The old saying “there’s no such thing as a free lunch” offers a lesson in life and economics. Even if something appears free, the inescapable realities that goods are scarce, and you must make a choice, mean that there’s always a cost – opportunity cost. This concept was first popularised by Nobel Laureate Milton Friedman, in his 1975 book, “There’s No Such Thing as a Free Lunch1

Harry Markowitz, another Nobel Prize winning economist, had a different perspective. Markowitz reportedly said: “Diversification is the only free lunch in investing.”2 Diversification, when done right, allows investors to achieve the maximum level of return for a given level of risk.3 This is the “free lunch” that Markowitz referred to.

But I propose that there’s another free lunch that was overlooked by Markowitz and Friedman. I’ll get to that later, but first, let’s discuss diversification.

Free lunch #1: Diversification

Diversification is a relatively simple concept. Let’s say you have a portfolio of just one company – a mining stock. If that company performs poorly, say due to falling commodity prices, then your portfolio is going to be hit hard.

Now let’s introduce a second company. For the sake of discussion, this company is equally as risky as the first, but it’s exposed to different risks. Let’s say this second company is a tech stock. When the first stock downgrades due to falling commodity prices, your second company is unaffected.

This imaginary portfolio, while still containing only stocks with equally high risk, just reduced its exposure to company-specific risk.

This concept can be expanded to add more and more stocks, so that any one company’s performance ends up having only a small impact on overall portfolio performance. It’s not just limited to stocks though – you can add bonds, commodities, or even different currency exposures to further diversify your risk. This is the basis for Modern Portfolio Theory* – which is what our friend Harry Markowitz won his Nobel Prize for.4

Free lunch #2: Lower fees

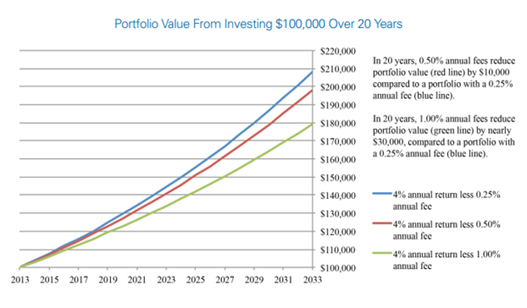

0.75% per annum doesn’t sound like a lot, does it? Even on a $100,000 portfolio, that works out to just $750. That couldn’t make a big difference over the long term, could it?

Well, yes. It could. While compounding interest is a great benefit when it works in your favour, it can also be a great detriment when it works against you. In fact, based on a hypothetical example of a $100,000 portfolio with a 4% p.a. return over 20 years, a 0.75% p.a. fee reduction (from 1% to 0.25%) results in almost $30,000 difference!

Source: Investor.gov. Hypothetical example provided for illustrative purposes only.

While there’s no way to guarantee higher returns in investing, seeking products with lower fees can have a strong impact on overall portfolio returns. And unlike returns, fees are something that investors can somewhat control.

Where to find low fees and broad diversification

All this is nice in theory, but in practice, where can low fees and broad diversification be found, all in one package?

BetaShares Australia 200 ETF (ASX code: A200). With management fees of 0.07% p.a., it aims to track the performance of an index (before fees) of 200 of the largest companies on the ASX.5

If you’re looking for a more global option, the BetaShares Diversified All Growth ETF (ASX code: DHHF) is the lowest fee diversified all-in-one ETF currently available in Australia.6 It provides exposure to approximately 8,000 equity securities listed on over 60 global exchanges. This is all available through a single trade on the ASX, and the management fee is 0.19% p.a.

For the more defensively inclined investor, the BetaShares Australian Composite Bond ETF (ASX code: OZBD) is a core portfolio allocation for fixed income. For a management fee of 0.19% p.a.,7 it offers exposure to 256 fixed income securities (as of 19 July 2022) including Australian Government bonds, State Government bonds, and corporate credit. OZBD aims to track the Bloomberg Australian Enhanced Yield Composite Bond Index, before fees and expenses.

*Markowitz’s theory was initially called the Theory of Portfolio Choice.

There are risks associated with an investment in these Funds, including:

- DHHF: asset allocation risk, market risk, currency risk, underlying ETFs risk and index tracking risk.

- A200: market risk, security specific risk, industry sector risk and index tracking risk.

- OZBD: interest rate risk, credit risk, market risk and index tracking risk

For more information on risks and other features of the Fund, please see the Product Disclosure Statement.

1. Friedman, Milton, There’s No Such Thing as a Free Lunch, Open Court Publishing Company, 1975

2. https://www.netwealth.com/ourviews/diversification-is-the-only-free-lunch-in-investing/

3. https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/modern-portfolio-theory-mpt/

4. https://www.nobelprize.org/prizes/economic-sciences/1990/press-release/

5. Additional fees and costs, such as transactional and operational costs, may apply. Refer to the PDS for more detail.

6. Ibid.

7. Ibid.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.

1 comment on this

Finance plays a crucial role in shaping our economic landscape, influencing everything from personal budgeting to global markets. It’s the backbone of businesses, governments, and individuals, driving decisions that impact our financial well-beingUnderstanding .the intricacies of finance empowers us to navigate the complex world of money and investments, ultimately paving the way for a more secure and prosperous future