Cameron Gleeson

Betashares Senior Investment Strategist. Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

6 minutes reading time

A wrap up of the charts catching our eye over the past month.

As sentiment remains wary around equity market growth we take a look at how the underlying fundamentals stack up for some of the best performing equity markets globally. Domestically we consider what drives returns for the ASX200 and the risk this poses. Finally, putting gold’s recent rally under the microscope we look for reasons why it may still go higher.

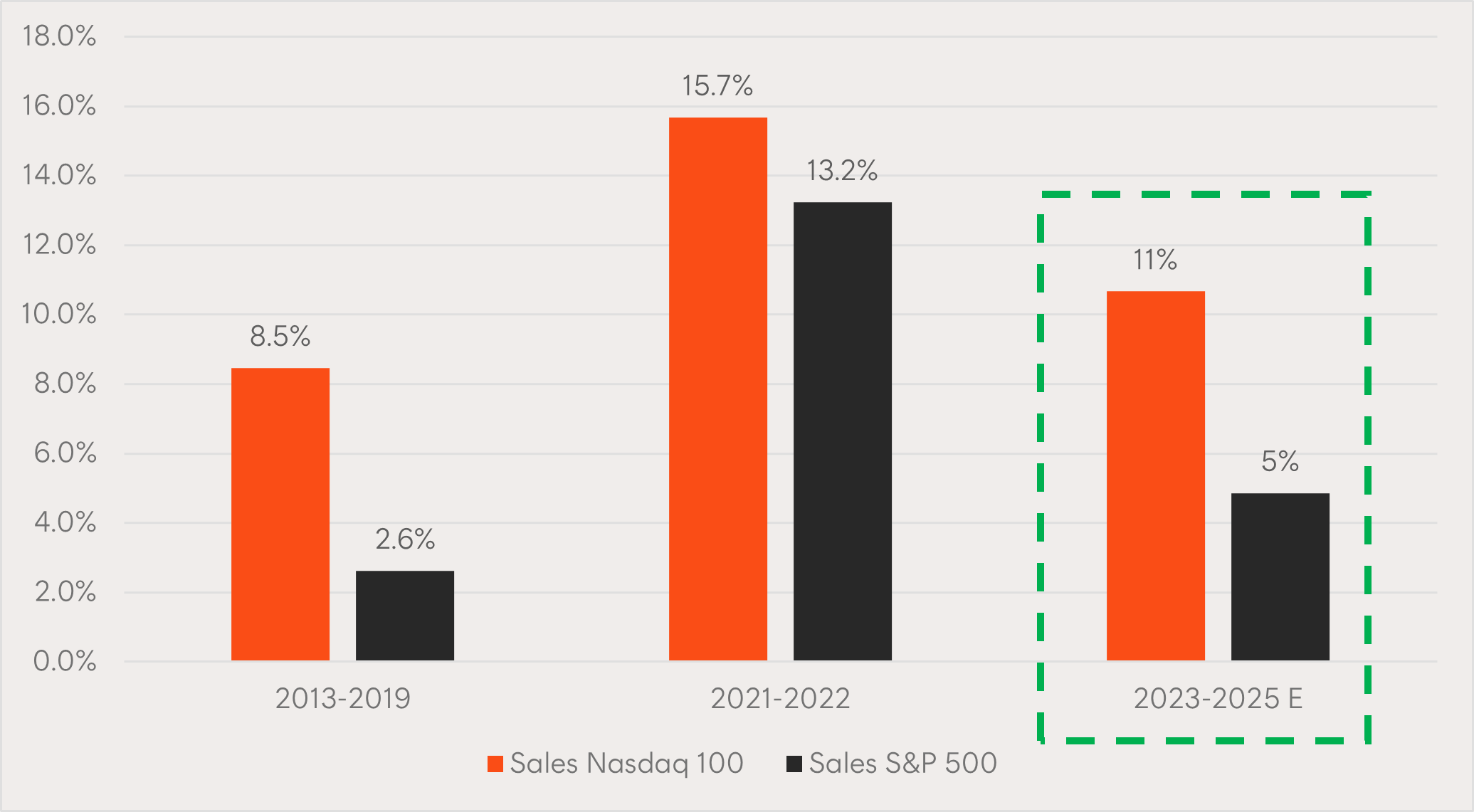

1 – Will strong fundamental growth continue to drive the Nasdaq’s outperformance?

Focusing on the US market, the strong fundamental growth of the region’s technology companies listed on the Nasdaq 100 have driven equity market growth. After a period of catchup by the S&P 500’s sales growth following Covid lockdowns, consensus estimates once again have the Nasdaq’s companies outpacing the rest.

Chart 1: Historical and consensus estimates of sales growth for the Nasdaq 100 and S&P 500. Past ten years and estimates of next two.

Source: Bloomberg. The chart shows historical sales growth from 2013 to 2022 and consensus forecast sales growth for the period from the end of 2023 to calendar year 2025. Actual outcomes may differ materially from forecast outcomes. No assurance is given that an investment in any Betashares ETF will deliver positive returns or outperform a particular market index. This data does not represent a revenue forecast for any ETF and does not take into account ETF fees and costs.

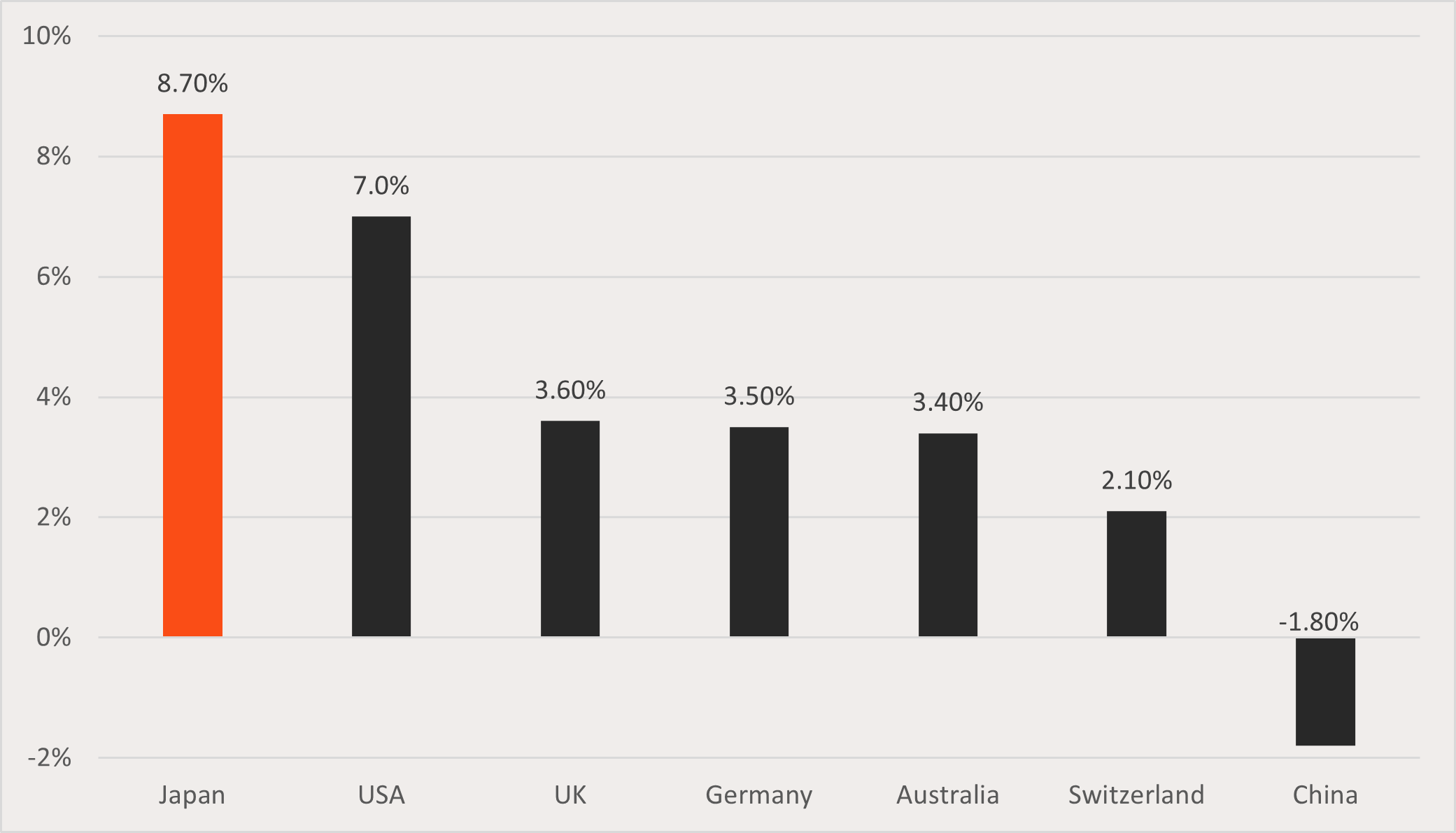

2 –Japanese equities have been a standout for earnings growth over the past decade

Many investors closely associate Japanese equities with the term ‘the lost decades’. However, structural corporate reforms, accommodative macroeconomic policies, and geopolitical tailwinds are starting to take hold as underlying company fundamentals improve. Japan has been the second-best performing major equity market in 2023 to date1, as highlighted by the metrics shown in the chart below.

Chart 2: Trailing 10-years earnings per share (EPS) Compound annual growth rate (CAGR), in local currency, for selected equity markets

Source: Morgan Stanley Research, Datastream, MSCI. Note EPS calculated in local currency. Based on MSCI indices. 10 years to 2023. Chart is provided for illustrative purposes. Past performance is no guarantee of future results.

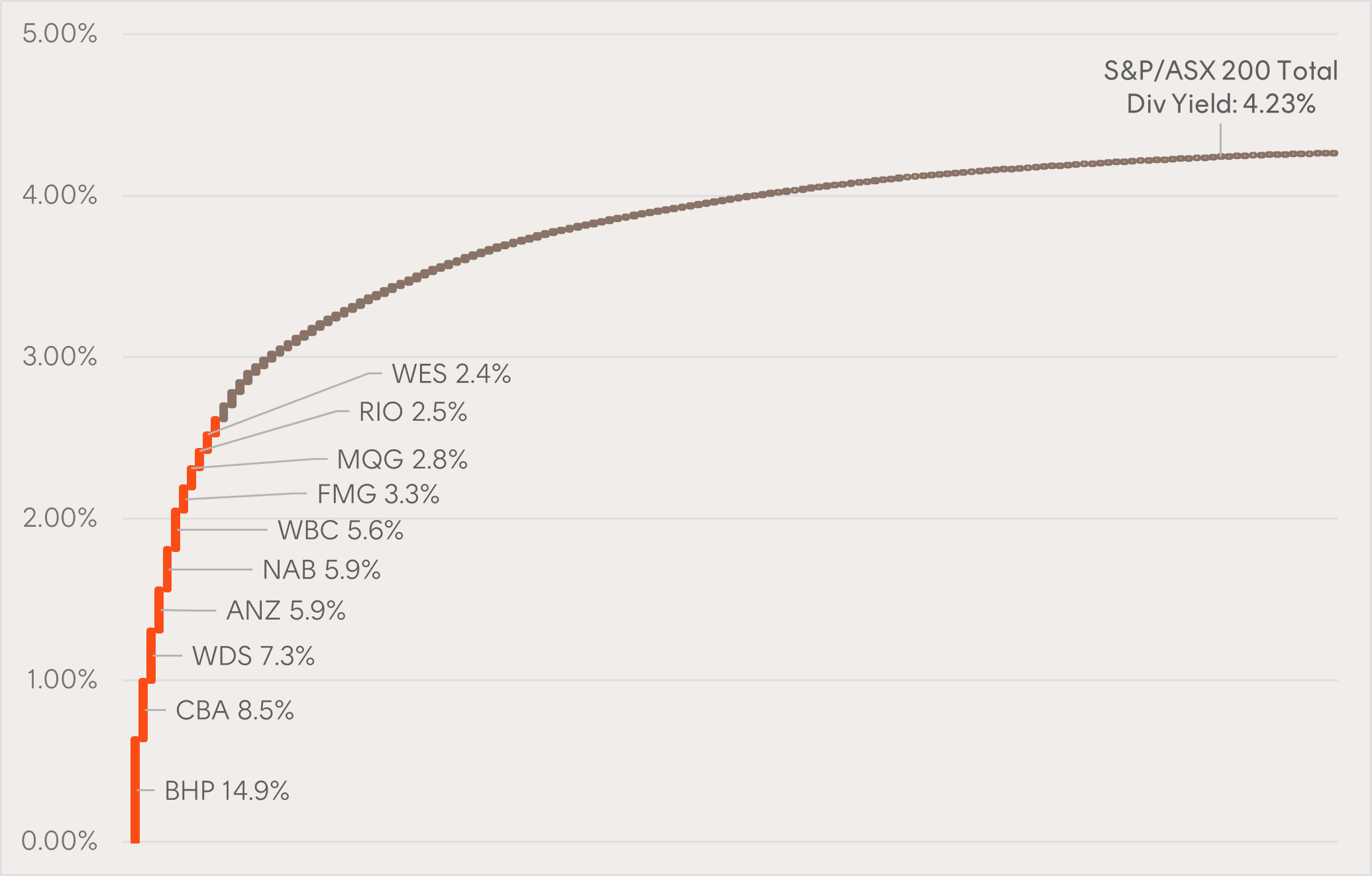

3 – The ASX remains reliant on dividends for returns, and the dividends remain heavily reliant on ten contributors

On 1 November 2007, the S&P/ASX200 Index reached 6,828 points; on the 1 November this year it was just 10 index points higher. If it wasn’t for dividends, the total market return over that 16-year period would have been close to zero. The top 10 contributors currently make up 60% of the index’s dividend yield, posing a potential threat to our domestic market’s returns if these dividend yields were to fall.

Chart 3: Cumulative contribution of each stock to the trailing 12-month S&P/ASX200 Index yield (highlighting the top 10 contributors)

Source: Bloomberg, Betashares, as at 24 November 2023. Chart shows the cumulative contribution of each stock to the overall dividend yield of the index, based on each constituent’s dividends and its proportionate weight in the index as a whole. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

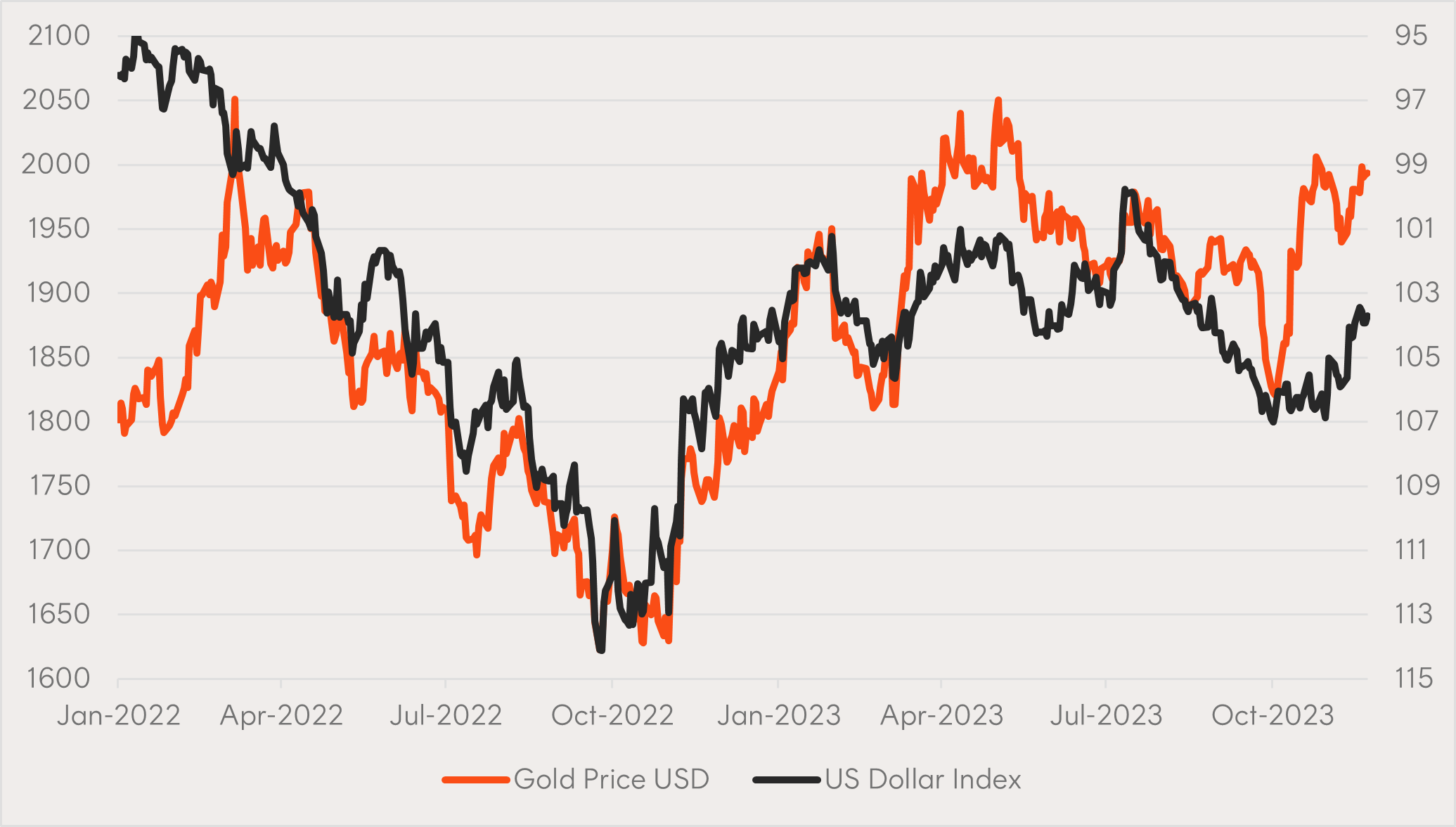

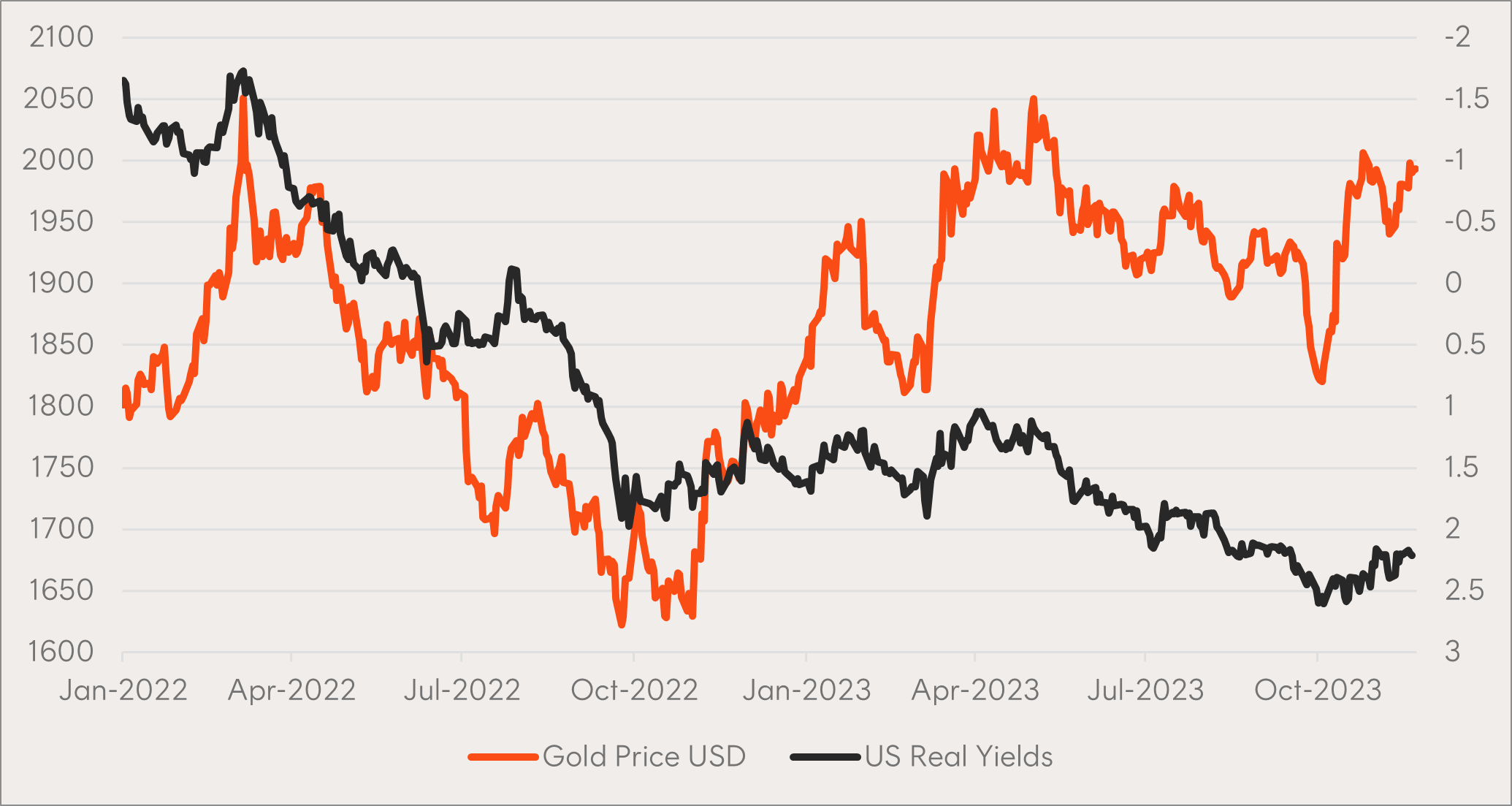

4 – Gold’s disconnect from its historical drivers could help bullish sentiment

Historically, the US dollar and US real yields have tended to be two key drivers of the gold price (in US dollars). More recently, these inverse relationships have broken down as the gold price has risen (chart 4 and 5) while we experience US dollar strength (inversed, chart 4) and higher real yields (inversed, chart 5). Many suspect this is on the back of gold’s safe haven utility and central banks buying gold in place of US dollars. A reversal of US dollar strength or falling US real yields could potentially be a catalyst for the gold price to take another leg higher.

Chart 4: USD gold price (orange, LHS) and US dollar index (black, RHS inverted).

Source: Bloomberg, as at 24 November 2023. Past performance is not indicative of future returns. USD gold price does not take into account fees and costs of an ETF investing in this asset class.

Chart 5: USD gold price (orange, LHS) and US real yields (black, RHS inverted).

Source: Bloomberg, as at 24 November 2023. Past performance is not indicative of future returns. USD gold price does not take into account fees and costs of an ETF investing in this asset class.

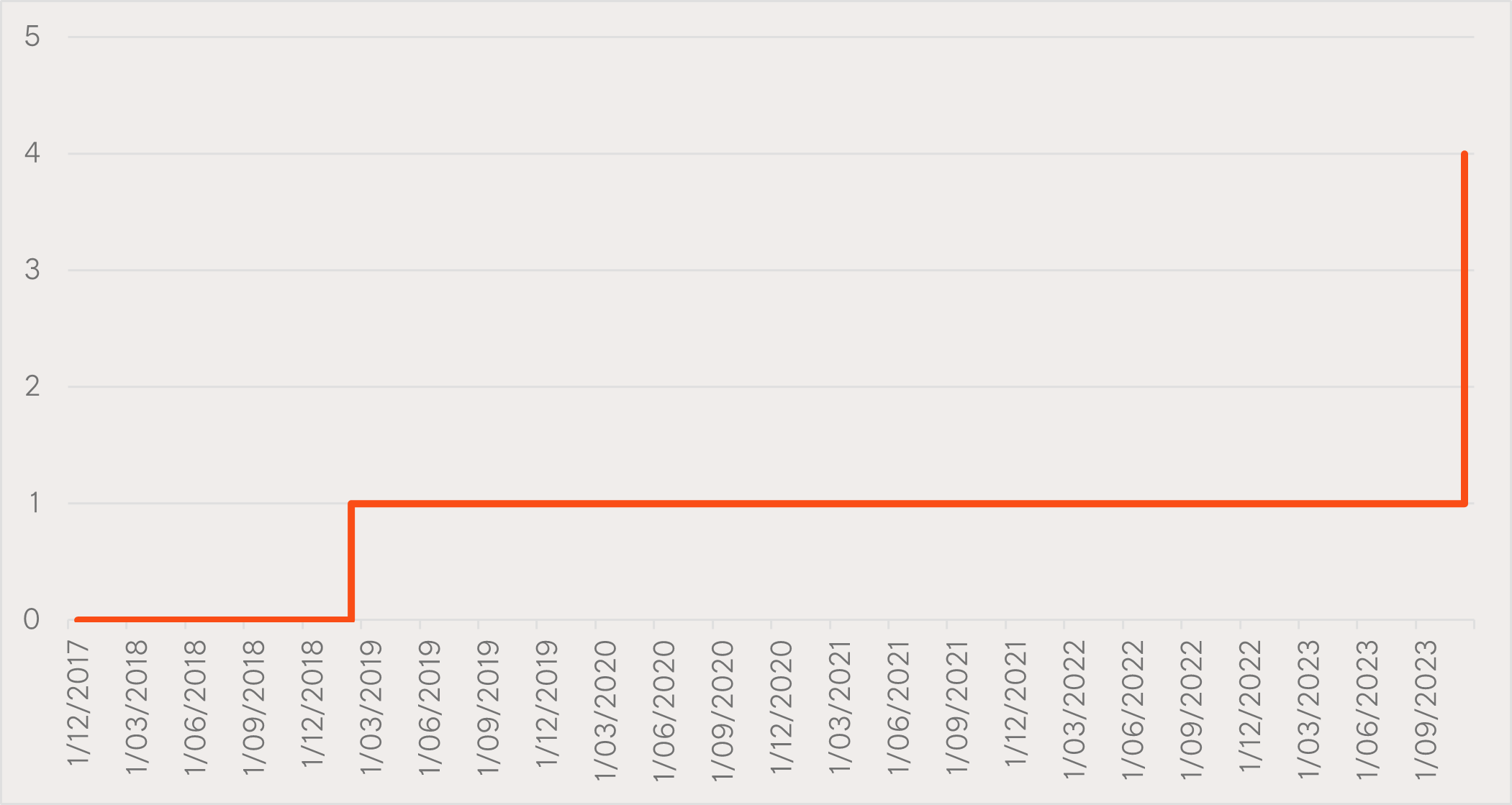

5 – OpenAI

On the lighter side of charts we have enjoyed over the past month, the fiasco at OpenAI has led to a 300% increase in the cumulative number of CEOs running the business in less than a week.

Chart 6: Cumulative number of CEOs at OpenAI

Source: Betashares.

Glossary:

- Interquartile range – The middle 50% range of values (in this case forward historical forward P/E ratios). The interquartile range is often seen as a fair measure of the data as it is less affected by outliers.

- P/E ratio – Price to earnings ratio. A common measure of value obtained by dividing the share price by the earnings per share.

- EPS – Earnings per share. The net profit a company produces, divided by the number of shares on issue. For an index, this is generally quoted as a weighted average of the index constituents.

- CAGR – Compound annual growth rate. The rate at which a given metric – usually earnings or revenue – grows over time.

1. Source: Bloomberg

Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

Read more from Cameron.