Reading time: 3 minutes

In 2020, China announced to the world that it would join the race to lower carbon emissions. It pledged to reach peak emissions before 2030 and achieve carbon neutrality before 2060. This falls roughly in line with the other two global heavyweights pledging carbon neutrality, the European Union and the United States, which have set a target for 2050.

Social, global and economic benefits

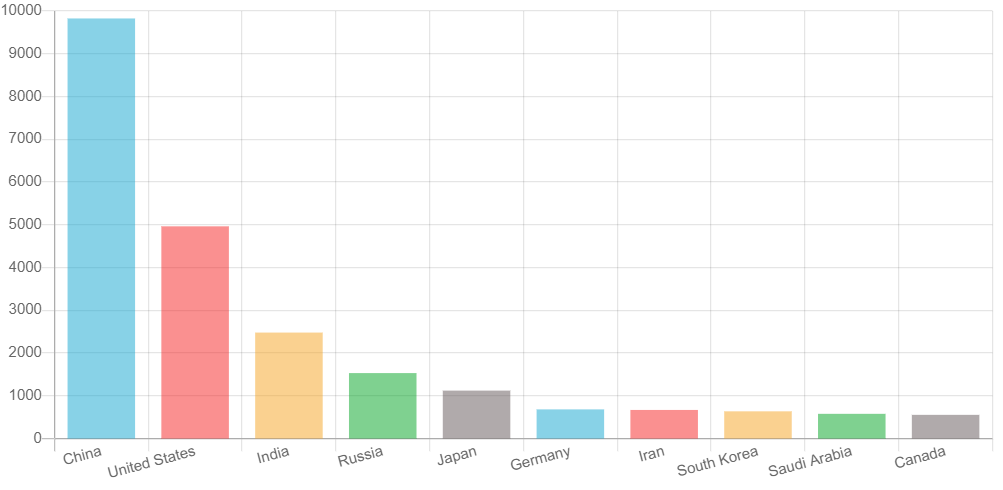

While there is a broad scientific consensus that a global commitment to lower carbon output is required, China must put additional resources towards this effort, given it was the biggest emitter of fossil fuel carbon dioxide (CO2) emissions in 2020, as seen in the chart below. This was almost 30% of the world’s total CO2 emissions for that year, and to put it into context, roughly twice the amount emitted by the second largest emitter, the United States.

Largest producers of fossil fuel CO2 emissions worldwide in 2020, by share of emissions

Outside of the obvious social and global benefits of China moving to a greener economy, there are some strong underlying economic drivers which could be influencing China’s decision to increase its climate aspirations. China, as the number one emitter of greenhouse gases, is working to develop and export various technologies and solutions to decarbonise the global economy, households, supply chains and drive innovations, bringing economic benefit to China as well as benefiting international clean energy markets.

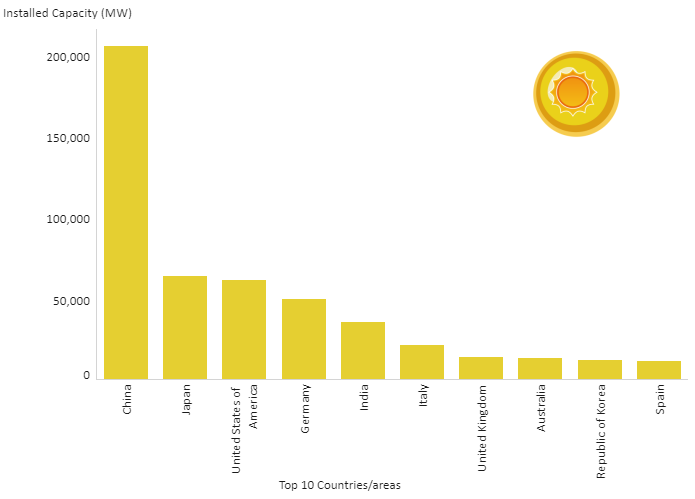

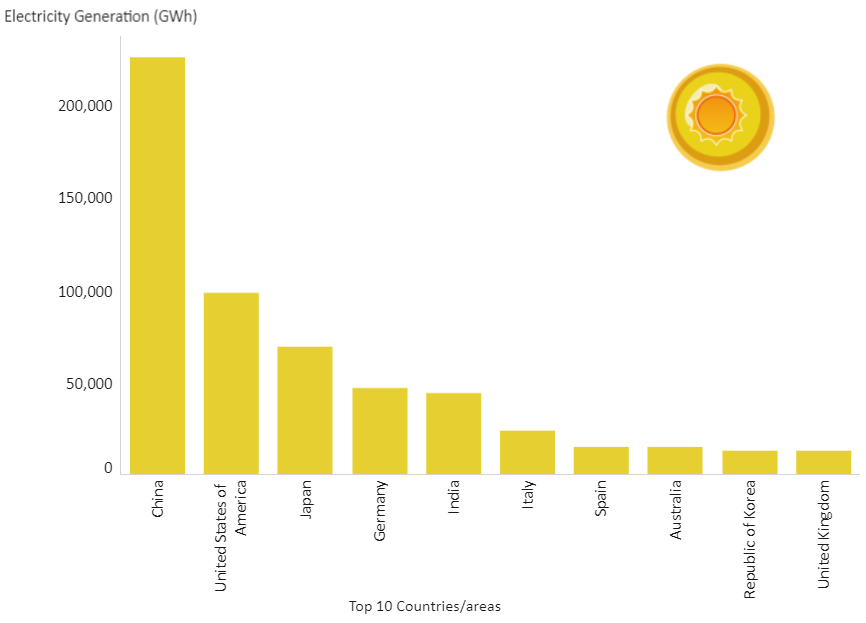

China has put itself in the box seat in the major sectors and technologies for decarbonising the electricity and transportation sectors, including solar power, wind power, advanced batteries and electric vehicles. As illustrated in the graphs below, China has a dominant position and is a global market leader in installed solar power and solar generation.

Top 10 Countries/Areas for Solar energy power capacity and generation for 2019

Source: https://www.irena.org/Statistics/View-Data-by-Topic/Capacity-and-Generation/Country-Rankings

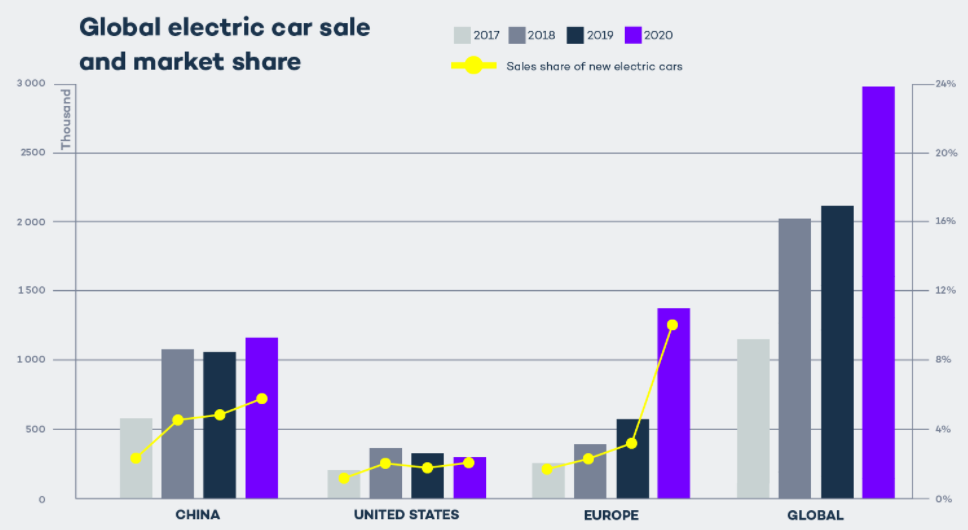

China is also in a great position to compete within the electric vehicle market, which is set to benefit from major economies putting hard dates on implementing limits on the manufacturing and sales of new cars and SUVs with internal combustion engines, as California and the UK have done with their 2035 and 2030 dates respectively.

Not only has China established itself as one of the largest producers of electric vehicles, but it also has a significant market share of electric vehicle sales as shown in the graph below.

Source: https://www.virta.global/global-electric-vehicle-market

What does this mean for Australia, our resource sector, and Australian investors?

China, which is Australia’s number 1 iron ore customer, has vowed to limit crude steel output this year to no more than its 2020 production, consistent with its goal of limiting industrial pollution. We have seen an increased focus on the Chinese steel industry play out in the price of iron ore, which has tumbled from its peak in May 2021 when the benchmark Chinese spot price was a whopping US$220 a tonne, to now around US$100 a tonne.

This has had a direct effect on the share prices of miners such as BHP, RIO and Fortescue, which have fallen significantly in recent weeks.

The rising momentum around the move to zero emissions is anticipated to result in investment dollars increasingly being allocated towards technologies, products and services that are playing their part in the transition. Conversely, high emissions industries, such as those in the resource sector to which many Australian investors’ portfolios have a significant weighting, are likely to face headwinds.

Investors may wish to consider allocating part of their portfolio to investments that have the potential to benefit from global efforts to combat climate change.

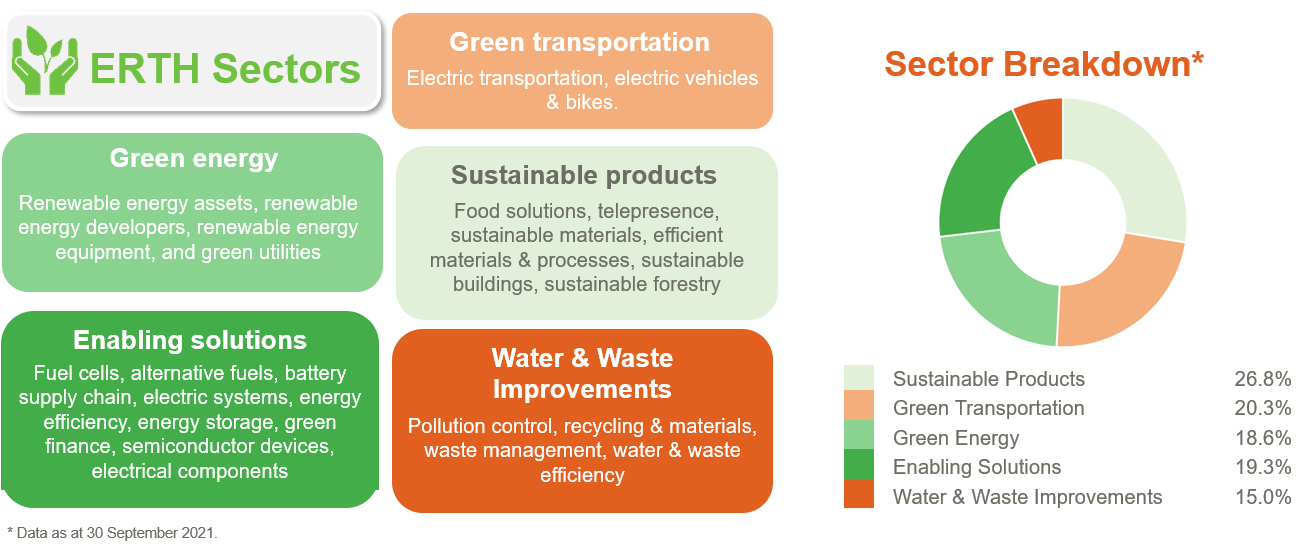

ERTH Climate Change Innovation ETF aims to track the performance of an index (before fees and expenses) that provides exposure to up to 100 of the largest companies that are at the forefront of tackling today’s climate and environmental challenges.

ERTH’s index includes companies with decarbonisation solutions within five key themes:

| There are risks associated with investment in ERTH, including market risk, international investment risk, sector risk and non-traditional index methodology risk. ERTH’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its concentrated sector exposure. ERTH should only be considered as a component of a diversified portfolio. For more information on risks and other features of ERTH, please see the Product Disclosure Statement, available at www.betashares.com.au. A Target Market Determination for ERTH is also available at www.betashares.com.au/target-market-determinations. |

Written by

Benjamin Cahill