David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Global markets

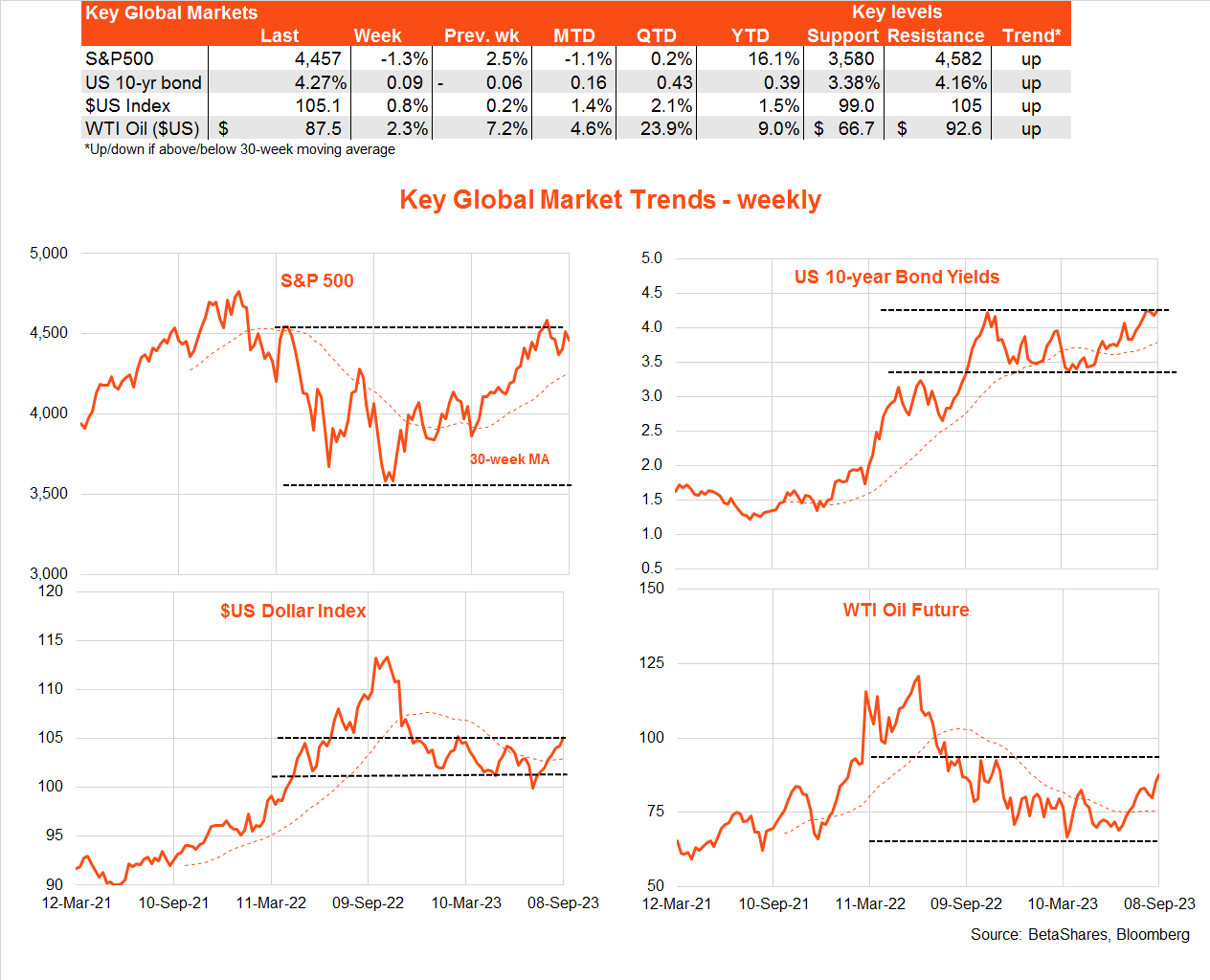

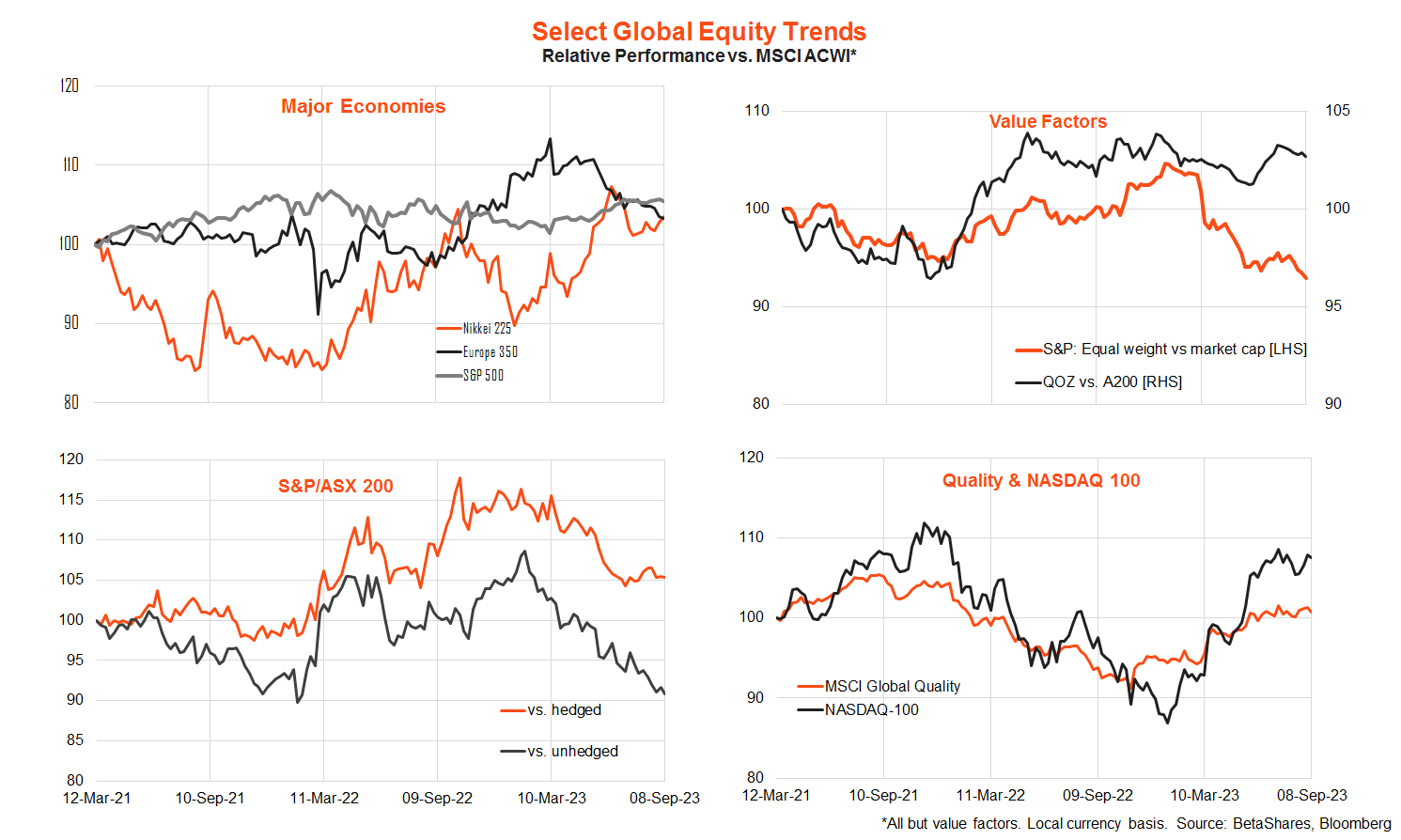

Global equities pulled back last week as bond yields edged higher, with markets reflecting concerns regarding overly strong US economic growth and the ongoing strength in oil prices.

The S&P 500 dropped 1.3% over the week, following a 2.5% rebound in the following week. On an end-week basis, the market remains around 3% below its recent 21 July peak, though has recovered 2% from its end-week low on August 11.

US 10-year bond yields rose 0.09% to 4.27% – at the top of their range since late last year. That said, markets attach a low risk on a Fed rate hike this month and see only a 50/50 chance of a rate hike at the next meeting in November.

Markets were unnerved last week with stronger than expected US ISM services sector survey, alongside Saudi Arabia’s decision to keep in place it’s one million barrel per day self-imposed oil production cut until the end of the year. Russia chimed in by extending its own smaller production cut! In short, hopes of a global “soft landing” are battling simmering concerns of “no landing” with a potential oil-led rebound in inflation.

Adding to the mix, China’s economic data continues to disappoint – with a softer than expected service sector survey last week.

Against this backdrop, markets will be focused on the US consumer price index (CPI) report on Wednesday (US time). Testing the market will be an anticipated lift in annual headline inflation from 3.2% to 3.6% due to higher oil prices. Although, it will be interesting to see the extent to which the market tries to take comfort from tamer core prices, with annual core CPI inflation expected to ease from 4.7% to 4.3%. Also testing the market will be retail sales and producer prices on Thursday.

Other key global news is a raft of likely further soft Chinese economic data on Friday (Australia time) with reports on retail spending, industrial production and fixed-asset investment.

Australian market

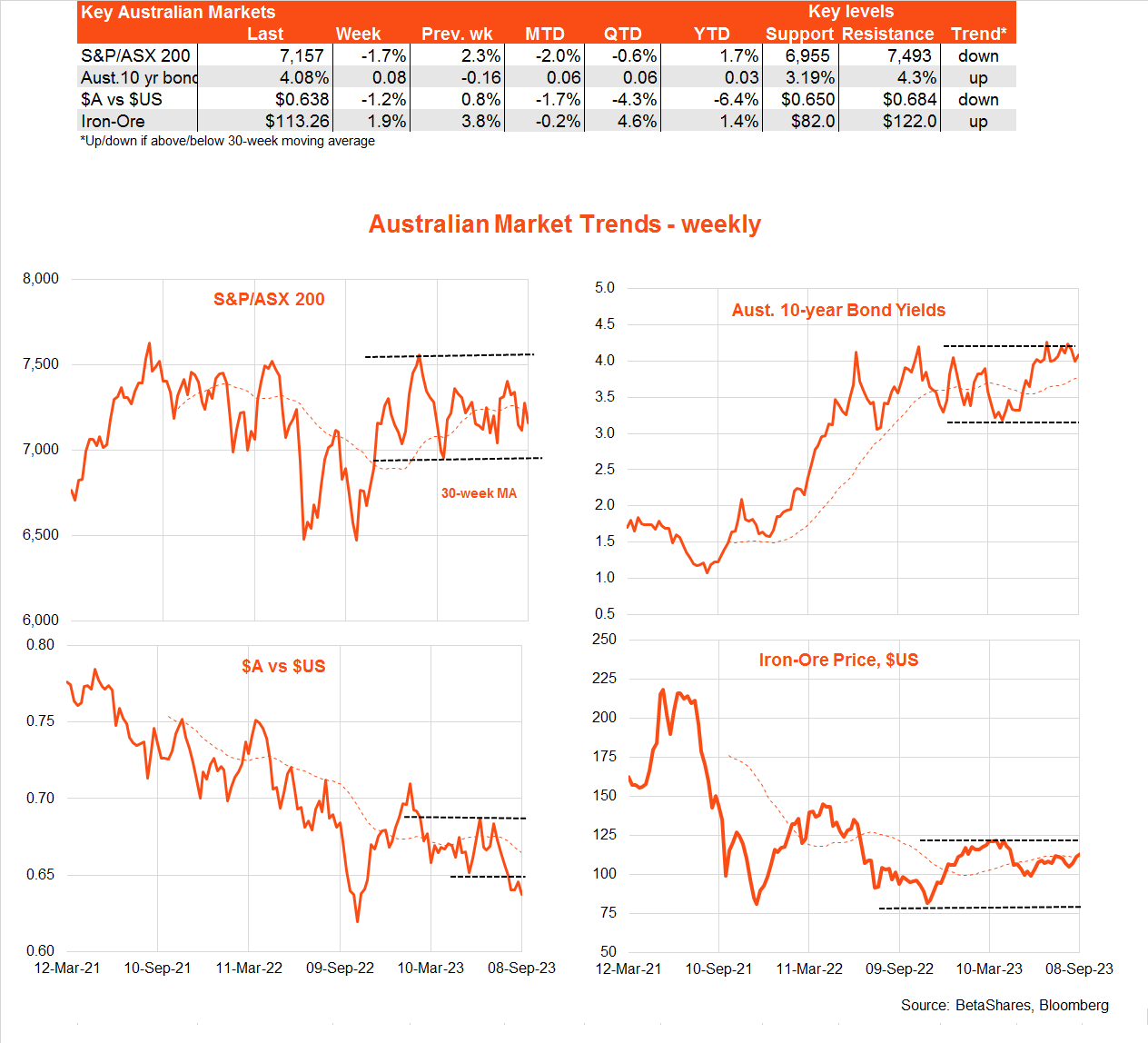

Key local highlights last week were the RBA’s widely expected decision to leave interest rates on hold and a modestly stronger than expected 0.4% gain Q2 GDP. Local stocks remain in a choppy sideways range, with bond yields at the top end of their range.

Of note lately has been the slump in the $A to below US65c, which reflects both strength in the US dollar globally and concerns over the Chinese economic outlook. Despite China woes, iron ore prices remain well supported at just over $US 100/tonne.

The RBA now appears in “wait and see” mode. It retains a soft near-term tightening bias, though it’s base case is likely that no further rate hikes will be needed. I think the RBA can now afford to sit pat and I’ve pencilled in the first rate cut for April next year.

The stronger than expected GDP result partly reflected firm business investment – likely due to a bring-forward of spending to take advantage of expiring tax incentives. Yet consumer spending and dwelling investment remained weak, and a slump in business profits does not bode well for business investment going forward.

We’ll learn more on the health of the economy with key Westpac and National Australia Bank respective consumer and business sentiment surveys tomorrow, followed by the August labour market report on Thursday. After a surprising 15k decline in employment in July (perhaps to to seasonal adjustment quirks around school holidays), jobs growth is expected to bounce back by 25k in August, with the unemployment rate easing back to 3.6% from 3.7%.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.