Bitcoin, along with the broader crypto market, turned south late in the week after disappointing economic data and hawkish remarks from the US on Friday. Bitcoin was off -4.66% over the last 7 days with its market capitalisation at US$1.19 trillion. The total crypto market cap is down to US$2.25 trillion, while bitcoin’s market dominance ticked higher to 53.2%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $60,784 | $65,399 | $60,372 | -4.66% |

| ETH (in US$) | $2,907 | $3,216 | $2,887 | -6.43% |

Source: CoinMarketCap. As at 12 May 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

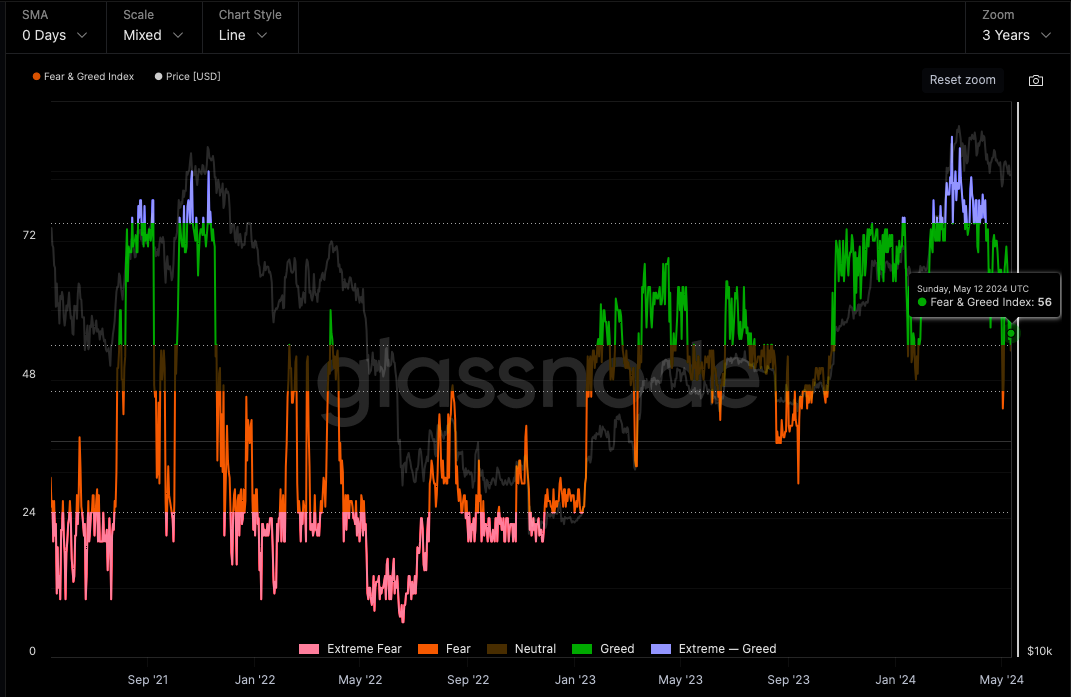

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Will sovereign wealth funds, pensions and endowments be next?

BlackRock has been playing an educational role, speaking with sovereign wealth funds, pensions and endowments about the new spot bitcoin ETFs. BlackRock’s Head of Digital Assets has indicated that the next wave of bitcoin buying may be fuelled by this type of investor finally coming to market. These institutions are starting to re-initiate conversations, with focus on the topic of allocating to bitcoin and how to think about it from a portfolio construction perspective1.

FTX customers set to get money back

Bankruptcy lawyers for failed crypto exchange FTX said last week that customers are set to receive funds that they lost, with interest on top. FTX creditors, along with ordinary investors numbering in the hundreds of thousands who used the exchange to trade crypto, are set to receive cash payments equivalent to around 118% of the assets held on the exchange. US$8 billion of customer assets were lost when the company went bust.

Payments will be sourced from a variety of assets, including digital currencies that FTX owned and shares in start-ups that may be sold. It has been around 17 months since FTX went under.

However, the caveat to the plan is that customers will receive the amount their crypto was worth when the exchange went bankrupt. Crypto markets have increased in value since, and clients will have lost out on any gains. The plan still requires approval from the Federal Court judge overseeing FTX’s bankruptcy, John T. Dorsey. It is likely that it will still take months for payouts to begin, and any objections raised by creditors could further extend the timeline2.

Block accumulating bitcoin

The financial technology conglomerate Block Inc. recently announced that it will be buying bitcoin (BTC) regularly every month for its balance sheet. The plan is to use 10% of its monthly gross profits from bitcoin-based products to purchase BTC. Block shared that, as of 31 March 2024, it held 8038 BTC on its balance sheet, which represented approximately 9% of its cash and marketable securities holdings.

The company stated, “We view bitcoin as an instrument of global economic empowerment; it is a way for individuals around the world to participate in a global monetary system and secure their own financial future3.”

Block Inc. is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. The company has diversified its portfolio services, ranging from financial services like Square, to entertainment with its streaming service TIDAL, providing a wide array of products and services in the financial and tech sectors.

Bitcoin (BTC): Price Drawdown from ATH

This metric shows the percent drawdown of the asset’s price from the previous all-time high (ATH).

According to data from Glassnode, the current drawdown from the previous ATH is 17.5%, which may be viewed as in line with historically ‘healthy’ corrections for this volatile asset.

Source: Glassnode. Past performance is not indicative of future performance.

Source: Alternative.me. Past performance is not indicative of future performance.

Altcoin news

The best performing ‘Top 25’ altcoin over the past week was Render (RNDR), up over 16% for the week and 538% for the 365 days to 12 May 2024. Helping push the price higher was a project called Octane X, recently announced at Apple’s keynote where the new iPads were introduced. It was noted that Octane X will be powered by RNDR.

Octane X has been described as the world’s first unbiased and spectrally correct GPU production rendering engine for macOS. It can work with Render networks to enhance graphic rendering, boost content creation, improve cloud services and empower application developers5.

According to the company’s website, “The Render Network is the first decentralized GPU rendering platform, empowering artists to scale GPU rendering work on-demand to high performance GPU Nodes around the world. Through a blockchain marketplace for idle GPU compute, the network provides artists the ability to scale next generation rendering work at fractions of the cost and at orders of magnitude increases in speed when compared to the centralized GPU cloud.”

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.coindesk.com/business/2024/05/02/blackrock-sees-sovereign-wealth-funds-pensions-coming-to-bitcoin-etfs/?_gl=1*1oo4lxj*_up*MQ..*_ga*MTc2NTM0Mjg3Ni4xNzE0ODkxNDc0*_ga_VM3STRYVN8*MTcxNDg5MTQ3NC4xLjAuMTcxNDg5MTQ3NC4wLjAuNDQ2Mjc2NjIx

2. https://www.nytimes.com/2024/05/08/business/ftx-bankruptcy-recovery.html

3. https://news.bitcoin.com/block-is-buying-bitcoin-every-month-for-its-balance-sheet/

4. As at 12 May 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.nasdaq.com/articles/render-token-price-forecast:-can-apple-partnership-drive-rndr-above-$14

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.