David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Global markets

Global equities pulled back a little further last week with the S&P 500 inching back 0.3% after a 0.8% fall the previous week. The S&P appears to be struggling to break through the previous early February high of 4,119 after having reached a recent high of 4,169 on 28 April. At this stage, the upward trend from the lows of last October appears to be faltering somewhat.

At the same time, US 10-year bond yields are also testing support at around 3.4%, with as yet no decisive break lower.

The ‘race against time’ for the US economy continues, with further signs last week of a potential descent into recession through a rise in jobless claims, decline in consumer confidence and a survey of ever tighter lending conditions. At the same time, the consumer price index report revealed that inflation pressures continue to ebb (with shelter costs now also easing in line with weaker rents), though at a slowing pace and with overall core inflation still fairly sticky.

Also not helping sentiment is the looming threat of a US debt default by early June if agreement is not reached to increase the debt ceiling sometime soon.

All this is enough for the Fed to likely want to pause raising rates in June, though continue to push back at the market’s view that rate cuts will take place later this year.

In terms of the global week ahead, highlights include a range of Fed speakers (including Powell) who may offer further views about interest rates. The game of debt-ceiling brinkmanship also continues in Washington this week, though negotiations seem likely to continue until the 11th hour – which could still be a few weeks away! Also of interest will be further reports on the US economy, through retail sales, industrial production and weekly jobless claims.

Australian market

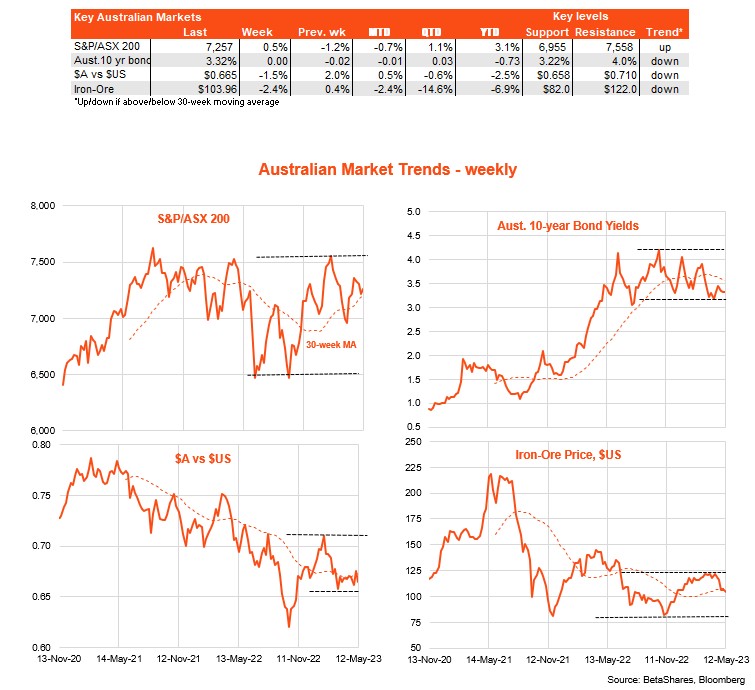

Australia’s S&P/ASX 200 equity index remains trapped in a meandering sideways range, with recent highs around 7,500 in early February and lows of 6,900 in late March. Bond yields also remain in a messy sideways range, albeit with lower lows and lower highs apparent over recent weeks.

Highlights last week were a further decline in retail sales volumes in the March quarter of 0.6%, following a small fall of 0.3% in the December quarter. This likely reflects both a slowing in underlying consumer spending under the weight of higher interest rates and inflation, but also a rotation back towards consumer services not fully captured in the retail sales report.

The National Australia Bank measure of business conditions slipped a little last month, though remained at a robust above-average level.

Of course, the major highlight last week was the Federal Budget, which revealed a surprise estimated surplus for the financial year about to end (due to a major upgrade to expected tax revenues), though this is then expected to move into progressively larger deficits over the next two financial years.

Overall, while the budget includes new spending in worthy social areas, and should be commended for saving most of the revised expected tax bounty, it nonetheless has relatively few net-spending cuts and won’t help the RBA’s task of slowing the economy and easing pressure on inflation and interest rates. All the heavily lifting with regards to slowing the economy remains in the RBA’s hands, and hence on the backs of a narrow slice of over-indebted households with a mortgage.

We will learn more on the state of households with the Westpac consumer sentiment survey due tomorrow. This is expected to show a modest easing in sentiment following the RBA’s surprise rate hike earlier this month. In this regard, also of interest tomorrow will be the release of the minutes to the RBA’s fateful May meeting.

But probably the highlight this week will be Wednesday’s March quarter wage price index report, which is expected to show firm quarterly wage growth of 0.9%. Such a result would suggest wage growth is still gradually rising, but not as yet a huge threat to the inflation outlook. Indeed, the RBA’s recent Statement on Monetary Policy noted “less upward momentum” in wages growth than a few months ago and that business contacts suggest wage growth to “moderate in the year ahead”.

Have great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.