2023 was not the year that many expected in global financial markets. Despite the US 10-year government bond yield rising to 5%, global equity markets have so far booked gains for the year to date. In fact, the results left many market watchers scratching their heads as conventional wisdom did not play out over the year.

| Index | Total return |

| MSCI ACWI (USD) | 12.40% |

| Nasdaq 100 (USD) | 42.56% |

| S&P 500 (USD) | 18.76% |

| Stoxx Europe 600 (EUR) | 8.60% |

| FTSE 100 (GBP) | 2.94% |

| S&P/ASX 200 (AUD) | 3.42% |

| Topix (JPY) | 26.94% |

| MSCI Emerging Markets (USD) | 2.11% |

| Nifty 50 (INR) | 8.92% |

| Shanghai Composite (CNY) | 1.22% |

As at 14 November 2023

The US equity market Magnificent 7

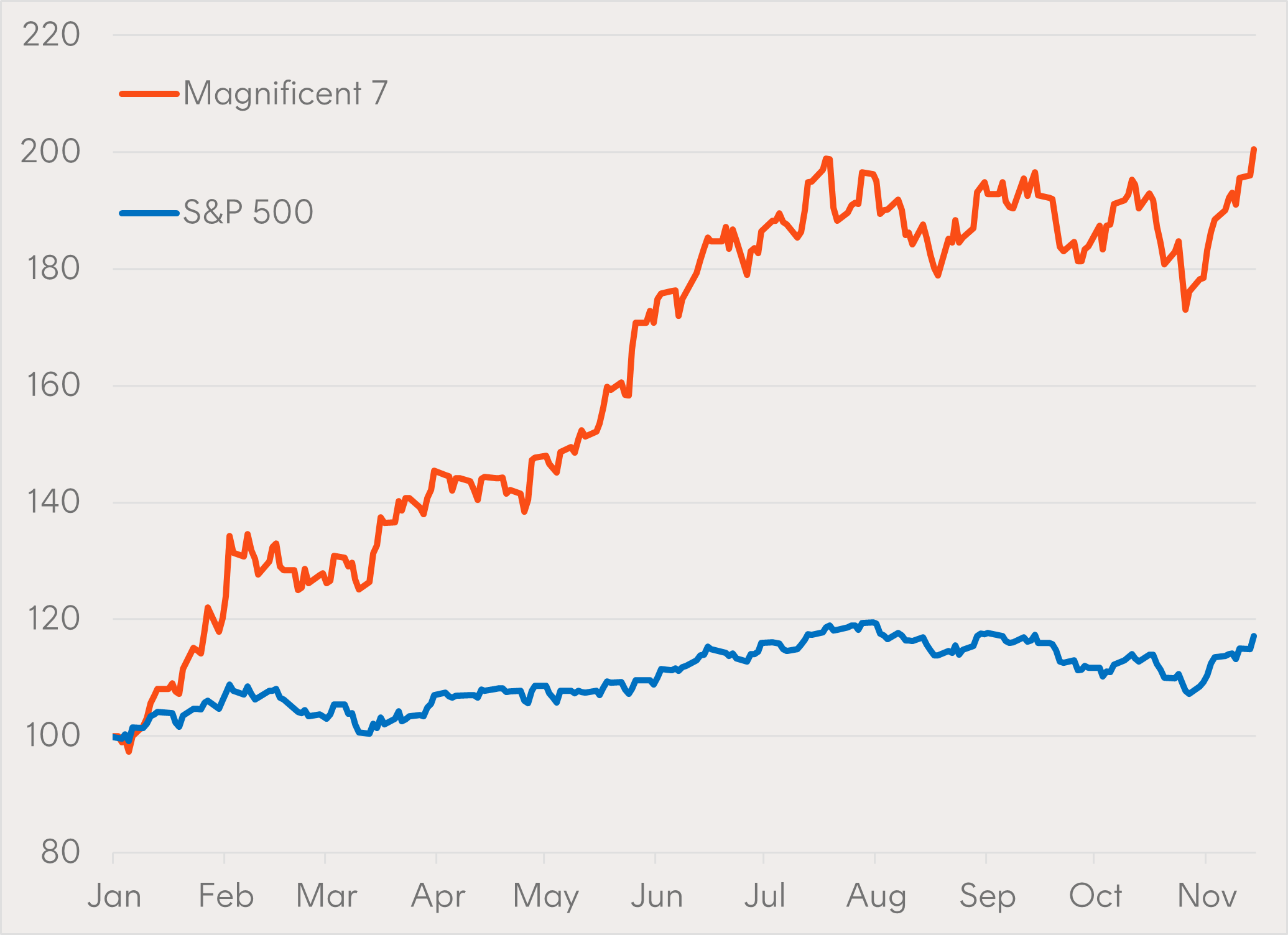

The seven companies (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA) coined the ‘Magnificent 7’ accounted for 45% of the MSCI All Country World Index (MSCI ACWI) performance in 2023. Despite the historical rate hike continuing and markets succumbing to a ‘higher for longer’ narrative, investor’s faith in the world’s largest companies drove markets forward.

Excluding these seven outliers, the S&P 500 would have been flat. The S&P 500 Equal Weight Index, which weighs the same 500 companies at 0.2% each, returned just 1% as it did not benefit from this concentrated growth.

A flat market still shows resilience in the face of higher interest rates, however the lack of breadth in the US equity market’s performance this year paints a very different picture to the headline figure. Silicon Valley Bank’s collapse in the first half, and US economic resilience in the face of government bond yields moving to 20-year highs in the second half were the main contributors to investor caution outside of those largest names.

Unsurprisingly given the companies attracted by its exchange, the Nasdaq 100 was once again a standout returning 43%.

Chart 1: Magnificent 7 does the heavy lifting in 2023

Source: Bloomberg. As at 14 November 2023. Past performance is not indicative of future performance.

Year of the rising sun

A long-awaited year in Japanese equity markets saw the region post the strongest returns outside of the US. The confluence of corporate governance reforms translating into company action, a positive macroeconomic environment in contrast to much of the world, and geopolitical tailwinds created what many have been anticipating as the perfect environment for equity market outperformance.

For the year to November, the Topix Index returned 27%, having reached new market highs in 2023 for the first time since its infamous 1989 crash.

An emerging shift

Emerging markets as a whole, measured by the MSCI Emerging Markets Index (MSCI EM), had a tough year in 2023 returning just 2%.

In signs of a changing of the guard, the largest contributor to performance for much of the past decade has become the largest detractor, with China contributing -2.72% to the MSCI EM’s returns. The hyped reopening in China following the end of its Covid zero policy in January failed to fuel both the domestic and global markets to the extent many had hoped.

As investors looked to who could fill the void of slower Chinese growth, a strong candidate emerged in India. India is undergoing structural changes to encourage foreign direct investments and shift the world’s supply chains with early success. The country also became the most populous in the world in 2023, overtaking China. It may be unsurprising then that India now boasts the highest projected economic growth amongst major developed and developing nations. This translated into a 9% return for the Nifty 50 Index in 2023 and shows strong promise looking ahead.

Europe and Australia

European equities experienced a strong start to the year and may be headed for a strong end. However, a persistent ECB rate hiking cycle and lower than expected corporate earnings during the year hurt the region’s hopes of keeping up with the US. As it stands, a late year rally has helped the region post a 9% year-to-date return, with the UK lagging behind with a 3% return for the FTSE 100.

As for Australia, the local market would have provided investors with a -1% return had it not been for its trusty dividend yield, which saw total returns equate to 3% for 2023. A frustratingly sideways market, which has become all too common for Australia, was not helped by global economic slowdown fears, a historic rate hiking cycle, and an index with no megacap technology exposure like we see in the US.

Looking ahead

Looking ahead to 2024, investors might look to a continuation of Japan and India’s outperformance in their respective peer groups.

As for the US, investors may want to be cautious of historic levels of concentration of the broader market in the Magnificent 7. Small- and mid-cap exposures, like the S&P 500 Equal Weight Index, may be able to bridge the performance gap.

Finally, for Australian investors looking overseas, a key risk will be currency, as an appreciation of the Australian dollar would impact investors unhedged returns.

Data as at 14 November 2023.

Written by

Tom Wickenden

Betashares – Investment Strategist. CFA level 2 candidate. Enthusiastic about markets and investing.

Read more from Tom.