Chamath De Silva

Betashares - Head of Fixed Income Chamath is responsible for the portfolio management function and fixed income product development at Betashares. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their international reserves section in Sydney and London, where he managed the RBA’s Japanese and European government bond portfolios. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne, is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

4 minutes reading time

- Cash and fixed income

- Currency hedged

At Betashares, our philosophy around fixed income product development is to empower investors to construct fixed income solutions tailored to their specific needs. Our US Treasury suite of funds provides investors with diverse avenues to obtain targeted exposure to the US Treasury market, the most important fixed income market globally.

US10 U.S. Treasury Bond 7-10 Year Currency Hedged ETF

Express a view on the world’s premier reserve asset and benchmark interest rate, the US 10-year Treasury yield

Securities held: Fixed rate U.S. Treasury bonds

Index: Bloomberg U.S. Treasury: 7-10 Year Total Return Index Hedged AUD

Maturity range : 7-10 years

Modified duration: ~7.5yrs

GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged

A capital-efficient way of adding duration to portfolios, and can also be used as a more amplified way of expressing a view on long-term nominal Treasury yields

Securities held: Fixed rate U.S. Treasury bonds

Index: S&P U.S. Treasury 20+ Year AUD Hedged Bond Index

Maturity range : 20-30 years

Modified duration: ~17yrs

UTIP Inflation-Protected U.S. Treasury Bond Currency Hedged ETF

Use as an inflation-protected US Treasury exposure or to express a view on inflation-adjusted real yields

Securities held: U.S. Treasury Inflation-Protected Securities (TIPS)

Index: Bloomberg Global Inflation-Linked: U.S. TIPS Total Return Index Hedged AUD

Maturity range : 1-30 years

Modified duration: ~6.5yrs

Fund characteristics and longer-term performance

All three funds provide exposure to US Government debt and can offer compelling portfolio diversification benefits, yet they serve varying purposes.

Unlike traditional (‘nominal’) Treasury exposures, UTIP holds TIPS. These offer an inflation-indexed exposure and a way for investors to focus purely on real yields without uncertainties of fluctuating inflation expectations.

Both US10 and GGOV offer access to the longer end of the nominal US Treasury curve. While they can be seen as the same macro expression, they differ in the durations and magnitude of interest rate risk they provide. US10 provides exposure to US Treasuries with maturities between 7 and 10 years, commonly seen as the benchmark tenor for asset allocators globally. GGOV offers exposure to long-term Treasuries with maturities of 20 years or more.

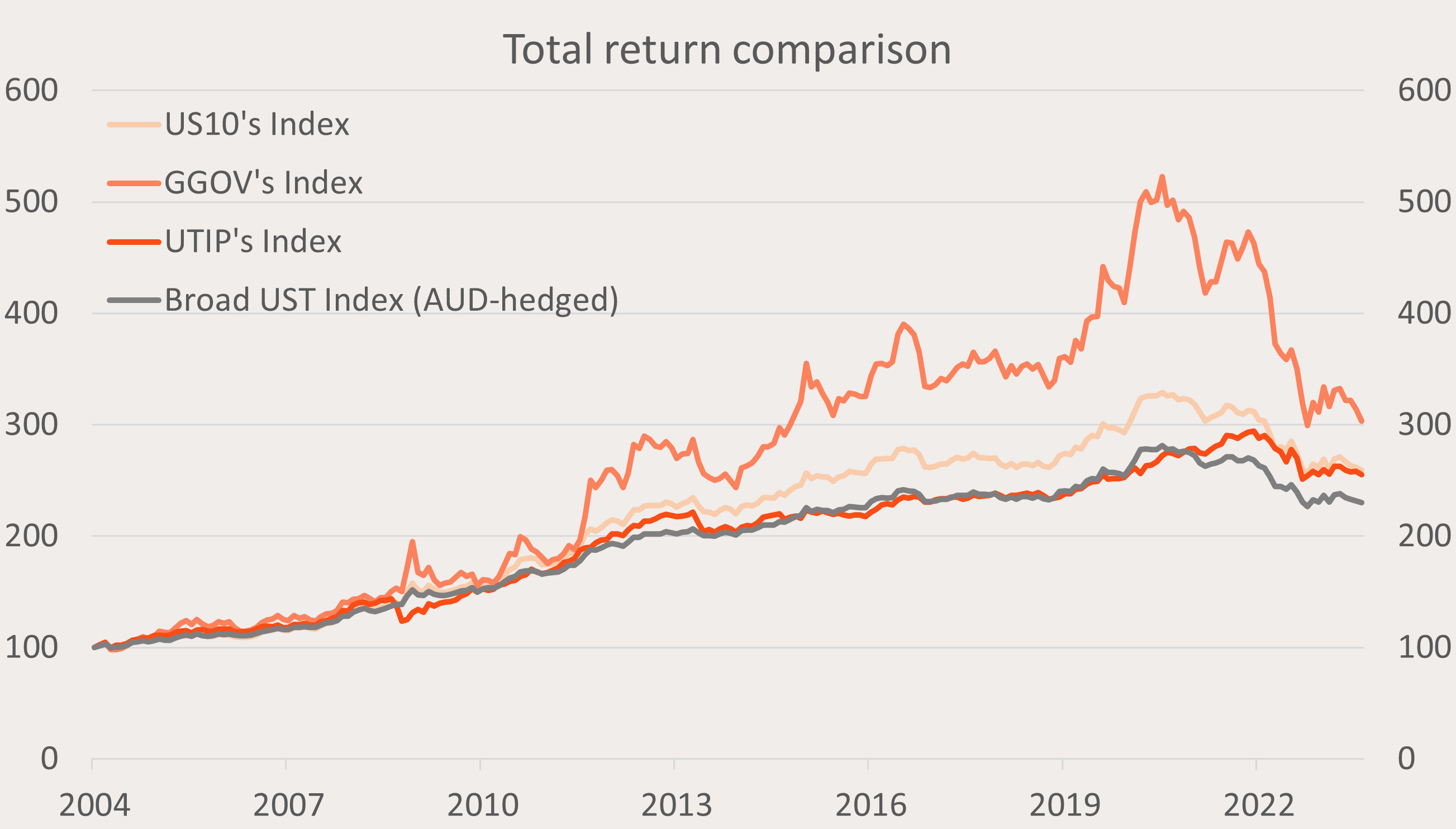

Since common inception the US10’s index, GGOV’s index and UTIP’s Index have all outperformed the broader Bloomberg US Treasury Total Return (in AUD-hedged terms).

Figure 1: Total return of US10’s Index, GGOV’s Index and UTIP’s Index vs nominal US Treasuries (AUD-hedged)

Source: Markit iBoxx; Bloomberg, as of 31 August 2023. Chart shows the total return performance of , US10 (‘7-10yr USTs’), GGOV (‘20+yr USTs’) and UTIP’s (‘Broad US TIPS’) Index and the iBoxx USD Treasuries AUD Hedged Index (‘Broad UST’), since common index inception in January 2004. 30-Jan-2004 = 100. Past performance is not an indicator of future performance of any index or ETF. You cannot invest in an index. Performance information does not show actual past performance of the respective ETF and does not take into account its management fees and costs.

US10 versus GGOV

The choice between US10 and GGOV hinges primarily on an investor’s duration preferences and appetite for volatility, as can be seen in the chart above. Both ETFs convey similar economic perspectives but offer varied degrees of exposure. Historical data from the past 30 years indicates that the correlation between changes in 20–30-year yields (GGOV’s maturity range) and shifts in the 10-year yield stands at +0.90, with GGOV’s average yield beta in response to 10-year yield changes being 0.80. This positions GGOV as an amplified bet on 10-year yields, despite its specific aim towards the 20–30-year segment of the curve.

Why you might consider UTIP over a nominal Treasury bond exposure

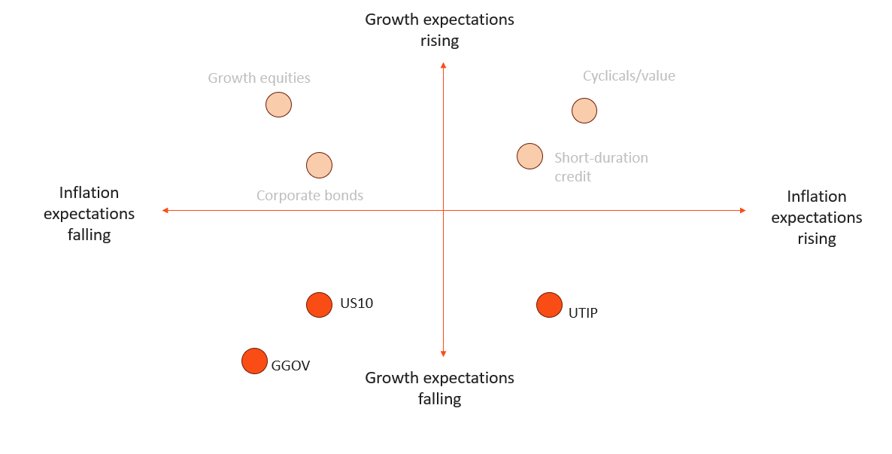

Both TIPS and nominal Treasury bonds benefit from waning growth expectations. However, nominal Treasuries gain the most during phases when inflation expectations are also diminishing, such as during US recessions. Conversely, TIPS are preferable during ‘stagflationary’ periods when growth is muted, yet inflation consistently surpasses predictions. TIPS also typically outshine nominal Treasuries when inflation expectations are on the upswing.

Figure 2: Betashares US Treasury exposures across dimensions of growth and inflation expectations

Note: Not a recommendation to make any investment or adopt any particular investment strategy

-

US10

U.S. Treasury Bond 7-10 Year Currency Hedged ETF

-

GGOV

U.S. Treasury Bond 20+ Year ETF – Currency Hedged

-

UTIP

Inflation-Protected U.S. Treasury Bond Currency Hedged ETF

There are risks associated with an investment in GGOV, US10 and UTIP, which may include interest rate risk, credit risk, international investment risk and inflation risk. For more information on risks and other features of the Funds, please see the respective Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

Any Betashares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares Funds or bears any liability in relation to the Betashares Funds.

Written by

Chamath De Silva

Head of Fixed Income

Chamath is the Head of Fixed Income at Betashares and is a voting member of the firm’s Investment Committee. He is responsible for managing the fixed income ETFs and leading the fixed income product development. In addition, he shares responsibility for the strategic and dynamic asset allocation decisions for the Betashares model portfolios. Previously, Chamath was a fixed income trader at the Reserve Bank of Australia, working in their FX reserves management function in Sydney and London. There, he managed the RBA’s Japanese and European government bond portfolios across a range of market conditions. Chamath holds a Bachelor of Commerce degree (First Class Honours in Finance) from the University of Melbourne. He is a CFA® charter holder and has sat on the Bloomberg AusBond Index Advisory Council.

Read more from Chamath.