David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Global markets

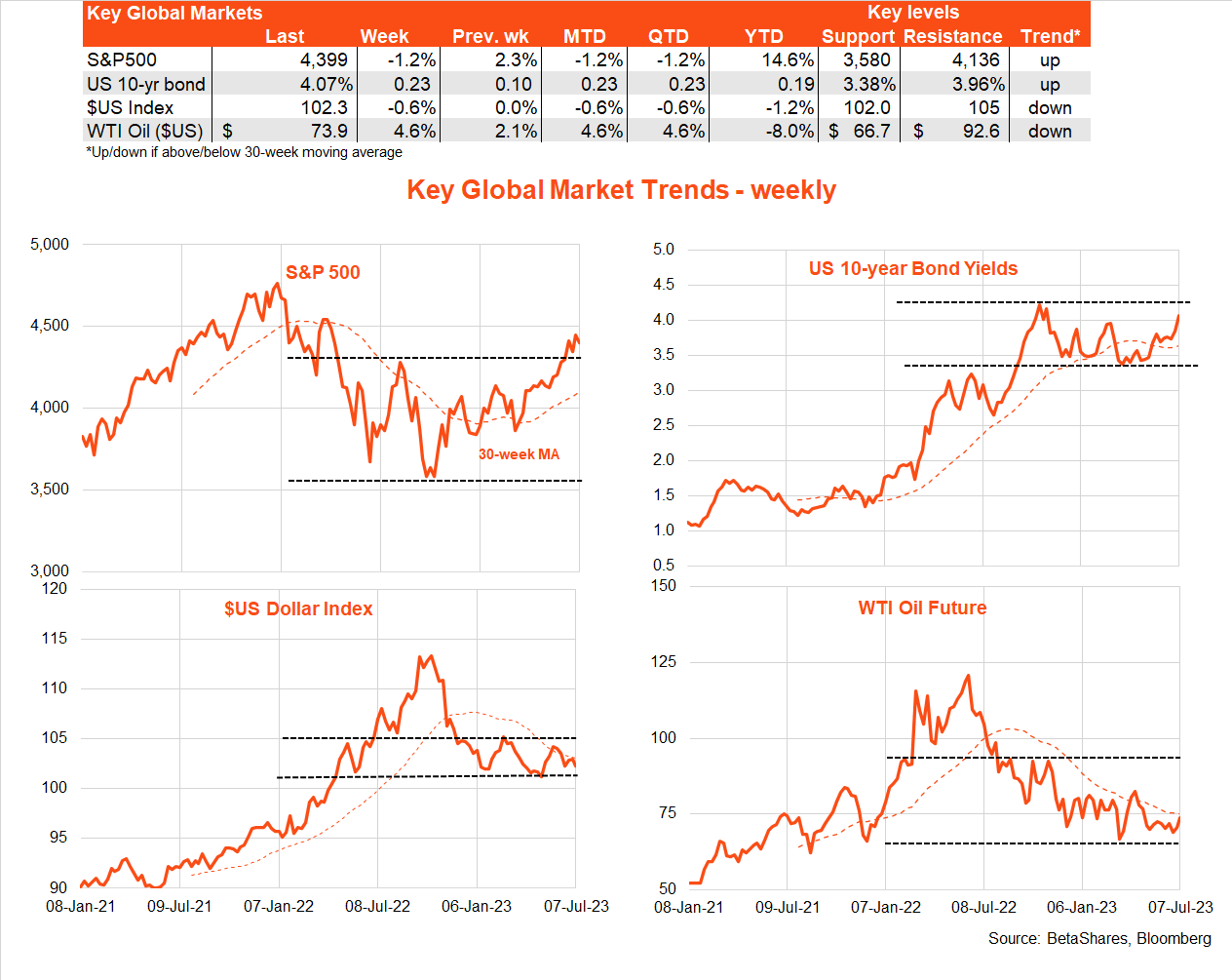

The key development over the past week was ongoing solid US economic reports, which along with hawkish Fed minutes saw bond yields move notably higher. US 10-year bond yields rose by 0.22% to 4.07% – a new high for the year though still a bit below the peak of 4.24% in late October 2022. Equity markets retreated under the weight of higher interest rates, though only modestly, with the S&P 500 down 1.1% over the week.

As I warned last week, it now seems “perhaps the greater near-term risk to markets is not that the US economy suddenly slips into recession, but that it remains too strong or reaccelerates – particularly the labour market.”

A key global focus this week will be the US CPI. While inflation is expected to continue to ease, core inflation is likely to remain stubbornly high and markets will be particularly sensitive to any upward surprise. The US earnings season also begins, though good earnings may not be as market supportive this time around given new concerns over an overly strong economy.

Soft landing hopes continue to favour growth/technology/quality exposures over value/commodity exposures – which, in turn, is not favouring the local Australian markets compared to global peers.

Australian market

Local bond yields also moved higher last week, reflecting US developments and the ‘hawkish pause’ by the RBA. Local stocks wilted, with the S&P/ASX 200 down 2.2%.

The RBA decided to hold off raising rates last week despite signs of resilience in consumer spending and house prices. The decision likely reflected the fact it had already raised rates in the past two months and felt a pause was warranted, especially given the more detailed quarterly CPI report was due in only a few weeks’ time. It still seems likely the RBA has at least one and possibly two more rate rises in mind.

Highlights this week will be the degree of further weakening in the NAB’s index of business conditions, along with a likely defiant speed (last hurrah?) by RBA Governor Lowe. The speech seems likely to defend the operation of the Bank Board in light of recent criticisms from the RBA Review. I would agree – as I have long maintained, once the political decision was made not to alter the RBA’s inflation target, the RBA Review essentially became a solution in search of a problem. I would much rather see a group of corporate types with real-world experience deliberating over monetary decisions than leaving those decisions to a new group of outspoken ivory tower economists.

Have a great week!

| Top events of the past week | Comment |

| RBA’s hawkish pause | The RBA decided to hold off raising interest rates after back-to-back moves in May and June. But it warned further rate rises may be needed. |

| Fed’s hawkish minutes | Minutes of the Fed’s June policy meeting, which left rates on hold, indicated that “almost all” members still anticipated the need to raise rates further in coming months. |

| Pesky US wage inflation/solid employment | Although the 209k rise in US June payrolls was a bit weaker than the market expected (especially after a much larger-than-expected private ADP employment report), average hourly earnings growth of 0.4% was a bit more than expected, keeping annual wage growth steady at 4.4%. A drop in weekly jobless claims confirmed the ongoing strength in the US labour market. |

| Key events to watch this week | Comment |

| US CPI | The June CPI is likely to show a further easing in annual rates of headline and core inflation, though the latter (expected at 5.0% from 5.3% in May) is likely to remain uncomfortably high. |

| US Q2 earnings season | The Q2 US earnings reporting season kicks off on Friday with key banking reports from the likes of JP Morgan and Citibank. Earnings are likely to hold up okay this season given the ongoing resilience of the economy – though there is a risk of negative earnings guidance for coming quarters. |

| NAB Business Survey | Although NAB’s index of business conditions has eased in recent months, it has so far remained above long-run average levels with capacity utilisation high. A further easing in conditions seems likely, though the RBA’s July pause could limit the decline. |

| RBA Governor Lowe’s Speech | In what may be a defiant speech, the Governor is set to talk on “The Reserve Bank Review and Monetary Policy”. He may seek to defend the Bank from some of the criticisms outlined in the Review, such as Board members acting as “rubber stamps”. |

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.