On 13 June 2022, the S&P 500 officially entered a bear market, closing more than 20% down from its record high set in January. It’s often said that no two bear markets are alike, and that certainly reads true if we contrast the economic conditions underlying today’s bear market with those of the previous bear market in 2020.

The ‘Covid-Crash’ of 2020 was the shortest bear market in history. It took only 33 days to bottom out and just five months to recover and reach fresh highs. Amid widespread economic lockdowns, the V-shaped market recovery was partly achieved through the swift action taken by major central banks, which slashed target interest rates to near zero levels and engaged in quantitative easing to steer their economies away from recession territory.

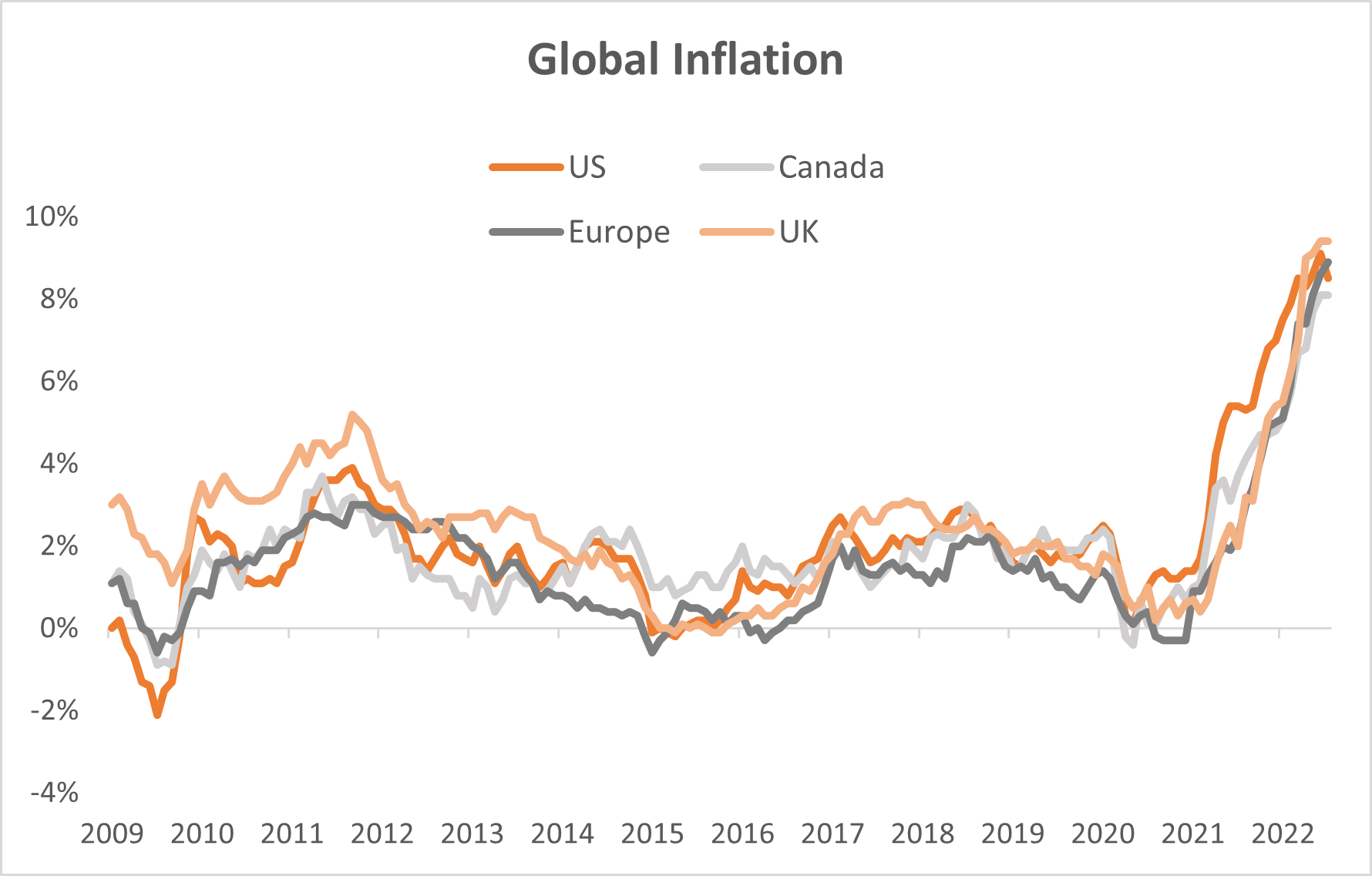

Inflation is the clear catalyst for today’s bear market, conjured up by a perfect storm of supply side bottlenecks and red-hot consumer demand, resulting from unprecedented levels of stimulus and a tight labour market.

Source: Bloomberg. US Inflation = US CPI Urban Consumers YoY NSA. Canada Inflation = STCA Canada CPI YoY NSA. Europe Inflation = Euro Area MUICP All Items YoY NSA. UK Inflation = UK CPI EU Harmonized YoY NSA.

We now embark on a curious stage of the market cycle. For the first time in decades, central banks have a fight on their hands to tackle inflation, and therefore can no longer provide the monetary accommodation that’s propped up the economy in times of weakness. What this suggests for sharemarkets, and this bear market more specifically, is that we may not see the V-shaped recovery that we have almost come to expect in recent times, when markets have experienced a pullback.

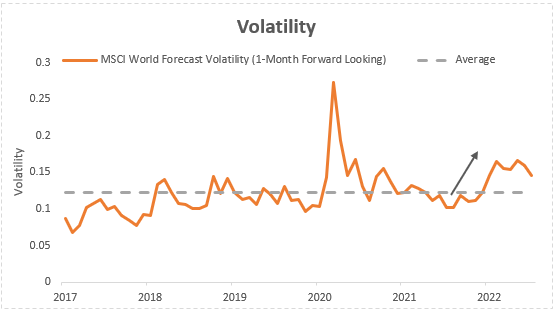

Additionally, as central banks continue to hike rates and wind down their support, uncertainty around future growth has led to higher volatility forecasts compared to previous years. Periods of higher volatility historically have coincided with sharemarket declines, and in the absence of central banks being able to provide additional liquidity, this volatile environment may exist for some time.

Source: Milliman. Graph shows Milliman’s forecast of 1 month realised volatility for the MSCI World Ex Australia Net Total Return Index in AUD. Future results are impossible to predict. Forecasts are, by their very nature, subject to various risks and uncertainties, and are based on certain assumptions which may not be correct. Actual events or results may differ materially. Average period relates to July 2017 – July 2022.

Implications for investors

Younger investors with longer investment horizons are generally better placed to maintain their long-term strategies during such environments. However, for more risk-conscious investors such as retirees or pre-retirees, the prospect of an extended bear market could have meaningful consequences.

In addition to a heightened sensitivity to market risk, retirees or pre-retirees are faced with longevity risk (the risk of outliving their savings), which means an allocation of their portfolio may still need to be invested in the sharemarket in order to provide sufficient income and returns over the course of their lives.

Is there an investment solution that provides investors with both sharemarket participation and its associated benefits (dividends and potential for capital growth), and downside risk management to help protect an investor’s capital during periods of market duress?

Potential solutions

Today there are exchange traded products available on the ASX that provide broad sharemarket exposure, together with in-built, rules-based risk management strategies.

Risk management strategies come in various forms. For instance, some strategies may be designed to target a specified level of volatility or risk within a portfolio, while other strategies may seek to provide downside capital protection.

The BetaShares Managed Risk Global Share Fund (managed fund) (ASX: WRLD) utilises both these risk-management techniques to reduce volatility, and provide defensive qualities during market downturns (as characterised by high volatility).

In practice, WRLD’s risk management strategy involves monitoring the expected volatility of the fund’s equity portfolio on a daily basis. If volatility rises beyond targeted levels, the fund will systematically add protection (or reduce sharemarket exposure) by selling equity index futures. As volatility returns to targeted levels, the fund will reduce protection and increase market exposure. This strategy aims to ensure that investors in WRLD are less exposed to the sharemarket during volatile times, but also able to participate in some of the upside when markets are rising and volatility has moderated (noting the strategy of selling futures may limit the fund’s capital growth when the sharemarket rises).

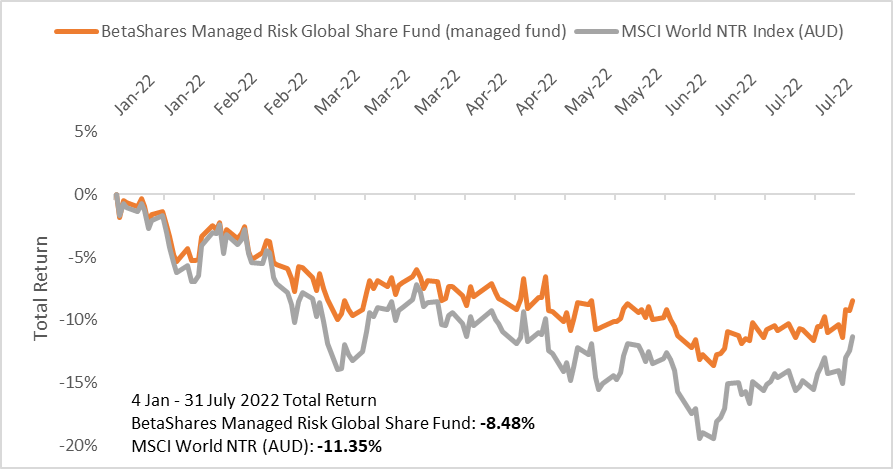

If we analyse the performance of WRLD since the market’s previous recorded high in January (below), we can see how the risk management strategy has provided protection for investors from some of the decline experienced by the broader sharemarket.

Source: Betashares, Bloomberg. Shows performance of WRLD against the MSCI World Total Return Index (AUD) for the period from 4 January 2022 to 31 July 2022. Past performance is not indicative of future performance. Assumes reinvestment of distributions.

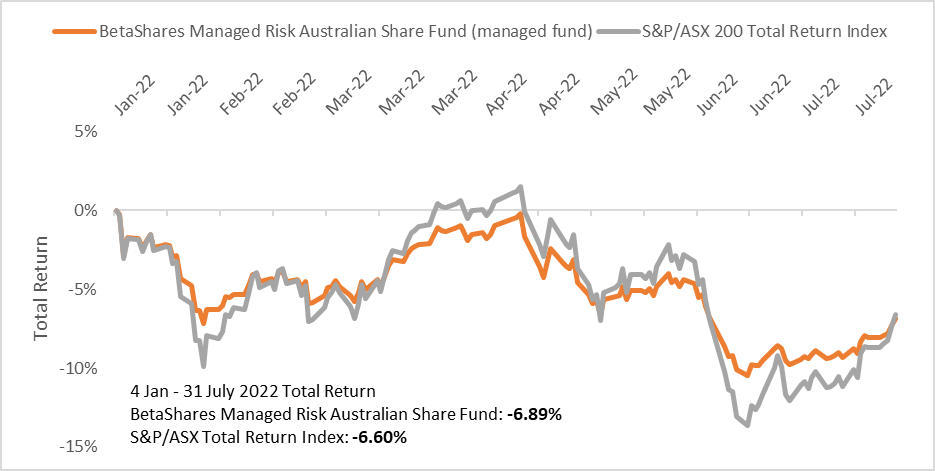

The BetaShares Managed Risk Australian Share Fund (managed fund) (ASX: AUST) is the other fund in BetaShares’ Managed Risk Series, and applies the same strategy, but in relation to the Australian sharemarket. It’s worth noting that Australia has yet to officially enter a bear market, unlike the US and other major sharemarkets.

However, in assessing the performance of AUST over the same time period (January 2022 to July 2022), we can see that despite the sharemarket pullback being shallower, the fund has provided a smoother (less volatile) return profile for a similar performance to the Australian sharemarket.

Source: Source: Betashares, Bloomberg. Shows performance of AUST against the S&P/ASX 200 Total Return Index for the period from 4 January 2022 to 31 July 2022. Past performance is not indicative of future performance. Assumes reinvestment of distributions.

Summary

Against the backdrop of an uncertain environment, the BetaShares Managed Risk Series (AUST and WRLD) provide an efficient, one-trade, solution for investors looking to remain exposed to the sharemarket but limit their downside risk and portfolio volatility.

| There are risks associated with an investment in the Funds, including market risk and the risk that the management strategy may not be effective. Selling futures in rising markets can be expected to limit each Fund’s capital growth. For more information on risks and other features of each Fund, please see the relevant Target Market Determination and Product Disclosure Statement, available at www.betashares.com.au. |