David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

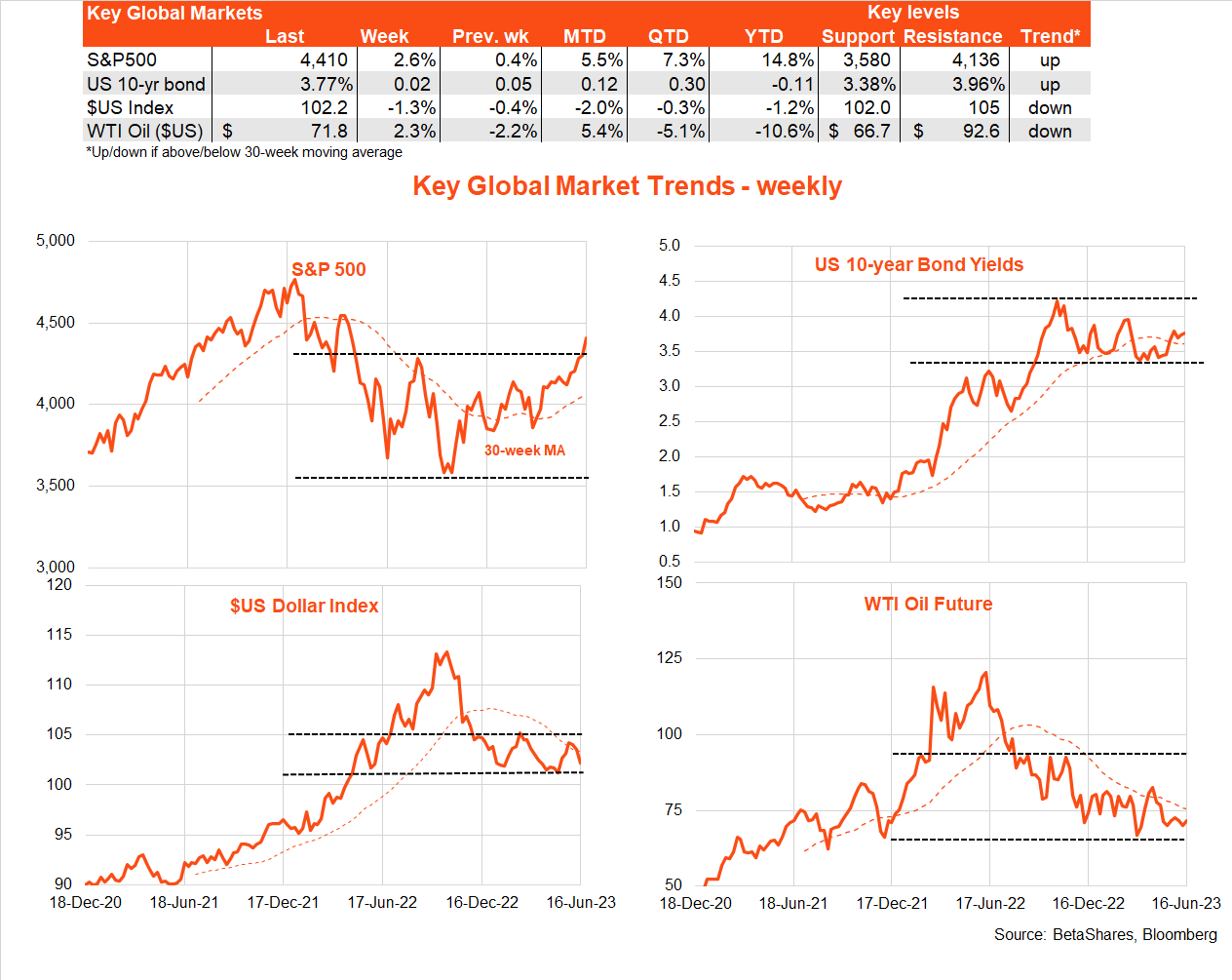

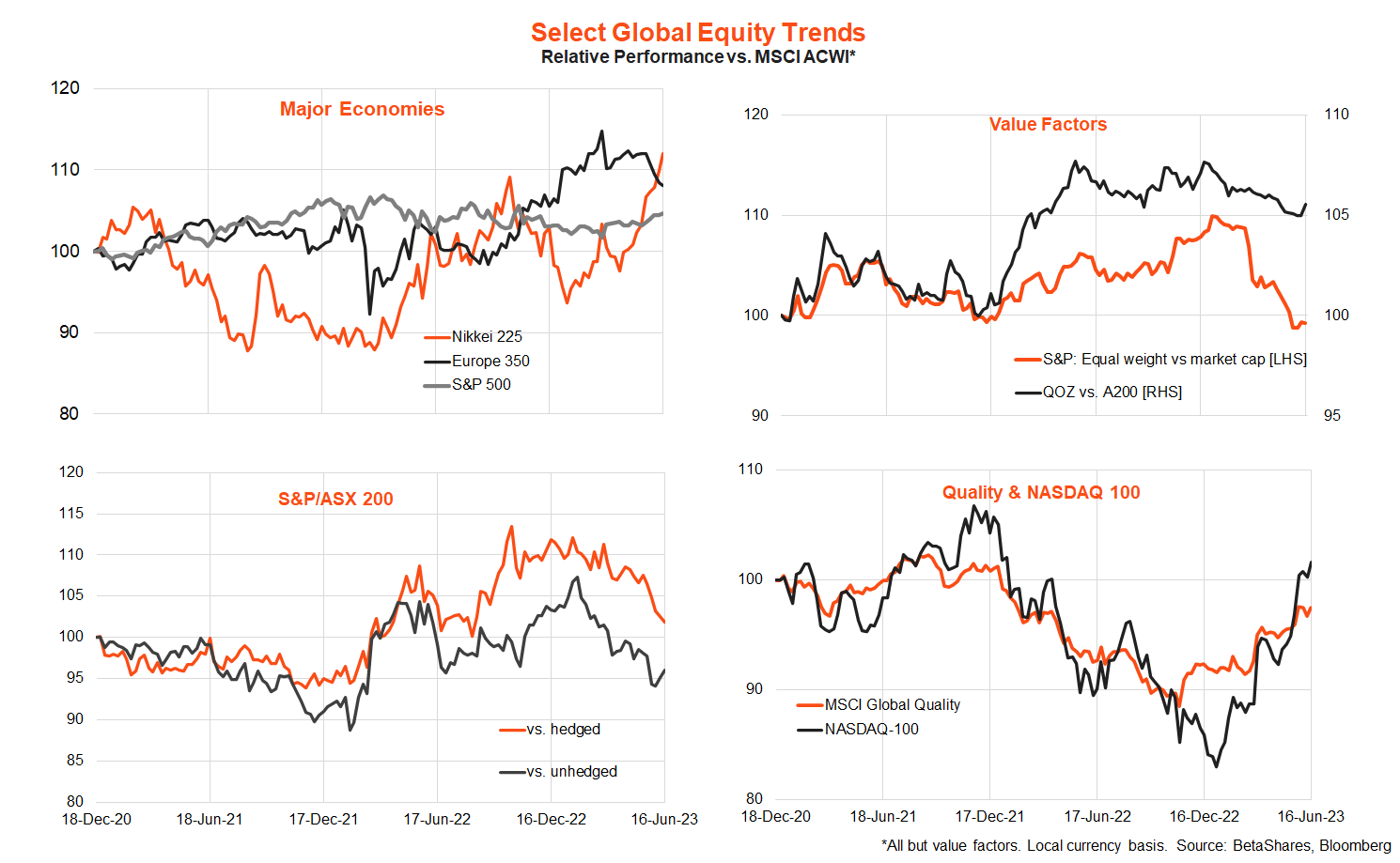

Global markets

It was another encouraging week in global markets, with investors taking the ‘hawkish pause’ by the US Fed well in their stride.

Although the Fed did pause as widely expected, it surprised by pencilling in another two rate hikes by year-end within its updated ‘dot plot’ projections. Although this initially spooked markets, Fed chair Powell (perhaps unintentionally) then calmed things down by noting that whether the Fed hikes again or not really depends on the data. And at this stage markets are still counting on a soft landing, with US inflation falling sufficiently quickly to allow the Fed to pivot and avoid a hard landing.

Of course, whether inflation falls sufficiently quickly remains to be seen. Last week’s US May CPI report was broadly in line with expectations – headline inflation was very weak, thanks to falling energy prices, though core inflation remained sticky with another 0.4% monthly gain.

An easing in core inflation should be assisted by the lagged flow through weaker rents, though the main question mark remains around core services excluding housing – which in turn is dependent on wages. Wages growth is also slowing, though remains fairly firm.

In other key global news, the European Central Bank (ECB) hiked rates another 0.25% and remains hawkish, while China modestly cut interest rates in the face of a subdued economic recovery. New Zealand, meanwhile, officially entered a technical recession with a second successive quarter of negative GDP growth.

There is little major global economic data this week, with the main focus likely to be on follow-up thoughts from Powell in two appearances before Congress. Markets may get excited if Powell talks up his new base case expectation that the US could get inflation down without a recession.

Also of note will be US weekly jobless claims (given they have lifted again in recent weeks), and updates on US manufacturing and service sector activity on Friday (US time).

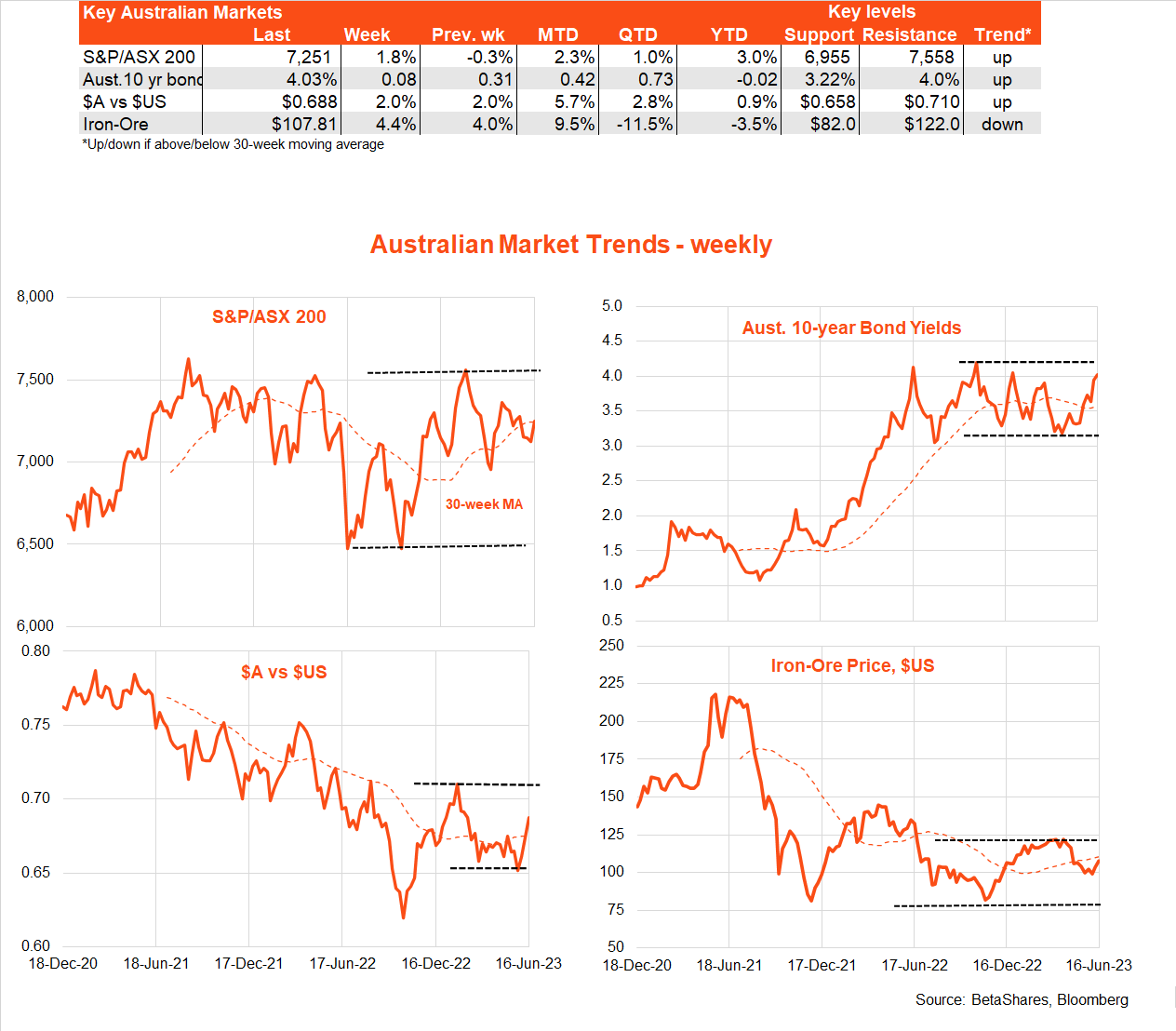

Australian markets

Local economic data was mixed last week, with soggy readings on business and consumer sentiment, yet a blockbuster 79k bounce back in employment in May after a surprise 4k decline in April. The unemployment rate also eased back to 3.6% from 3.7%.

All up, the recent volatility in employment growth appears to reflect seasonal adjustment distortions around Easter – but taking the average 40k employment gain over the past two months, it’s still hard to avoid the conclusion that the labour market remains red hot. Overall activity is also being boosted by the ramp-up in immigration. Along with ongoing evidence that housing demand is already bouncing back, it now seems increasingly likely the RBA will hike rates at least once or twice more in coming months.

In terms of the week ahead, the focus will be on the strength of the tightening bias revealed in tomorrow’s minutes of the RBA’s June policy meeting. Also tomorrow, RBA Deputy Governor Michele Bullock will give a speech that may shed more light on the RBA’s thinking with regards to another rate hike next month.

My base case view is that resilient economic growth and stubborn core wage/price inflation will likely see both the Fed and RBA hike rates twice more this year, which will increase the risk of a harder landing later this year or early 2024.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.