell’s Jackson Hole speech | Fed chair Powell will deliver a major speech on the policy outlook. Of interest will be whether he tries to push against or validate the recent move higher in long-term bond yields. |

| Chinese dominoes and/or policy response | Will further cracks appear in the Chinese property sector and/or will policy makers deliver more forceful policy stimulus? |

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.