Jing Jia

Portfolio Manager - Jing is responsible for managing fixed income and multi-asset solutions at Betashares. Prior to Betashares, Jing was part of Australian Unity and Altius Asset Management’s investments teams, where he was involved in the management of fixed income and money market portfolios, as well as strategic and asset allocation of funds across asset classes. Jing is a CFA® charter holder, a member of CFA society Sydney, and holds a Bachelor of Commerce degree (Majoring in Actuarial Science) from the University of Melbourne.

3 minutes reading time

- Cash and fixed income

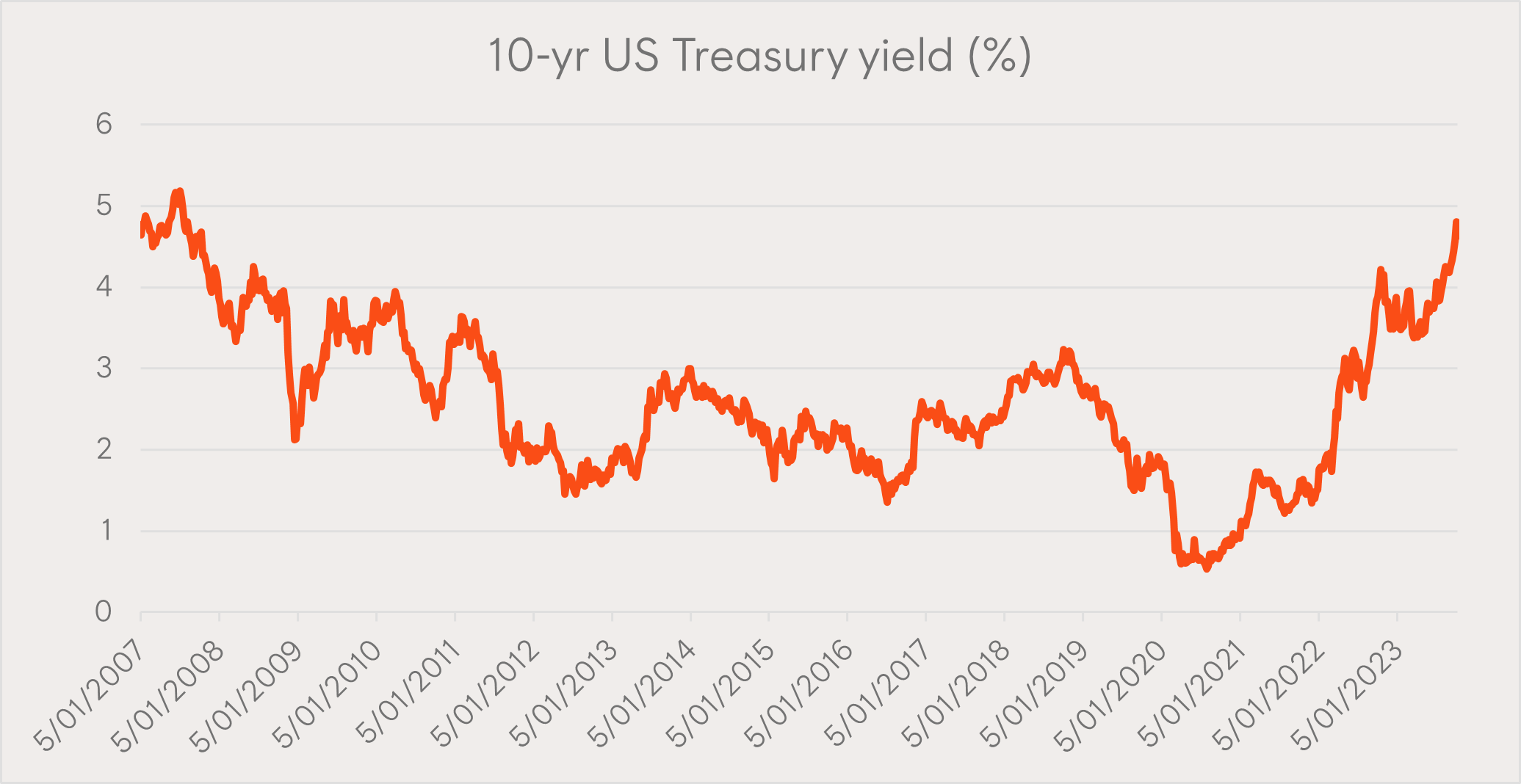

The biggest story in markets over the past couple of weeks has been the capitulation in bond yields. Following several data prints showing a still too hot US economy, the sharp repricing of a “higher for longer” rates regime has resulted in a bear steepening in US bond yields – with the Q3 move in the US 2s10s yield curve the 7th largest quarterly move over the past 40 years and the 3rd largest outside a US recession.

Importantly, this move has not been driven by worse inflation prospects but has instead been driven by increases in real yields, as markets raised pricing of an ongoing hawkish stance from the Fed and reflecting an assumption that the floor for US rates had moved higher. As a result, the US 10-year bond yield breached 4.80% last week, levels last seen in July 2007, before the GFC. While US 20 and 30-year bond yields have also reached 15+ year highs, echoing the same sentiment.

Figure 1: UST 10y Yield (2007-2023)

Source: Bloomberg. Past performance is not an indicator for future performance. You cannot invest directly in an index.

Introducing the US10 U.S. Treasury Bond 7-10 Year Currency Hedged ETF

Whilst there of course remain risks that yields could continue to push higher, if you are of the view that Treasuries are in oversold territory, this point could represent an opportunity to obtain exposure to duration – our suite of US Treasury ETFs contains a number of exposures to express this view.

Listed in late September, US10 is our most recent addition to this suite and provides AUD hedged exposure to US Treasuries with maturities between 7 and 10 years, commonly seen as the world’s benchmark interest rate.

Key details of US10:

- Securities held: Fixed rate U.S. Treasury bonds

- Index: Bloomberg U.S. Treasury: 7-10 Year Total Return Index Hedged AUD

- Maturity range: 7-10 years

- Modified duration: ~7.5yrs

For investors with a preference for longer duration and a higher appetite for volatility, GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged provides exposure to long-term Treasuries with maturities of 20 years or more. Both US10 and GGOV offer access to the longer end of the nominal US Treasury curve. While they can be seen as the same macro expression, they differ in the durations and magnitude of interest rate risk they provide.

Additional Information:

There are risks associated with an investment in US10 and GGOV, including interest rate risk, credit risk and international investment risk. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account an investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

Jing is responsible for managing fixed income and multi-asset solutions at Betashares. Jing is a CFA® charter holder, a member of CFA society Sydney, and holds a Bachelor of Commerce degree (Majoring in Actuarial Science) from the University of Melbourne.

Read more from Jing.