Equity Markets Quarterly Commentary Q1 2025

5 minutes reading time

With US regional banking and debt ceiling woes making headlines, the USD gold price is testing all-time highs. Even if these particular issues turn out to be transient, the investment case for holding gold remains compelling in our view, given longer term structural tailwinds and the role gold can play as a portfolio diversifier. For Australian investors, however, it is important to consider currency hedging a gold exposure due to the historically inverse relationship between the USD gold price and the USD/AUD exchange rate.

We see four key drivers of the gold price in 2023 and beyond:

1. Economic uncertainty

Gold is commonly perceived to be a “safe-haven” asset during times of economic instability or market volatility, with historically lower correlations to stocks and bonds. In a recent survey from Bloomberg1, 52% of professional investors selected gold as their number one investment choice should the US government hit the debt ceiling. Unlike US treasuries, gold can be held as a tangible asset that does not rely on the performance or stability of the US government.

Whether or not the current debt ceiling issues are resolved, the impacts of the Fed’s hiking cycle and second order impacts like tightening credit conditions are starting to weigh on the US economy – creating a supportive environment for investor demand of gold.

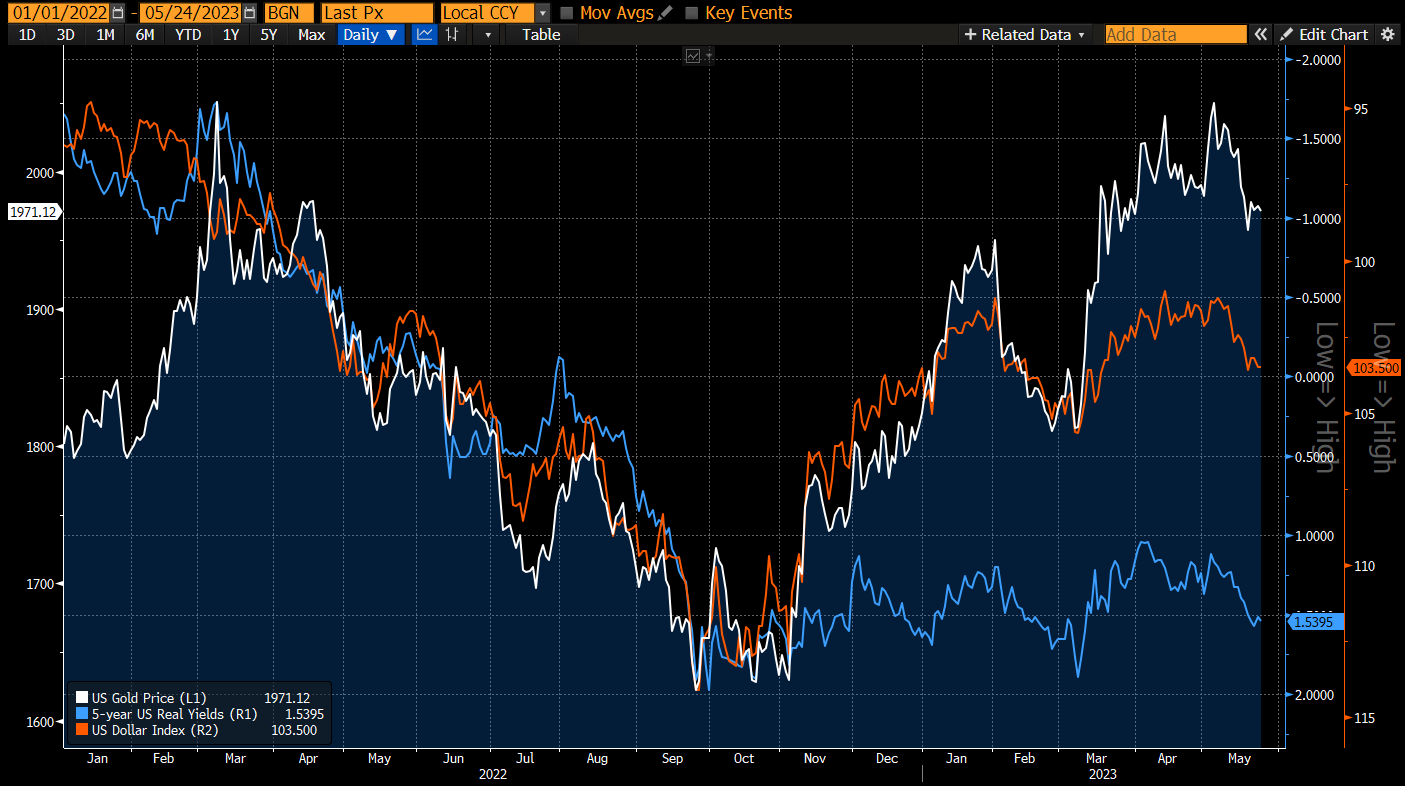

2. The opportunity cost of holding gold

Some investors believe gold should be held as a hedge against inflation, however this ignores the impact of central bank policy in an inflationary environment and a key element of gold – an investment that produces no income. When inflation threatens to break out, central banks will generally respond by increasing rates on the risk free asset (cash/bonds). Where government bond yields, after adjusting for inflation expectations (i.e. real yields), are increasing, the opportunity cost of holding a non-income producing asset like gold also increases. Hence gold becomes relatively less attractive as an asset when real yields are high/rising and more attractive when real yields are low/falling.

While increasing real yields help explain the fall in the gold price through the middle of 2022, gold’s rally since November can only be attributed to other factors. Notwithstanding that, any collapse in real yields from this point forward, particularly due to a Fed pivot, could provide a further tailwind for gold.

3. Strength (or weakness) in the US dollar

Gold has historically been used to hedge against a weakening US dollar. As mentioned above, gold’s value does not rely on the performance or stability of the US government, hence it arguably can be seen as “the currency of last resort”.

The sell-off in US dollars over the Northern Hemisphere winter created an attractive environment for gold. Given the Fed appears poised to pivot prior to other central banks, such as the ECB, we may see further US dollar weakness throughout H2 2023.

Chart 1: USD gold price (white), US dollar index (orange, inverted), 5-year US real yields (blue, inverted): 1 Jan 2022 – 24 May 2023

Source: Bloomberg, as at 24 May 2023. Past performance is not indicative of future returns. USD gold price does not take into account fees and costs of an ETF investing in this asset class.

Source: Bloomberg, as at 24 May 2023. Past performance is not indicative of future returns. USD gold price does not take into account fees and costs of an ETF investing in this asset class.

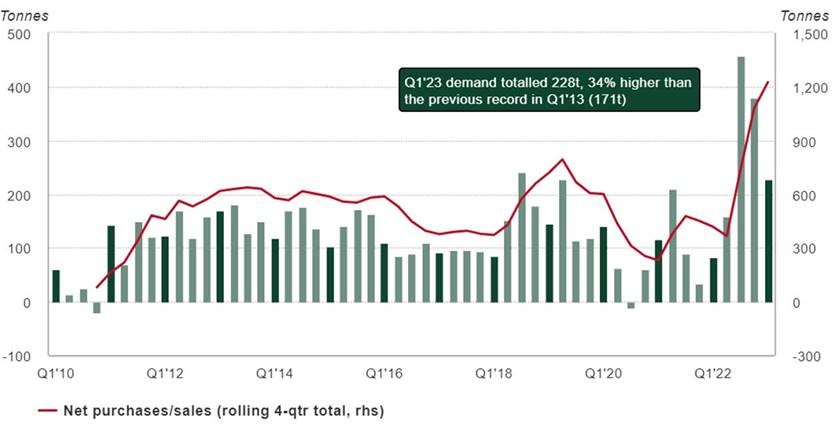

4. Geopolitical factors creating record central bank demand for gold

In the wake of the Ukraine invasion, the US showed they are not afraid to weaponise the dollar-centric global financial system by imposing crippling sanctions on another nation state. As the world’s reserve currency, the US dollar gives the US enormous leverage on the world stage. While the US dollar’s primacy in trade and finance looks entrenched for now, central banks, particularly from emerging market (EM) countries like China, India, Turkey and Singapore, have been buying record amounts of gold. For countries running large current account surpluses, gold is an asset that allows them to diversify their reserves away from US dollars and treasuries, and therefore reduce the potential leverage the US government may seek to exert over them. If this is a government’s objective, there seem to be few (if any) practical alternatives to increasing their investment in gold.

According to the Gold Council, aggregate central bank purchases reached a new Q1 record this year, following a record-breaking year in 2022. It is expected that central bank buying will continue to drive overall demand for gold throughout 2023.

Chart 2: Quarterly Aggregate Central bank gold buying: 1 Jan 2010 – 31 Mar 2023

Sources: Metals Focus, Refinitiv GFMS, World Gold Council, as at 31 March 2023

Sources: Metals Focus, Refinitiv GFMS, World Gold Council, as at 31 March 2023

Implementation:

QAU Gold Bullion Currency Hedged ETFQAU is physically backed by gold bullion held in a segregated account with a third-party custodian. The bullion bar list issued by JP Morgan is published on our website.

It is the only currency-hedged gold ETF currently available in the Australian market – i.e. giving ‘purer’ exposure to the US dollar gold price rather than the AUD price of gold. If the USD gold price rallies at a time of US dollar weakness, Australian investors with unhedged gold exposure may find their investment returns partially or entirely eroded in AUD terms.

Additional info:

- Factsheet

- Research Report

- Product Summary to assist with SOAs

- Target Market Determination

- Product Disclosure Statement

There are risks associated with an investment in QAU, including market risk, gold price risk and currency hedging risk. QAU should only be considered as a component of a broader portfolio. For more information on risks and other features of QAU, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD).

1. https://www.bloomberg.com/news/articles/2023-05-15/debt-ceiling-negotiations-have-investors-eyeing-gold-if-us-defaults

1 comment on this

Considering its reputation as a “safe-haven” asset during economic instability, why did 52% of professional investors, according to a Bloomberg survey, choose gold as their top investment choice in the event of the US government hitting the debt ceiling? What unique characteristics of gold make it stand out in comparison to US treasuries during such scenarios, particularly with its status as a tangible asset independent of the US government’s performance or stability?

Visit us telkom university