David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

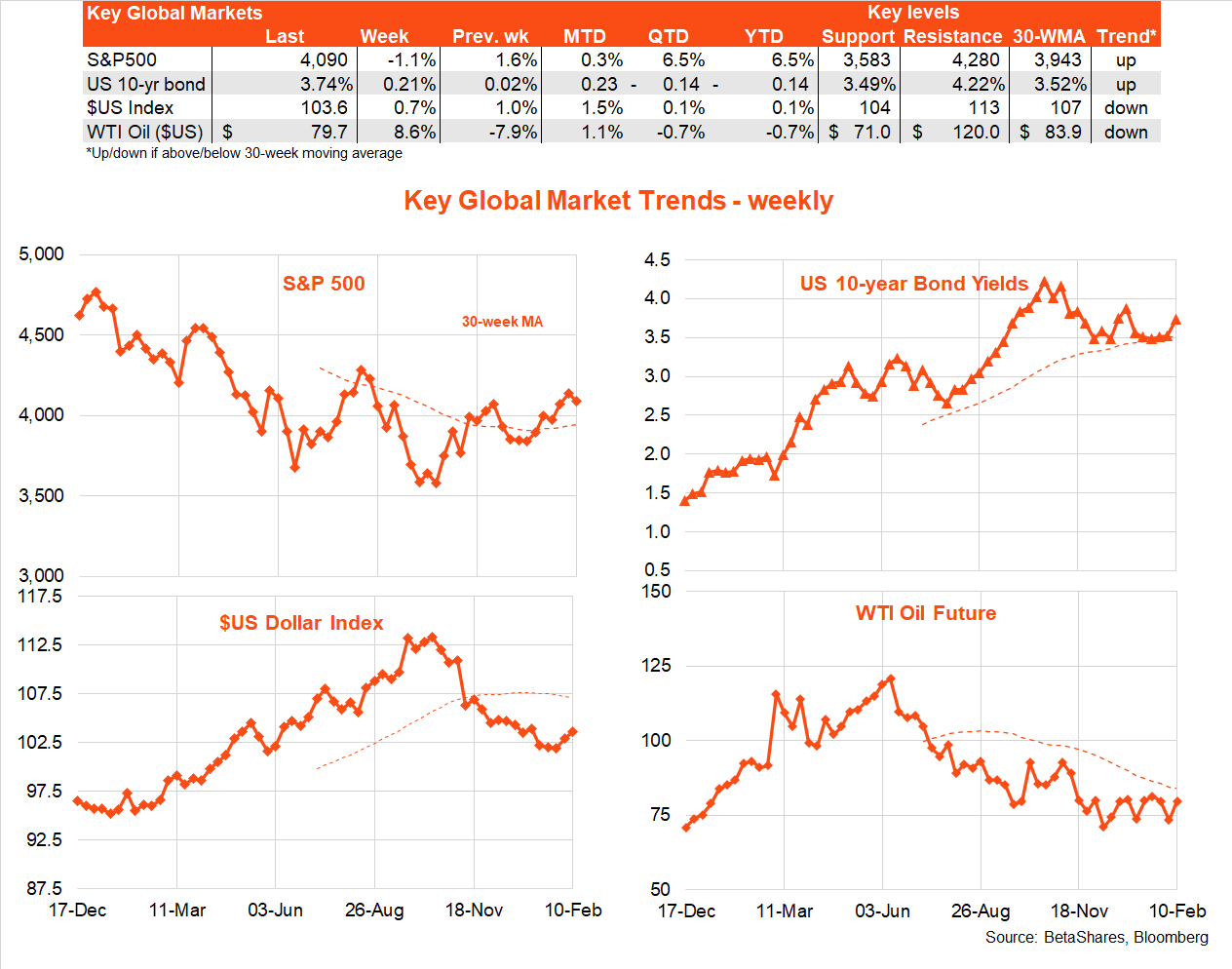

Global markets

The aftershock of the previous week’s much stronger than expected January US payrolls report continued to reverberate across global markets last week, with equities in retreat and bond yields and the $US higher. Outside the US, Russia’s announced oil production cut helped push up oil prices.

There was not a lot of key data to digest, but rather a chorus of Fed speakers who reiterated their determination to get inflation down. That said, some temporary relief came after Fed chair Powell decided not to ramp up his hawkishness in a key post-payroll speech – merely repeating what he said after the prior week’s policy meeting.

Having already expected a US rate hike in March, markets over the past week have effectively priced in a further hike in May – which it now expects to be the last, after which the Fed is still expected to cut rates later this year.

But given signs of US economic resilience and firmer commodity prices in the wake of China’s re-opening and the ongoing Ukraine war, there’s renewed nervousness over whether US inflation might stop falling.

A pause in the trend of US disinflation would potentially trigger another leg higher in expected Fed tightening – and, if so, another likely leg lower in equity prices. This is the ‘no landing’ scenario I discussed last week which, in a re-run of 2022, would be bad news for both bonds and equities at least for a time.

As it stands, US 10-year bond yields leapt from 3.52% to 3.74% last week and broke above their downtrend line from their late-22 highs. Key resistance is at the 30 December high of 3.88%. The S&P 500 eased back 1.1% and is now testing support at 4,090. The $US rose 0.6% after a 1% gain in the previous week. Reflecting Russia’s announcement, oil prices bounced back 9% and have moved sideways so far this year after a downtrend over the second half of last year. At $US79.8/barrel, oil prices are back at the top end of their recent range, with resistance around $US81.

Against this backdrop, this week’s January US CPI report looms large. Markets anticipate disinflation will continue for now, with year-on-year growth in the headline CPI expected to fall from 6.5% to 6.2%, and from 5.7% to 5.5% for the core CPI. That said, the monthly gains for both CPI measures are expected to be a relatively firm 0.4%.

Also notable next week will be any signs of economic slowing in US retail sales and weekly jobless claims (which finally bounced a little higher last week). But at this delicate stage, markets seem unsure whether they want to see weaker or stronger economic growth.

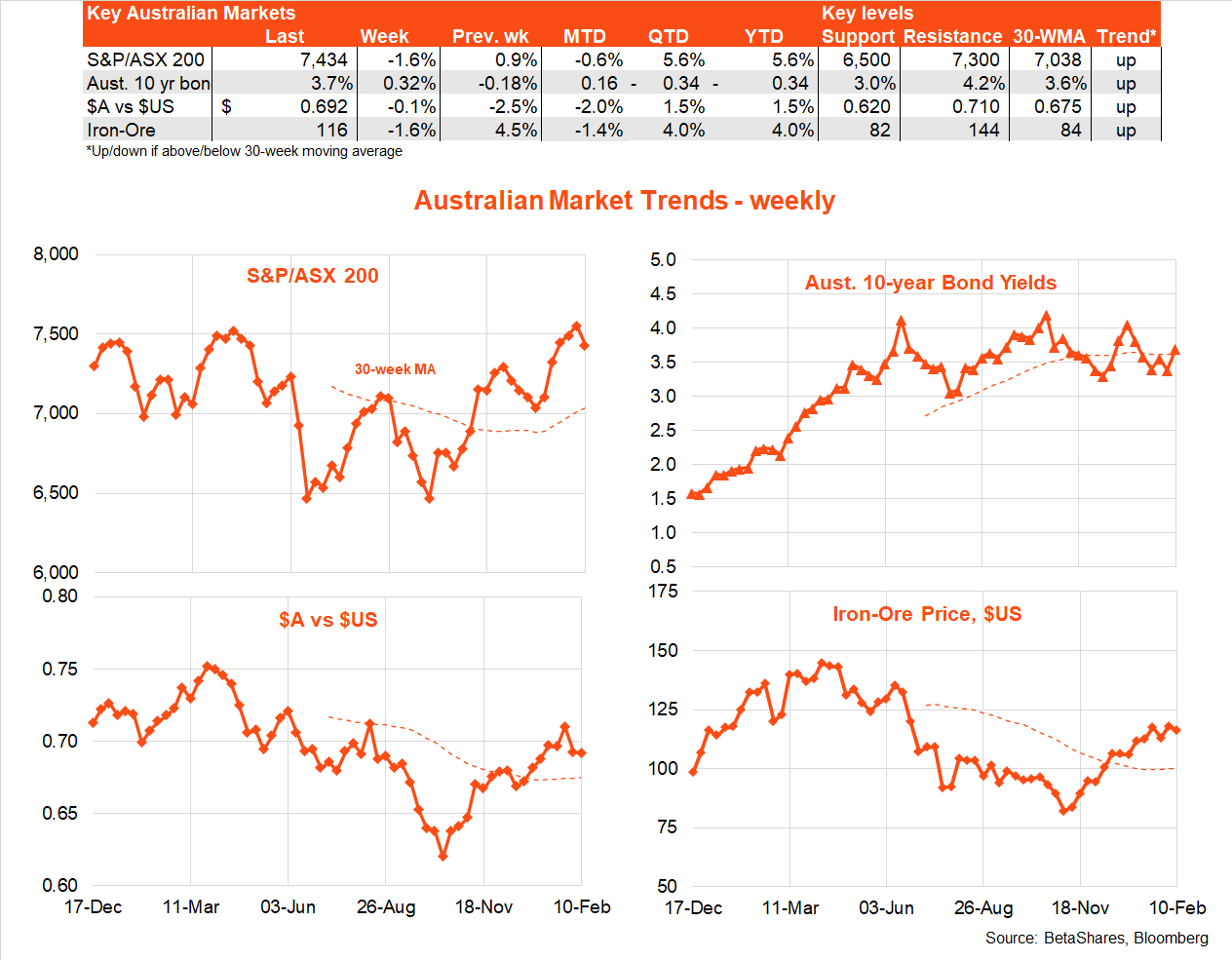

Australian market

The obvious highlight locally last week was the Reserve Bank’s first rate hike of the year and the hawkish tilt contained in its post-meeting Statement. Critically, the RBA noted: “The Board expects further increases (my italics) in interest rates will likely be needed over the months ahead.” This promptly saw markets price in a further rate increase in April after the second and (previously expected to be final) rate hike of the year in March. Whether more rate hikes will be required critically depends on the pace of wage growth and consumer spending in coming months, along with any risk of a US recession.

For the record, I now concede the RBA will likely raise rates not once, but twice more, taking the cash rate to 3.85% by April. By that stage, however, I anticipate enough signs of local and US economic weakness to allow the RBA to pause – with the first rate cut expected on Melbourne Cup day!

Along with Wall Street weakness, the RBA’s hawkish tilt saw the S&P/ASX 200 slip 1.6% last week – with the market stumbling close to resistance at the 7,592 high of April last year. Until this level breaks, the market remains trapped in a wish-washy broad 6,400 to 7,500 sideways range.

At 3.8%, local 10-year bond yields remain mid-way within their recent broad 3.25% to 4% range. And after its big drop in the previous week, due to $US strength, the $A consolidated last week just under US70c – though it has broken below the uptrend support line from its mid-October low of US62c.

In terms of the week ahead, we’ll get updates on business and consumer confidence from the NAB and Westpac surveys on Tuesday. I anticipate a moderate further weakening in both under the weight of higher rates. Thursday’s January labour market report, however, will likely show the all-important jobs market remains firm, with around a 25k bounce back in employment (after the surprise 15k fall in December) and the unemployment rate holding steady at a generational low of 3.5%. This will keep expectations for further RBA rate hikes alive and well.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.