David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

- Global

Global markets – week in review

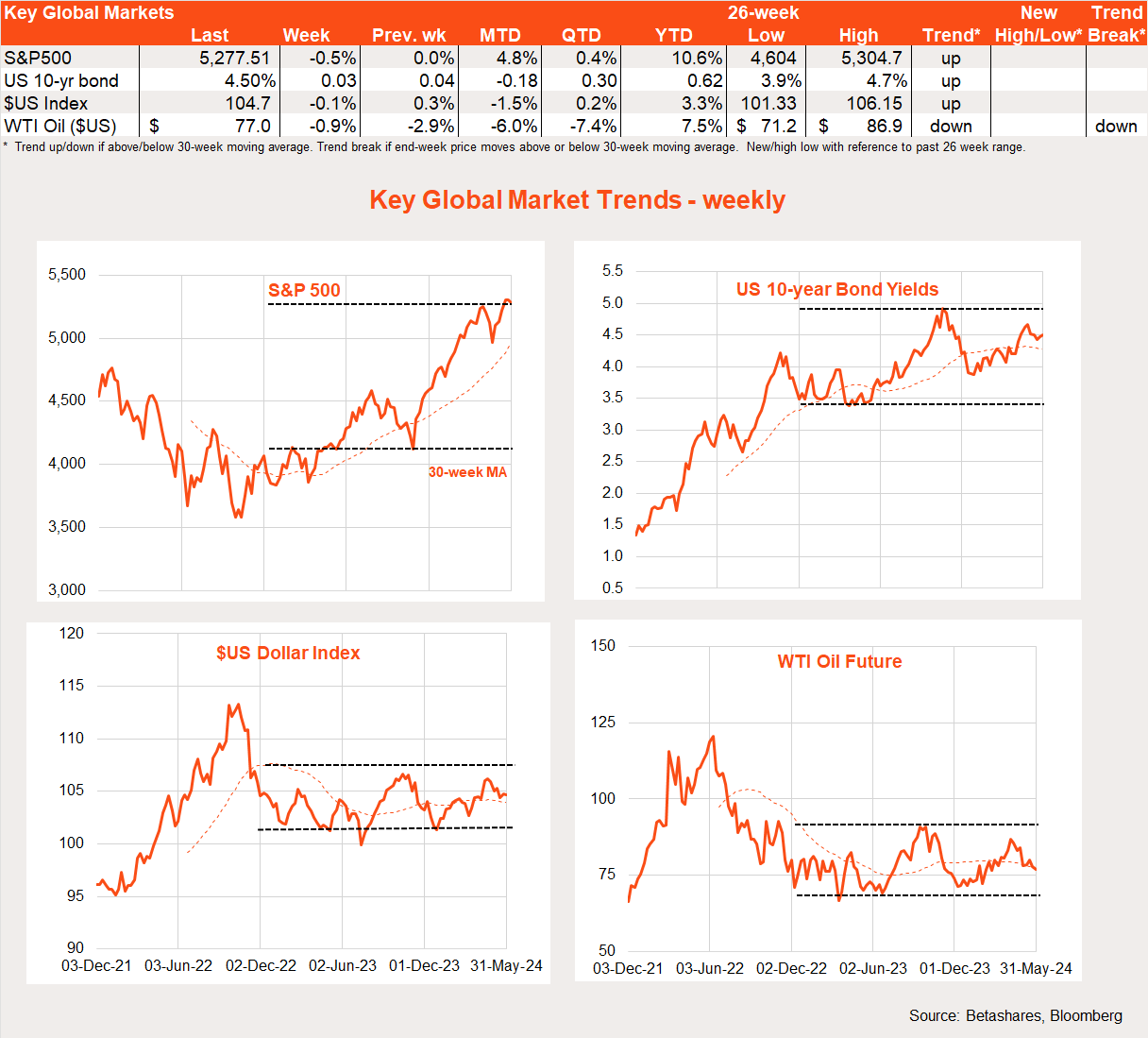

Global stocks eased back for the 2nd week in a row, with a series of poorly received US bond auctions helping to push up bond yields and push down equity values.

Probably the main highlight last week was several US bond auctions which were met with tepid demand and placed upward pressure on global bond yields. Along with sticky inflation and geopolitical upheaval, concerns over the still-huge US budget deficit is a third – but so far less considered – risk to the global market outlook.

No one quite knows when and if America will face its “Truss moment”*, whereby markets start to demand a higher bond yield risk-premium due to mounting bond supply.

What we do know is if and when that day arrives, it would likely also cause ructions on Wall Street, with higher yields threatening economic growth and hence corporate earnings, but also currently elevated equity valuations. The Fed might try to stem the disruption by buying bonds (or engaging in some form of yield curve control), but this might only cause more market disquiet.

Also weighing on the US market last week was a surprise revenue downgrade by tech-darling Salesforce, which saw its share market value shed by a lazy 20%. It momentarily also knocked valuations among some of the Magnificent 7.

A few Fed speakers also chimed in, continuing to suggest a low risk of another US rate hike – though with the first possible rate cut not until later this year.

The week ahead

The major global highlight this week will be Friday’s May US payrolls report, with another solid 185k employment gain expected. The unemployment rate is expected to hold steady at 3.9%. Private average hourly earnings are expected to rise 0.3% in the month – which would keep annual growth steady at a still firm 3.9%.

Such a result would be consistent with a still solid outlook for the US economy and “higher for longer” interest rate outlook.

That said, two central banks this week are widely expected to cut rates – the Bank of Canada and European Central Bank – due to somewhat better progress in lowering inflation and relatively softer economic growth than in the US. That said, Friday’s EU inflation report was a touch stronger than expected, suggesting the ECB this week may push back against expectations for deeper cuts later this year.

One last point of interest will be the OPEC meeting, with the expectation being of an extension of production cuts to help hold oil prices up in the face of slowing demand.

Global equity trends

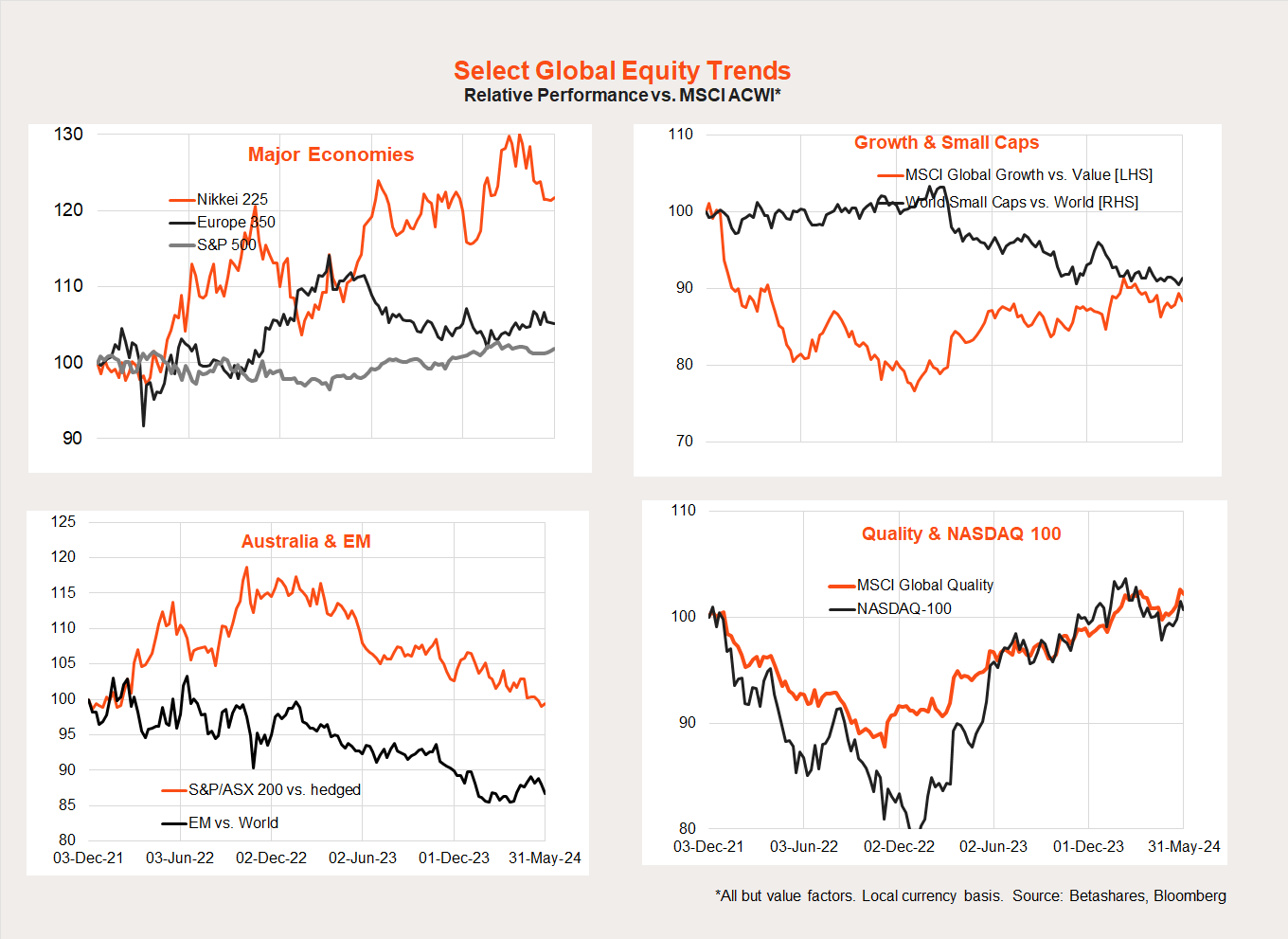

Looking at global equity trends, the equity rebound over recent weeks has favoured a bounce back in the relative performance of Nasdaq 100/global quality exposures. There are also growing signs of a broader rebound in global growth over value.

At the same time, the China-led rebound in emerging market relative performance has stalled a little. Japan is enduring a relative performance correction after recent strong gains while Australia and global small caps continue to underperform.

Australian markets

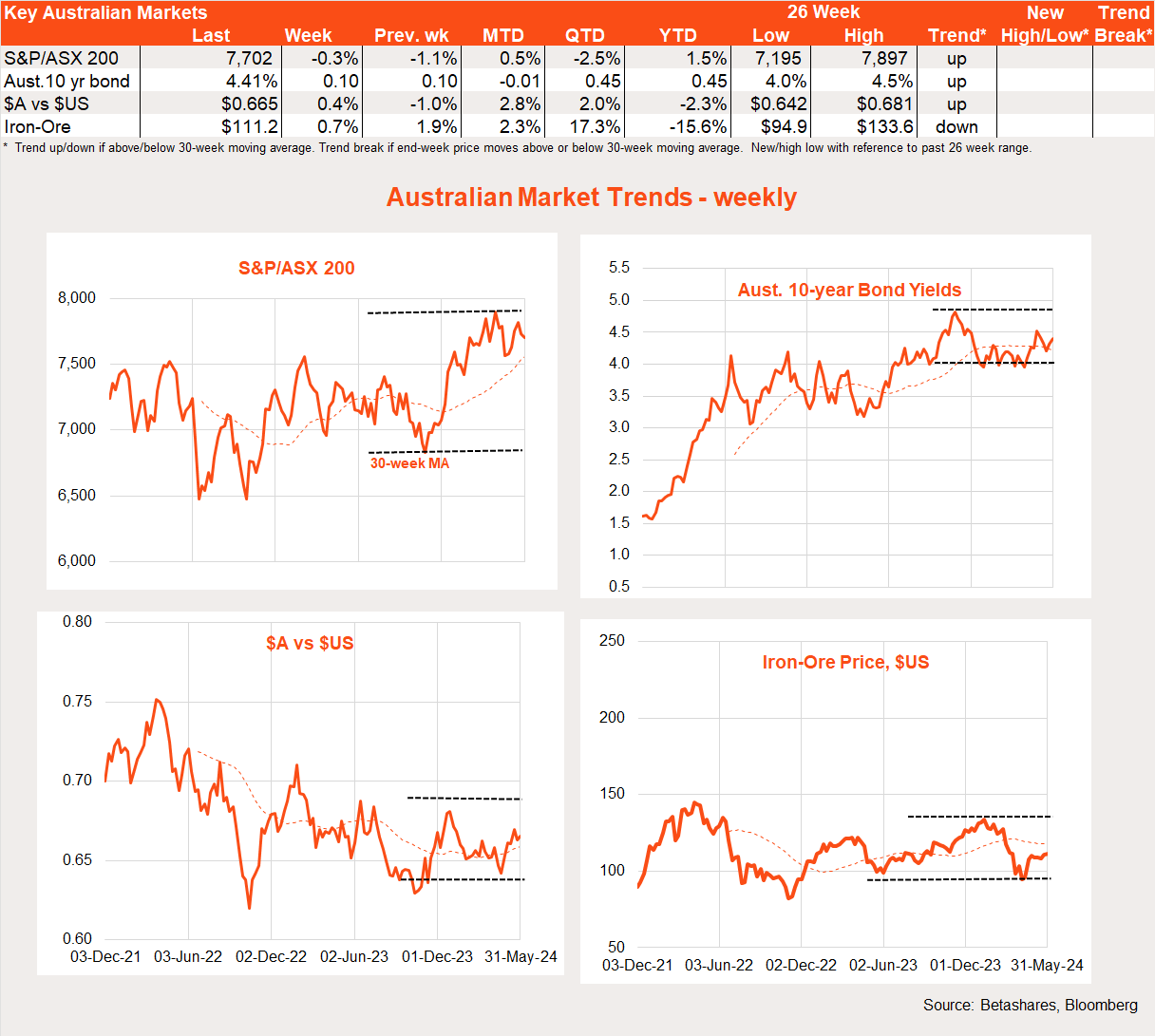

The S&P/ASX 200 slipped back a further 0.3% last week, not helped by a slightly higher-than-expected monthly CPI inflation report. Adding to the challenging environment, there was also a swag of tepid activity indicators last week, suggesting the economy remains in a soft patch – as will likely be confirmed by this week’s Q1 GDP report.

It’s still not clear whether the advent of monthly CPI reports are helping rather than hurting assessments of the economy. Most of the data added each month is patchy and volatile, and as I feared when the move to monthly CPI reports was first suggested, I suspect it is providing at least as much noise as signal each month.

All that said, at 3.6%, annual growth in the April CPI report was a touch higher than the 3.4% market expectation, which appeared to reflect surprising strength in clothing prices and an earlier than expected inclusion of the latest round of health insurance premium increases.

In other news, April retail spending was soft – limping ahead by only 0.1% – while Q1 construction spending was also weaker than expected due to a surprise (likely temporary) drop in public infrastructure spending. Weak April building approvals and weak Q1 residential construction confirmed that home building remains in the doldrums – despite clear excess demand!

The only real bright spot in otherwise bleak economic data last week was the ongoing strength in business investment, with Q1 capital spending up and surveyed investment intentions suggesting still reasonably solid business investment of just under 10% next financial year (from around 10% this financial year).

Despite it being the first week of the month, there is no RBA meeting this week – under the new timetable the next meeting takes place on June 17-18. Instead, the highlight this week will be Wednesday’s likely soft Q1 GDP report. Dragged down by consumer spending – and despite strong immigration – the report is likely to show the economy barely holding its head above water, with a only tepid growth of 0.2% expected. Expectations will firm up following business profits, inventory and trade data over the next two days.

The mix of weak economic activity yet still firm inflation will likely keep the RBA sidelined for a good while longer.

Have a great week!

*The “Truss moment” refers to the time in late-2022 when, as the then UK Prime Minister, Elizabeth Truss pushed ahead with a fiscal stimulus plan in the face of high inflation. The market reaction was to significantly push up UK bond yields and the resulting market disruptions soon led the Government to backtrack on stimulus plans and force Truss to resign as PM.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

2 comments on this

when I go back and re read all your advice, and see where we are today, I can see just how wrong your analysis has been. I love all the new flashy words that our financial so-called experts are using today in an attempt to soften the high cost of living and convince the mum’s and dad’s that inflation is still stubbornly high, and our economy is in bad shape. Gotta love you economists.

An interesting and informative explanation of the “Truss Moment” – good stuff (as always).