The video gaming industry of today bears little resemblance to the industry of years gone by, when teenagers saved their cash to buy a cartridge of their favourite game at Walmart.

There are now around 3 billion gamers globally, of whom a full 2.5 billion play on their mobile devices1, with this number forecast to rise as more people go online and smartphone penetration rises. Factors such as increases in digital distribution and cloud gaming are expected to improve the profitability of game developers and publishers, while gamers are increasingly using video games as social media platforms to engage with other users.

Investors can now consider the BetaShares Video Games and Esports ETF (ASX Code: GAME), which has been designed to provide exposure to the world’s leading companies in this fast-growing sector.

The rise of video gaming

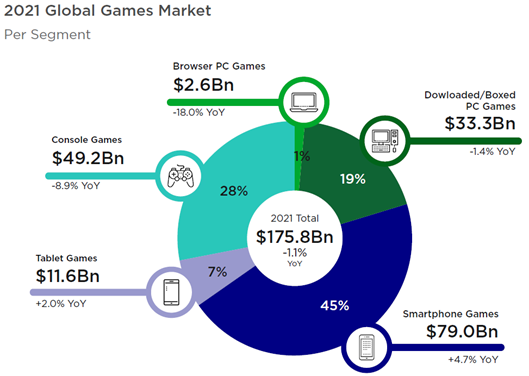

Global games market revenue is estimated at ~US$176 billion in 2021, and forecast to increase to ~$219 billion in 20242. For perspective, global video games now generate more revenue than the global movie business and North American sports combined3.

While the industry was on an already fast growth trajectory, revenues in the industry spiked 20% between 2019 and 2020 as the COVID-19 pandemic took hold, and the world’s population spent much more time at home – creating a new base level of industry sales.

The gaming market can be broadly segmented into:

- Mobile games (smartphones and tablets)

- Console games

- PC games

Mobile accounts for more than half the global market, and mobile revenue growth is forecast to continue to outperform console and PC over the next three years, driven by growth regions, continued innovations in mobile monetisation, and console and PC publishers bringing their IP to mobile devices.

Source: Newzoo, Global Games Market Report 2021

There are around 3 billion players globally, of whom 2.5 billion are mobile gamers4. The number of players is forecast to increase by more than 10% by 2024, driven by rising access to the internet, improvements in internet infrastructure, and increased smartphone penetration.

Source: Newzoo, Global Games Market Report 2021

While still in the early stages, there are also signs that games will increasingly be used as social platforms, and play a significant role in the development of the metaverse.

Digital distribution improves profit margins

Not only is revenue expected to grow, but profit margins are also forecast to increase – largely as a result of increased digital distribution.

Where 20 years ago the purchase of a video game typically took place at a retail outlet, today ~83% of total video game sales (PC and console) are digital5. As more sales shift to digital channels, publishers’ margin profiles are expected to improve as they avoid the need to manufacture, package, and ship physical product.

Innovations in mobile monetisation

Companies are becoming increasingly skilled at engaging gamers in free to play (F2P) games and then monetising the experience once gamers become attached to the game. Monetisation involves microtransactions (MTX), such as extra lives and skins, or payments for new downloadable content (DLC), such as maps or missions.

Given that only 38% of today’s mobile gamers spend money on video games6, there is plenty of potential to further monetise the mobile user base.

Esports

The global esports audience is forecast to reach 577 million in 2024, up from 474 million in 2021.

Industry revenues, generated via the sale of sponsorship, media rights, digital streaming, tickets and merchandising, and publisher fees are forecast to be more than $1.6 billion by 2024, representing a compound annual growth rate (CAGR) of 11.1% between 2019 and 20247.

Driving the rapid revenue growth of the industry is increased investment in esports marketing by brands drawn by the potential of reaching a large and engaged audience.

BetaShares Video Games and Esports ETF (ASX: GAME)

GAME’s index provides exposure to leading companies in three key sectors:

- Developers/publishers: companies that design and execute the creation of video games.

- Esports: companies that own, operate, or develop professional/competitive video game tournaments, leagues, teams, or viewing platforms.

- Hardware: companies or organisations that create video game platforms.

To be eligible for inclusion in the index, a company must derive at least 50% of its revenue from Video Gaming and/or Esports.

Top 10 Companies in GAME’s Index: 11 February 2022

| ACTIVISION BLIZZARD INC | 17.9% |

| ELECTRONIC ARTS INC | 14.5% |

| TENCENT HOLDINGS LTD | 14.0% |

| NINTENDO CO LTD | 13.4% |

| TAKE-TWO INTERACTIVE SOFTWARE | 7.6% |

| SEA LTD | 7.1% |

| NEXON CO LTD | 3.9% |

| BANDAI NAMCO HOLDINGS INC | 3.3% |

| NCSOFT CORP | 2.8% |

| CAPCOM CO LTD | 2.4% |

Source: Bloomberg. No assurance is given that these companies will remain in the index or will be profitable investments.

Summary

The rise of video gaming and esports looks likely to continue in the coming years, supported by an expanding and engaged user base.

The BetaShares Video Games and Esports ETF (GAME) aims to provide a cost-effective and convenient way to access a portfolio of some of the world’s leading video gaming and esports companies.

1. Newzoo, Global Games Market Report 2021

2. Ibid.

3. https://www.marketwatch.com/story/videogames-are-a-bigger-industry-than-sports-and-movies-combined-thanks-to-the-pandemic-11608654990

4. Newzoo, Global Games Market Report 2021

5. Newzoo

6. IronSource, Mobile Gaming Trends 2021, Oct 15, 2020.

7. Ibid.

Written by

Betashares ETFs