David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

- Global

Global markets

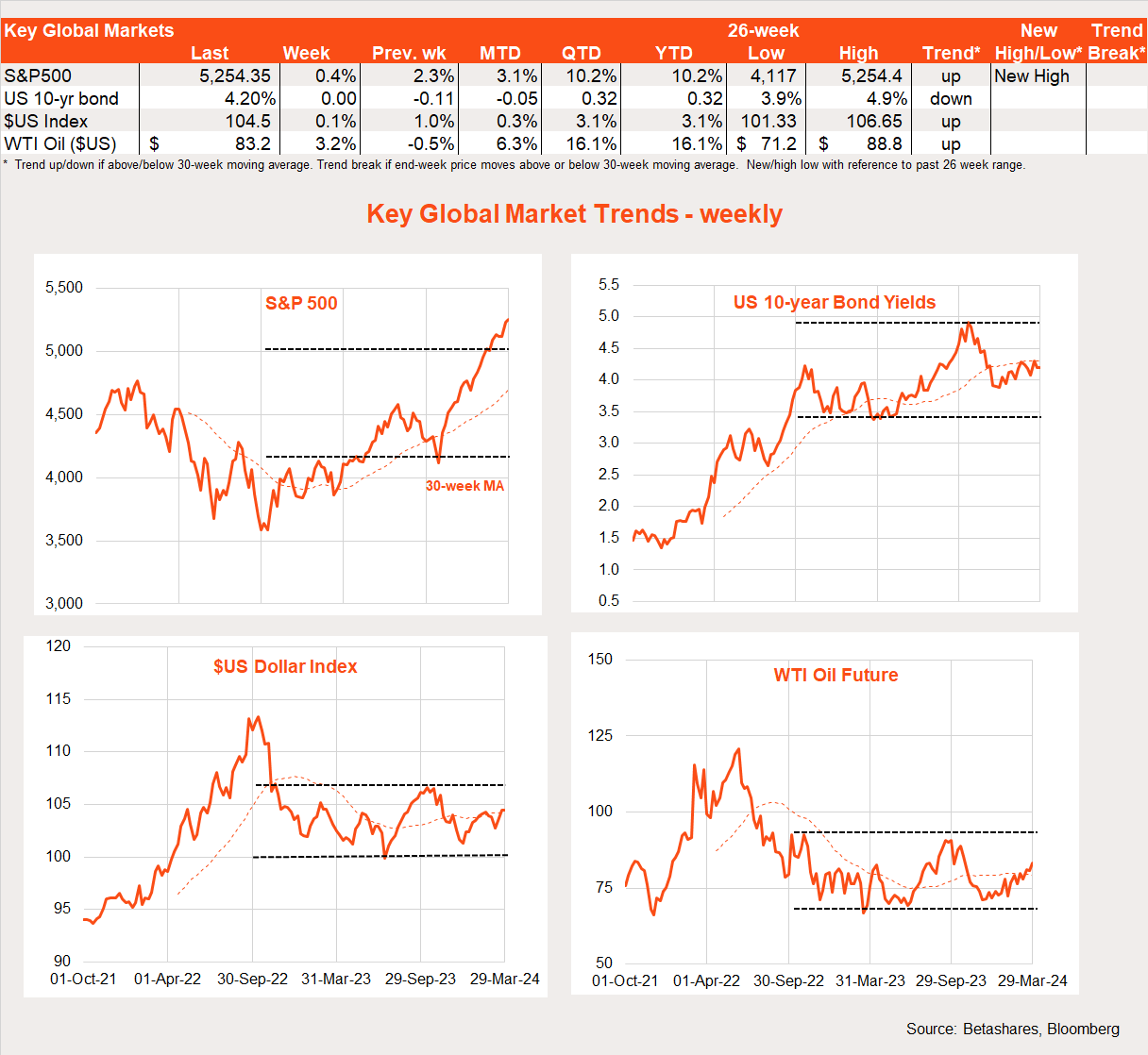

US stocks edged up further last week and bond yields were steady as a key inflation report matched expectations and Fed chair Powell continued to sound relaxed and comfortable. While the next move in US rates is likely still down, the Fed (rightly) is in no hurry.

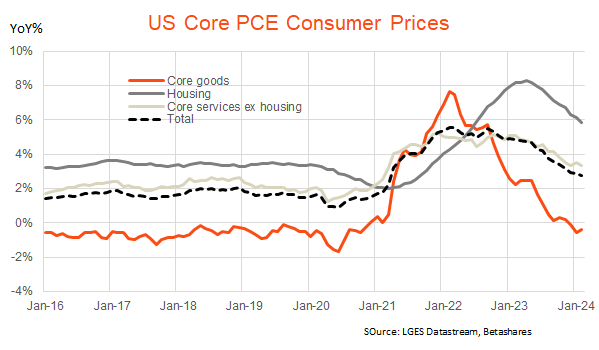

The highlight last week was Friday’s US private consumption expenditure deflator (PCE), with core prices rising 0.3% – in line with expectations. After some upward surprises with regard to the CPI and PPI in recent months, the ‘as expected’ result was at least some relief to markets. Annual core PCE inflation edged lower to 2.8% from 2.9%. Core services – the so-called ‘super core’ measure – rose only 0.2% in the month after a worryingly large 0.7% gain in January.

Of course, what’s most important is what the Fed thinks – and on that score Fed chair Powell seemed comforted by Friday’s report, describing it as “good to see.. [and] in line with expectations”. The Fed still sees inflation coming down, although concedes there could be some bumps along the away.

Probably the biggest barrier to near-term US rate cuts is not the inflation story, but rather the resilience in economic growth. Real consumer spending – also released last Friday – rose a stronger than expected 0.8% in February, while the March ISM manufacturing survey overnight was also stronger than expected. The manufacturing sector looks to be recovering from its post-COVID slump at the same time as the services sector remains strong.

Against this backdrop, Wednesday’s job opening data and Friday’s payrolls will be important markers. February job openings are expected to drop, but remain at a relatively high level of 8.8 million. Another 200k gain in jobs is expected in Friday’s March payrolls report, with the unemployment rate holding steady at 3.9%. If both reports are solid, expectations of the first US rate cut are likely to get pushed out beyond June.

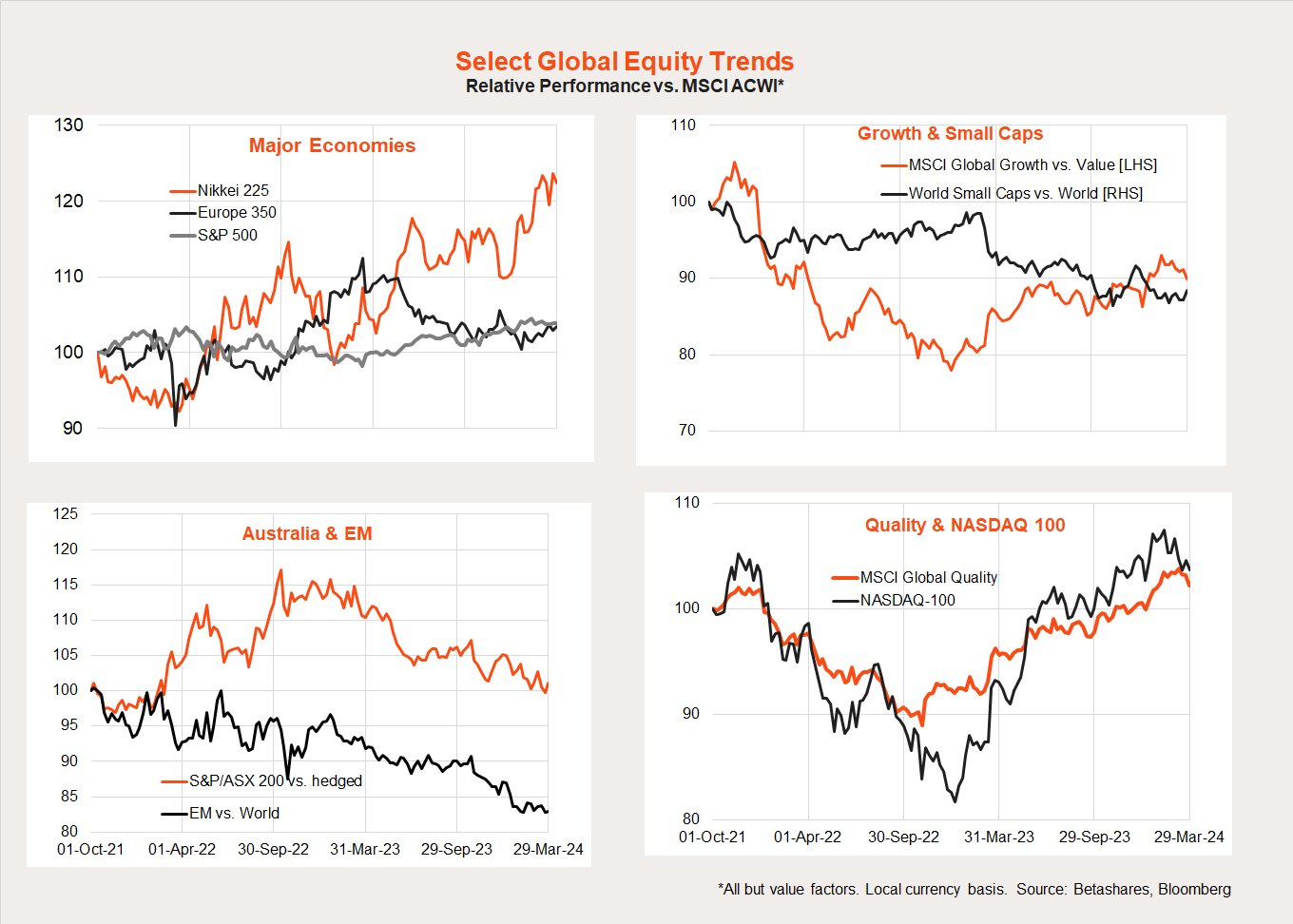

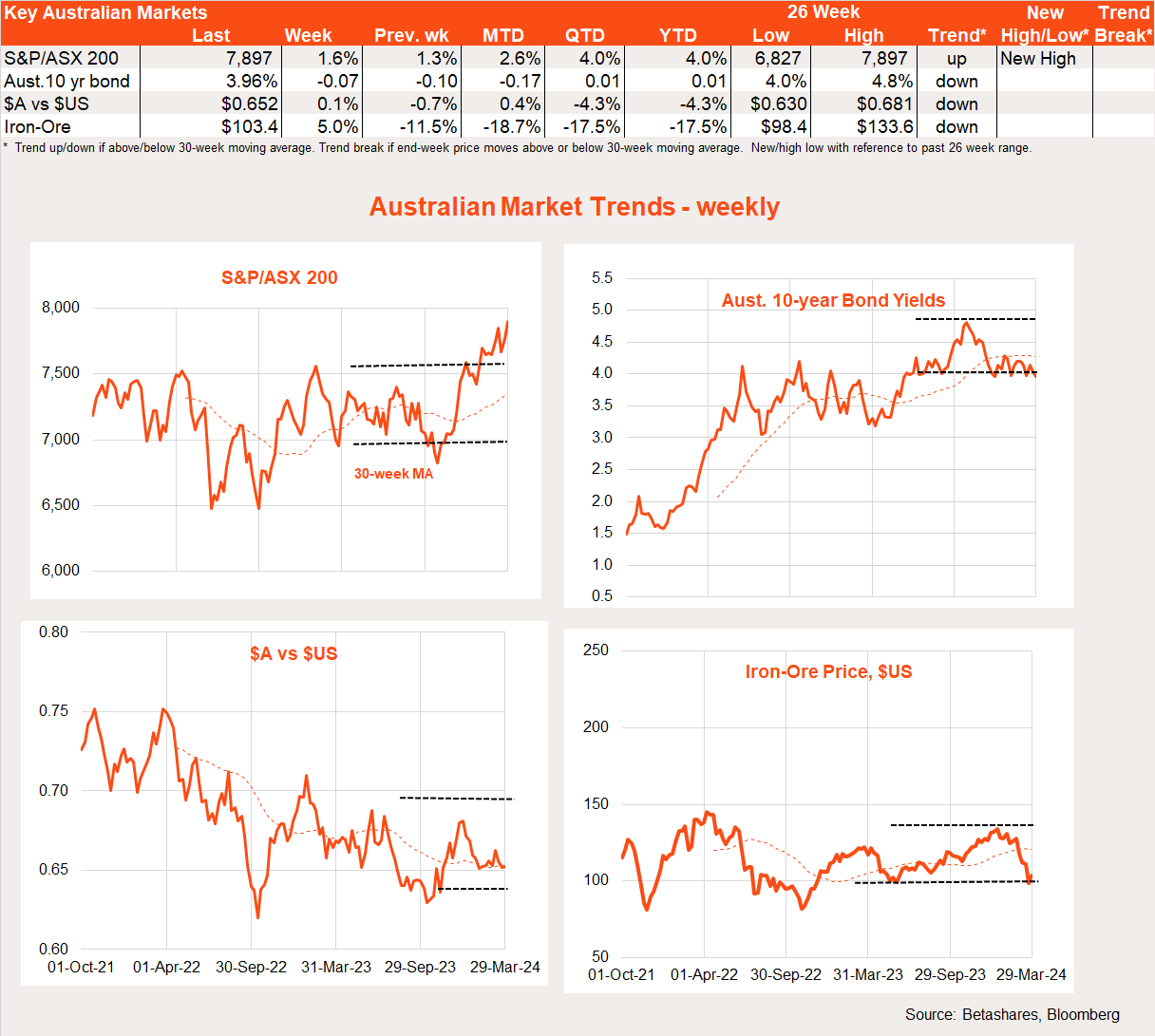

Looking at global equity trends, a pullback in Nasdaq-100/global growth relative performance has been evident in recent weeks along with the move higher in bond yields and reduced expectations of near-term US rate cuts. Europe, Japan and ‘value’ generally has been somewhat firmer. Australia and emerging markets, however, continue to generally underperform – with weakness in iron-ore prices not helping the local resources sector.

Australian markets

It was a good week for local stocks, however, with a relatively benign monthly CPI report keeping hopes alive for RBA rate relief sometime later this year. The S&P/ASX 200 rose 1.6% after a good 1.3% gain the previous week – to confirm the market’s recent breakout into record territory.

Annual growth in the February CPI held steady at 3.4% – which was a touch better than the 3.5% market expectation. Annual growth in the seasonally adjusted and the trimmed mean measures ticked up a little, to 3.7% and 3.9% respectively. Among the menagerie of underlying measures of inflation, only annual growth in the CPI excluding volatile items and holiday travel edged down, to 3.9% from 4.1%.

Overall, though, we might conclude the inflation report was a touch better than feared – and likely has neutral implications for the interest rate outlook.

There’s little on the local data front this week, with minutes from the latest RBA policy meeting due later today. Although the minutes are likely to confirm the RBA still had a rate hike as its other policy option – alongside keeping rates steady – their tone is likely to suggest the former was not a serious consideration. Unlike with the US Fed, though, the RBA is still reticent to openly signal an easing policy bias.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

1 comment on this

David – Hi

I always read with interest your newsletters and look at your graphs as well as world graphs.

Like covid 19, our banking and government officials are not telling us the truth on the current state of affairs.

The language often used by our experts is less than exciting and very vague to say the least.

It is well known that inflation throughout the world is stalling, but still a serious issue.

All our RB experts seem to dumb it down, but in reality, the next 18 months will deliver news that most experts may know, but are to afraid to make public in order to avoid PANIC in the markets.

As someone who had 250K in Betashares ETF’s, I now have rolled this over into Perth Mint Gold.

Betashares Gold was lack luster and high in fees and hedged.

Already, I have experienced huge gains on the back of my core ETF’s, all which have delivered +20%

I know that you know, but you want to paint a picture according to the graphs you present.

A turnabout is on its way

Just my thoughts from a 71yo who knows not much about anything

cheers

silvio fontana