Tighter monetary policy is set to remain a dominant theme in markets this year, after central banks unleashed an unprecedented rate hike bonanza in 2022 in an attempt to slay the inflation dragon.

But the dragon may not be dead yet, despite the world’s top central banks unleashing scores of rate hikes and suggesting more may be needed before the job is done.

So how do investors navigate this changing climate and how can they use ETFs to do it? Here are six ETFs that can help investors play offensive and defensive strategy in a rising or relatively high-rate environment as they seek to grow and protect their wealth.

1. QOZ FTSE RAFI Australia 200 ETF

● ASX code: QOZ

● Asset class: Australian shares

● Distribution frequency: Semi-annual

● Management fee and costs: 0.40% p.a.*

While the past year may have seen a significant decline in the value of growth stocks, housing prices, and cryptocurrency, it wasn’t all bad news for investors.

In fact, the Australian stock market proved to be a bright spot, with the QOZ fund generating a 5.25% return in 2022, outperforming both the S&P/ASX 200 Index, which had a 1.08% loss, and the S&P 500’s nearly 20% drop.

The case to play offence with QOZ

One of the reasons for QOZ’s outperformance in 2022 vs. the ASX 200 was the composition of the fund, which was over-weight to traditional ‘value’ sectors such as financials, energy and consumer staples. These sectors have historically tended to perform well in a rising rate environment.

Additionally, the fund weights stocks based on their “economic importance” rather than size as measured by market capitalisation, and companies are included based on factors such as sales, cash flow, dividends, and book value.

As interest rates rise and borrowing costs become more burdensome, investors are increasingly focusing on companies with strong financials and attractive valuations, while seeking to avoid those with weak balance sheets or that are fundamentally expensive. QOZ may hold an edge in this market environment due to this methodology.

2. USD U.S. Dollar ETF

● ASX code: USD

● Asset class: Currency

● Distribution frequency: Annual

● Management fee and costs: 0.45% p.a.

The Federal Reserve has made it clear that it is willing to accept the risk of a recession in order to tame inflation.

In an economic downturn, a common market phenomenon known as “the flight to safety” can occur, where investors tend to sell high-risk assets and seek out relatively safer investments such as the US dollar, which is widely considered to be the world’s dominant reserve currency.

As a result of the Fed’s aggressive tightening and increasing likelihood of a recession, the value of the US dollar rose during 2022.

The case to play defence with USD

USD holds US dollar cash deposits and allows investors to benefit from potential gains in the value of the US dollar relative to its Australian counterpart (but with the potential for losses if the US dollar falls in value).

Historically, the US dollar has tended to perform well during economic downturns. Furthermore, market pricing suggests that US interest rates could surpass 5% in 20231, and that it could maintain a higher level than Australia’s for at least the next 12-18 months2.

This difference in interest rates may allow investors to make a “carry trade”, where they could earn interest income from higher-yielding US dollar deposits while also potentially benefiting from capital appreciation if the US dollar continues to strengthen against the Australian dollar.

3. FUEL Global Energy Companies ETF – Currency Hedged

● ASX code: FUEL

● Asset class: Global shares – sectors

● Distribution frequency: Semi-annual

● Management fee and costs: 0.57% p.a.*

The pain Australian consumers felt at the bowser over the last year has been the oil companies’ gain.

Energy stocks and ETFs were one of the best investments of 2022, as supply interruptions and soaring travel demand sent crude oil prices from around US$75 per barrel at the start of 2022 to multiple peaks above US$120 across the year. As a result, FUEL surged 25.36% in the 12 months to 31 January, as shares of global oil giants rose to track soaring oil prices. Over a longer, five-year period to end January, FUEL’s total return was 4.07% p.a.3

The case to play offence with FUEL

While oil prices have dropped from the peaks of 2022, they remain high due to ongoing conflicts and potential changes in policies such as China’s “zero-COVID” strategy.

The market is expecting that even if crude oil prices do not reach triple-digit levels in the near-term, they are likely to remain high enough for energy companies to generate significant profits and offer increased dividends and share buybacks.

FUEL offers investors the opportunity to access a portfolio of major energy companies including Chevron and Royal Dutch Shell.

Of course, FUEL’s returns can be expected to have a high degree of volatility due to its concentrated exposure to the energy sector.

4. QPON Australian Bank Senior Floating Rate Bond ETF

● ASX code: QPON

● Asset class: Fixed income

● Distribution frequency: Monthly

● Management fee and costs: 0.22% p.a.*

As interest rates rise, the value of fixed-rate bonds tends to fall as they become less attractive to investors who can earn higher returns on newer bonds issued at higher rates.

However, one type of bond that can benefit from rising rates is floating-rate bonds. The interest rate on a floating rate bond increases as interest rates rise, while the capital value of such bonds has historically been much less sensitive to increases in interest rates than fixed rate bonds.

The case to play defence with QPON

QPON holds senior floating-rate bonds issued by Australian major banks and regional banks. The ETF gained 0.98% in 2022, compared to a 9.71% fall for the Bloomberg AusBond Composite 0+Yr index (a fixed-rate bond exposure).

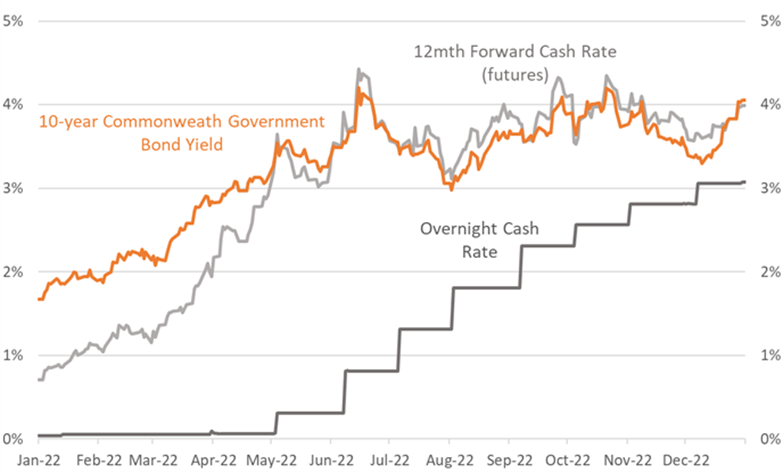

The Reserve Bank of Australia (RBA) Governor, Philip Lowe, stated in December 2022 that the central bank plans to raise “interest rates further over the period ahead” in order to control inflation (see below).

Australian interest rates; forward rate pricing based on Cash Rate futures

Source: Bloomberg, Betashares. Past performance is not an indicator of future performance.

In this context, QPON may be an attractive option for investors seeking to generate above-cash returns from floating rate bonds (noting that they have a higher risk profile than cash deposits), while avoiding equity risk or fixed-rate bonds.

5. ROYL Global Royalties ETF

● ASX code: ROYL

● Asset class: Global shares

● Distribution frequency: At least annually

● Management fee and costs: 0.69% p.a.*

Royalty companies receive revenues from royalty payments, which are typically based on underlying revenues rather than profits. Given this link to revenues, and the fact that rising inflation means higher prices, royalty payments may increase in inflationary environments.

Betashares recently launched ROYL, which allows investors to capitalise on the growing appetite for royalties.

The case to play offence with ROYL

ROYL offers investors a diverse range of global companies (see below) that earn a substantial portion of their income from royalty and intellectual property payments including mining, energy, entertainment, and pharmaceuticals.

ROYL – top 10 holdings

Source: Betashares

One current portfolio holding example is PrairieSky Royalty, a Canada-based firm that grants third-parties access to its mineral-rich lands in exchange for royalties, which in the September 2022 quarter alone generated nearly CA$155 million in revenue, with CA$146 million from royalties . PrairieSky Royalty’s recent performance is reflected in the company’s decision to double its quarterly dividend to shareholders.4

6. AAA Australian High Interest Cash ETF

● ASX code: AAA

● Asset class: Cash

● Distribution frequency: Monthly

● Management fee and costs: 0.18% p.a.*

In 2018, Bridgewater Associates Founder, Ray Dalio, made waves in the investment community by stating “cash is trash” instead of the traditional adage “cash is king.” However, in October 2022, he changed his stance and tweeted, “The facts have changed and I’ve changed my mind about cash as an asset: I no longer think cash is trash.”5

As interest rates have risen, cash has become more appealing to investors, including those in Australia. This is reflected in the interest rate on AAA’s cash deposits, which is now above 3% p.a.

The case to play defence with AAA

Investors may wonder why they should invest in a cash ETF when they can simply deposit money in a savings account. In the rising interest rate environment, banks are aggressively competing for retail deposits by offering high “honeymoon” rates that only last for a few months before resetting to much lower rates.

AAA offers an attractive income (after fees and expenses) through competitive rates on its cash deposits across multiple banks, including National Australia Bank, Bank of Queensland, and Rabobank.

Additionally, by keeping money in AAA, investors can earn interest and take advantage of market opportunities as soon as they arise.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant PDS and Target Market Determination (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice.

Risks include: interest rate and credit risk with bond and cash investments, royalties-related risks, sector risk, currency risk, and market risk with share investments.

Resources

1. https://www.bloomberg.com/news/articles/2023-01-05/george-says-fed-should-hold-rates-above-5-well-into-2024 . Actual outcomes may differ materially from forecasts.

2. https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf, https://www.atlantafed.org/cenfis/market-probability-tracker. As at 20 February 2023.

3. Past performance is not indicative of future performance.

4. Past performance is not indicative of future performance. No assurance is given that this company will remain in the portfolio or be a profitable investment.

5. https://finance.yahoo.com/news/ray-dalio-u-turns-long-104648946.html

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.

1 comment on this

RECEIVED AND LOOK FORWARD TO MORE.