The SVB crisis becomes the poster child of the anti-ESG movement

On 10 March 2023, Silicon Valley Bank (SVB), a prominent lender to the startup ecosystem, collapsed. It had over US$200 billion in assets, making it the 16th largest bank in the US by assets, and its collapse marked the biggest bank failure since the global financial crisis in 2008. The failure of SVB has been used by some conservative politicians and news outlets in the US to drive home their anti-ESG messaging. Multiple political commentators who were already targeting ESG investment approaches have blamed the bank’s collapse on ‘woke’ practices.

How the SVB collapse unfolded

The forty-year-old bank had US$40 billion in deposits in 2018. By the end of 2021, the deposit base had surged to US$189 billion, driven by a massive increase in startup IPO activity.

With rising stock prices and low interest rates, SVB found it hard to initiate new loans and instead chose to invest these deposits in a combination of loans and ‘safe’ interest bearing government bonds. However, when the Federal Reserve raised interest rates in 2022, SVB’s bond investments declined in value. Rate hikes caused the startup funding environment to dry up, leading to startups drawing down their deposits in SVB. This, coupled with the decline in bond values, led to a shortfall in liquidity which saw SVB sell part of its bond portfolio at a loss. This sparked a panic with depositors, who rushed to withdraw their money from SVB, leading to a bank run which ultimately resulted in the Federal Deposit Insurance Corporation stepping in to protect deposits.

Get woke, go broke…

Anti-ESG crusaders certainly did not waste the SVB crisis. The collapse of SVB became a target for those groups, along with some conservative politicians and news outlets chipping in to do their bit in the campaign against incorporating ESG factors into investment processes.

The New York Post, owned by News Corp., published an article suggesting that employees were too busy pursuing ‘woke’ practices while the bank collapsed1. The Wall Street Journal, also owned by News Corp., published an editorial suggesting that the company’s Board composition may have meant it was “distracted by diversity demands”2.

Anti-ESG advocate and Florida Governor Ron DeSantis was quoted as saying SVB was “so concerned with DEI (diversity, equity, and inclusion) and politics and all kinds of stuff. I think that really diverted them from their core mission”3. Donald Trump Jr’s tweet on the topic read: “SVB is what happens when you push a leftist/woke ideology and have that take precedent over common sense business practices.”

Source: The New York Post, The Wall Street Journal and Twitter

…but the SVB collapse had nothing to do with being ‘woke’…

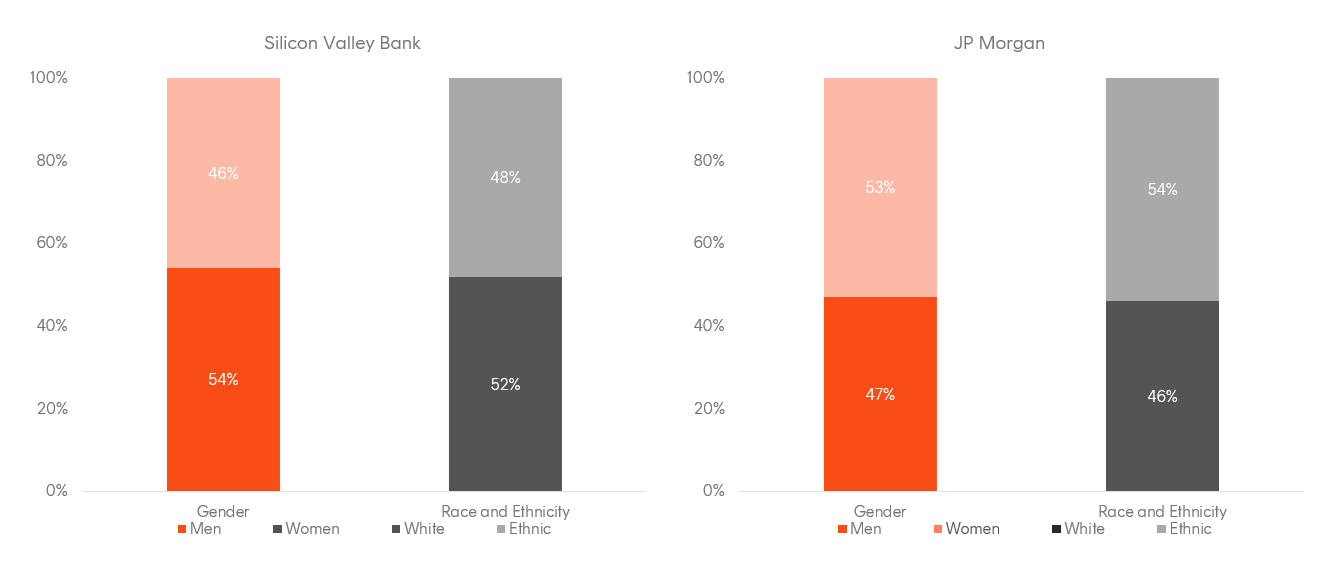

SVB highlighted its DEI initiatives prominently online with the percentage breakdown of the race and gender makeup of its workforce, senior leadership, and Board. But so have JP Morgan and several other banks and large multinational businesses across the globe. In fact, based on publicly available data, JP Morgan had a more diverse workforce than SVB did in 2021.

Diversity metrics

Source: 2021 DEI disclosures for SVB and JP Morgan

The anti-ESG camp called out SVB for its excessive investments in community-related projects as contributing to its collapse. SVB had committed to invest more than US$16 billion in low and moderate-income communities and climate-friendly businesses4. In a similar vein, JP Morgan made a commitment to invest US$30 billion to help close the racial wealth gap and advance economic inclusion among ethnic minority communities5.

More broadly, there is little evidence to suggest that companies that are getting ‘woke’ are going broke, despite the best efforts of the anti-ESG brigade. In fact, there is support for the view that exactly the opposite is occurring and many companies adopting ‘woke’ practices are thriving. For instance, Deloitte research found that “inclusive” and “managed” talent companies had a 2.3 times higher cashflow per employee over a three-year period relative to companies that did not have a diverse employee base6.

So why did SVB collapse?

…and everything to do with poor governance and negligent risk management

In SVB’s 2022 proxy statement, the company said, as part of an effort to enhance its internal governance structure, it was planning to discontinue and sunset its Finance Committee in April 2023 . As per the filing, one of the key responsibilities of SVB’s Finance Committee was financial and balance sheet strategies. The statement did not clarify or indicate whether this key oversight responsibility would be managed by another committee, raising a question mark over whether relevant financial risks were being adequately considered at Board level.

Furthermore, SVB did not have a Chief Risk Officer (CRO) for eight months in 20228, and even though not having one does not imply risk management was ignored, it may have hinted at a lax attitude towards risk management among SVB executives. Another issue may have been the lack of experience on the risk committee – SVB’s risk committee consisted of a former healthcare senior executive, a former Treasury undersecretary, venture capital partners, consulting firm executives and a Napa Valley vineyard owner9.

There was a broader governance failure as well, with the CEO and CFO selling millions of dollars’ worth of stock in the run up to the collapse10. There are reports suggesting the CEO received a call from ratings agency Moody’s to give him a heads-up about SVB’s bonds being in danger of being downgraded to junk status, the timeline of which aligns with the stock sales, leading to concerns of insider trading11.

SVB, along with other mid-sized banks, lobbied to relax the provisions of the Dodd-Frank Act that would have required SVB to undertake mandatory stress testing. The original provision subjected banks with more than US$50 billion in assets to stress testing and increased scrutiny from the Federal Reserve, but this threshold was raised to US$250 billion as a result of the lobbying, effectively allowing SVB to fly under the radar12.

The anti-ESG movement is gathering steam

Organisations including the State Financial Officers Foundation (SFOF) and the American Legislative Exchange Council (ALEC) are leading the anti-ESG charge in the US by opposing the use of ESG factors in the investment process for fund managers. The anti-ESG lobbying groups are working with Republican-governed states to introduce bills which restrict government pension funds from allocating monies to fund managers deploying ESG factors in the investment process. Legislation banning ESG investing approaches is growing in popularity in the US. There have been about 160 anti-ESG bills introduced in the first three months of 2023, mostly from Republican-ruled states, where ‘anti-woke’ culture is common13.

SVB collapse – What’s woke got to do with it?

For a bank, adopting ‘woke’ culture within business practices is generally associated with catering to new communities and customer segments which previously have been ignored largely due to their ethnicity and gender.

As opposed to what the anti-ESG brigade would have us believe, this is far from a charitable venture and offers opportunities for new areas of growth. SVB’s focus on DEI initiatives and DEI-focused lending programs was in line with what other large banks are doing in the US.

SVB collapsed because it ignored basic banking principles and had poor governance and risk management practices. We expect the anti-ESG movement will continue to use scapegoats like SVB to push their agenda, though there is little empirical evidence that being ‘woke’ causes companies to go broke. Poor governance and negligent risk management, on the other hand, is a fine recipe for disaster.

Betashares Capital Ltd (ABN 78 139 566 868 AFS Licence 341181) is the issuer of the Betashares funds. Read the Target Market Determination and PDS at www. betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances. The value of the units may go down as well as up. The Fund should only be considered as a component of a diversified portfolio.

1. https://nypost.com/2023/03/11/silicon-valley-bank-pushed-woke-programs-ahead-of-collapse/

2. https://www.wsj.com/articles/who-killed-silicon-valley-bank-interest-rates-treasury-federal-reserve-ipo-loan-long-term-bond-capital-securities-startup-jpmorgan-bear-stearns-lehman-brothers-b9ca2347?mod=e2tw

3. https://www.businessinsider.com/republicans-blame-woke-politics-for-silicon-valley-banks-collapse-2023-3

4. https://finance.yahoo.com/news/silicon-valley-bank-gets-spin-153000424.html

5. https://www.jpmorganchase.com/impact/racialequity

6. https://joshbersin.com/2015/12/why-diversity-and-inclusion-will-be-a-top-priority-for-2016/

7. https://ir.svb.com/financials/annual-reports-and-proxies/default.aspx

8. https://fortune.com/2023/03/10/silicon-valley-bank-chief-risk-officer/

9. https://www.dailysignal.com/2023/03/13/silicon-valley-bank-collapse-shows-banks-need-risk-management-not-environmental-and-social-justice-policies/

10. https://abcnews.go.com/Business/svb-execs-sold-millions-company-stock-lead-collapse/story

11. https://www.nytimes.com/2023/03/14/business/silicon-valley-bank-gregory-becker.html

12. https://www.protechtgroup.com/en-au/blog/svb-collapse-risk-managers-step-up

13. https://www.exposedbycmd.org/2023/03/24/alec-to-sfof-pipeline-unearthed/

Written by

Vinnay Cchoda