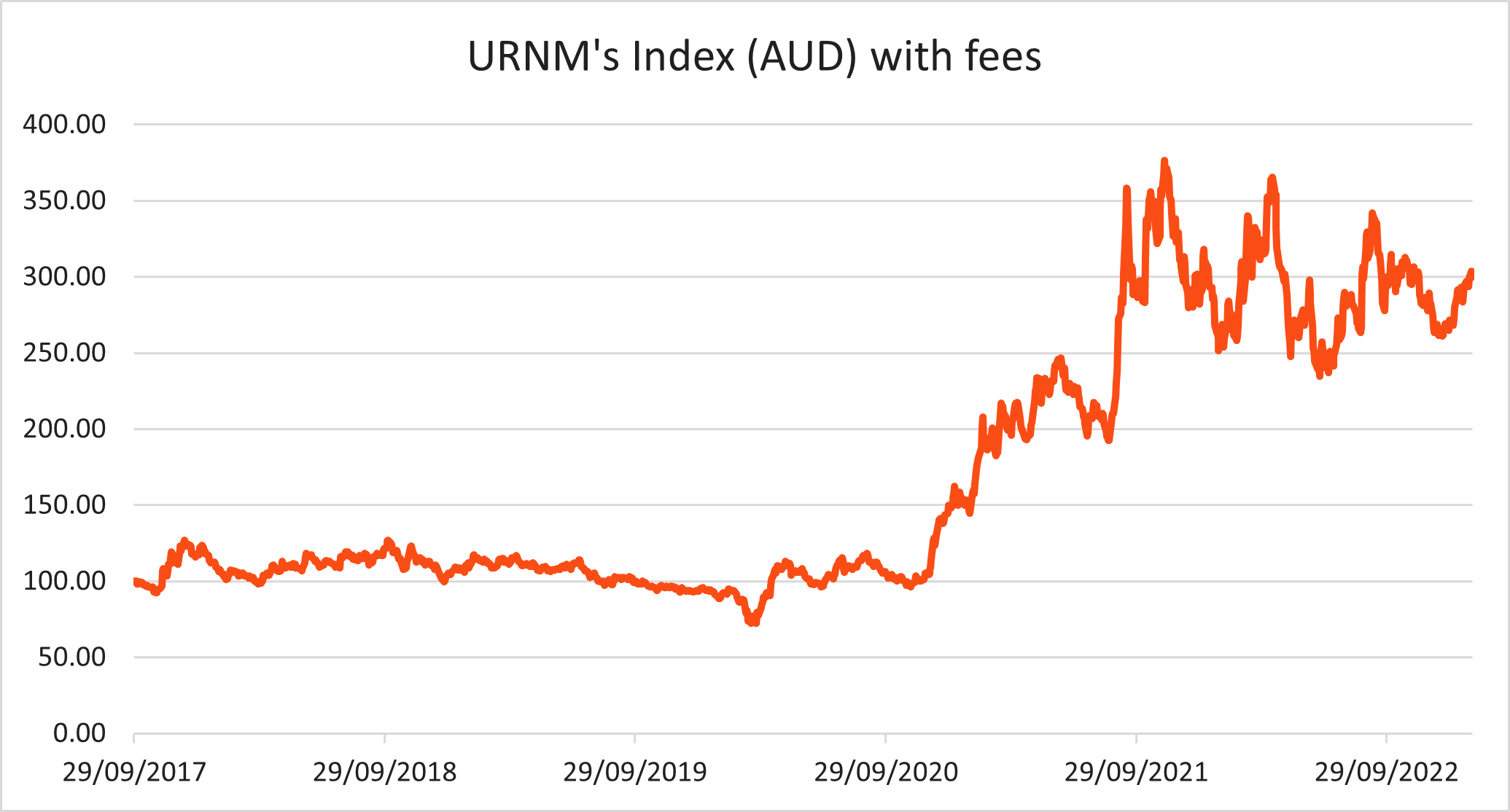

2022 was a quiet year for uranium equities, which registered falls of 5.99%1 in a year that was marked by volatility across almost all asset classes. That didn’t stop the price of uranium oxide (U3O8) from marking its third consecutive year of gains though, up 11.9% in 2022, and 96.2% over the last three calendar years2.

Source: Bloomberg, Betashares. As at 31 January 2023. Past performance is not indicative of future performance of any index or ETF. Graph shows performance of the index that Betashares Global Uranium ETF (ASX: URNM) seeks to track, net of management fees and costs (0.69% p.a.), and not the performance of URNM. You cannot invest directly in an index.

In the first few months of the year, we’ve seen these trends continue, with U3O8 posting modest gains. Uranium equities also saw some gains in the first two months of 2023, before selling off over March (so far), as broad equity market volatility picked up. While U3O8 is now at levels that is allowing some lower cost projects to begin restarting their mines3, they remain well below levels that some industry figures believe are needed to incentivise sufficient production to meet demand4.

It looks like 2023 is shaping up to be an interesting year in uranium markets.

Recent news

Since our last update in August, there have been several major developments for uranium markets.

Japan has continued its about-face on nuclear energy, introducing a new policy that aims to maximise the use of its existing fleet, both by restarting as many reactors as possible, and by extending the lives of ageing reactors.

South Korea’s ‘10th Basic Plan for Long-Term Electricity Supply and Demand’ calls for nuclear to account for nearly 35% of electricity generation by 2036, up from 23.4% in 20185.

The Swedish Government is aiming to introduce a new law that would remove restrictions on the number of nuclear reactors. The Prime Minister said in a press conference that there was an “obvious need for more electricity production in Sweden”, and that they should be able to “build more reactors in more places”6.

The Indian Government has provided “in principle” approval for five locations to build new nuclear power plants. India already has 22 operating reactors, with 11 currently under construction7.

Last year, the US Department of Energy National Nuclear Security Administration announced that it would create a 1 million pound (385 tonne) federal strategic uranium reserve. More recently, contracts have begun being awarded for the reserve, with enCore Energy, Ur Energy, Uranium Energy Corp, Energy Fuels, and Peninsula Energy all having been contracted so far8.

Trends to watch

Uranium ‘overfeeding’

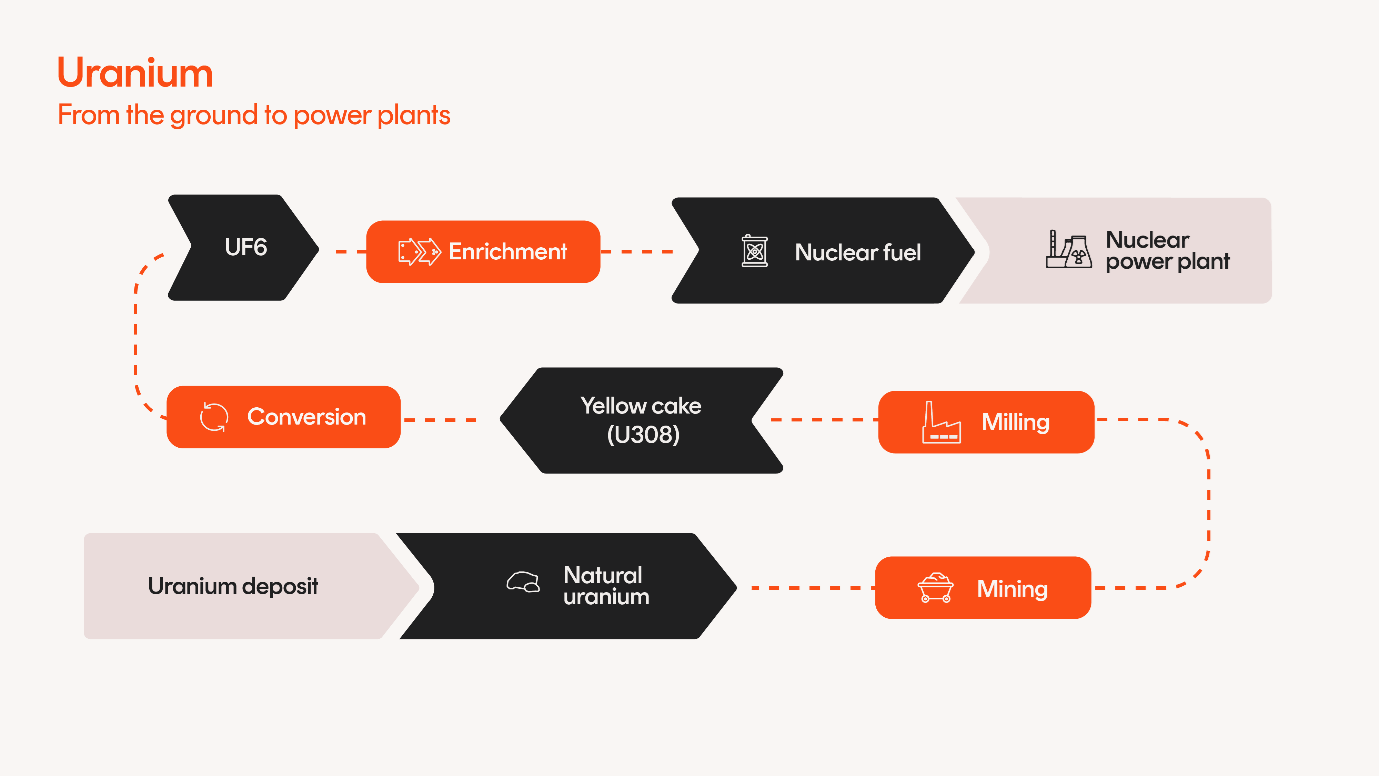

Uranium enrichment is a key part of the fuel cycle.

Initially, ‘yellow cake’ – the output from uranium mills, usually located at the project site – is converted from uranium oxide (U3O8) into uranium hexafluoride (UF6). Enrichment is the process that turns this UF6 into a product that can be used in a nuclear power plant.

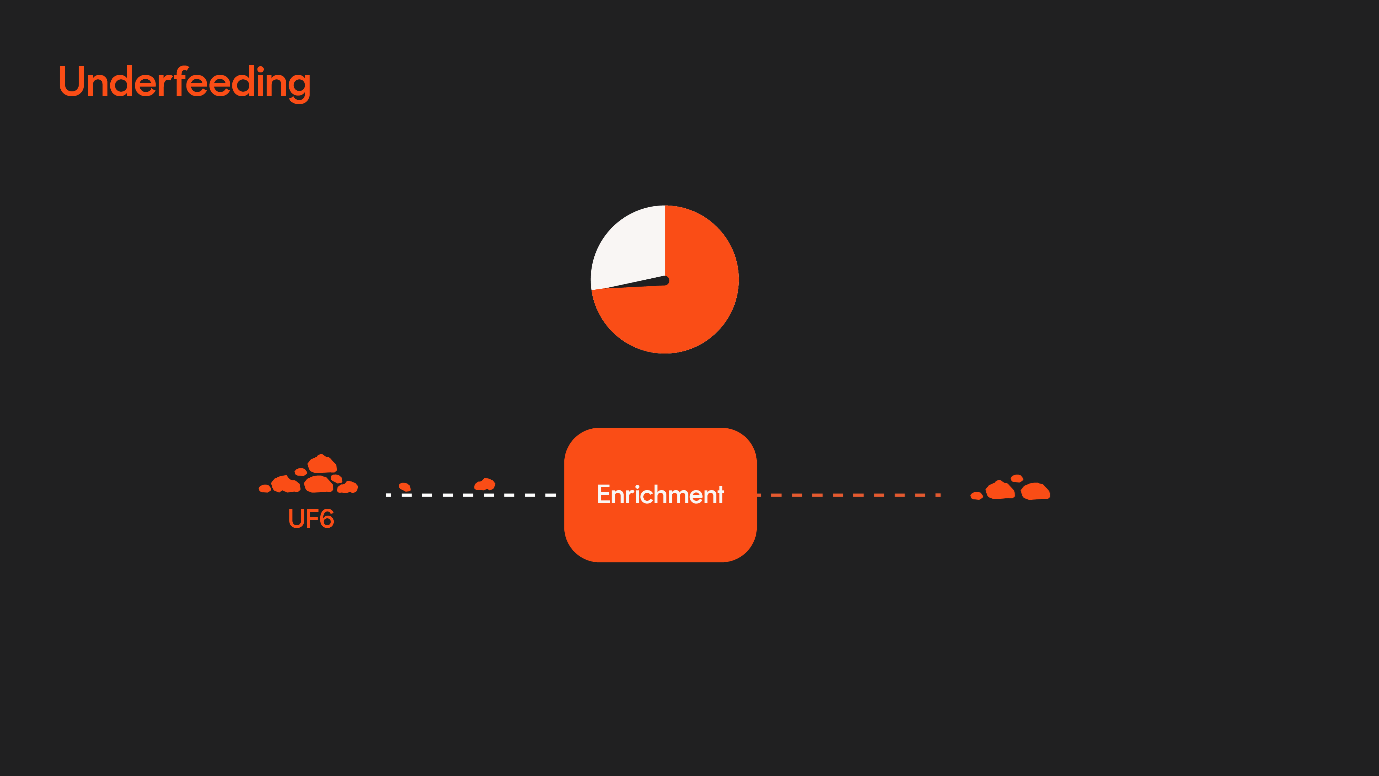

In years past, there has been a trend of ‘underfeeding’, due to an excess of enrichment capacity. Essentially, a smaller amount of UF6 is ‘fed’ into the enrichment centrifuges, which are then operated for a longer period, resulting in the same output for a smaller input. This has been an important factor in keeping uranium prices low prior to the last three years9.

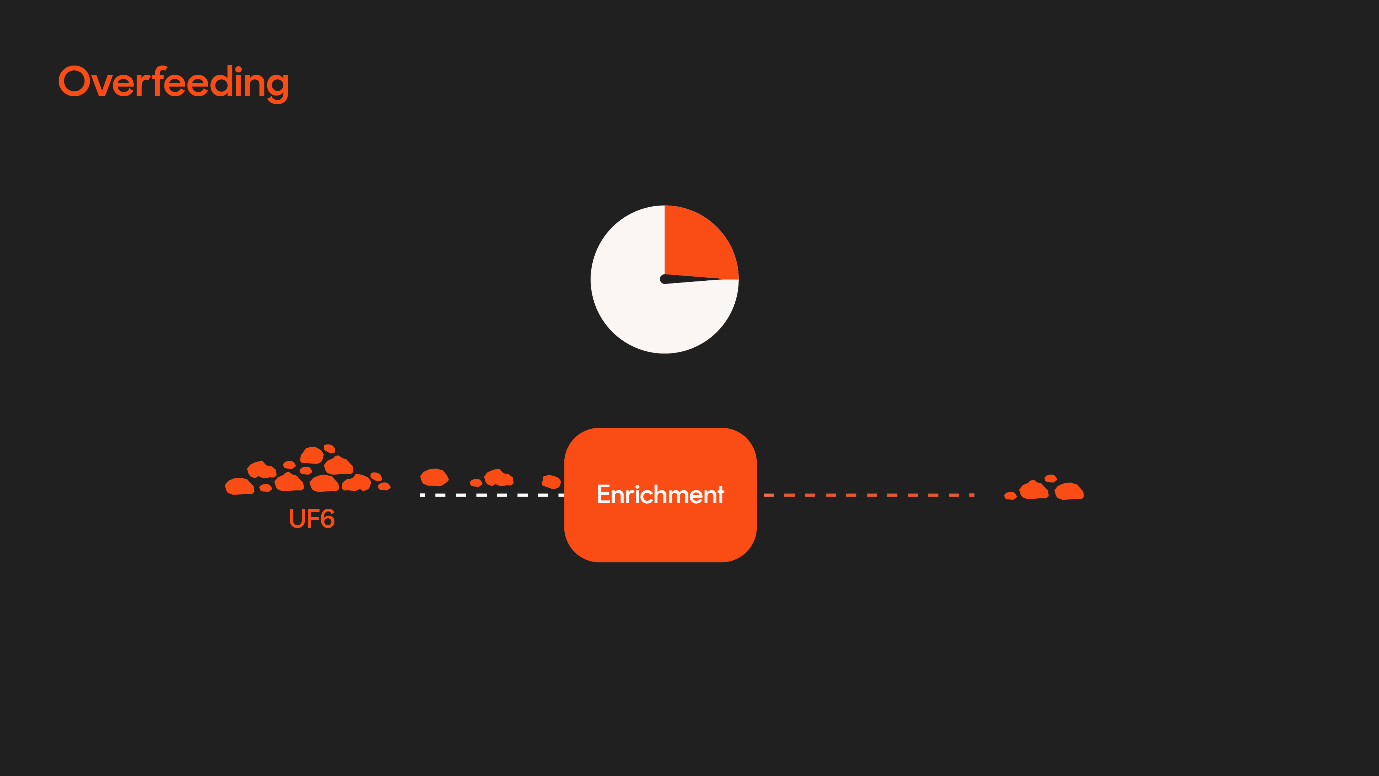

However, some industry figures are now expecting a reversal in this trend10. Due to a shortage of enrichment capacity, not only are facilities expected to stop underfeeding, but some may even begin overfeeding. As the name implies, this is the opposite of underfeeding. Additional amounts of UF6 are fed into centrifuges, which then can be run for a shorter period. This is a more efficient use of enrichment capacity, but requires more UF6, which in turn increases demand for U3O8.

According to Brandon Munro, CEO of Bannerman Energy and World Nuclear Association Advisory Panel Member, one current bottleneck in this process is conversion capacity. In the most recent Annual General Meeting for Bannerman Energy, he expressed the view that additional conversion capacity would be supportive for U3O8 prices as additional UF6 supply could mean less underfeeding, and possibly even overfeeding, which would free up enrichment capacity.

According to some estimates, this could create 20 million to 30 million pounds (9,000 to 13,500 tonnes) of additional demand for U3O811. In 2022, the total volume of U3O8 sold across contracts and spot markets was 175 million pounds (79,000 tonnes)12. That’s around 11% to 17% of the U3O8 market.

Moving away from Russian supply

Russia accounted for around 5% of mined U3O8 supply in 2021, while its neighbour and ally, Kazakhstan, accounted for a massive 45%13. Much of Kazakhstan’s uranium is sent to Russia for conversion and enrichment, further complicating matters for Europe and the US. Based on the most recent data available from the World Nuclear Association, it was estimated that Russia accounted for 38% of conversion capacity14 and 46% of enrichment capacity10 globally.

Russia’s invasion of Ukraine has resulted in repeated calls for European and US governments and corporates to sever ties with Russia. If utilities are to reduce their dependence on Russian supply, additional investment in mines, conversion facilities and enrichment facilities in “friendly” countries will be required.

Decarbonisation

As the world increasingly looks to reduce its reliance on coal and gas, while simultaneously electrifying many processes that were previously fuelled by oil, significant investment in electricity production will be required to meet our climate goals. Over the past decade or so, most of the attention has been on wind, solar and the grid-scale storage capacity required to make these major parts of our energy mix. More recently though, a reprioritisation of energy security has seen renewed interest in nuclear energy, as evidenced by the number of governments that have changed their policies and plans (see Recent News section above, plus our last update in August).

Nuclear energy undoubtedly faces challenges, such as high capital costs, a history of cost overruns, and a lack of widely agreed permanent storage solutions for waste. However, given the appeal of CO2-free, long-lifespan, reliable and demand-responsive power, and with new technologies, such as small-scale modular reactors (SMRs), emerging, nuclear is expected to have a role in a decarbonised future.

How to invest in uranium

URNM Global Uranium ETF is the first uranium-focused equities ETF traded on the ASX. It provides exposure to a portfolio of global companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or companies that hold physical uranium or uranium royalties. URNM provides a cost-effective and easily accessible way to gain exposure to companies involved in the uranium industry.

-

URNM

Global Uranium ETF

There are risks associated with investment in URNM, including market risk, concentration risk, uranium companies risk and emerging markets risk. URNM’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its more concentrated exposure. URNM should only be considered as a component of a diversified portfolio. For more information on risks and other features of URNM, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au.

References:

1. As measured by the Indxx North Shore Uranium Mining Index (AUD), adjusted for the 0.69% p.a. management fee and costs applicable to Betashares Global Uranium ETF (ASX: URNM).

2. All U3O8 prices and returns quoted are in US dollars.

3. Sources: Peninsula Energy’s Lance project to restart, Boss Energy’s Honeymoon project to restart, Paladin Energy’s Langer Heinrich project to restart.

4. Source: Uranium ‘needs US$80/lb incentive’ to meet demand this decade

5. Source: Korea Curbs Plans for Renewables in Push For More Nuclear

6. Source: Sweden plans new law to enable nuclear plant construction

7. Source: Government proposes to set up more nuclear power plants

8. Source: US uranium producers announce contracts and production ramp-ups

9. Source: World Nuclear Association: Uranium Enrichment

10. Source: US uranium renaissance is coming, and GTI Energy is sitting pretty

11. Sources: Uranium Insider, Per Jander of WMC Energy, Bruce Lane of GTI Energy

12. Source: Cameco: Supply & Demand

13. Source: World Uranium Mining Production

14. Source: Conversion and Deconversion. Based on estimated world primary conversion capacity 2020.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.

1 comment on this

A good overview of Ur useage